NuLegacy Gold Corporation (“NuLegacy” or the

“Company”) (TSXV:

NUG; OTCQB:

NULG.F) reports that it has completed its

previously announced non-brokered private placement of 75,000,000

units (the “Units”) at a price of C$0.075 per Unit to raise gross

proceeds to the Company of C$5.625 million (the “Offering”).

NuLegacy’s CEO Albert Matter comments that, “We

want to thank our new shareholders and many of our existing

shareholders who once again stepped up to provide the capital to

continue this 10-year adventure of elephant hunting in Nevada.

Together with our current cash position, net of issue expenses, we

have ~ C$ 9.5 million (~US$ 6.5 million) on hand to complete the

planned 16-hole fall/spring 2020/2021 exploration program.

These holes should cost in the order of US$

250,000 apiece to drill; you need deep holes when you are hunting

for Nevada’s elephant-sized deposits. Our analysis of the

~7.5 sq. km target area (the Rift Anticline) suggests that a 14 to

16-hole pattern1 would be able to find a deposit whether it’s of

the size of the current three giants in the Cortez, (with a likely

footprint of ~ 1.5 sq. km.) or a more regular Nevada sized deposit

(with a likely footprint of ~ 0.3 sq.km).2

https://nulegacygold.com/site/assets/files/6527/0014.1200x0.jpg

)

While we are highly confident of drilling

success in the Rift Anticline, at the recommendation of one of our

advisors, Dr. Hennigh, we are proceeding with the additional CSAMT

and gravity surveys, as referenced in our last news release.

https://nulegacygold.com/news/news-releases/nulegacy-gold-announces-c-5.625-million-private-placement/

The additional cross-sectional CSAMT lines

parallel to the existing east-west lines, will help confirm the

length and structural continuity of the prospective target. The

CSAMT lines being surveyed at an oblique angle to the existing

lines will provide triangulation that should improve our drill site

targeting.

https://nulegacygold.com/site/assets/files/6538/0025.1200x0.jpg

Further, we are increasing the density of the

gravity survey stations over the Rift Anticline from 200 meter

spacing to 100 meters spacing which is expected to provide better

resolution of the gravity lows indicative of decalcification of

carbonates at depth, i.e. the beneficiation needed for gold

precipitation.

Our US$500,000 expansion of our permitted Plan

of Operations over the Red Hill property is on schedule for

submission to the BLM in July with acceptance anticipated in

September; discussions are under way toward a drilling contract/s

for one RC rig and two core rigs to start drilling

mid-October.”

Offering details: Each Unit consisted of

one common share of the Company (a “Common Share”) and one-half of

one transferable Common Share purchase warrant (each full warrant,

a “Warrant”). Each Warrant entitles the holder to acquire one

Common Share of the Company at an exercise price of C$0.125 for a

period, subject to acceleration, of 24 months from closing of the

Offering.

The net proceeds of the Offering will be used to

carry out the expanded exploration program on the Rift Anticline

including the 16 planned core holes, as well as for general

corporate and working capital purposes.

Certain finder’s and/or advisory fees were paid

in cash, shares and/or warrants to various arm’s length dealers in

connection with the Offering in accordance with the policies of the

TSXV. All securities issued pursuant to the Offering are subject to

a four month hold period from the date of issue.

About NuLegacy Gold

Corporation: Focused on confirming high-grade Carlin-style

gold deposits on its premier 108 sq. km (42 sq. mile) district

scale Red Hill Property in the Cortez gold trend of Nevada.

The Red Hill Property is located on trend and adjacentI to the

three multi-million ounce Carlin-type gold deposits (the Pipeline,

Cortez Hills and Goldrush deposits) that are amongst Barrick Gold’s

largest, lowest cost and politically safest gold minesII.

1 There should be time enough for four to six

holes in the fall (2020) before winter shut down with the balance

of the holes scheduled to start up in the late spring 2021. 2 The

proximity of Red Hill to other gold deposits in the Cortez trend is

not necessarily indicative of gold mineralization at Red Hill.

