CVW CleanTech Inc. (the “Company” or “CVW CleanTech”)

(TSX-V: CVW) is pleased to announce that the non brokered

private placement originally announced on September 6, 2022, with

an upsize announced on September 20, 2022 (the

“

Financing”) has been closed. In addition, CVW

CleanTech would like to announce the appointment of Pierre

Lassonde, CM, OQ, as a Special Advisor to the Chief Executive

Officer and Board of Directors coupled with his investment in the

Company.

Appointment of Pierre

Lassonde as Special AdvisorCVW CleanTech would like to welcome

Pierre Lassonde, a highly respected Canadian entrepreneur and

investor, as a special advisor to the Company. Mr. Lassonde will

lend his considerable experience and knowledge by providing

strategic insights to the Chief Executive Officer and Board of

Directors on corporate strategy, sustainable investing and

alternative financing strategies. Mr. Lassonde has participated in

the Financing by purchasing 208,333 each of common shares and

warrants, representing approximately 17.9% of the Financing. Mr.

Lassonde now holds 3,242,333 common shares and 708,333 warrants of

the Company, representing approximately 2.7% and 3.3% of the

Company’s issued and outstanding common shares on an undiluted and

partially-diluted basis respectively.

Mr. Lassonde

commented, “I am excited to collaborate with CVW CleanTech as the

company looks to create value for all stakeholders through the

pursuit of its vision of a greener future. CVW CleanTech is a

company oriented towards a sustainable world, and I am thrilled to

provide my insight to this business as we look to create a true

Canadian champion in the space.”

Mr. Akshay Dubey,

Chief Executive Officer, commented, “Pierre’s significant

experience will be an extremely valuable asset to our organization

as we advance our vision and transform CVW CleanTech by deploying

our patented CVW™ technologies and consider the potential for

partnerships in the clean tech space. Pierre’s involvement with our

Company and his investment is a strong endorsement of our strategy

and the potential that exists within this platform.”

Private PlacementThe Financing consisted of an

issuance of 1,166,667 Units priced at $1.20 per Unit for aggregate

gross proceeds of $1,400,000, with each such Unit being comprised

of one common share and one common share purchase warrant. Each

such warrant entitles the holder thereof to acquire one common

share at a price of $1.80 per share until October 7, 2026. The

common shares and warrants issued pursuant to the offering will be

subject to a standard four month hold period expiring on February

8, 2023. The proceeds of the Financing are expected to be used for

general corporate purposes and to provide additional working

capital to CVW CleanTech. Completion of the Financing is subject to

the receipt of all regulatory approvals, including final approval

of the TSXV.

Mr. Dubey subscribed for 208,334 Units on the

same terms as arm’s length investors, as per the Company’s

announcement of Mr. Dubey’s participation on September 6, 2022,

with such participation representing approximately 17.9% of the

Financing. The participation of a director and officer in the

Financing constitutes a “related party transaction” for the

purposes of Multilateral Instrument 61-101 – Protection of Minority

Security Holders in Special Transactions (“MI

61-101”). The Company is relying on the exemption from the

requirements to obtain a formal evaluation and minority shareholder

approval in connection with the insider participation in reliance

on sections 5.5(a) and 5.7(1)(a) of MI 61-101, as neither the fair

market value of the securities to be issued, nor the fair market

value of the consideration for the securities to be issued will

exceed 25% of the Company’s market capitalization as calculated in

accordance with MI 61-101.

About CVW CleanTech Inc.

CVW CleanTech is a clean technology innovator

that has focused on providing solutions to the mining sector of

Canada’s oil sands industry. The Company’s CVW™ technology provides

sustainable solutions to reduce the environmental footprint of the

oil sands industry. Our technology reduces the environmental impact

of oil sands froth treatment tailings, while economically

recovering valuable products that would otherwise be lost. CVW™

recovers bitumen, solvents, heavy minerals and water from tailings,

preventing these commodities from entering tailings ponds and the

atmosphere: volatile organic compound and greenhouse gas emissions

are materially reduced; hot tailings water is improved in quality

for recycling; and residual tailings can be thickened more readily.

