Iberian Minerals Corp. (TSX VENTURE:IZN) today announced financial

and operating results for the three and nine month periods ended

September 30, 2011, with comparative figures for the three and nine

month periods ended September 30, 2010. The unaudited condensed

consolidated financial statements and related notes, and Management

Discussion and Analysis may be found on www.sedar.com. Unless

stated otherwise, all reported figures are in U.S. dollars. The

Company reported net income of $123.6 million for Q3 2011,

representing $0.27 per share.

Financial Highlights:

Three months ended September 30, 2011

- Recorded net income of $123.59 million or $0.27 per registered share

which included:

- Sales of $60.11 million and gross loss of $24.09 million;

- A realized loss of $52.42 million on commodity hedges (included in

sales) which caused the gross loss;

- An unrealized non-cash gain of $164.22 million on derivative

financial instruments outstanding, partially as a result of

commodity hedging positions in copper and zinc that were delivered

into during the period and were thus retired and partially due to a

decline in metals prices impacting the fair value of outstanding

hedge positions.

- Cash flow provided by operations before changes in working capital

items was $1.49 million.

Nine months ended September 30, 2011

Recorded net income of $201.55 million or $0.51 per registered share

- which included:

- Sales of $183.48 million and gross loss of $54.02 million;

- A realized loss of $171.03 million on commodity hedges (included in

sales) which caused the gross loss;

- An unrealized non-cash gain of $292.66 million on derivative

financial instruments outstanding, partially as a result of

commodity hedging positions in copper and zinc that were delivered

into during the period and were thus retired and partially due to a

decline in metals prices impacting the fair value of outstanding

hedge positions.

- Cash flow provided by operations before changes in working capital

items was $22.28 million.

- In June 2011 the Company completed a CA$76 million equity financing

which allowed for the buy-out of Trafigura's 45.96% net-profit interest

("NPI") in Condestable (for 2011 to 2014) for $60 million. The buy-out

of the NPI was completed on June 30, 2011.

Operational Highlights - CMC:

Three months ended September 30, 2011

- Condestable Mine processed copper ore at expected rates. The average

copper ore grade was 1.05% in 2011 versus 1.21% in 2010.

- CMC processed 597,139 tonnes of ore in 2011 versus 564,541 tonnes of

ore in 2010 (increase of 6%).

- Copper concentrate production in 2011 was 24,551 DMT versus 24,544 DMT

in 2010 (no change versus prior year).

- Contained copper production in 2011 was 5,688 FMT versus 6,088 FMT in

the prior year (decrease of 6%).

- The Cash Operating Cost in 2011 was $1.19 per payable pound of copper

produced versus prior year of $0.99.

Nine months ended September 30, 2011

- Condestable Mine processed copper ore at expected rates. The average

copper ore grade was 1.09% in 2011 versus 1.16% in 2010.

- CMC processed 1,769,167 tonnes of ore in 2011 versus 1,666,932 tonnes

of ore in 2010 (increase of 6%).

- Copper concentrate production in 2011 was 72,428 DMT versus 68,840 DMT

in 2010 (increase of 5%).

- Contained copper production in 2011 was 17,387 FMT versus 17,252 FMT in

the prior year (increase of 1%).

- The Cash Operating Cost in 2011 was $1.12 per payable pound of copper

produced versus prior year of $1.02. For the current year this is below

the 2011 guidance of $1.15 per payable pound of copper.

Other

- In May 2011 CMC completed an amendment to its senior debt facility and

increased the principal to $60 million and extended the term by six

months (to September 2013).

- Major project works were completed on the previously announced 10%

processing plant expansion. The processing plant reached 6,600 tpd of

ore processed in June 2011.

Operational Highlights - MATSA:

Three months ended September 30, 2011

- MATSA processed 518,682 tonnes of ores in 2011 versus 460,999 tonnes of

ores in 2010 (increase of 12%).

