Castle Resources Announces Positive Preliminary Economic Assessment for the Granduc Copper Project

February 28 2013 - 3:50PM

Marketwired Canada

Castle Resources Inc. (TSX VENTURE:CRI) ("Castle" or the "Company") is very

pleased to provide investors the results from the its preliminary economic

assessment ("PEA") completed for its 100% owned Granduc Copper Project located

near Stewart, British Columbia and prepared in accordance with National

Instrument 43-101. The PEA confirms that current resources achieve a pre-tax net

discounted value ("NDV 8%") of $489 million and a pre-tax net present value

("NPV 8%) of $388 million, a 4 year payback period and annual production

averaging 70 million pounds of payable copper equivalent over a 15 year mine

life. (All figures in US dollars except where noted). Castle Resources

commissioned Tetra Tech, an independent third party, to prepare the PEA.

PEA Highlights:

-- Base Case (defined below) initial estimated CAPEX of $494 million

including a 16.3% contingency of $69 million with estimated sustaining

capital of $239 million over a 15 year mine life

-- Base Case pre-tax NDV 8% from a discounting start date of Q1 2016 is

$489 million with a pre-tax IRR of 20.9%; post-tax NDV 8% of $319

million with a post-tax IRR of 17.8%. Changing the discounting start

date to Q1 2013 results in a NPV 8% of $388 million pre-tax and $253

million post-tax, but does not impact the IRR.

-- Life of Mine average operating cash flow is $142 million per year; Peak

Life of Mine (Years 2-8 inclusive) is $164 million per year

-- The project evaluation assumes flat long term metal prices equal to the

rolling three year average of $3.65/lb Cu, $28/oz Ag and $1480/oz Au.

The benchmark magnetite prices used is $122/tonne. The assumed exchange

rate is C$1.00 = US$0.99.

-- The resource used is 11.32 million tonnes in the measured & indicated

category grading 1.47% Cu, 0.17 g/t Au and 12.4 g/t Ag and 44.63 million

tonnes in the inferred category grading 1.43% Cu, 0.19 g/t Au & 10.7 g/t

Ag

-- Peak Life of Mine (Years 2 - 8 inclusive) annual payable production is

forecasted at 72 million lbs of copper, 811 koz silver, 9.5 koz gold and

251,000 tonnes of magnetite

-- 8,500 tonnes/day underground mining operation

-- Base Case gross cash operating costs of $2.04/lb payable Cu and net cash

costs (inclusive of by- product credits) of $1.37/lb payable Cu.

Cautionary Statement: Mineral resources that are not mineral reserves do not

have demonstrated economic viability. This preliminary economic assessment is

preliminary in nature; it includes inferred mineral resources that are

considered too speculative geologically to have the economic considerations

applied to them that would enable them to be categorized as mineral reserves,

and there is no certainty that the results of the preliminary economic

assessment will be realized.

"The results of our PEA clearly demonstrate the strong economics of the Granduc

Copper Project," stated Mr. Mike Sylvestre, President & CEO of Castle Resources.

"Given the excellent potential to continue to expand the Granduc resource, the

project economics should continue to improve as we lengthen the life of mine and

continue the process of optimization."

Mr. Sylvestre continued: "The PEA represents a significant milestone in the

development of the Granduc on our road towards a completed feasibility study.

With the completion of the PEA we now have robust economics to add to the

Granduc story, along with a continually expanding high-grade copper resource and

excellent infrastructure already in place, notably the Granduc Road and 17 km

haulage tunnel. We are particularly pleased with the CAPEX estimate, a figure

that in a climate of rising costs for large mining projects is very reasonable

and will be attractive to potential off-take and joint venture partners as we

advance the project towards feasibility."

The PEA envisions an underground mining operation similar in scope to the

historic mining operations from the 1970s and 80s. The PEA assumes that the mine

will use the low cost, high productivity sub-level caving method for

approximately 80% of ore mined. The remaining 20% of ore will be mined using the

blast hole stoping method which will consume the bulk of waste rock from

development for backfill. Under the PEA, the ore will be transported by rail

through the 17 km Tide haulage tunnel to the concentrator. The concentrator

would operate at a steady-state rate of 8,500 tonnes/day, beginning with all of

the crushed ore being ground in a SAG mill to 160 microns, then only the rougher

concentrate representing 15% of the total ore will be reground to a size of

approx. 25 microns. Rougher tailings will be subjected to magnetic separation to

recover approx. 61% of the feed magnetite.

