Evergold Corp. (TSX-V: EVER, OTC: EVGUF, WKN:

A2PTHZ) (“

Evergold” or the

“

Company”) is pleased to announce that it intends

to complete a non-brokered private placement financing for

aggregate gross proceeds of up to $3,500,000 through the issuance

of a combination of hard-dollar units of the Company (“

HD

Units”) at a price $0.045 per HD Unit and flow-through

units (“

FT Units”) at a price of $0.050 per FT

Unit (the “

Offering”). It is expected

that the majority of the gross proceeds from the sale of the FT

Units will be used for drilling the large-scale DEM1 porphyry

prospect in central B.C., where a small, first-ever 3-hole

reconnaissance drill program carried out last fall delivered broad

intercepts of low-grade gold and silver from surface and, within

that broad envelope, local high grades of an impressive spectrum of

high-value elements, including precious and strategic metals (see

news, January 15, 2024). Encouragingly, a geophysical

survey completed earlier this month over the immediate area of the

DEM1 prospect revealed a large target, suggestive of the presence

of abundant sulphides, extending to depth below the reconnaissance

drill holes (see news, May 13, 2024).

“The early drill results from DEM1 demand

immediate follow-up, and we’re keen to get down to it this season,”

said Kevin Keough, President and CEO. “As a founder and key

shareholder with considerable equity exposure to this company,

neither I nor the other directors take lightly the level of

dilution required to finance the next stage of drilling. However,

the only way to add real value to a junior mineral exploration

company is with the drill bit, achieving and developing discoveries

of merit, which we believe DEM to be, and it’s a capital-intensive

process. That said, precious metal prices are very strong, and we

retain 100% of the upside exposure to the DEM1 prospect, in

addition to our other key, fully drill-permitted gold-silver

properties: Golden Lion in B.C., and Rockland, Nevada. These

assets, combined with our current very low share price (less than

half the level at which we capitalized the company on founding),

presents a compelling value proposition. Very strong results out of

the ground, which we believe the DEM1 system is capable of

delivering, should therefore be attended by a corresponding upward

re-rating in our share price, regardless of our capital

structure.”

In connection with the Offering, the Company has

entered into a fiscal advisory agreement with Canaccord Genuity

Corp. (“Canaccord”). Subject to the approval of

the TSX Venture Exchange (“TSXV”), the Company

shall compensate Canaccord in the amount of $25,000, payable in

hard-dollar units of the Company (the “Compensation

Units”) to be issued at C$0.045 per unit with the same

terms as the Offering. In addition, finder’s fees in cash or

securities, or a combination of both, may be payable by Evergold in

connection with the Offering, subject to the rules of the

TSXV.

Financing Details:

Each HD Unit will be comprised of one (1) common

share of the Company and one (1) common share purchase warrant

(each whole warrant, a “HD Warrant”). Each HD

Warrant will entitle the holder thereof to acquire one additional

common share of the Company at an exercise price of $0.06 for a

period of twenty-four (24) months following the closing of the

Offering.

Each FT Unit will be comprised of one (1) common

share of the Company qualifying as a “flow-through share” as

defined in subsection 66(15) of the Income Tax Act (Canada) (a

“FT Share”), and one (1) common share purchase

warrant (each whole warrant, a “FT Warrant”). Each

FT Warrant will entitle the holder thereof to acquire one

additional common share of the Company at an exercise price of

$0.06 per share for a period of twenty-four (24) months following

the closing of the Offering.

The gross proceeds from the issuance of the FT

Units will be used for “Canadian exploration expenses” on the

Company’s Canadian mineral properties, primarily the DEM property,

and will qualify either as "flow-through critical mineral mining

expenditures" or "flow-through mining expenditures" (the

"Qualifying Expenditures"), each as defined in

subsection 127(9) of the Income Tax Act (Canada). The Company

intends to renounce the Qualifying Expenditures to subscribers of

FT Units for the fiscal year ended December 31, 2024 and to incur

the Qualifying Expenditures on or before December 31, 2025. The net

proceeds from the issuance of HD Units will be primarily used for

exploration activities at the Company’s properties, as well as for

general working capital purposes.

