Dacha Reports Net Income of US$0.94 Per Share and Financial Results for the Six Months Ending September 30, 2011

November 24 2011 - 6:15AM

Marketwired Canada

Dacha Strategic Metals Inc. ("Dacha" or the "Company") (TSX

VENTURE:DSM)(OTCQX:DCHAF) is pleased to announce that it has released its

interim financial results for the three and six months ended September 30, 2011.

For more information please see the Company's interim financial statements and

Management's Discussion and Analysis ("MD&A") posted on SEDAR at www.sedar.com.

Dacha reported net earnings of US$70.8 million or US$0.94 per basic share for

the six months ended September 30, 2011 from total revenue of US$77.5 million

(US$80.1 million from gain on its metal investments offset by US$2.6 million

loss on security investments). For the six months ending September 30, 2010,

Dacha reported net income of US$3.6 million or US$0.05 per basic share from

total revenue of US$7.5 million (US$6.9 million from gain on its metal

investments offset by US$0.4 million loss on security investments).

As of September 30, 2011, its metals inventory, with a cost basis of US$20.5

million, had an estimated market value of US$121.0 million. During the six

months ended September 30, 2011, Dacha purchased US$3.1 million of metals and

disposed of US$3.9 million of metals for realized profit of approximately US$3.0

million. A physical inventory count was also conducted by the Company's auditors

with the Company's entire inventory held at Pacorini Metals, in two separate LME

approved warehouses in Busan, Korea. Subsequent to the quarter end Dacha has

opened a third warehouse in Singapore, also operated by Pacorini Metals.

Dacha's net assets at September 30th are US$125.3 million or US$1.60 per share

based on 78.1 million shares outstanding, or, US$1.37 per share on a fully

diluted basis of 98.7 million shares outstanding.

Outlook on Rare Earth Market and Hong Kong Rare Earth Conference update

Dacha attended the Roskill Rare Earth conference in Hong Kong last week to meet

with existing customers, potential new customers and industry participants. A

major theme from the conference is the severe impact of flooding in Thailand on

two significant users of rare earth magnets, namely Japanese auto makers and the

Hard Disk Drive manufacturers. This has severely weakened an already slow market

as Japan draws down inventories in hopes of falling prices.

The lack of export buying has the potential to impact export quotas for 2012.

Speculation in Hong Kong had the year end use as much as 10,000 tonnes short of

the quota. Industry participants would not be surprised if 2012 quotas were

reduced in the first half of 2012.

In addition to potentially lower export quotas, the consolidation of the Rare

Earth market continues inside China and the number of exporters with quotas is

expected to fall from the current 26. Chinese rare earth mining and processing

seems to be headed for an oligopoly situation with much of the industry falling

under the control of a few state owned enterprises.

2012 Export Quotas and approved exporters will likely be released sometime

around Christmas with the Lunar New Year falling on January 23rd in 2012.

Normal Course Issuer Bid

During the six months ended September 30, 2011, the Company purchased and

cancelled 3,450,000 common shares at an average cost of $0.91. Subsequent to

September 30, 2011, an additional 1,300,000 common shares have been purchased

for cancellation at an average cost of $0.62. Dacha expects to continue to

purchase shares over the remainder of the fiscal year, depending on market

conditions and other investment opportunities that may be available.

About Dacha

Dacha Strategic Metals Inc is an investment company focused on the acquisition,

storage and trading of strategic metals with a primary focus on Rare Earth

Elements. Dacha is in the unique position of holding a commercial stockpile of

Physical Rare Earth Elements. Its shares are listed on the TSX Venture Exchange

under the symbol "DSM" and on the OTCQX exchange under the symbol "DCHAF".

Except for statements of historical fact relating to the Company, certain

information contained herein constitutes "forward-looking information" under

Canadian securities legislation. Forward-looking information includes, but is

not limited to, statements with respect to the Company's ability to trade in

rare earth elements, the realization value of Dacha's physical inventory

portfolio, proposed investment strategy of the Company, and general investment

and market trends. Generally, forward-looking information can be identified by

the use of forward-looking terminology such as "plans", "expects" or "does not

expect", "is expected", "budget", "scheduled", "estimates", "forecasts",

"intends", "anticipates" or "does not anticipate", or "believes", or variations

of such words and phrases or statements that certain actions, events or results

"may", "could", "would", "might" or "will be taken", "occur" or "be achieved".

Forward-looking statements are based on the opinions and estimates of management

as of the date such statements are made. Forward-looking information is subject

to known and unknown risks, uncertainties and other factors that may cause the

actual results, level of activity, performance or achievements of Dacha to be

materially different from those expressed or implied by such forward-looking

information. Although management of Dacha has attempted to identify important

factors that could cause actual results to differ materially from those

contained in forward-looking information, there may be other factors that cause

results not to be as anticipated, estimated or intended. There can be no

assurance that such statements will prove to be accurate, as actual results and

future events could differ materially from those anticipated in such statements.

Accordingly, readers should not place undue reliance on forward-looking

information. Dacha does not undertake to update any forward-looking information,

except in accordance with applicable securities laws.

The market value of the Company's physical inventory is estimated using price

quotes published by two of the largest independent news sources for the metals

industry, namely, Asian Metal (www.asianmetal.com) and Metal-Pages

(www.metal-pages.com). In cases where these websites do not provide a price

quote on the type or quality of metal held in the Company's physical inventory,

the Company relies on a price quote provided by independent third-party industry

participants.

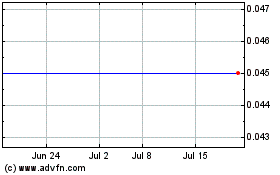

Deep South Resources (TSXV:DSM)

Historical Stock Chart

From Jun 2024 to Jul 2024

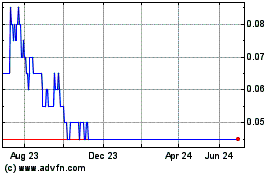

Deep South Resources (TSXV:DSM)

Historical Stock Chart

From Jul 2023 to Jul 2024