Castle Resources Announces Acquisition of Common Shares of Winston Resources Inc. on Sale of Interest in Elmtree Gold Property

June 25 2012 - 12:39PM

Marketwired Canada

Castle Resources Inc. ("Castle" or the "Company") (TSX VENTURE:CRI) announced

that it acquired control over 18,000,000 common shares (the "Winston Shares") of

Winston Resources Inc. (CNSX:WRW) ("Winston Resources"), representing

approximately 29% of the issued and outstanding common shares of Winston

Resources. The Winston Shares were issued to the Company from treasury upon

completion of a reverse takeover (the "RTO") of Gorilla Resources Corp.

("Gorilla") by CNRP Mining Inc. ("CNRP") following which Gorilla changed its

name to Winston Resources Inc, all as further described in a news release of

Winston Resources dated June 22, 2012 (the "Winston Press Release"). CNRP has

become a 100% subsidiary of Winston Resources.

Pursuant to a purchase and assignment agreement (the "Purchase Agreement")

entered into on April 30, 2012 between the Company and CNRP, immediately prior

to the RTO the Company received 18,000,000 common shares of CNRP (the "CNRP

Shares") as part of the sale by the Company to CNRP of the Castle Interest (as

defined below) and the Underlying Option Agreement (as defined below). The CNRP

Shares were exchanged for common shares of Winston Resources on a one-for-one

basis under the RTO.

The Company was the registered and beneficial owner of a 60% right, title and

interest (the "Castle Interest") in certain mining claims and mining patents

commonly known as the Elmtree Gold Property located in New Brunswick (the

"Property"). Pursuant to an option agreement dated June 1, 2009 (the "Underlying

Option Agreement"), Stratabound Minerals Corp. granted the Company the exclusive

right, title and option to acquire an additional 10% right, title and interest

in the Property (the "Underlying Option"), which Underlying Option may be

exercised on or before June 26, 2012.

Under the terms of the Purchase Agreement between the Company and CNRP, the

Company sold the Castle Interest to CNRP, and assigned all of the Company's

rights, obligations and interests under the Underlying Option Agreement to CNRP,

all in exchange for the following consideration:

(a) payment to the Company by CNRP of the following cash payments:

(i) $250,000 on or before the six month anniversary of the

completion of the RTO; and

(ii) $250,000 on or before the 12 month anniversary of the

completion of the RTO; and

(b) the issuance of the CNRP Shares to the Company; and

(c) the grant by CNRP to the Company of a 3% net smelter return

royalty on the Castle Interest to be calculated and payable in

accordance with the Purchase Agreement.

Pursuant to the RTO, the CNRP Shares held by the Company were acquired by

Gorilla in exchange for the Winston Shares, at a deemed price of $0.25 per

Winston Share, as further described in the Winston Press Release.

As a condition to acquiring the CNRP Shares and, subsequently, the Winston

Shares, the Company entered into a voting trust agreement dated June 22, 2012,

pursuant to which the Company assigned all of its voting rights in and to the

Winston Shares to Daniel Wettreich, the CEO of Winston Resources, and agreed not

sell any of the Winston Shares to any third party without the prior written

consent of Winston Resources until the earlier of the date on which the Company

dividends or distributes the Winston Shares to the shareholders of the Company

or the date that is 24 months from the completion of the RTO.

The Winston Shares are held for investment purposes. The Company may, depending

on market and other conditions, increase or decrease its beneficial ownership of

securities of Winston Resources, whether in the open market, by privately

negotiated agreements or otherwise, subject to a number of factors, including

general market conditions and other available investment and business

opportunities.

About Castle Resources

Castle is a Toronto-based junior mineral development company focusing on

high-quality, advanced projects. Management's goal is to continue the

redevelopment of the 100% owned past producing Granduc Copper Mine in Stewart,

B.C. For more information please visit the Castle Resources' website at

www.castleresources.com.

Disclaimer

Certain statements contained in this news release may contain forward-looking

information within the meaning of Canadian securities laws. Such forward-looking

information is identified by words such as "estimates", "intends", "expects",

"believes", "may", "will" and include, without limitation, statements regarding

the company's plan of business operations (including plans for progressing

assets), estimates regarding mineral resources, projections regarding

mineralization and projected expenditures. There can be no assurance that such

statements will prove to be accurate; actual results and future events could

differ materially from such statements. Factors that could cause actual results

to differ materially include, among others, metal prices, risks inherent in the

mining industry, financing risks, labour risks, uncertainty of mineral resource

estimates, equipment and supply risks, title disputes, regulatory risks and

environmental concerns. Most of these factors are outside the control of the

company. Investors are cautioned not to put undue reliance on forward-looking

information. Except as otherwise required by applicable securities statutes or

regulation, the company expressly disclaims any intent or obligation to update

publicly forward-looking information, whether as a result of new information,

future events or otherwise.

This news release does not constitute an offer to sell or solicitation of an

offer to sell any of the securities in the United States. The securities have

not been and will not be registered under the United States Securities Act of

1933, as amended (the "U.S. Securities Act") or any state securities laws and

may not be offered or sold within the United States or to a U.S. Person unless

registered under the U.S. Securities Act and applicable state securities laws or

an exemption from such registration is available.

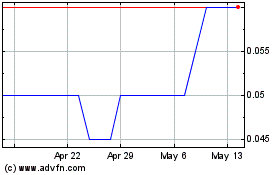

Churchill Resources (TSXV:CRI)

Historical Stock Chart

From Jun 2024 to Jul 2024

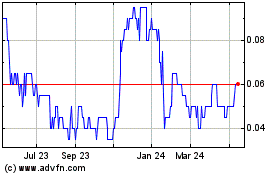

Churchill Resources (TSXV:CRI)

Historical Stock Chart

From Jul 2023 to Jul 2024