- In fiscal Q3 2022, for the 3 months ended April 30, 2022,

Mednow is forecasted to have quarterly revenue of C$5 - C$5.5M,

quarter-over-quarter growth of approx. 175%;

- In the 2022 calendar year, revenue is forecasted to range

between C$42.5M and C$47.5M;

- 2022 gross margin is expected to average at approximately 20%,

with 40K - 45K active patients, and a net loss for the year;

- Revenue for the 2023 calendar year is forecasted to range

between C$105M and C$110M;

- 2023 gross margin is expected to average at approximately 25%,

with 110K - 120K active patients;

- In the 2023 calendar year, Mednow is expected to produce

approximately $5M to $10M in Adjusted EBITDA;

- Mednow plans to launch its Montreal, Quebec pharmacy

fulfillment centre by May 2022

Mednow Inc. (“Mednow’' or the “Company”) (TSXV:

MNOW) (OTCQB:MDNWF), Canada’s on-demand virtual pharmacy, is

pleased to provide a corporate update on its upcoming fiscal Q3

2022 quarterly earnings, which will be released in June 2022.

Financial Performance and Key

Performance Indicators

In fiscal Q3 2022, Mednow is forecasted to have quarterly

revenue of $5 - $5.5M, quarter-over-quarter growth of approx. 175%.

Mednow’s second quarter 2022 results have highlighted strong

quarter-over-quarter performance with revenue growth of 230% or

C$1.9 compared to first quarter 2021 revenue of C$570K. Patients

grew 20% to 19K patients versus the previous quarter. Mednow’s

second quarter gross margin was 19%, with a cash balance of

C$16M.

On February 24, 2022, Mednow provided annual forecasted growth

figures for the calendar years 2022 and 2023. For the calendar year

2022, revenue is forecasted to range between C$42.5M to C$47.5M.

Contributions of approximately C$42M are anticipated to come from

its pharmacy services, while approximately C$3M is anticipated to

come from doctor services. The gross margin is expected to average

at approximately 20%, with 40K - 45K active patients, and a net

loss for the year. For the calendar year 2023, Mednow is expected

to produce adjusted EBITDA of approximately $5M - $10M. Revenue for

2023 is forecasted to range between C$105M to C$110M, with C$102M

contributed by pharmacy services and C$5M coming from doctor

services. The gross margin is expected to average at approximately

25%, with 110K - 120K active patients.

Operational Milestones

Mednow currently operates in the Provinces of British Columbia,

Ontario, Nova Scotia and Manitoba. On April 18, 2022, Mednow

launched a licensed pharmacy in Winnipeg, which offers prescription

delivery services in the Province of Manitoba.

On March 31, 2022, Mednow closed the previously announced

acquisition of a pharmacy in Toronto (“Mednow East”). Mednow East

is a Toronto company that operates an online and brick-and-mortar

pharmacy, delivering prescriptions in the Province of Ontario.

Mednow plans to launch its Montreal, Quebec fulfillment centre

in May 2022. The Company plans to launch the Calgary, Alberta

fulfillment centre later this year.

About Mednow Inc.

Mednow is a healthcare technology company offering virtual

access with a high-standard of care. Designed with accessibility

and quality of care in mind, Mednow.ca provides virtual pharmacy

and telemedicine services as well as doctor home visits through an

interdisciplinary approach to healthcare that is focused on the

patient experience. Mednow’s services include free at-home delivery

of medications, a user-friendly interface for easy upload,

transfer, and refill of prescriptions, access to healthcare

professionals through an intuitive chat experience, a specialized

PillSmart™ system that packages prescriptions, and vitamins by date

and time, and doctor consultations.

To learn more, follow Mednow on Facebook, Twitter, LinkedIn, and

Instagram, or visit our website at www.mednow.ca/.