- Produced 28,707 DMT of copper concentrate (2010 - 26,754 DMT), 18,260

DMT of zinc concentrate (2010 - 5,968 DMT) and 7,280 DMT of lead

concentrate (2010 - nil). Contained metal production was 6,638 FMT of

copper (2010 - 5,767 FMT), 8,632 FMT of zinc (2010 - 2,834 FMT), 1,217

FMT of lead (2010 - nil) and 235,549 ounces of silver (2010 - 181,978

ounces).

- The Cash Operating Cost was $1.56 per payable pound of copper produced

(2010 - $2.06 per payable pound of copper produced). For the current

year this is below the 2011 guidance of $1.75 per payable pound of

copper produced.

Nine months ended September 30, 2011

- MATSA processed 1,499,209 tonnes of ores in 2011 versus 1,200,355

tonnes of ores in 2010 (increase of 25%). The copper ore head grade was

2.20% (2010 - 1.83%)

- Produced 84,064 DMT of copper concentrate (2010 - 66,817 DMT), 50,893

DMT of zinc concentrate (2010 - 21,645 DMT) and 23,525 DMT of lead

concentrate (2010 - nil). Contained metal production was 18,916 FMT of

copper (2010 - 15,399 FMT), 24,390 FMT of zinc (2010 - 10,400 FMT),

4,216 FMT of lead (2010 - nil) and 725,101 ounces of silver (2010 -

516,488 ounces).

- The Cash Operating Cost was $1.67 per payable pound of copper produced

(2010 - $2.24 per payable pound of copper produced). For the current

year this is below the 2011 guidance of $1.75 per payable pound of

copper produced.

Other

- In May 2011 MATSA was awarded the exploration concessions by the local

authorities for the Sotiel property. The Sotiel mine, which forms part

of the concessions, was a past producing mine and is located

approximately 30 km from the Aguas Tenidas operation.

Outlook:

Operations

The Company updates previously issued production guidance for 2011.

- At Condestable, due to a decreased copper ore grade in recent months,

it is expected that produced metal will be as follows: 22,500 FMT

copper, 13,000 Foz gold and 289,300 Foz silver. The Cash Operating Cost

per pound of payable copper produced is expected to be $1.15.

- The production guidance for Aguas Tenidas remains as follows: 25,000

FMT copper, 33,900 FMT zinc, 3,700 FMT lead and 730,000 Foz silver. The

Cash Operating Cost per pound of payable copper produced is expected to

be $1.75.

- The labour contract negotiations on-going at MATSA are progressing in a

positive fashion. The most recent contract expired on December 31,

2010. The Company remains hopeful that a new collective labour

agreement will be reached in the coming weeks.

Development

The Company continues activities relating to the study of a

possible rehabilitation and re-start of the Sotiel Mine together

with a related expansion study for the operations at Aguas Tenidas.

A budget for this work program of approximately $20 million was

approved by the Board of Directors in June 2011 and is expected to

be spent over the remainder of 2011 and early 2012. The Company

could make a construction decision by the end of 2011.

Summarized Financial Results

The following table presents a summarized Statement of

Operations for the three and nine months ended September 30, 2011

with comparatives for the three and nine months ended September 30,

2010.

Three months ended Nine months ended

September 30, September 30,

----------------------------------------------------------------------------

(thousands of U.S. Dollars) 2011 2010 2011 2010

----------------------------------------------------------------------------

$ $ $ $

Sales 60,110 57,482 183,482 164,976

Costs and expenses of mining

operations 84,196 71,966 237,499 223,574

----------------------------------------------------------------------------

Gross loss (24,086) (14,484) (54,017) (58,598)

Expenses

Administrative expenses and

other 1,876 1,066 4,947 3,281

Exploration and evaluation

expenditures 4,816 - 4,816 -

Foreign exchange gain (4,770) (177) (1,607) (6,394)

Contingent consideration fair

value - 9,442 - 5,233

Unrealized (gain) loss on

derivative instruments (164,216) 97,862 (292,656) (21,093)

----------------------------------------------------------------------------

Total expenses (other income) (162,294) 108,193 (284,500) (18,973)

