GGL Resources Corp.: Closing of First Tranche of the Non Flow-Through Private Placement and Repricing of Warrants for Flow-Th...

August 22 2012 - 11:51AM

Marketwired Canada

NOT FOR DISSEMINATION IN THE UNITED STATES

Raymond A. Hrkac, President and CEO of GGL Resources Corp. (TSX VENTURE:GGL)

announces that GGL has had an initial closing of its non-brokered private

placement originally announced on July 4, 2012. Up to 3,000,000 non-flow-through

units each at a price of $0.05 per unit will be sold.

In the initial closing, 2,400,000 non flow-through units at $0.05 per unit were

placed for gross proceeds of $120,000. Each non flow-through unit consists of

one non flow-through common share and one non-transferable common share purchase

warrant. Each warrant will entitle the holder to purchase one non flow-through

common share until August 17, 2017 at $0.10 per share, subject to an

Acceleration Event. The securities for this initial closing have a hold period

until December 18, 2012.

If GGL's common shares trade on the TSX Venture Exchange ("TSXV") at a closing

price greater than $0.40 per share for twenty consecutive trading days at any

time after four months and one day from the closing date, GGL may accelerate the

expiry of the warrants by giving notice to the holders thereof, and in such case

the warrants will expire on the 30th day after the date on which such notice is

given ("Acceleration Event").

The proceeds from the sale of the units will be used for general exploration

work and for general corporate purposes. Future closings of the private

placement are subject to acceptance for filing by the TSXV.

Flow-through units

On August 9, 2012, Mr. Hrkac announced that the Company intends to raise up to

$120,000 by way of a non-brokered private placement of flow-through units at a

price of $0.05 per unit. Each flow-through unit will consist of one flow-through

common share and one non-transferable non flow-through warrant. Originally each

warrant would entitle the holder to purchase one non flow-through common share

for three years from the closing date at $0.10 per share, subject to an

Acceleration Event (see above definition). The Company will be relying on the

recently announced TSXV Temporary Relief Measures to change the warrant's

exercise price to $0.05 per share during the first year and $0.10 per share for

years two and three, subject to an Acceleration Event and meeting the TSXV

requirements.

The proceeds from the sale of flow-through common shares will be used to incur

Canadian Exploration Expense ("CEE"), as defined in the Income Tax Act (Canada).

GGL will renounce such CEE to the subscribers effective for the 2012 tax year.

The private placement is subject to acceptance for filing by the TSXV.

About GGL

GGL is a diversified mineral exploration company. GGL holds mineral claims and

leases in the Northwest Territories of Canada ("NT") prospective for gold,

silver, nickel, base metals and diamonds. All of the NT holdings are wholly

owned by GGL, except for the Doyle Diamond Project where De Beers Canada Inc.

has a 60% interest and GGL a 40% carried interest. In British Columbia, Canada,

GGL owns a 100% interest in the McConnell Creek gold and copper-gold Property.

GGL RESOURCES CORP.

Raymond A. Hrkac, President & CEO

Forward-Looking Information: This news release contains "forward-looking

statements" and the cautions regarding such statements apply.

This news release does not constitute an offer to sell or a solicitation of an

offer to buy any of the securities in the United States. The securities have not

been and will not be registered in the United States Securities Act of 1933, as

amended (the "US Securities Act") or any state securities laws and may not be

offered or sold within the United States or to US Persons unless registered

under the US Securities Act and applicable securities laws or an exemption from

such registration is available.

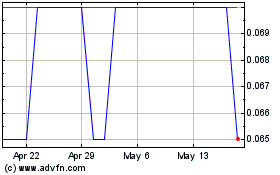

GGL Resources (TSXV:GGL)

Historical Stock Chart

From Nov 2024 to Dec 2024

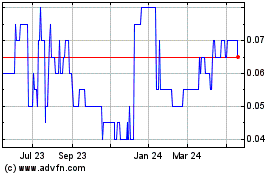

GGL Resources (TSXV:GGL)

Historical Stock Chart

From Dec 2023 to Dec 2024