Nevada Exploration Announces $600,000 Private Placement, Corporate Update, and Shares for Debt

July 15 2014 - 8:30AM

Marketwired Canada

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE

UNITED STATES

Nevada Exploration Inc. ("NGE" or the "Company") (TSX VENTURE:NGE) is pleased to

announce a non-brokered private placement offering of up to 12,000,000 units

(the "Units") at a price of $0.05 per Unit (the "Offering"), for total gross

proceeds of up to $600,000. Each Unit will consist of one common share and one

non-transferable common share purchase warrant entitling the holder to purchase

one common share at an exercise price of $0.05 for a period of three years,

subject to an accelerated expiry provision described below. As set out in more

detail later in the release, NGE will make the Offering available to existing

shareholders under a new prospectus exemption process as set out in BC

Instrument 45-534.

Corporate Update and Use of Proceeds

In the last 165 years, explorers have identified and evaluated nearly 100,000

prospects within Nevada's 300,000 km2. Of these prospects, approximately 665

have become producing gold mines, representing the highest concentration of gold

deposits per unit area of any jurisdiction in the world.

In the last few years, new research aimed at understanding Nevada's unique gold

endowment has identified the large-scale geologic processes and events

responsible for the genesis and spatial distribution of Nevada's gold deposits.

Rather than the simplistic concept of linear trends (e.g. the Battle Mountain -

Eureka Trend and the Carlin Trend), this new research defines the extent of

suitable conditions for gold deposition to a larger area, of approximately

110,000 km2, centred on north-central Nevada. Of this area, only 40% has been

effectively explored because the remaining 60% is covered beneath sand and

gravel in the valley basins where conventional exploration methods are

challenged. NGE's management believes that the covered 60% of this area contains

as much gold as has already been found in the exposed 40%, and that searching in

these covered areas represents the best opportunity to find large new gold

deposits anywhere in the world.

Recognizing this incredible opportunity to find new large gold deposits, NGE has

spent the last 10 years developing and applying new hydrogeochemistry

(groundwater chemistry) exploration technology to complete the first systematic

search for gold in Nevada's covered basins (for more information please visit

www.nevadaexploration.com). Today the rest of the industry is beginning to

recognize the potential to find new gold deposits in these formerly "off-trend"

areas, as well as the need to explore the 60% of this area that sits beneath

cover. Illustrative of how the industry is shifting its exploration strategies

to incorporate these new ideas, NGE has learned that Barrick Gold Corp. has

begun to collect hydrogeochemistry samples to explore in covered settings in

Nevada's Antelope Valley and Monitor Valley. With a 10 year head start, NGE has

identified many prospective basin targets, assembled large land positions

covering many of these areas, and has positioned itself to lead the industry in

this next chapter of exploration in Nevada.

To sustain this lead, and to provide shareholders with the opportunity to

benefit from NGE's considerable work and investment to date, NGE is completing

this Offering to raise the capital needed to maintain the Company's property

portfolio, and to allow NGE's Management to engage with industry participants in

order to attract additional exploration partners and resources. Of the proposed

total gross proceeds of $600,000, NGE expects to use $270,000 for property

payments and maintenance; $160,000 to support its exploration office, and

$160,000 to meets its public company related corporate administration.

Discussing the Offering and NGE's strategic vision, Wade Hodges, CEO & Chairman

said: "In the year and a half since we last went to the market to raise capital,

we have incorporated the most recent geologic models into our large

hydrogeochemistry database and regional geophysical and geologic datasets to

further reduce Nevada's vast highly prospective basins down to discrete targets,

with a combined total area of less than five percent of the north-central Nevada

focus area. In the last year NGE has completed additional groundwater sampling

and acquired new property positions in the areas covering the high priority

targets. With major industry players such as Barrick now beginning to adopt

these same strategies, we believe that NGE is positioned to be a leader and that

the time has come for us to raise our profile within the industry. With this

financing we will secure our properties for another year and have time to engage

in discussions with interested exploration partners, all with the goal of

leveraging our existing properties, the targets we have identified but not yet

acquired, our large state-wide database, and our proprietary technology to

create opportunities for our shareholders to participate in a large gold

discovery in Nevada."

Additional Information about the Offering

The Offering will be conducted in reliance upon British Columbia Instrument

45-534 (the "Instrument"), which permits an issuer to distribute securities to

its existing shareholders, subject to the terms and conditions of the

Instrument. Under the Instrument, NGE may accept qualifying subscriptions of up

to $15,000 from existing shareholders.

NGE advises shareholders interested in participating in the Offering to contact

the Company as soon as possible.

For the purpose of determining existing NGE shareholders entitled to purchase

Units under the exemption provided by the Instrument, the Company has set July

14, 2014, as the record date. All participants that elect to subscribe for the

Offering under the exemption provided by the Instrument will need to represent

in writing that they were an NGE shareholder in principal on or before the

record date, and that they still are.

