Rye Patch Files Lawsuit Against Subsidary of Coeur d'Alene Mines

December 06 2011 - 8:00AM

Marketwired Canada

Rye Patch Gold Corp. (TSX VENTURE:RPM)(OTCQX:RPMGF) ("Rye Patch" or the

"Company"), through its wholly owned subsidiary Rye Patch Gold US Inc. ("Rye

Patch Gold US") filed a lawsuit against Coeur Rochester, Inc. ("CRI"), a

wholly-owned subsidiary of Coeur d'Alene Mines Corporation. The lawsuit was

filed in the Second Judicial District Court of the State of Nevada, Washoe

County, Reno, Nevada, Case No. CV11-03482. Rye Patch Gold US has asserted claims

for relief for quiet title, trespass, slander of title and injunctive relief.

Rye Patch Gold US has also asserted claims for damages which Rye Patch Gold US

may incur as a result of CRI's actions.

Rye Patch Gold US began locating its LH unpatented mining claims on October 27,

2011, and by November 21, 2011, had located and monumented more than 400

unpatented mining claims.

The lawsuit is based on CRI's claim jumping of the senior unpatented mining

claims owned by Rye Patch Gold US in Pershing County, Nevada. On August 31,

2011, CRI failed to pay the federal annual mining claim maintenance fees for

unpatented mining claims which formerly were part of the Coeur Rochester Mine in

Pershing County. Under U.S. federal law CRI's failure to pay the annual mining

claim maintenance fees caused the CRI mining claims to be forfeited and void. In

a previous case, the United States Supreme Court upheld the effect of the

federal law and confirmed that failure to comply with the annual maintenance

requirements causes an unpatented mining claim to be forfeited and void. As a

result of CRI's failure to pay the fees, on August 31, 2011, the federal public

lands were available to locate mining claims and any United States citizen or

company could enter the public lands and locate unpatented mining claims.

On November 28, 2011, Rye Patch Gold US informed CRI that Rye Patch Gold US had

located its mining claims. Subsequently, on December 2, 2011, without notice to

Rye Patch Gold US and without consent of Rye Patch Gold US, CRI began claim

jumping the mining claims of Rye Patch Gold US by attempting to locate new CRI

mining claims over the Rye Patch Gold US mining claims. Rye Patch Gold US

notified CRI that CRI was claim jumping and requested that CRI cease its

attempts to claim jump Rye Patch Gold US. CRI did not respond to this request

and it continued to attempt to locate mining claims over the pre-existing Rye

Patch Gold US senior claims. Rye Patch Gold US was compelled to commence a

lawsuit in order to protect its rights under the U.S. mining law and Nevada

statutes.

Shortly after Rye Patch Gold US filed its lawsuit, CRI filed a separate lawsuit

in the Sixth Judicial District Court in Pershing County, Nevada, Case No. CV11

11231. CRI asserts claims for relief that its junior mining claims are superior

to the senior mining claims of Rye Patch Gold US. Rye Patch Gold US denies the

allegations in the CRI complaint and intends to vigorously defend title to the

claims of Rye Patch Gold US. In its complaint, CRI admitted that it did not pay

the federal annual mining claim maintenance fees on or before August 31, 2011.

CRI also filed a motion for a temporary restraining order to prevent Rye Patch

Gold US from working on its claims, a motion which Rye Patch Gold US intends to

vigorously oppose. Without affording Rye Patch Gold US an opportunity to oppose

the motion, the court entered a temporary restraining order which is effective

until December 15, 2011 when a court hearing will be held to determine whether a

preliminary injunction should be entered during the pendency of the lawsuit. Rye

Patch Gold US intends to file a motion to dissolve the temporary restraining

order and to oppose CRI's request for a preliminary injunction.

As announced on May 18, 2010, May 11, 2009, and June 2, 2009, in respect of the

Lincoln Hill, Wilco, and Jessup projects, Rye Patch Gold's resource inventory

along the Oreana trend now totals 1,182,780 ounces of gold and gold equivalent

in the measured and indicated category plus 2,727,100 ounces of gold and gold

equivalent in the inferred category. Table 1 summarizes Rye Patch Gold's

precious metal inventory in Nevada, USA. Table 1 does not include reserves and

resources located on the 100% owned LH claims.