I The similarity and proximity of these deposits

in the Cortez Trend including Goldrush is not necessarily

indicative of the gold mineralization in NuLegacy’s Red Hill

Property.II As extracted from Barrick’s Q4-2013 and Q1-2014

reports. As reported by Barrick, the Goldrush resource

contains 8,557,000 indicated ounces of gold within 25.78 million

tonnes grading ~10.57 g/t and 1,650,000 inferred ounces within 5.6

million tonnes grading ~9.0 g/t.

Dr. Roger Steininger, a Director of NuLegacy, is

a Certified Professional Geologist (CPG 7417) and the qualified

person as defined by NI 43-101, Standards of Disclosure for Mineral

Projects, responsible for approving the scientific and technical

information contained in this news release.

ON BEHALF OF THE BOARD OF NULEGACY GOLD

CORPORATION

Albert J. MatterChief Executive Officer &

DirectorTel: +1 (604) 639 - 3640Email: albert@nuggold.com

For more information about NuLegacy visit:

www.nulegacygold.com or www.sedar.com.

This new release does not constitute an offer to

sell or a solicitation of an offer to buy any of the securities in

the United States. The securities have not been and will not be

registered under the United States Securities Act of 1933, as

amended (the "U.S. Securities Act"), or any state securities laws

and may not be offered or sold within the United States or to or

for the account or benefit of a U.S. person (as defined in

Regulation S under the U.S. Securities Act) unless registered under

the U.S. Securities Act and applicable state securities laws or an

exemption from such registration is available.

Cautionary Statement on Forward-Looking

Information: This news release contains

forward-looking information and statements under applicable

securities laws, which information and/or statements relate to

future events or future performance (including, but not limited to,

the proposed use of proceeds from the Offering, the prospective

nature of the Rift Anticline target, the proposed exploration,

drilling and permitting programs thereon and the timing, cost and

likelihood of success thereof) and reflect management’s current

expectations and beliefs based on assumptions made by and

information currently available to the Company. Readers are

cautioned that such forward-looking information and statements are

neither promises nor guarantees, and are subject to risks and

uncertainties that may cause future results to differ materially

from those expected including, but not limited to, actual results

of exploration activities, unanticipated geological, stratigraphic

and structural formations, environmental risks, operating risks,

accidents, labor issues, delays in obtaining governmental approvals

and permits, the availability of financing, market conditions,

future prices for gold, changes in personnel and other risks in the

mining industry. There are no known resources or reserves in the

Red Hill Property, any proposed exploration programs are

exploratory searches for commercial bodies of ore and the presence

of gold resources on properties adjacent or near the Red Hill

Property including Goldrush is not necessarily indicative of the

gold mineralization on the Red Hill Property. There is also

uncertainty about the spread of COVID-19 and the impact it will

have on the Company’s operations, personnel, supply chains, ability

to procure exploration equipment, contractors and other personnel

on a timely basis or at all and economic activity in general. All

the forward-looking information and statements made in this news

release are qualified by these cautionary statements and those in

our continuous disclosure filings available on SEDAR at

www.sedar.com. The forward-looking information and statements in

this news release are made as of the date hereof and the Company

does not assume any obligation to update or revise them to reflect

new events or circumstances save as required by applicable

law.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

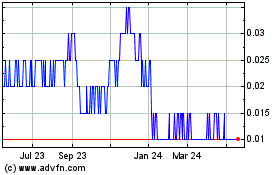

Nulegacy Gold (TSXV:NUG)

Historical Stock Chart

From Oct 2024 to Nov 2024

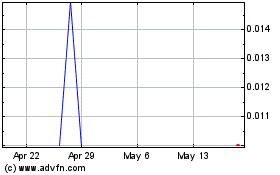

Nulegacy Gold (TSXV:NUG)

Historical Stock Chart

From Nov 2023 to Nov 2024