Hemlo Explorers Inc. (the “

Company”) (TSXV: HMLO)

is pleased to announce that it has closed the first tranche of the

non-brokered private placement (the “

Offering”)

announced on April 20, 2023. Under the first tranche of the

Offering, the Company issued 7,293,333 units

(“

Units”), each comprised of one non flow-through

common share and one common share purchase warrant (each whole

common share purchase warrant, a “

Warrant”) and

2,291,110 “flow-through” units (“

FT Units”), each

comprised of one flow-through common share and one Warrant, for

aggregate gross proceeds of approximately $753,000. The common

share component of each FT Unit was issued as a “flow-through

share” (as defined in subsection 66(15) of the Income Tax Act

(Canada)). Each Warrant is exercisable to acquire one common share

of the Company (a “

Warrant Share”) at an exercise

price of $0.15 per Warrant Share until December 30, 2024, but

subject to accelerated expiry terms following the four month and a

day hold period (as further described below) if the Company’s

common shares trade at or above $0.50 per share for 20 consecutive

days in which case the Company will have the right to accelerate

the exercise period to a date ending at least 30 days from the date

that notice of such acceleration is provided to the holders of the

Warrants.

The proceeds of the FT Unit portion of the first

tranche of the Offering will be used for the exploration of the

Company’s Hemlo area projects, and the proceeds of the Unit portion

of the first tranche of the Offering will be used for general

corporate purposes and exploration of the Company’s properties.

In connection with the closing of the first

tranche of the Offering, the Company paid certain cash finders fees

and issued 270,800 finder’s warrants (each, a “Finder’s

Warrant”) to eligible finders in respect of subscriptions

for Units and FT Units referred by such finders. Each Finder’s

Warrant is exercisable to acquire one common share of the Company

(a “Finder’s Warrant Share”) at an exercise price

of $0.075 per Finder’s Warrant Share until December 30, 2024.

All securities issued in connection with the

first tranche of the Offering (being the Units, the FT Units, the

Finder’s Warrants, and the securities comprising each of the

foregoing) are subject to a statutory hold period expiring October

31, 2023. Certain directors and officers of the Company

participated in the Offering, purchasing in the aggregate 310,000

Units for aggregate proceeds of $24,900.

The Offering remains subject to final approval

of the TSX Venture Exchange. In addition, the TSX Venture Exchange

has granted Hemlo an extension until August 4, 2023 with respect to

closing any additional tranches of the Offering.

This news release does not constitute an offer

to sell or a solicitation of an offer to sell any of the securities

in the United States. The securities have not been and will not be

registered under the United States Securities Act of 1933, as

amended (the "U.S. Securities Act") or any state securities laws

and may not be offered or sold within the United States or to U.S.

Persons unless registered under the U.S. Securities Act and

applicable state securities laws or an exemption from such

registration is available.

Early Warning

In connection with the closing of the first

tranche of the Offering, Northfield Capital Corporation

(“Northfield”) acquired ownership and control of

2,666,667 common shares of the Company and 2,666,667 Warrants to

acquire 2,666,667 additional common shares of the Company.

Prior to the completion of the first tranche of

the Offering, Northfield owned and controlled an aggregate of

10,592,120 common shares of the Company (of which 10,086,821 common

shares are owned by Northfield directly and 505,299 common shares

are owned by Mr. Robert Cudney (a “control person” (as such term is

defined in the Securities Act (Ontario) of Northfield)), and

another entity owned by Mr. Robert Cudney) and convertible

securities entitling Northfield and Mr. Robert Cudney to acquire an

additional 1,350,000 common shares of the Company (of which

1,100,000 convertible securities are owned by Northfield directly

and 250,000 convertible securities are owned by Mr. Robert Cudney)

representing approximately 28.76% of the issued and outstanding

common shares of the Company as of June 29 2023 (or approximately

31.28% calculated on a partially diluted basis, assuming the

exercise of the 1,350,000 convertible securities only).

Upon completion of the first tranche of the

Offering, Northfield, together with Mr. Robert Cudney, own and

control an aggregate of 13,258,787 common shares of the Company (of

which 12,753,488 common shares are owned by Northfield directly and

505,299 common shares are owned by Mr. Robert Cudney, and another

entity owned by Mr. Robert Cudney) and convertible securities

entitling Northfield and Mr. Robert Cudney to acquire an additional

4,016,667 common shares of the Company (of which 3,766,667

convertible securities are owned by Northfield directly and 250,000

convertible securities are owned by Mr. Robert Cudney) representing

approximately 28.57% of the issued and outstanding common shares of

the Company as of June 30, 2023 (or approximately 34.26% calculated

on a partially diluted basis, assuming the exercise of the

4,016,667 convertible securities only).

The common shares of the Company and Warrants

were acquired in a private placement transaction which did not take

place through the facilities of any market for the Company’s

securities. This transaction was effected for investment purposes

and Northfield could increase or decrease its investments in the

Company at any time, or continue to maintain its current investment

position, depending on market conditions or any other relevant

factor. The common shares of the Company and Warrants were acquired

for aggregate consideration of $200,000.03, pursuant to the

exemption contained in Section 2.3 of National Instrument 45-106 on

the basis that Northfield is an “accredited investor” as defined

herein.

This portion of this new release is issued

pursuant to National Instrument 62-103 – The Early Warning System

and Related Take-Over Bid and Insider Reporting Issues, which also

requires an early warning report to be filed on SEDAR

(www.sedar.com) containing additional information with respect to

the foregoing matters. A copy of the related early warning report

may be obtained on the Company’s SEDAR profile or by contacting

Northfield at 141 Adelaide Street West, Suite 301, Toronto,

Ontario, M5H 3L5, Attention: Michael Leskovec tel: 647

794-4360.

About Hemlo Explorers Inc.

Hemlo Explorers is a Canadian-based mineral

exploration company with a portfolio of properties in Ontario and

Nunavut. We are focused on generating shareholder value through the

advancement of our Hemlo area projects, including Project Idaho,

the Pic Project (under the option to Barrick Gold Inc.) and the

North Limb Project.

For more information please contact:

Brian Howlett, President & CEOHemlo

Explorers Inc.brian@hemloexplorers.ca (647) 227-3035

http://www.hemloexplorers.ca

Forward-Looking Statements

Certain information set forth in this news

release may contain forward-looking statements that involve

substantial known and unknown risks and uncertainties, including,

but not limited to, the Offering, the use of proceeds, and the

Company’s plans with respect to the exploration and development of

its properties. These forward-looking statements are subject to

numerous risks and uncertainties, certain of which are beyond the

control of Hemlo Explorers Inc., including, but not limited to, the

impact of general economic conditions, industry conditions,

volatility of commodity prices, risks associated with the

uncertainty of exploration results and estimates, currency

fluctuations, dependency upon regulatory approvals, the uncertainty

of obtaining additional financing and exploration risk. Readers are

cautioned that the assumptions used in the preparation of such

information, although considered reasonable at the time of

preparation, may prove to be imprecise and, as such, undue reliance

should not be placed on forward-looking statements. The Company

does not undertake to update any forward-looking statements, except

in accordance with applicable securities laws.

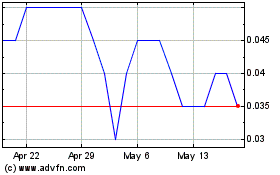

Hemlo Explorers (TSXV:HMLO)

Historical Stock Chart

From Nov 2024 to Dec 2024

Hemlo Explorers (TSXV:HMLO)

Historical Stock Chart

From Dec 2023 to Dec 2024