----------------------------------------------------------------------------

Table 1: Rye Patch Gold's NI43-101 Resource Inventory(1)(5)

----------------------------------------------------------------------------

Contained

Gold Silver Contained Contained Gold & Gold

Resource Tonnes Grade Grade Gold Silver Equivalent

Property Category (x1000) (g/t) (g/t) Ounces Ounces Ounces (4)

----------------------------------------------------------------------------

Wilco (2) Measured 7,526 0.69 4.595 164,000 1,111,000 186,220

Indicated 30,844 0.51 3.601 522,000 3,638,000 594,760

Inferred 121,838 0.41 5.075 1,660,000 19,871,000 2,057,420

----------------------------------------------------------------------------

Jessup(2) Measured 7,775 0.51 8.745 128,000 2,184,000 171,680

Indicated 12,642 0.41 7.167 172,000 2,906,000 230,120

Inferred 4,494 0.55 7.922 77,000 1,146,000 99,920

----------------------------------------------------------------------------

Lincoln Measured - - - - - -

Hill(3) Indicated - - - - - -

Inferred 17,215 0.69 17.143 380,000 9,488,000 569,760

----------------------------------------------------------------------------

Total Oreana Trend Measured & Indicated

Resources 986,000 9,839,000 1,182,780

Total Oreana Trend Inferred Resources 2,117,000 30,505,000 2,727,100

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1) All resources on 100% basis. Metallurgical recoveries and net smelter

returns are assumed to be 100%. Conforms to 43-101 resource definitions;

(2) Cutoff grade for Wilco Measured and Indicated resource is reported at

0.2 g/t Au for oxide mineralisation and 1.45 g/t Au for sulphide

mineralisation. The Inferred resource cut-off grade is reported at 0.2 g/t

Au for oxide, sulphide and carbonaceous ore types; however, a higher opt Au

cut-off grade may be required to upgrade the inferred resource to the

measured and indicated resource category. Cut-off grade for Jessup is

reported at 0.2 g/t Au for oxide mineralisation and 0.34 g/t Au for

transition and sulphide mineralisation; and

(3) The Inferred resource is reported at a cut-off grade of 0.34 g/t (0.01

opt) Aueq for oxide and transitional ore types;

(4) Wilco, Jessup and Lincoln Hill resources includes Au equivalent ounces

(Aueq.); where Aueq. = (Au ozs) + (Ag ozs X $Ag/oz)/$Au/oz, for Au/oz =

$900, and Ag/oz = $18.

(5) Table 1 does not include any reserves or resources located on the 100%

owned LH claims.

----------------------------------------------------------------------------

Mr. William Howald, AIPG Certified Professional Geologist #11041, Rye Patch

Gold's CEO and President, is a Qualified Person as defined under National

Instrument 43-101. He has verified the information contained in, and has

reviewed and approved the contents of, this news release.

Rye Patch Gold Corp. is exploring well-known mineral trends in Nevada - the

world's fourth-richest gold region. Starting with 150,000 inferred ounces of

gold in mid-2007, this well-funded Company now has 1.2-million ounces of gold

and gold equivalent in the measured and indicated category, plus 2.7-million

ounces of gold and gold equivalent in the inferred category. Rye Patch Gold is a

Tier 1, Nevada-focused and discovery-driven company seeking to build a sizeable

inventory of gold and silver resource assets in the mining friendly state of

Nevada, USA. The Company's seasoned management team is engaged in acquisition,

exploration, and development of quality resource-based gold and silver projects.

Rye Patch Gold is developing gold and silver assets along the emerging Oreana

trend, located in west-central Nevada, and is exploring 66 square kilometres

along the Cortez trend near Barrick's two new gold discoveries. The Company has

established gold and silver resource milestones and time frames in order to

build a premier resource development company. For more information about Rye

Patch Gold, please visit our website at www.ryepatchgold.com.

On behalf of the Board of Directors

William C. (Bill) Howald, CEO & President

This news release contains forward-looking statements, which address future

events and conditions, which are subject to various risks and uncertainties. The

Company's actual results, programs and financial position could differ

materially from those anticipated in such forward-looking statements as a result

of numerous factors, some of which may be beyond the Company's control. These

factors include: the availability of funds; the timing and content of work

programs; results of exploration activities and development of mineral

properties, the interpretation of drilling results and other geological data,

the uncertainties of resource and reserve estimations, receipt and security of

mineral property titles; project cost overruns or unanticipated costs and

expenses, fluctuations in metal prices; currency fluctuations; and general

market and industry conditions.

Forward-looking statements are based on the expectations and opinions of the

Company's management on the date the statements are made. The assumptions used

in the preparation of such statements, although considered reasonable at the

time of preparation, may prove to be imprecise and, as such, undue reliance

should not be placed on forward-looking statements.

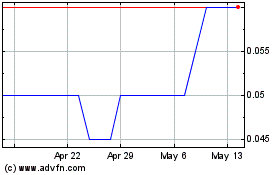

Churchill Resources (TSXV:CRI)

Historical Stock Chart

From Jun 2024 to Jul 2024

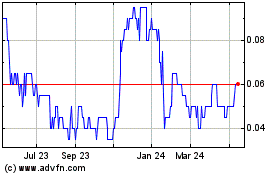

Churchill Resources (TSXV:CRI)

Historical Stock Chart

From Jul 2023 to Jul 2024