A new minerals industry would be created with the production and

export of zircon and titanium, essential ingredients in the

ceramics and pigment industries.

Disclosure regarding forward-looking

information

This news release contains forward-looking

statements and information within the meaning of applicable

Canadian securities laws (collectively, “forward-looking

information”) that reflect the current expectations of management

about the future results, performance, achievements, prospects or

opportunities for CVW CleanTech Inc.

Forward-looking statements are frequently, but

not always, identified by words such as “expects”, “anticipates”,

“believes”, “intends”, “estimates”, “potential”, “possible” and

similar expressions, or statements that events, conditions or

results “will”, “may”, “could” or “should” occur or be achieved.

The forward-looking statements may include statements regarding the

expected expenditure of the proceeds of the Financing, intentions

about future investment plans, work programs, capital expenditures,

timelines, strategic plans, market price of commodities or other

statements that are not statements of fact. Forward-looking

statements are statements about the future and are inherently

uncertain, and actual achievements of the Company may differ

materially from those reflected in forward-looking statements due

to a variety of risks, uncertainties and other factors. For the

reasons set forth above, investors should not place undue reliance

on forward-looking statements. Important factors that could cause

actual results to differ materially from the Company’s expectations

include: uncertainties in the timing and receipt of regulatory and

exchange approvals; uncertainties involved in disputes and

litigation; fluctuations in interest rates, commodity prices,

currency exchange rates, and other financial conditions, and the

resultant effect on viability of investments; changes in the

availability, and cost, of technical labour required for our

business; price escalation and/ or inflationary pressures affecting

the cost of equipment and material required to commercialize our

projects; the uncertainty of estimates of capital and operating

costs; the need to obtain additional financing and uncertainty as

to the availability and terms of future financing; the duration and

full impact of COVID-19; the impact on the Company of increasing

inflation; and other risks and uncertainties disclosed in other

information released by the Company from time to time and filed

with the appropriate regulatory agencies.

All forward looking

statements are based on the Company’s beliefs and assumptions which

are based on information available at the time these assumptions

are made. The forward-looking statements contained herein are as of

the date set out above and are subject to change after this date,

and the Company assumes no obligation to publicly update or revise

the statements to reflect new events or circumstances, except as

may be required pursuant to applicable laws.

Although management believes that the

expectations represented by such forward-looking information or

statements are reasonable, there is significant risk that the

forward-looking information or statements may not be achieved, and

the underlying assumptions thereto will not prove to be accurate.

Actual results or events could differ materially from the plans,

intentions and expectations expressed or implied in any

forward-looking information or statements, including the underlying

assumptions thereto, as a result of numerous risks, uncertainties

and factors including: failure to obtain regulatory approvals; the

possibility that opportunities will arise that require more cash

than the Company has or can reasonably obtain; dependence on key

personnel; dependence on corporate collaborations; potential

delays; uncertainties related to early stage of technology and

product development; uncertainties as to fluctuation of the stock

market; uncertainties as to future expense levels and the

possibility of unanticipated costs or expenses or cost overruns;

and other risks and uncertainties which may not be described

herein. The Company has no policy for updating forward looking

information beyond the procedures required under applicable

securities laws.

For further information, please contact:

|

Darren Morcombe |

Akshay Dubey |

|

Chairman, Board of Directors403.460.8135 |

Chief Executive Officer 403.460.8135 |

|

PR@CVWCleanTech.com |

Akshay.Dubey@CVWCleanTech.com |

Neither the TSX Venture Exchange nor

its Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

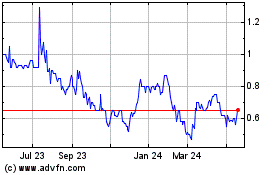

CVW Cleantech (TSXV:CVW)

Historical Stock Chart

From Dec 2024 to Jan 2025

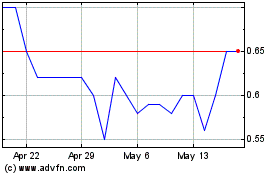

CVW Cleantech (TSXV:CVW)

Historical Stock Chart

From Jan 2024 to Jan 2025