Operating income (loss) 138,208 (122,677) 230,483 (39,625)

Net finance (income) costs (4,490) 5,897 3,783 4,786

----------------------------------------------------------------------------

Income (loss) before taxation 142,698 (128,574) 226,700 (44,411)

Current income tax expense

(recovery) (931) 2,933 150 5,611

Future income tax expense

(recovery) 20,042 (29,112) 25,003 3,796

----------------------------------------------------------------------------

Net income (loss) 123,587 (102,395) 201,547 (53,818)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Basic earnings (loss) per share

($) 0.27 (0.30) 0.51 (0.16)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Diluted earnings per share ($) 0.26 (0.30) 0.48 (0.16)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Key operating statistics

CMC:

----------------------------------------------------------------------------

Three months Nine months

Periods ended

September 30, Unit 2011 2010 2011 2010

----------------------------------------------------------------------------

Ore mined t 608,008 550,346 1,787,493 1,654,379

Ore processed t 597,139 564,541 1,769,167 1,666,932

Copper ore grade % 1.05 1.21 1.09 1.16

Concentrate grade % 23 25 24 25

Copper recovery rate % 91 90 90 89

Copper concentrate DMT 24,551 24,544 72,428 68,840

Copper contained in

concentrate FMT 5,688 6,088 17,387 17,252

Gold contained in

concentrate oz 3,543 3,382 10,574 10,660

Silver contained in

concentrate oz 79,404 76,216 240,667 207,925

Payable copper

contained in

concentrate FMT 5,424 5,823 16,588 16,491

Payable gold

contained in

concentrate oz 3,207 3,065 9,574 9,334

Payable silver

contained in

concentrate oz 71,213 68,363 215,625 191,329

----------------------------------------------------------------------------

Cash Operating Cost

per lb of payable

copper USD $ 1.19 $ 0.99 $ 1.12 $ 1.02

----------------------------------------------------------------------------

MATSA:

----------------------------------------------------------------------------

Three months Nine months

Periods ended September 30, Unit 2011 2010 2011 2010

----------------------------------------------------------------------------

Copper ore

Ore mined t 257,205 348,691 878,166 927,636

Ore processed t 274,240 362,290 867,343 920,555

Copper ore grade % 2.20 1.82 2.20 1.83

Concentrate grade % 23 22 22 22

Copper recovery rate % 86 82 86 83

Copper concentrate DMT 22,601 24,908 72,859 62,633

Copper contained in concentrate FMT 5,184 5,393 16,336 13,881

Silver contained in concentrate oz 61,993 77,105 220,676 199,913

Payable copper contained in

concentrate FMT 4,958 5,144 15,608 13,275

Payable silver contained in

concentrate oz 40,193 53,411 163,966 139,830

Polymetallic ore

Ore mined t 230,785 104,843 645,342 281,397

Ore processed t 244,442 98,709 631,866 279,800

Zinc ore grade % 5.39 4.91 5.71 6.19

Zinc concentrate grade % 47 47 48 48

Zinc recovery rate % 66 61 68 61

Copper ore grade % 1.17 1.08 1.10 1.26

Copper concentrate grade % 24 20 23 21

Copper recovery rate % 51 38 38 40

Lead ore grade % 1.55 - 1.69 -

Lead concentrate grade % 18 - 18 -

Lead recovery rate % 33 - 39 -

Zinc concentrate DMT 18,260 5,968 50,893 21,645

Copper concentrate DMT 6,106 1,846 11,205 4,184

Copper/lead concentrate DMT - - - 6,071

Lead concentrate DMT 7,280 - 23,525 -

Zinc contained in concentrate FMT 8,632 2,834 24,390 10,400

Copper contained in concentrate FMT 1,454 374 2,580 1,518

Lead contained in concentrate FMT 1,217 - 4,216 -

Silver contained in concentrate oz 173,556 104,873 504,425 316,575

Payable zinc contained in

concentrate FMT 7,171 2,357 20,321 8,427

Payable copper contained in

concentrate FMT 1,393 355 2,468 1,415

Payable lead contained in

concentrate FMT 999 - 3,510 -

Payable silver contained in

concentrate oz 97,776 20,799 303,121 177,466

----------------------------------------------------------------------------

Cash Operating Cost per lb of

payable copper USD 1.56 2.06 1.67 2.24

----------------------------------------------------------------------------

About Iberian Minerals Corp.