It is expected that the Offering will close on

or about June 10, 2024, or such other date or dates that the

Company may determine (the "Closing Date"),

subject to the receipt of all required regulatory approvals,

including the acceptance of the TSX-V. All securities issued in

connection with the Offering will be subject to a hold period of

four months and one day from the Closing Date, in accordance with

applicable Canadian securities laws.

The securities offered have not been registered

under the U.S. Securities Act of 1933, as amended, and may not be

offered or sold in the United States absent registration or an

applicable exemption from the registration requirements. This press

release shall not constitute an offer to sell or the solicitation

of an offer to buy nor shall there be any sale of the securities in

any jurisdiction in which such offer, solicitation or sale would be

unlawful.

Qualified Person

Charles J. Greig, M.Sc., P.Geo., the Company’s

Chief Exploration Officer and a Qualified Person as defined by NI

43-101, has reviewed and approved the technical information in this

news release.

About Evergold

Evergold Corp. is a TSX-V listed mineral

exploration company with projects in B.C. and Nevada. The Evergold

team has a track record of success in the junior exploration space,

most recently the establishment of GT Gold Corp. in 2016 and the

discovery of the Saddle epithermal vein and porphyry copper-gold

deposits near Iskut B.C., sold to Newmont in 2021 for a fully

diluted value of $456 million, representing a 1,136% (12.4 X)

return on exploration outlays of $36.9 million.

For additional information, please contact:

Kevin M. Keough President and CEO Tel: (613)

622-1916kevin.keough@evergoldcorp.cawww.evergoldcorp.ca

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this news release.

Cautionary Statement Regarding

Forward-Looking Information

This news release includes certain

“forward-looking statements” which are not comprised of historical

facts. Forward-looking statements include estimates and statements

that describe the Company’s future plans, objectives or goals,

including words to the effect that the Company or management

expects a stated condition or result to occur. Forward-looking

statements may be identified by such terms as “believes”,

“anticipates”, “expects”, “estimates”, “may”, “could”, “would”,

“will”, or “plan”. Since forward-looking statements are based on

assumptions and address future events and conditions, by their very

nature they involve inherent risks and uncertainties. Although

these statements are based on information currently available to

the Company, the Company provides no assurance that actual results

will meet management’s expectations. Risks, uncertainties and other

factors involved with forward-looking information could cause

actual events, results, performance, prospects and opportunities to

differ materially from those expressed or implied by such

forward-looking information. Factors that could cause actual

results to differ materially from such forward-looking information

include, but are not limited to, risks related to the amendment of

the size of the Offering and the completion, terms and expected

closing date of the Offering, failure to identify mineral

resources, delays in obtaining or failures to obtain required

governmental, environmental or other project approvals, political

risks, inability to fulfill the duty to accommodate First Nations,

uncertainties relating to the availability and costs of financing

needed in the future, changes in equity markets, inflation, changes

in exchange rates, fluctuations in commodity prices, delays in the

development of projects, capital and operating costs varying

significantly from estimates and the other risks involved in the

mineral exploration and development industry, and those risks set

out in the Company’s public documents filed on SEDAR. Although the

Company believes that the assumptions and factors used in preparing

the forward-looking information in this news release are

reasonable, undue reliance should not be placed on such

information, which only applies as of the date of this news

release, and no assurance can be given that such events will occur

in the disclosed time frames or at all. The Company disclaims any

intention or obligation to update or revise any forward-looking

information, whether as a result of new information, future events

or otherwise, other than as required by law.

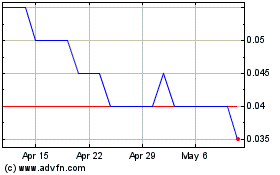

Evergold (TSXV:EVER)

Historical Stock Chart

From May 2024 to Jun 2024

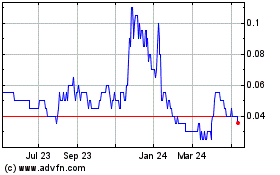

Evergold (TSXV:EVER)

Historical Stock Chart

From Jun 2023 to Jun 2024