Based on test work completed on behalf of Castle and historical performance, the

concentrator is expected to achieve a recovery of approximately 95% and will

produce a clean 27% copper concentrate. It is anticipated that concentrate will

be trucked 52 km by road to a marine load-out facility near Stewart, where it

will be shipped in vessels with 50 kt capacity to end users located primarily in

Asia.

The Base Case project includes production of a copper concentrate, that also

contains payable silver and gold, as well as a magnetite concentrate that would

be sold as feed to the steel industry. In addition, Castle commissioned an

independent study to analyze the impact of selling some magnetite as heavy media

to regional coal producers (this study will be included in the full PEA when

published on SEDAR). In the Alternative Case, the economics in the PEA examine

the impact the Granduc Copper Project without magnetite production.

Project Economics:

Base Case: A copper concentrate (with Ag/Au credits) and a magnetite concentrate

will be produced

Alternative Case: A copper concentrate (with Ag/Au credits) will be produced (no

magnetite)

Initial CAPEX for the Base Case is estimated at $494 million including a 16.3%

contingency of $69 million. Sustaining capital is estimated at $239 million, or

approximately $15 million per year over the 15 year life of project. For the

Alternative Case, Initial CAPEX is lower at $485 million while sustaining

capital is unchanged.

Base Case CAPEX & OPEX (US dollars)

Item Initial CAPEX

Mining $ 167 million

Processing $ 67 million

Tailings Storage Facility $ 28 million

Infrastructure $ 70 million

------------------

Total Directs $ 332 million

Indirects & Owners $ 93 million

Contingency $ 69 million

------------------

Total $ 494 million

Item Sustaining CAPEX

Mining $ 178 million

Tailings Storage Facility $ 33 million

Contingency $ 28 million

------------------

Total $ 239 million

Item OPEX

Mining $ 23.52/tonne

Processing & Tailings $ 9.31/tonne

G&A $ 6.55/tonne

Magnetite Resource:

As an addition to the previously reported Cu, Au, and Ag resource estimation,

Tetra Tech has been retained to estimate the magnetite content of the Granduc

deposit. The Qualified Person for this resource estimation is Robert Morrison,

Ph.D., MAusIMM (CP), P.Geo., Lead Resource Geologist for Tetra Tech. The current

Granduc inferred magnetite resource is 37.1 million tonnes grading 13.3%

magnetite, assuming a 2.8% magnetite cut-off, applied only to blocks above the

0.8% CuEq (Cu-Au-Ag Cu-equivalent) cut-off. This estimation utilizes existing Fe

assays, a strong Fe-magnetite correlation, and incorporates new magnetite

assays. The magnetite grades were estimated into the existing high-grade Cu

domains of the deposit, where data density allowed, using a combination of

Conditional Simulation and Collocated Cokriging. At a 0.8% CuEq cut-off,

magnetite was estimated into 11.04 Mt of the initial Measured and Indicated

Resource, and 28.04 Mt of the initial Inferred Resource. The remainder of the

blocks (including all 14.11 Mt of the North Zone above 0.8% CuEq cut-off, as

well as 0.28 Mt Measured & Indicated and 2.48 Mt Inferred in the Main Zone above

0.8% CuEq cut-off), representing approximately 30% of the total resource, did

not have magnetite estimated. This is not to indicate that these blocks do not

contain any magnetite, only that there is insufficient data to facilitate such

an estimate at this time.

