Klondike Silver Corp. (the "Company") (TSX VENTURE: KS) is pleased

to report that it has acquired additional mineral properties in and

around the Sandon Silver Camp of south-central British Columbia,

including several past-producing mines.

Klondike Silver is the dominant landholder in the Slocan Camp,

which has produced more than 70 million ounces of silver plus

by-product base metals since the late 1800s. The Company's holdings

now encompass 29 former producers, extensive exploration lands and

a fully permitted 100-tonne-per-day flotation mill.

The Company acquired the following properties and historic mines

from Locke Goldsmith, an internationally experienced mine and

mineral exploration geologist credited with several mineral

discoveries in the Slocan Mining Camp. Soil geochemistry is now

underway or completed on the majority of these properties and

results are forthcoming.

- HALLMAC: This former producer (1980-1984) has rail in place

and natural ventilation and strong air flow from the adit. Proposed

work, including drill-testing, would focus on the projected

position of the lode on the 1690 Level.

- VULTURE: Historical mapping and soil sampling suggest that an

offset portion of the previously mined lode at this former producer

(pre-1900 and 1952) may be present upslope and east of the drift. A

second mineralized lode is exposed on an adjacent claim. The lower

Vulture adit has not yet been located. A soil sampling program has

recently begun and proposed work includes hand-trenching and

underground mapping.

- ENTERPRISE: This former producer was worked by various parties

to 1972, with production from a "dry" ore silica vein with high

silver and low base metals. Sampling in 1980 returned positive

results at the face of the 8 Level (lowest adit). Large dumps at

several portals were selectively sampled, with results suggesting

some fractions contain appreciable mineralization. Further sampling

is proposed, along with site work (road clearing, etc.).

- CHAMBERS: One adit and several stopes to surface have been

located at this past-producing mine, which operated intermittently

to 1984. Proposed work will focus on higher grade, silver-rich

areas if the adit portal is open.

- ADAMS LODE: Several adits were developed to explore lodes on

the Chicago and Cristein claims. The Adams Lode has been projected

by soil geochemistry to continue from Sandon Creek through these

claims. A sample of the lode assayed 28.36 oz silver per ton,

52.42% lead and 1.40% zinc. Hand-trenching along the trend of the

geochemical anomalies is proposed.

- CONDUCTOR: The Conductor Lode may be a northeastern extension

of the formerly productive Alamo Lode. Soil geochemistry and

geological mapping have identified three or more lodes and two

mineralized breccia zones. Samples from an exposed lode and nearby

dumps have returned positive results. More work is planned,

including sampling, mapping, hand-trenching, and drilling of the

Conductor Lode and possibly other lodes.

- TUFA: This former crown grant has no recorded history,

although adits and trenches exist on the property. Results are

awaited from recent soil sampling and may be followed by an

underground sampling program using existing adits.

- VERNON: This area has no published history, but covers a weak

geochemical anomaly that may be tested with further soil

sampling.

Klondike Silver's exploration efforts in and around the Sandon

Silver Camp are focused on reviving the most promising historic

mines near the existing mill and exploring historic and more

recently discovered lodes with production potential.

The Company is also pleased to announce that it has completed a

private placement announced on June 17, 2009. This private

placement consisted of 9,500,000 flow through units at a price of

$0.06 per unit. Each unit consisted of one flow-through common

share and one common share purchase warrant. Each common share

purchase warrant will entitle the holder to purchase one common

share until July 13, 2011 at $0.10 per share. Any shares issued

will be subject to a hold period expiring on November 15, 2009.

Barrington Capital Corp. was paid a cash commission totaling

$45,600.

The Company also announces an amendment and the closing of a

private placement previously announced June 25, 2009. The total

number of units is increased from 10,000,000 units to 10,610,000

units. The private placement consisted of 2,310,000 flow through

units and 8,300,000 non flow-through units, totaling 10,610,000

units at a price of $0.06 per unit. Each unit consisted of one

flow-through common share or non flow-through share and one common

share purchase warrant. Each common share purchase warrant will

entitle the holder to purchase one common share until July 12, 2011

at $0.10 per share. Any shares issued will be subject to a hold

period expiring on November 14, 2009. Union Securities Ltd. and

Wolverton Securities Ltd. were paid a cash commission totaling

$5,520.

Proceeds of the private placements will primarily be used for

exploration programs, property option payments and general working

capital.

The Qualified Person for the purpose of National Instrument

43-101 is Trygve Hoy, PEng, PhD who has read and agreed with the

technical information in this news release.

About Klondike Silver:

Klondike Silver Corp. has assembled a quality portfolio of

silver properties in historic mineral districts in North America,

and is applying advanced exploration technologies to add value to

these core assets. Klondike Silver is reviving the Gowganda and Elk

Lake silver camps in Ontario, and the world-famous Klondike

district of Yukon Territory. The Company owns a 100 TPD fully

operational flotation mill in Sandon, BC, which is currently

processing material from one of its Yukon properties and local

mines in the historic Slocan Silver Camp.

Klondike Silver is a member of the Hughes Exploration Group of

Companies and is led by a team with a stellar track record of

discovery and development in Canada.

Visit Klondike Silver's web-site: www.klondikesilver.com to see

Smartstox interviews with Company President, Richard Hughes.

The statements made in this news release may contain

forward-looking statements that may involve a number of risks and

uncertainties. Actual events or results could differ materially

from the Company's expectations and projections.

The TSX Venture Exchange does not accept responsibility for the

adequacy or accuracy or contents of this news release.

Contacts: Corporate Inquiries: Klondike Silver Corp. Kevin Hull

or Alan Campbell (604)-685-2222 info@klondikesilver.com

www.klondikesilver.com AGORACOM Investor Relations KS@agoracom.com

www.agoracom.com/ir/KlondikeSilver

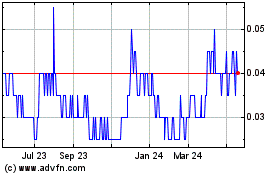

Klondike Silver (TSXV:KS)

Historical Stock Chart

From Jun 2024 to Jul 2024

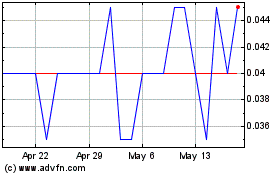

Klondike Silver (TSXV:KS)

Historical Stock Chart

From Jul 2023 to Jul 2024