Crown Point Energy Inc. Provides an Operational Update for Tierra del Fuego and Cerro de Los Leones Concessions, Argentina

July 17 2013 - 6:00AM

Marketwired Canada

Crown Point Energy Inc. (TSX VENTURE:CWV) ("Crown Point" or "the Company") is

pleased to provide an operational update for its 25.78% interest Las Violetas

Exploitation Concession in the Province of Tierra del Fuego and for its 100%

interest Neuquen Basin, Cerro de Los Leones Exploration Concession in the

Province of Mendoza.

Operational Update

Tierra del Fuego, Austral Basin

Drilling Operations

Crown Point and its partners are currently reviewing several drilling rig

options and negotiations are underway to obtain and import a drilling rig into

Tierra del Fuego to conduct a multi-well and multi-year drilling program on its

25.78% interest Las Violetas Exploitation Concession in the Province of Tierra

del Fuego. Drilling operations are expected to commence in the fourth quarter of

2013. The initial program of 8 wells is part of a multi-well drilling campaign

to exploit the predominantly gas charged Springhill sandstones on its

concessions in the Province of Tierra del Fuego in particular the Las Violetas

Concession. Capital expenditures for Crown Points' capital program are expected

to be funded using Crown Point's existing resources and cash flows.

The initial eight well phase of the Las Violetas Exploitation Concession

drilling program is a low risk development program. These wells are expected to

take 20 days to drill and case (including rig up and rig down), and completion

and tie-in are expected to take an additional 30 days per well.

The locations are fully defined with 3D seismic and are either infill locations

or low risk pool step-outs. Additionally, Crown Point and its partners have

identified a number of high reward exploration and exploitation locations on the

Las Violetas Exploitation Concession. If any future drilling activities at these

locations is successful, it could further add to the present drilling inventory.

It is anticipated that production increases resulting from the drilling program

will qualify for improved gas pricing under the New Gas Incentive Program,

announced by the Argentine government in January 2013. Crown Point has applied

for participation in the New Gas Incentive Program. The government of Argentina

has extended the negotiation period until August 15, 2013

As previously announced, Crown Point and its partners recently received all

necessary governmental approvals for 10 year extensions of the Las Violetas

Exploitation Concession, as well as the Rio Cullen and Angostura Exploitation

Concessions, in which Crown Point also holds a 25.78% interest and which are

also in the Province of Tierra del Fuego. The following are the key terms of the

extensions:

Las Violetas Exploitation Concession

-- Cash payment: US$5 million (gross) (net $1.3 million) paid in three

equal installments commencing immediately and subsequently in 180 day

successive periods;

-- Base royalty: increase from 12 to 15%;

-- Variable royalty: 0.5% to a maximum of 2.5% (in 0.5% increments) with

increasing oil and gas prices;

-- Minimum total development investment commitment: US$46.9 million

including 18 wells (gross) (net US$12.1 million) to be expended over the

remaining life of the concession;

-- Minimum total exploration investment commitment: US$5.0 million (gross)

(net US$1.25 million) to be expended over the next 60 months.

The two year capital commitment for the Las Violetas Exploitation Concession,

including the extension fee, development and exploration commitments, is

US$21.23 million (gross) (net - US$5.47mm).

Rio Cullen and Angostura Exploitation Concessions

-- Exploration commitment - Rio Cullen: US$3.3 million (gross) (net US$0.85

million), Angostura: US$3.8 million (gross) (net US$0.98 million) which

in both cases includes seismic and drilling and is to be expended over a

24 month period.

-- Base royalty: increase from 12 to 15%;

-- Variable royalty: 0.5% to 2.5% (in 0.5% increments) with increasing oil

and gas prices; and

-- After fulfillment of the exploration commitments there is an additional

minimum total additional investment commitment on each concession:

US$1.8 million (gross) (net US$0.46 million).

The combined two year capital commitment for both the Rio Cullen and Angostura

Exploitation Concessions is US$7.1 million (gross) (net - US$1.83mm).

Cerro de Los Leones, Province of Mendoza, Neuquen Basin

The seismic interpretation and geological integration continues at the 100%

interest Cerro de Los Leones Exploration Concession focusing on two separate

potentially multi-zone structural features. These structural features have been

identified on the recently acquired 3-D seismic program. The structural features

comprise the northern extension of a larger structural trend of producing fields

located immediately to the south of Crown Point's concession, which producing

fields include the YPF field Pampa Palauco. The Argentina Secretary of Energy

records show that Pampa Palauco has to date produced 21.4 million barrels of

oil. Engineering well design and reservoir evaluation is underway for these two

prospects. A drilling rig of suitable capacity to drill and evaluate these two

structures is expected to be available at year end. These drilling of these

structures would evaluate both the conventional reservoirs as well as the

unconventional Vaca Muerta oil shales.

About Crown Point

Crown Point Energy Inc. is an international oil and gas exploration and

development company headquartered in Calgary, Canada, incorporated in Canada,

trading on the TSX Venture Exchange and operating in South America. Crown

Point's exploration and development activities are focused in the Golfo San

Jorge, Neuquen and Austral basins in Argentina. Crown Point has a strategy that

focuses on establishing a portfolio of producing properties, plus production

enhancement and exploration opportunities to provide a basis for future growth.