Neither TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

DEFINITIONS OF CERTAIN NON-IFRS FINANCIAL MEASURES

This press release uses certain non-IFRS financial measures

which are defined below. Non-IFRS financial measures are not

standardized financial measures under International Financial

Reporting Standards (“IFRS”). As such, these measures may

not be comparable to similar financial measures that are disclosed

by other companies. These measures include “EBITDA” and “Adjusted

EBITDA”. These measures should not be reviewed and assessed as a

substitute for financial information reported under IFRS. A

reconciliation of the non-IFRS measures to the IFRS measure is

below.

RECONCILIATION OF NON-IFRS FINANCIAL MEASURES

The following are reconciliations of net loss and comprehensive

loss to EBITDA. The adjustments include:

- The amortization and depreciation expenses of intangible

assets, fixed assets, and the right-of-use assets of the

Company.

- The interest expenses, which primarily includes interest

expense on the Company’s credit facility and interest expense

recorded in accordance with IFRS 16.

The following are reconciliations of EBITDA to Adjusted EBITDA.

The adjustments include:

- The loss on investment in equity securities in connection with

the Company’s investment in Life Support Mental Health Inc.

- The share-based compensation expense recorded by the Company in

connection with its stock option plan.

- The acquisition costs incurred by the Company for its completed

and pending acquisitions.

The exclusion of certain items in calculating the non-IFRS

measures does not imply that they are non-recurring, infrequent,

unusual or not useful to investors.

Additional information relating to the composition of Adjusted

EBITDA and an explanation of how Adjusted EBITDA provides useful

information to an investor and the additional purposes, if any, for

which management uses Adjusted EBITDA is incorporated herein by

reference to the Company’s Management’s Discussion and Analysis for

the period ended January 31, 2022 filed on March 23, 2022 (the

“MD&A”) under the Company’s profile on www.sedar.com.

The relevant information can be found on page 23 of the MD&A

under the heading “Definitions of Certain Non-IFRS Financial

Measures.”

EQUIVALENT HISTORICAL NON-GAAP MEASURE

For the month ended January 31,

2022(Unaudited) Net loss and comprehensive loss for the period

$

(1,784,021

)

Interest expense

8,106

Depreciation and amortization

109,258

EBITDA1

(1,666,657

)

Loss on investment in equity securities

16,063

Share-based compensation

366,361

Acquisition costs

49,463

Adjusted EBITDA1

(1,234,770

)

EBITDA and Adjusted EBITDA has been discussed in the section

"Definitions of Certain Non-IFRS Financial Measures" in the

Company's MD&A for the period ended January 31, 2022 available

under the Company’s profile on www.sedar.com.

There is no difference between the Adjusted EBITDA that is

forward-looking information referenced in the body of this press

release and the equivalent historical Adjusted EBITDA presented in

the table above.

This release includes certain statements and information that

may constitute forward-looking information within the meaning of

applicable Canadian securities laws. All statements in this press

release, other than statements of historical facts, including

statements regarding future estimates, plans, objectives, timing,

assumptions or expectations of future performance, including

without limitation, Mednow’s Q3 2022 forecasted revenue of C$5 -

C$5.5 million, and expected quarter-over-quarter growth of 175%;

the Company’s expectation that in 2022 the Company’s revenue will

range between C$42.5M and C$47.5M, the Company’s expectation that

the Company’s 2022 gross margin will average at approximately 20%,

with 40,000 to 45,000 active patients, and be at a net loss for the

year, the Company’s expectation that revenue for the 2023 calendar

year will range between C$105M and C$110M, the Company’s

expectation that the Company’s 2023 gross margin will average at

approximately 25%, with 110,000 to 120,000 active patients, the

Company’s expectation that it will produce adjusted EBITDA of

approximately $5M to $10M in the 2023 calendar year, the Company’s

intention to launch its Montreal, Quebec pharmacy fulfillment

centre by May 2022 and a Calgary, Alberta fulfillment center later

this year are forward-looking statement and contains

forward-looking information. Generally, forward-looking statements

and information can be identified by the use of forward-looking

terminology such as “intends” or “anticipates”, or variations of

such words and phrases or statements that certain actions, events

or results “may”, “could”, “should”, “would” or “occur”.