The following Qualified Persons have reviewed and approved the technical

disclosure contained in this press release:

-- Robert Morrison, Ph.D., MAusIMM (CP), P.Geo., Lead Resource Geologist

for Tetra Tech, regarding the resource estimate

-- Garth Liukko, P.Eng., Mine Engineer for Tetra Tech, regarding mining

methods and mining capital and operating costs

-- Cam McKinnon, P.Eng., Process Manager for Tetra Tech, regarding mineral

processing and metallurgical testing, recovery methods and process

capital and operating costs

-- Dharshan Kesavanathan, P.Eng., Manager of Private Sector Water for Tetra

Tech, regarding surface infrastructure design and the associated capital

and operating cost estimates

-- Sabry Abdel Hafez, Ph.D., P.Eng., Mine Engineer for Tetra Tech,

regarding the economic analysis

-- Andre C. Gagnon, P.Eng., Geotechnical Engineer for Tetra Tech, regarding

tailings storage facility design and the associated capital and

operating costs

-- Brad Leonard, P. Geo., Castle's Exploration Manager has reviewed and

approved the contents of this news release on behalf of the Company

About Castle Resources

Castle is a Toronto-based junior mineral development company focused on the

exploration and redevelopment of the 100% owned past producing Granduc Copper

Mine. Castle currently has 173 million shares outstanding shares. For more

information please visit the Castle Resources' website at

www.castleresources.com.

Disclaimer

This press release contains forward-looking information within the meaning of

Canadian securities laws. forward-looking information includes, but is not

limited to, statements with respect to the Granduc project; Castle's ability to

raise additional funds necessary; the future price of copper; gold, silver and

magnetite, the estimation of mineral reserves and mineral resources; conclusions

of economic evaluation; the realization of mineral reserve estimates; the timing

and amount of estimated future production, development and exploration; costs of

future activities; capital and operating expenditures; success of exploration

activities; mining or processing issues; currency exchange rates; government

regulation of mining operations; and environmental risks. Generally,

forward-looking statements can be identified by the use of forward-looking

terminology such as "plans", "expects" or "does not expect", "is expected",

"budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or

"does not anticipate", or "believes", or variations of such words and phrases or

statements that certain actions, events or results "may", "could", "would",

"might" or "will be taken", "occur" or "be achieved". Forward-looking statements

are based on the opinions and estimates of management as of the date such

statements are made. Forward-looking statements are subject to known and unknown

risks, uncertainties and other factors that may cause the actual results, level

of activity, performance or achievements of Castle to be materially different

from those expressed or implied by such forward-looking statements, including

but not limited to those risks described in Castle's public disclosure documents

filed on SEDAR from time to time. Although management of Castle has attempted to

identify important factors that could cause actual results to differ materially

from those contained in forward-looking statements, there may be other factors

that cause results not to be as anticipated, estimated or intended. There can be

no assurance that such statements will prove to be accurate, as actual results

and future events could differ materially from those anticipated in such

statements. Accordingly, readers should not place undue reliance on

forward-looking statements. Castle does not undertake to update any

forward-looking statements, except in accordance with applicable securities

laws.

This news release does not constitute an offer to sell or solicitation of an

offer to sell any of the securities in the United States. The securities have

not been and will not be registered under the United States Securities Act of

1933, as amended (the "U.S. Securities Act") or any state securities laws and

may not be offered or sold within the United States or to a U.S. Person unless

registered under the U.S. Securities Act and applicable state securities laws or

an exemption from such registration is available.

FOR FURTHER INFORMATION PLEASE CONTACT:

Castle Resources Inc.

Mike Sylvestre

President & CEO

416-366-4100

mike@castleresources.com

Castle Resources Inc.

Lenny Foreht

VP Operations & Corporate Development

416-644-9003

lforeht@castleresources.com

www.castleresources.com

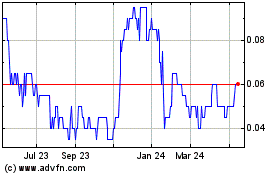

Churchill Resources (TSXV:CRI)

Historical Stock Chart

From Jun 2024 to Jul 2024

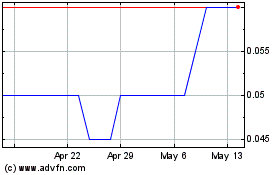

Churchill Resources (TSXV:CRI)

Historical Stock Chart

From Jul 2023 to Jul 2024