Guardian Exploration Expands Alberta Bakken Landholdings by 6,000 Acres, Adds Board Member and Announces $1.5 Million Brokered F

March 03 2011 - 12:51PM

Marketwired Canada

Guardian Exploration Inc. ("Guardian" or the "Company") (TSX VENTURE:GX) is

pleased to announce that it has purchased an additional 6,025 acres of

prospective Alberta Bakken lands in townships directly adjacent to the Blackfeet

Nation in Glacier and Pondera County, Montana. The acreage increases Guardian's

holdings in the area to approximately 9,000 acres in an area where Newfield

Exploration, Rosetta Resources and Anschutz Exploration have focused their

Alberta Bakken exploration efforts. The majority of Guardian's lands on the

Reservation are held by production from the Cut Bank formation, where the

company currently produces 35 barrels of oil per day. An operational update

provided by Newfield on February 15, 2011 stated; "To date, Newfield has drilled

five vertical wells, completed and placed on production a horizontal well, and

has a second horizontal well awaiting completion. All of the wells to date have

encountered oil..." From visits to the area, Guardian's Management believes that

the aforementioned completed well is the Sheriff 1-11H well that is only 7 miles

away from Guardian lands. A location even closer to Guardian lands has been

drilled by Arkanova Energy, who in January of this year released the finding

that their Tribal-Max 1-2817 well did in fact encounter the Bakken and Three

Forks zones. This well was drilled to a depth of 5,908 feet and is 2 miles

directly south of Guardian lands.

Using information provided by the Montana Board of Oil and Gas, a total of 16

wells have been spud in the past 18 months on the Blackfeet Reservation

targeting formations deeper than 4,000 feet, with another 12 wells permitted to

be drilled.

Graydon Kowal, President and Chief Executive Officer noted "Guardian has been

watching this play develop over the past several years and now has seen enough

evidence from the other operators in the area and our own geological review to

be confident that the Company's current exploration focus is in Montana

targeting the Alberta Bakken."

The Company is also pleased to announce that it has entered into an agreement

with D&D Securities Inc. of Toronto (the "Agent") to act as agent on a

"reasonable commercial efforts" basis for the placement of up to 15,000,000

Units of the Company at a price of $0.10 per Unit, each Unit consisting of one

common share ("Common Share") in the capital of the Company and one-half (1/2)

Common Share purchase warrant ("Warrant"), each whole Warrant being exercisable

for one (1) Common Share of the Company at a price of $0.25 per share (the

"Warrant Price") for a period of 18 months following closing, provided that if

after four months and one day following the Closing Date, the closing price of

the common shares of the Corporation on the principal market on which such

shares trade is equal to or exceeds $0.375 for 10 days (the "Eligible

Acceleration Date") the Warrant Expiry Date shall accelerate to the date which

is 30 calendar days following the date a formal notice is issued by the Company

announcing the reduced warrant term, provided such notice is sent to all warrant

holders no more than five business days following the Eligible Acceleration

Date.

The Agent will receive a cash commission equal to 7% of the aggregate gross

proceeds of the Offering. The Agent will also receive an Agent's Warrant

exercisable to purchase that number of Shares that is equal to 10% of the

aggregate number of Units sold. Each Agent's Warrant will entitle the holder to

acquire one Share at a price of $0.25 per Share for a period of 18 months from

the date of closing of the Offering.

The securities issued in the Offering will be subject to a hold period of four

months plus one day from closing.

The Offering is scheduled to close on or about March 30, 2011 and is subject to

applicable regulatory and TSX Venture Exchange approval and completion of

definitive documentation. Proceeds from the Offering will be used for

exploration and development expenditures on the above-noted Montana Bakken lands

and for working capital purposes.

The Units will be offered by way of private placement exemptions in the

provinces of Ontario, British Columbia and Alberta and such other jurisdictions

within and outside of Canada as may be agreed to between the Company and the

Agent. The Offering will not be available in the United States except under

applicable registration exemptions under the United States Securities Act of

1933.

The Company is also pleased to announce the appointment of Mr. Abbas Mahdi to

the board of directors of Guardian. Mr. Mahdi is a geologist with 13 years of

experience in production enhancement and optimizations with a large

international oil & gas service and engineering company. Mr. Mahdi specializes

in the areas of fracturing and completions of unconventional resources and has a

successful track record in strategic and operational management.

Mr. Kowal stated, "We are excited to add someone of Mr. Mahdi's experience to

the Guardian team. He is a vital component of Guardian's ongoing strategy of

unlocking the value of its conventional and unconventional oil & gas assets in

Montana."

The Company further announces that it has entered into a convertible promissory

note in the aggregate amount of $250,000 with a private company owned by the

President of Guardian Exploration Inc. The loan matures on June 30, 2011 and

will accrue interest at the rate of 15% per year, payable monthly and is secured

against the assets of the Company. In addition, the loan is convertible into

common shares of the Company at a deemed price of $0.07 per share. Final

completion of the loan is subject to TSX Venture Exchange ("TSXV") approval and

the loan conversion feature is subject to TSX Venture Exchange ("TSXV") approval

and disinterested shareholder approval.

The Company also announces, subject to the stock option plan, the grant of

1,400,000 stock options to certain directors, officers, employees and

consultants. The options vest over a 2 year period, are exercisable at a price

of $0.10 per share and expire in March 2016. The shares issuable upon exercise

of the options may not be traded for 4 months and one day from the date of

grant. The Company has also amended 500,000 options previously issued to

directors, officers, employees and consultants of the Company in May 2006 with

an original exercise price of $1.10 per share and 600,000 options issued in

October 2007 with an exercise price of $0.15 per share, by reducing the exercise

price of the options and extending the expiry date. By virtue of the amendment,

the previously issued options will have an expiry date of February 2016 and an

exercise price of $0.10 per share. The amendment is subject to disinterested

shareholder approval, to be sought at the next annual general meeting of the

shareholders of the Company, and the approval of the TSX Venture Exchange.

Guardian is a Calgary-based corporation engaged in the acquisition, exploration

and development of resource properties. Common shares of the company trade on

the TSX Venture Exchange under the trading symbol "GX".

Investors are cautioned that this news release contains forward looking

information. Such information is subject to known and unknown risks,

uncertainties and other factors that could influence actual results or events

and cause actual results or events to differ materially from those stated,

anticipated or implied in the forward-looking information. Readers are cautioned

not to place undue reliance on forward-looking information, as no assurances can

be given as to future results, levels of activity or achievements.

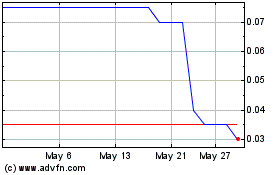

Guardian Exploration (TSXV:GX)

Historical Stock Chart

From Jun 2024 to Jul 2024

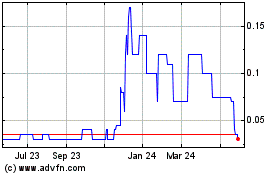

Guardian Exploration (TSXV:GX)

Historical Stock Chart

From Jul 2023 to Jul 2024