Advisories

Forward-Looking Statements

Certain information regarding Crown Point set forth in this document may

constitute forward-looking statements under applicable securities laws and

necessarily involve substantial known and unknown risks and uncertainties,

including information relating to the following: the intent of Crown Point and

its partners to import a drilling rig into Tierra del Fuego to conduct a

multi-well and multi-year drilling program; the expectation that drilling

operations in the Las Violetas Exploitation Concession will commence in the

fourth quarter of 2013 and the number of wells to be drilled; the expectation

that the multi-well Las Violetas Exploitation Concession drill program will

target predominantly gas charged Springhill sandstones; the expectation of how

capital expenditures will be funded; the expectation that drilling on the Las

Violetas Exploitation Concession represents a low risk development program; the

expected time to drill, case, tie-in and complete the wells to be drilled; the

expectation that successful drilling on certain high reward exploration and

exploitation locations on the Las Violetas Exploitation Concession could add

additional drilling locations; the expectation that production increases

resulting from the drilling program will be eligible for the New Gas Program;

and the timing of the availability of a drilling rig for evaluating certain

prospects on the Cerro de Los Leones Exploration Concession. These

forward-looking statements are based on numerous assumptions including but not

limited to the following: the Company being eligible for the New Gas Program and

the terms thereof, drilling success, expectations with respect to future

production levels, future capital expenditure levels, expectations of cash flow

from operating activities, commodity prices, costs associated with capital

expenditures, the availability of personnel and equipment when expected, the

timely receipt of applicable regulatory and other governmental approvals, and

the continuance of existing laws and regulations.

The reader is cautioned that assumptions used in the preparation of such

information may prove to be incorrect. These forward-looking statements are

subject to numerous risks and uncertainties, certain of which are beyond Crown

Point's control, including without limitation, risks associated with the

following: oil and gas exploration, development, exploitation, production,

marketing and transportation, loss of markets, volatility of commodity prices,

environmental risks, inability to obtain drilling rigs or other services,

capital expenditure cost increases, including drilling, completion and facility

costs, unexpected decline rates in wells, wells not performing as expected,

delays resulting from or inability to obtain required regulatory approvals,

ability to access sufficient capital from internal and external sources, the

impact of general economic conditions in Canada, Argentina, the United States

and overseas, industry conditions, changes in laws and regulations (including

the adoption of new environmental laws and regulations, changes to tax laws and

changes to the New Gas Program) and changes in how they are interpreted and

enforced, political risks (including the risk of the expropriation of the

Company's assets), increased competition, the lack of availability of qualified

personnel or management, fluctuations in foreign exchange or interest rates, and

stock market volatility. Readers are cautioned that the foregoing list of

factors is not exhaustive. Crown Point's actual results, performance or

achievement could differ materially from those expressed in, or implied by,

these forward-looking statements and, accordingly, no assurance can be given

that any of the events anticipated by the forward-looking statements will

transpire or occur, or if any of them do so, what benefits that the Company will

derive therefrom. Readers are cautioned that the foregoing list of factors is

not exhaustive. All forward-looking statements, whether written or oral,

attributable to the Company or persons acting on its behalf are expressly

qualified in their entirety by these cautionary statements. Additional

information on these and other factors that could affect Crown Point's

operations and financial results are included in reports on file with Canadian

securities regulatory authorities and may be accessed through the SEDAR website

(www.sedar.com ) or Crown Point's website (www.crownpointventures.ca ). The

forward-looking statements contained in this document are made as at the date of

this news release and Crown Point does not undertake any obligation to update

publicly or to revise any of the included forward-looking statements, whether as

a result of new information, future events or otherwise, except as may be

required by applicable securities laws.

Analogous Information

Certain information contained herein is considered "analogous information" as

defined in National Instrument 51-101 - Standards of Disclosure of Oil and Gas

Activities ("NI 51-101"). Such analogous information has not been prepared in

accordance with NI 51-101 and the Canadian Oil and Gas Evaluation Handbook. In

particular, this press release presents overviews of certain historic production

relating to fields in close proximity to areas in which the Company has an

interest. Such information is based on independent public data and public

information received from other government sources and the Company has no way of

verifying the accuracy of such information. Such information has been presented

to help demonstrate that hydrocarbons may be present in the Company's area of

interest. There is no certainty that such results will be achieved by the

Company and such information should not be construed as an estimate of future

reserves or resources or future production levels.

TSX Venture Exchange

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term

is defined in the policies of the TSX Venture Exchange) accepts responsibility

for the adequacy or accuracy of this news release.

FOR FURTHER INFORMATION PLEASE CONTACT:

Crown Point Energy Inc.

Murray D. McCartney

President & CEO

(403) 232-1150

mmccartney@crownpointenergy.com

Crown Point Energy Inc.

Arthur J.G. Madden

Vice-President & CFO

(403) 232-1150

amadden@crownpointenergy.com

Crown Point Energy Inc.

Brian J. Moss

Executive Vice-President & COO

(403) 232-1150

bmoss@crownpointenergy.com

www.crownpointenergy.com

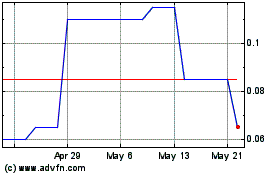

Crown Point Energy (TSXV:CWV)

Historical Stock Chart

From Jun 2024 to Jul 2024

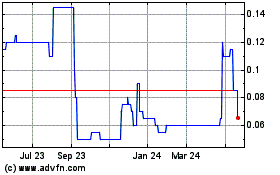

Crown Point Energy (TSXV:CWV)

Historical Stock Chart

From Jul 2023 to Jul 2024