Rye Patch Updates Rochester Project Resources Based on Coeur d'Alene's Recent Disclosures

November 06 2012 - 8:00AM

Marketwired Canada

Rye Patch Gold Corp. (TSX VENTURE:RPM)(OTCQX:RPMGF)(FRANKFURT:5TN) (the

"Company" or "Rye Patch") updates gold and silver resources on the LH and OG

unpatented lode mining claims in Pershing County, Nevada based solely on

information disclosed by Coeur d'Alene Mines Corporation ("CDE"). The LH and OG

unpatented lode mining claims are located on lands previously staked by CDE's

subsidiary, Coeur Rochester Inc. ("CRI"), and which became void prior to the

staking of the LH and OG claims by Rye Patch Gold US Inc., the Company's

wholly-owned subsidiary.

On September 11, 2012 and October 25, 2012, CDE presented at the Denver Gold

Forum and the Spokane Silver Summit, respectively. In these presentations, CDE

disclosed the amount of reserves and resources affected by the on-going legal

dispute between CRI and Rye Patch Gold US Inc. Based on CDE's published 2011,

yearend reserve and resource disclosure in its 10-K and the recent

presentations, the mineral resources on the LH and OG unpatented lode mining

claims are shown in Table 1.

Table 1: CDE's Coeur Rochester Inc. Measured, Indicated and Inferred

Resources

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Contained Ounces(5)

Rochester Year End Grade (100% Basis)

2011 Resources (1) (Ounces/Ton) X 1000

----------------------------------------------------------------------------

Tons

X1000 Silver Gold Silver Gold Ageq (4)

Measured &

Indicated 251,472 0.45 0.003 112,348 867 155,698

----------------------------------------------------------------------------

Inferred 40,543 0.58 0.003 23,619 122 29,719

----------------------------------------------------------------------------

----------------------------------------------------------------------------

----------------------------------------------------------------------------

----------------------------------------------------------------------------

LH and OG

CRI Ounces (2) Claim Ounces(3)

Rochester Year End (74% M+I tons) (26% M+I tons)

2011 Resources (1) X 1000 X 1000

----------------------------------------------------------------------------

Tons

X1000 Silver Gold Ageq (4) Silver Gold Ageq (4)

Measured &

Indicated 251,472 83,137 641 115,216 29,210 225 40,481

----------------------------------------------------------------------------

LH and OG

CRI Ounces Claim Ounces

(59% Inferred tons) (41% Inferred Tons)

Inferred 40,543 13,935 71 17,534 9,683 50 12,184

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1) Rochester resources from Coeur d'Alene Mines Corporation 2011 yearend

resource table at $1,500 per ounces gold and $30 per ounce silver;

(2) Coeur d'Alene Mines Corporation disclosure, Denver Gold Forum,

September 11, 2012 (website presentation);

(3) Converse of Coeur d'Alene Mines Corporation disclosure showing

resources on LH and OG Claims;

(4) Ageq equals gold ounces times fifty plus silver ounces (Ageq =

((Au(i)50) + Ag); and

(5) Separate measured and indicated tons unknown to Rye Patch.

These estimates in respect of the LH and OG unpatented lode mining claims should

not be construed as current mineral resources attributable to Rye Patch, as they

are derived solely from public information disclosed by CDE, and Rye Patch has

not verified any of the data that CDE has relied upon in estimating CDE's total

published resources on the Rochester project. Although CDE's published report

appears to be prepared by a qualified person and the procedures, methodology and

key assumptions disclosed therein are those adopted and consistently applied in

the mining industry, no independent qualified person engaged by Rye Patch has

done sufficient work to analyze, interpret, classify or verify CDE's information

to determine any current mineral reserve or resource on the LH and OG unpatented

lode mining claims. Accordingly, the reader is cautioned in placing any reliance

on the above estimates.

The value and quality of the measured, indicated, and inferred silver equivalent

ounces vary with jurisdiction, infrastructure, geometry, grade and metallurgy.

The quality of these ounces is considered excellent since Nevada has

extraordinary infrastructure, the resource is near surface, and grades and

metallurgy are assumed to be similar as those immediately adjacent in the

Rochester and Packard mines.

CDE reported on December 5, 2011 that based on the 2010 year end reserve

statement, up to 20% of the proven and probable reserve was affected by the

disputed claims. From its September 11, 2012 and October 25, 2012 presentations,

CDE now reports that no proven or probable reserves are located on the LH and OG

claims, notwithstanding a 19% increase in gold price ($1,220 vs. $1,025) and a

42% increase in silver price ($23 vs. $16.25) used in calculating the December

31, 2011 year end reserve and resource disclosure.