Iberian Minerals Corp. is a Canadian listed global base metals

company with interests in Spain and Peru. The Condestable Mine,

located in Peru approximately 90 km south of Lima operates at 2.4

million tonnes per year producing copper, and associated silver and

gold in a concentrate. The Aguas Tenidas Mine is in the Andalucia

region of Spain approximately 110 km north-west of Seville and

operates a 2.2 million tonnes per year underground mine and

concentrator that produces copper, zinc and lead concentrates that

also contain gold and silver.

Note 1 - The Cash Operating Cost per pound of payable copper is

a non-IFRS performance measure. It includes cash operating costs,

including treatment and refining charges ("TC/RC"), freight and

distribution costs, and is net of by-product metal credits (zinc,

gold and silver). The Cash Operating Cost per pound of payable

copper indicator is consistent with the widely accepted industry

standard established by Brook Hunt and is also known as the C1 cash

cost.

FORWARD LOOKING STATEMENTS:

This news release contains certain "forward-looking statements"

and "forward-looking information" under applicable securities laws.

Except for statements of historical fact, certain information

contained herein constitutes forward-looking statements.

Forward-looking statements are frequently characterized by words

such as "plan", "expect", "project", "intend", "believe",

"anticipate", "estimate", and other similar words, or statements

that certain events or conditions "may" or "will" occur. Forward

looking information may include, but is not limited to, statements

with respect to the future financial or operating performances of

the Corporation, its subsidiaries and their respective projects,

the timing and amount of estimated future production, estimated

costs of future production, capital, operating and exploration

expenditures, the future price of copper, gold and zinc, the

estimation of mineral reserves and resources, the realization of

mineral reserve estimates, the costs and timing of future

exploration, requirements for additional capital, government

regulation of exploration, development and mining operations,

environmental risks, reclamation and rehabilitation expenses, title

disputes or claims, and limitations of insurance coverage.

Forward-looking statements are based on the opinions and estimates

of management at the date the statements are made, and are based on

a number of assumptions and subject to a variety of risks and

uncertainties and other factors that could cause actual events or

results to differ materially from those projected in the

forward-looking statements. Many of these assumptions are based on

factors and events that are not within the control of the

Corporation and there is no assurance they will prove to be

correct. Factors that could cause actual results to vary materially

from results anticipated by such forward-looking statements include

changes in market conditions and other risk factors discussed or

referred to in the section entitled "Risk Factors" in the

Corporation's annual information form dated March 30, 2011.

Although the Corporation has attempted to identify important

factors that could cause actual actions, events or results to

differ materially from those described in forward-looking

statements, there may be other factors that cause actions, events

or results not to be anticipated, estimated or intended. There can

be no assurance that forward-looking statements will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such statements. The

Corporation undertakes no obligation to update forward-looking

statements if circumstances or management's estimates or opinions

should change except as required by applicable securities laws. The

reader is cautioned not to place undue reliance on forward-looking

statements.

Neither TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Contacts: Iberian Minerals Corp. Laura Sandilands Investor

Relations and Corporate Communications 416-815-8558

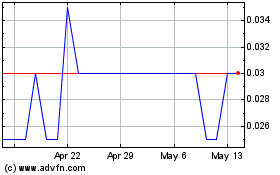

InZinc Mining (TSXV:IZN)

Historical Stock Chart

From Jun 2024 to Jul 2024

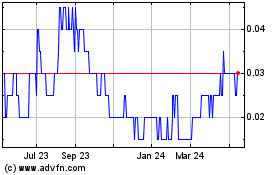

InZinc Mining (TSXV:IZN)

Historical Stock Chart

From Jul 2023 to Jul 2024