Forward-looking statements are based on certain material

assumptions and analysis made by the Company and the opinions and

estimates of management as of the date of this press release,

including that during the next 12 months, the Company will build

and open retail pharmacies in the provinces of Alberta and Quebec,

the Company will have national delivery capabilities in summer

2022, the Company will be successful in the deployment of its

resources and personnel, the Company’s operations will not be

adversely impacted by COVID-19, the availability of financing, the

cost of planned expansion, third party contractors and supplies and

governmental and other approvals required to conduct the Company’s

planned activities will be available on reasonable terms and in a

timely manner and that general business and economic conditions

will not change in a material adverse manner, the Company will be

successful in its targeted marketing campaigns and advertising

initiatives that will allow the Company to grow its active patients

to 40,000 to 45,000 active users in calendar 2022 and 110,000 to

120,000 active patients in calendar 2023, the Company will be

successful in growing its active users to its estimated target

range in calendar 2022 and calendar 2023, which will allow the

Company to generate between C$42.5 million and C$47.5 million of

revenue, average gross margin of 20% and a net loss in calendar

2022, and between C$105 million and C$110 million of revenue,

average gross margin of 25% and adjusted EBITDA in the range of $5

million to $10 million in its calendar 2023 year, the Company will

be able to continue to buy medications and other goods at

reasonable prices and underlying purchase terms to achieve its

expected gross margin in calendar 2022 and calendar 2023, the

Company will be able to control operating costs to be able to

achieve its target and forecasted earnings and adjusted EBITDA, the

Company’s web and mobile application will be able to support a

higher number of patients and users who will use the application to

transact with the Company, and the Company will be successful in

its strategic objectives, including the integration of existing

business acquisitions and the pursuit of other investments and

acquisitions.

These forward-looking statements are subject to known and

unknown risks, uncertainties and other factors that may cause the

actual results, level of activity, performance or achievements of

the Company to be materially different from those expressed or

implied by such forward-looking statements or forward-looking

information. Important factors that may cause actual results to

vary, include, without limitation, changes in market conditions,

fluctuations in the currency markets, changes in national and local

governments, legislation, taxation, controls, regulations, and

political or economic developments in Canada or other countries in

which the Company may carry on business in the future; risks

relating to the credit worthiness or financial condition of

suppliers and other parties with whom the Company does business;

inadequate insurance or inability to obtain insurance to cover

these risks; availability and increasing costs associated with

operational inputs and labor; business opportunities that may be

presented to, or pursued by the Company; the Company’s ability to

successfully integrate acquisitions; the ongoing economic impacts

of the COVID 19 pandemic, and the risk factors discussed or

referred to in the Company’s disclosure documents under the

Company’s profile at www.sedar.com Although management of the

Company has attempted to identify important factors that could

cause actual results to differ materially from those contained in

forward-looking statements or forward-looking information, there

may be other factors that cause results not to be as anticipated,

estimated or intended. There can be no assurance that such

statements will prove to be accurate, as actual results and future

events could differ materially from those anticipated in such

statements. Accordingly, readers should not place undue reliance on

forward-looking statements and forward-looking information.

Management is providing the future oriented financial information

in this press release in order to assist shareholders and potential

investors in understanding the Company’s financial and business

targets. Readers are cautioned that reliance on such information

may not be appropriate for other purposes. Other than as required

by applicable regulations and laws, the Company does not undertake

to update any forward-looking statement, forward-looking

information or financial outlook.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220426005558/en/

Investor Relations: Benjamin

Ferdinand, CFO ir@mednow.ca 1.855.686.6300

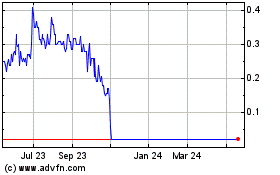

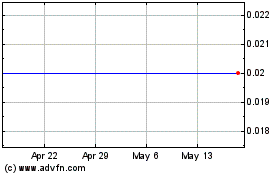

Mednow (TSXV:MNOW)

Historical Stock Chart

From Dec 2024 to Jan 2025

Mednow (TSXV:MNOW)

Historical Stock Chart

From Jan 2024 to Jan 2025