Last fall, Rye Patch Gold US Inc. located unpatented lode mining claims on open

federally owned public lands of the United States of America. The federal lands

became open for the staking of unpatented lode mining claims on September 1,

2011 when CRI did not pay the time-sensitive, mandatory unpatented claim

maintenance fee. As a result of CRI's failure, its former 541 unpatented lode

mining claims were forfeited and void as a matter of law, and the public lands

became open for the location of unpatented lode mining claims by United States

citizens.

CRI received decision letters from the United States Bureau of Land Management

officially declaring CRI's former 541 unpatented lode mining claims forfeited

and void as a matter of law. CDE reported in its 10-K that CRI failed to pay the

mandatory claim maintenance fees, resulting in the former 541 unpatented lode

mining claims becoming void.

Since the federal lands that previously covered the forfeited 541 unpatented

lode mining claims were open to mineral location by all United States citizens,

including Rye Patch Gold US Inc., for 56 days, Rye Patch Gold US Inc. began

staking the 402 LH unpatented lode mining claims on the open federal lands. The

claim staking commenced on October 27, 2011, and all monumentation was completed

by November 21, 2011. In late November 2011, Rye Patch Gold US Inc. contacted

CRI to notify it that the 402 LH unpatented lode mining claims had been staked.

CRI responded by overstaking the senior 402 LH unpatented lode mining claims

with a junior set of claims denoted as the N unpatented lode mining claims, and

this triggered the legal proceedings between Rye Patch Gold US Inc. and CRI over

title to the claims. In 2012, an additional 11 unpatented lode mining claims

were staked on open lands bringing Rye Patch Gold US Inc.'s total number of

unpatented lode mining claims to 413 for the Rochester Project.

Rye Patch Gold US Inc. controls over 100 square kilometres (40 sq. miles) along

the Oreana trend. The LH and OG Claims which comprise the Rochester Project

consist of 413 unpatented lode mining claims which cover over 30 square

kilometres (7,500 acres).

The Company is a Tier 1, Nevada-focused and discovery-driven company seeking to

build a sizeable inventory of gold and silver resource assets in the mining

friendly state of Nevada, USA. The Company's seasoned management team is engaged

in the acquisition, exploration, and development of quality resource-based gold

and silver projects. Rye Patch Gold US Inc. is developing gold and silver

resources along the emerging Oreana trend, located in west-central Nevada, and

is exploring 66 square kilometres along the Cortez trend near Barrick's two new

gold discoveries. The Company has established gold and silver resource

milestones and time frames in order to build a premier resource development

company. For more information about the Company, please visit our website at

www.ryepatchgold.com.

On behalf of the Board of Directors

William C. (Bill) Howald, CEO & President

This news release contains forward-looking statements, which address future

events and conditions, which are subject to various risks and uncertainties. The

Company's actual results, programs and financial position could differ

materially from those anticipated in such forward-looking statements as a result

of numerous factors, some of which may be beyond the Company's control. These

factors include: the availability of funds, the financial position of Rye Patch

to pursue legal undertakings; the outcome of legal action relating to the

Rochester property and the LH unpatented claims, the timing and content of work

programs; results of exploration activities and development of mineral

properties, the interpretation of drilling results and other geological data,

the uncertainties of resource and reserve estimations, receipt and security of

mineral property titles; project cost overruns or unanticipated costs and

expenses, fluctuations in metal prices; currency fluctuations; and general

market and industry conditions. Litigation is inherently uncertain and factors

that could cause actual results to differ materially from those in

forward-looking statements include unexpected judicial findings of fact,

previously unknown facts arising, and decisions which depart from past legal

precedent and similar events.

Forward-looking statements are based on the expectations and opinions of the

Company's management on the date the statements are made. The assumptions used

in the preparation of such statements, although considered reasonable at the

time of preparation, may prove to be imprecise and, as such, undue reliance

should not be placed on forward-looking statements.

FOR FURTHER INFORMATION PLEASE CONTACT:

Rye Patch Gold Corp.

(604) 638-1588

(604) 638-1589 (FAX)

info@ryepatchgold.com

www.ryepatchgold.com

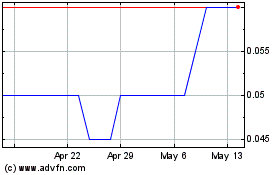

Churchill Resources (TSXV:CRI)

Historical Stock Chart

From Jun 2024 to Jul 2024

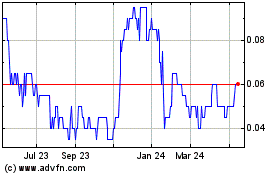

Churchill Resources (TSXV:CRI)

Historical Stock Chart

From Jul 2023 to Jul 2024