Klondike Silver Corp. Receives $1,050,960 from 506 Tonnes of Silver/Lead Concentrate

October 27 2009 - 3:15PM

Marketwired

Klondike Silver Corp. (TSX VENTURE: KS) (the "Company") is pleased

to announce the Company received $1,050,960 from over 500 tonnes of

concentrate shipped to a smelter in the last year. The 506 tonnes

of silver/lead concentrate had an average grade of 67.43% lead and

88 oz/tonne silver. At current metal prices the bulk sample would

have grossed over $1.4M, encouraging management to move forward

with more bulk sampling this coming year.

"We are encouraged by the results from the mill and are moving

forward on a number of fronts to provide mill feed. The western

drift extension in the 4625 level of the Silvana mine is underway

into a previously unexplored area where the Main Lode structure was

recently intersected. Underground drilling is currently testing a

number of targets at the east end of the same level." comments

Company President, Richard Hughes. "We've recently completed a four

hole surface drill program in the Hewitt Van-Roi exploration area

with the final hole intersecting a wide structural zone, on strike

with the Hewitt vein, which is believed to be an extension of the

lode system. The Connaught property and Stump property also saw

summer exploration programs which we expect to see results from

shortly. These programs were designed to further the Company's

understanding of the high-grade vein systems occurring on both

properties as well as prepare them for potential 2010 bulk

samples."

The Company is especially encouraged with the positive

performance and recovery rates shown by the mill throughout the

processing of the bulk sample. With the knowledge gained the

Company feels confident in its decision to continue providing mill

feed from underground exploration in the immediate area as well as

proposed bulk sampling from its high-grade Yukon properties.

Total milling costs of the 506 tonne sample were $217,970.

Mining and transportation costs of the bulk sample, which were paid

in advance in early 2008, totaled $877,500. Overall the Company

experienced a slight loss of $36,490 due to collapsing metal prices

in late 2008/early 2009. As the transportation and mining had been

paid for in advance, the total milling cost was more than offset by

revenue which prompted the Company to go ahead with the milling,

even though the low metal prices meant it would not be able to

recoup all of its transport costs. This is the largest/highest

grade sample has put through the mill since its acquisition.

The Company would also like to announce it has arranged for a

private placement of up to 2,500,000 units for total proceeds of up

to $162,500. The financing will consist of flow through units

priced at $0.065 per unit. Each of the units will consist of one

flow through common share and one non-flow through,

non-transferable share purchase warrant entitling the holder to

purchase one additional common share for one year at a price of

$0.065 per share in the first year, $0.10 per share in the second

year and $0.15 for the remaining three years. Proceeds from the

private placement will be used for general exploration

expenditures.

About Klondike Silver:

Klondike Silver Corp. has assembled a quality portfolio of

silver properties in historic mineral districts in North America,

and is applying advanced exploration technologies to add value to

these core assets. Klondike Silver is reviving the Gowganda and Elk

Lake silver camps in Ontario, and the world-famous Klondike

district of Yukon Territory. The Company owns a 100 TPD fully

operational flotation mill in Sandon, BC, which is currently

processing material from one of its Yukon properties and local

mines in the historic Slocan Silver Camp.

Klondike Silver is a member of the Hughes Exploration Group of

Companies and is led by a team with a stellar track record of

discovery and development in Canada.

Visit Klondike Silver's web-site: www.klondikesilver.com to see

Smartstox interviews with Company President, Richard Hughes.

The statements made in this news release may contain

forward-looking statements that may involve a number of risks and

uncertainties. Actual events or results could differ materially

from the Company's expectations and projections.

The TSX Venture Exchange does not accept responsibility for the

adequacy or accuracy or contents of this news release.

Contacts: Klondike Silver Corp. Kevin Hull or Alan Campbell

(604)-685-2222 info@klondikesilver.com AGORACOM Investor Relations

KS@agoracom.com http://www.agoracom.com/ir/KlondikeSilver

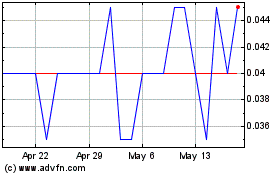

Klondike Silver (TSXV:KS)

Historical Stock Chart

From Jun 2024 to Jul 2024

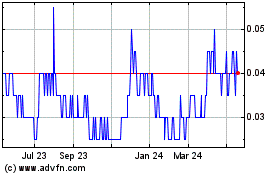

Klondike Silver (TSXV:KS)

Historical Stock Chart

From Jul 2023 to Jul 2024