Gowest Announces Additional Closing of Private Placement

July 11 2014 - 2:08PM

Marketwired Canada

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN

THE UNITED STATES

Gowest Gold Ltd. (the "Corporation" or "Gowest") (TSX VENTURE:GWA) is pleased to

announce that it has completed an additional closing of its previously announced

non-brokered private placement (the "Offering") for aggregate gross proceeds of

$179,000. At the closing, the Corporation issued a total of 2,237,500 units

("Units"), at a price of $0.08 per Unit, with each Unit being comprised of one

common share of the Corporation and one common share purchase warrant (a

"Warrant"). Each Warrant is exercisable to acquire one common share of the

Corporation at a price of $0.11 for a period of two years following the closing

date.

The Corporation has raised a total of $1,100,000 to date pursuant to the

Offering. As previously announced, the Corporation intends to issue and sell a

further 36,250,000 Units to Fortune Future Holdings Limited ("Fortune"), at a

price of $0.08 per Unit, for additional gross proceeds to the Corporation of

$2,900,000 (the "Second Fortune Closing"). The Second Fortune Closing is subject

to shareholder approval. A special meeting of the shareholders of the

Corporation is scheduled for August 15, 2014 for the purpose of obtaining

requisite shareholder approval. Meeting materials will be mailed to all

shareholders of record on July 16, 2014 on or prior to July 25, 2014.

Further details concerning the Offering, including the Second Fortune Closing,

are contained in the Corporation's press release of June 23, 2014.

All of the securities issuable in connection with the Offering will be subject

to a hold period expiring four months and one day after date of issuance.

The securities offered have not been registered under the United States

Securities Act of 1933, as amended, and may not be offered or sold in the United

States or to, or for the account or benefit of, U.S. persons absent registration

or an applicable exemption from registration requirements. This release does not

constitute an offer for sale of securities in the United States.

Subscriptions by insiders of the Corporation accounted for approximately $10,000

of the gross proceeds of this closing of the Offering. Participation by the

insiders in the Offering is exempt from the valuation and minority shareholder

approval requirements of Multilateral Instrument 61-101 - Protection of Minority

Security Holders in Special Transactions ("MI 61-101") by virtue of the

exemptions contained in Sections 5.5(b) and 5.7(1)(b) of MI 61-101.

Completion of the Second Fortune Closing remains subject to receipt of TSX

Venture Exchange approval.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION PROVIDER (AS THAT TERM IS

DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR

THE ADEQUACY OF THIS RELEASE.

About Gowest

Gowest is a Canadian gold exploration and development company focused on the

delineation and development of its 100% owned Bradshaw Gold Deposit (Bradshaw),

on the Frankfield Property, part of the Corporation's North Timmins Gold Project

(NTGP). Gowest is exploring additional gold targets on its 109-square-kilometre

NTGP land package and continues to evaluate the area, which is part of the

prolific Timmins, Ontario gold camp. The latest updated resource estimate for

Bradshaw included approximately 945,600 ounces of gold ("Au") in the Indicated

category (6.0 million tonnes at a grade of 4.9 grams per tonne ("g/t") Au) and

536,800 ounces of gold in the Inferred category (3.7 million tonnes at a grade

of 4.2 g/t Au). As was used in the Corporation's Preliminary Economic

Assessment, the current estimate is based on a 3.0 g/t Au cut-off and a

conservative gold price of US$1,200/oz. This resource estimate has been

completed by Neil N. Gow, P. Geo., an independent Qualified Person, and reported

in accordance with the requirement of National Instrument 43-101 - Standards of

Disclosure for Mineral Projects and CIM Standards on Mineral Resources and

Reserves.

Forward-looking statements

This news release contains certain "forward-looking statements" including with

respect to the Second Fortune Closing, development plans and activities

(including the anticipated timing thereof) in respect of the Bradshaw project,

the Corporation's relationship with Fortune, the use of proceeds of the Offering

and the Corporation's development plans for the Bradshaw deposit. Such

forward-looking statements involve risks and uncertainties. Forward-looking

statements involve known and unknown risks, uncertainties, assumptions and other

factors that may cause the actual results, performance or achievements of the

Corporation to be materially different from any future results, performance or

achievements expressed or implied by the forward-looking statements. Such

factors include, among others: the reliance of the Corporation on a limited

number of properties (and, in particular, the Corporation's Bradshaw deposit);

the inherent speculative nature and hazards associated with exploration,

development and production activities; assumptions regarding the need for

further financing and related to the cost, timing or available of such

financing; the hazards and risks normally encountered in mineral exploration and

development and limitations of insurance coverage; uncertainties related to the

Corporation's resource estimates, which are based on detailed estimates and

assumptions; risks that the Corporation's title to its material mineral

properties could be challenged; the assumption of the Corporation that it will

be able to obtain permits and other authorizations it requires on a timely

basis; uncertainties related to actual capital costs, sustaining capital costs,

engineering and construction schedules, operating costs and expenditures,

production schedules and economic returns; risks associated with the Corporation

being subject to environmental laws and government regulation; and the lack of

mineral production or earnings history of the Corporation. Any forward-looking

statement speaks only as of the date of this news release and, except as may be

required by applicable securities laws, the Corporation disclaims any intent or

obligation to update any forward-looking statement, whether as a result of new

information, future events or results or otherwise.

FOR FURTHER INFORMATION PLEASE CONTACT:

Greg Romain

President & CEO

Tel: (416) 363-1210

Email: info@gowestgold.com

Greg Taylor

Investor Relations

Tel: 905 337-7673 / Mob: 416 605-5120

Email: gregt@gowestgold.com

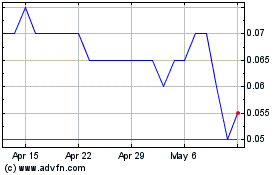

Gowest Gold (TSXV:GWA)

Historical Stock Chart

From May 2024 to Jun 2024

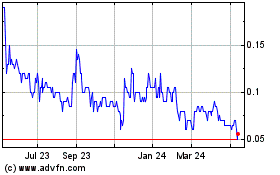

Gowest Gold (TSXV:GWA)

Historical Stock Chart

From Jun 2023 to Jun 2024