Castle Resources Announces Earning of 60% Interest in Elmtree Gold Project and Letter of Intent to Sell the Interest

April 10 2012 - 12:11PM

Marketwired Canada

Castle Resources Inc. (TSX VENTURE:CRI) ("Castle" or the "Company") is pleased

to announce that it has earned its 60% interest in the property more commonly

known as the Elmtree gold property located in New Brunswick (the "Elmtree Gold

Project") and has also entered into a letter of intent to sell this interest to

CNRP Mining Inc. in consideration for: (i) payment of $500,000 in cash over a 12

month period, (ii) the issuance of approximately 33% of a new junior resource

company (see below), and (iii) the granting of a 3% NSR interest of the Elmtree

Deposit.

"This transaction not only monetizes Castle's 60% interest in Elmtree, but

positions our shareholders to receive future development and exploration upside

at Elmtree," stated Mr. Mike Sylvestre, President & CEO of Castle Resources.

"Given Castle's 100% focus on the exploration and development of the Granduc

Copper Project in Northwest B.C., we are pleased with CNRP's strategy to further

explore and optimize the economics of the Elmtree deposit."

The Letter of Intent (the "Letter of Intent") defines the essential terms under

which the parties would enter into a definitive binding agreement (the

"Definitive Agreement") whereby CNRP Mining Inc. ("CNRP") would acquire from

Castle: (i) Castle's 60% interest in the Elmtree Gold Project, and (ii) all

rights, title and interest to that certain option agreement (the "Option

Agreement") executed between Castle and Stratabound Minerals Corp.

("Stratabound") whereby Castle can acquire from Stratabound a further 10%

interest in the Elmtree Gold Project all in accordance with and on the terms set

out in the Option Agreement.

Simultaneous with the transactions contemplated by the Definitive Agreement and

as set out in the Letter of Intent, CNRP has agreed to be acquired by Gorilla

Resources Corp., a public company listed on the Canadian National Stock Exchange

("Gorilla"), in a reverse take over ("RTO"), through the issuance by Gorilla of

38,800,000 common shares of Gorilla. At closing of the RTO, the CNRP shares that

Castle will receive, will result in Castle holding 18,000,000 shares of Gorilla

valued at $4.5 million representing 33.43% of the share capital of Gorilla

following completion of the RTO closing. Please see press release of Gorilla of

today's date for more information on the RTO transaction. The shares issuable to

Castle will be subject to a lock-up in favour of Danny Wettreich, President and

CEO of CNRP, for a period of 24 months following closing unless Castle

distributes such shares to its shareholders in which case the lock-up will no

longer apply. Under the terms of the Letter of Intent, Castle is also provided

with the ability to nominate one director to the board of the newly formed

company public junior resource company.

Castle's obligations under the Letter of Intent are subject to, among other

things, completion by Castle of satisfactory due diligence on CNRP and the

properties which it holds or which it will hold upon completion of the RTO, all

required third party consents and receipt of all required regulatory approvals.

About Castle Resources

Castle is a Toronto-based junior mineral development company focusing on

high-quality, advanced projects. Management's goal is to continue the

redevelopment of the 100% owned past producing Granduc Copper Mine in Stewart

B.C. For more information please visit the Castle Resources' website at

www.castleresources.com.

Disclaimer

Certain statements contained in this news release may contain forward-looking

information within the meaning of Canadian securities laws. Such forward-looking

information is identified by words such as "estimates", "intends", "expects",

"believes", "may", "will" and include, without limitation, statements regarding

the company's plan of business operations (including plans for progressing

assets), estimates regarding mineral resources, projections regarding

mineralization and projected expenditures. There can be no assurance that such

statements will prove to be accurate; actual results and future events could

differ materially from such statements. Factors that could cause actual results

to differ materially include, among others, metal prices, risks inherent in the

mining industry, financing risks, labour risks, uncertainty of mineral resource

estimates, equipment and supply risks, title disputes, regulatory risks and

environmental concerns. Most of these factors are outside the control of the

company. Investors are cautioned not to put undue reliance on forward-looking

information. Except as otherwise required by applicable securities statutes or

regulation, the company expressly disclaims any intent or obligation to update

publicly forward-looking information, whether as a result of new information,

future events or otherwise.

This news release does not constitute an offer to sell or solicitation of an

offer to sell any of the securities in the United States. The securities have

not been and will not be registered under the United States Securities Act of

1933, as amended (the "U.S. Securities Act") or any state securities laws and

may not be offered or sold within the United States or to a U.S. Person unless

registered under the U.S. Securities Act and applicable state securities laws or

an exemption from such registration is available.

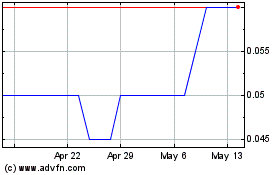

Churchill Resources (TSXV:CRI)

Historical Stock Chart

From Jun 2024 to Jul 2024

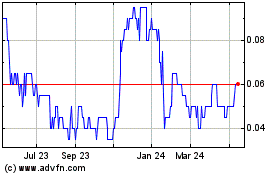

Churchill Resources (TSXV:CRI)

Historical Stock Chart

From Jul 2023 to Jul 2024