The exemption provided by the Instrument is not available to shareholders

resident in Ontario; Newfoundland and Labrador; or jurisdictions outside of

Canada. The Company may combine the Offering under the Instrument with sales

pursuant to other available prospectus exemptions, including sales to accredited

investors.

The maximum number of Units to be issued under the Offering is 12,000,000, for

maximum gross proceeds of $600,000. There is no minimum number of Units or gross

proceeds. In the event that NGE receives subscriptions exceeding $600,000, the

Units will be allocated pro rata among all subscribers.

The Offering is scheduled to close on or about August 8, 2014, and is subject to

receipt of all necessary regulatory and TSX Venture Exchange approvals. The

securities issued in connection with the Offering will be subject to a four

month hold period from the date of issue, as well as to any other re-sale

restrictions imposed by applicable securities regulatory authorities.

Subject to approval by the TSX Venture Exchange and applicable securities

legislation, NGE may pay eligible arms-length finders a finder's fee of up to 8%

of the gross proceeds raised, in addition to a number of Compensation Warrants

equal to 8% of the total Units subscribed. The Compensation Warrants shall be

issued on the same terms as the Warrants issued under the Offering.

If on any 20 consecutive trading days after the issuance of the Units the

closing sales price (or closing bid price on days when there are no trades) of

the common shares of NGE quoted on the TSX Venture Exchange is greater than

$0.11, NGE may accelerate the expiry date of the Warrants to the 30th day after

the date on which NGE gives notice to the Warrant holder of such acceleration.

The securities issued by NGE have not been, and will not be, registered under

the United States Securities Act of 1933, as amended (the "1933 Act"), or the

securities laws of any state of the United States, and may not be offered or

sold in the United States absent registration, or an applicable exemption

therefrom, under the 1933 Act and the securities laws of all applicable states.

This press release shall not constitute an offer to sell or the solicitation of

an offer to buy the securities in the United States or in any jurisdiction in

which such offer, sale or solicitation would be unlawful.

Shares for Debt

Recognizing the need to preserve the Company's cash and reduce its liabilities,

NGE today also announces that subject to both shareholder and TSX Venture

Exchange approval, it has entered into shares for debt agreements with

management and a non-arms length party pursuant to which the Company will issue

2,050,000 Common Shares at a price of $0.05 to: (a) settle $30,000 in

outstanding accrued salary for each of three senior officers of the company; and

(b) settle $12,500 in outstanding accounts payable due to an accounting firm, in

which an officer and director of the Company is a partner, for $12,500 of

accounting services rendered in the ordinary course of business. Unlike the

Units being issued as part of the Offering described above, the shares issued

under the shares for debt agreements do not include warrants. NGE will seek

shareholder approval for these shares for debt agreements at the Company's next

Annual General Meeting.

About Nevada Exploration Inc.

NGE is an exploration company focused on gold in Nevada. NGE is led by an

experienced management team that has been involved with the discovery of more

than 30 million ounces of gold in Nevada.

NGE is aggressively applying the latest in covered deposit exploration

technology to identify, acquire, and advance new exploration properties in

Nevada's highly prospective, yet underexplored covered basins. Specifically, NGE

has developed proprietary hydrogeochemistry (groundwater chemistry) exploration

technology to explore for gold in Nevada's covered basins where traditional

exploration techniques are challenged.

Using its industry-leading exploration technology, NGE has assembled a portfolio

of new gold projects, and with interests in more than 135 square kilometres (52

sq mi), has established itself a major player in this world class jurisdiction.

NGE's business model is to leverage its properties and technology to create

shareholder value through generative exploration, joint ventures, and other

exploration partnerships.

Wade A. Hodges, President & CEO, Nevada Exploration Inc., is the Qualified

Person, as defined in National Instrument 43-101, and has prepared the technical

and scientific information contained in this News Release and the referenced

presentation.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that

term is defined in the policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this release.

Cautionary Statement on Forward-Looking Information:

This release and referenced presentation contains certain "forward-looking

statements" including, without limitation, expectations, beliefs, plans and

objectives regarding the potential transactions and ventures discussed in this

release. Among the important factors that could cause actual results to differ

materially from those indicated by such forward-looking statements are the risks

inherent in mineral exploration, the need to obtain additional financing,

environmental permits, the availability of needed personnel and equipment for

exploration and development, fluctuations in the price of minerals, and general

economic conditions.

FOR FURTHER INFORMATION PLEASE CONTACT:

Nevada Exploration Inc.

Wade Hodges

CEO & Chairman

+1 (888) 263 2110

info@nevadaexploration.com

www.nevadaexploration.com

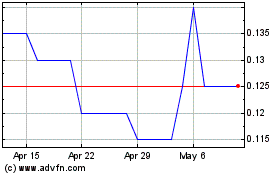

Nevada Exploration (TSXV:NGE)

Historical Stock Chart

From Jun 2024 to Jul 2024

Nevada Exploration (TSXV:NGE)

Historical Stock Chart

From Jul 2023 to Jul 2024