Velan Inc. (TSX: VLN) (the “Company”), a world-leading manufacturer

of industrial valves, announced today its financial results for its

second quarter ended August 31, 2021.

Highlights:

- Sales for the

quarter amounted to $101.9 million, an increase of 33.6 million or

49.1% compared to the same quarter of the previous fiscal year.

This quarter’s sales level represents the highest volume in the

last six quarters.

- Gross profit for

the quarter of $31.4 million, or 30.8%, an increase of $14.3

million or 580 basis points from the same quarter of the previous

year. The gross profit percentage of 29.1% for the first six-month

of the fiscal year is the highest in recent history, a performance

essentially driven by the improved sales volume, a more profitable

product mix delivered, as well as the margin improvement activities

undertaken over the past fiscal years within the scope of the V20

restructuring and transformation plan.

- Net income1 of

$5.0 million and EBITDA2 of $10.7 million for the

quarter represent a significant improvement compared to last year’s

results. The better results are explained primarily by an increased

gross profit, driven by an improved sales volume and product mix,

despite notably lower Canada Emergency Wage Subsidies

(«CEWS»).

- Strong order

backlog2 of $575.8 million at the end of the quarter.

- Net new orders

(“bookings”)2 of $81.6 million for the quarter, a

decrease of $19.7 million or 19.5% compared to the same quarter of

the previous fiscal year. The Company’s book-to-bill ratio of 0.80

for the quarter has a stronger relation to the improved sales

volume rather than the softer quarter in terms of bookings.

Nonetheless, the book-to-bill ratio for the six-month period stands

at a positive 1.12.

- The Company’s

net cash amounted to $68.1 million at the end of the quarter, an

increase of $5.2 million since the beginning of the fiscal

year.

Yves Leduc, CEO of Velan Inc., said, “I am very

pleased with our company’s best quarterly results in years, but I

am certainly not surprised. We are seeing the convergence of many

of the positive factors reported in previous quarters, whose

effects had either been slowed by the global economic crisis or

were simply expected to materialize over time.

Let’s start with our sales, growing near 50%

over the same period last year. Our Italian operations were able to

overcome most of the shipping hurdles experienced in the first

quarter, we achieved notable progress in reducing our North

American operations’ production delays caused by the many changes

deployed during the first year of the pandemic, and both our Indian

and Chinese operations are having a record production year. Still

experiencing one of the highest backlogs in years, we did see a

slower quarter in bookings, but they have outpaced billings in the

first six months of the year and, good news, we are observing a

recovery of our North American MRO business, as distributors are

steadily increasing their stock.

Another important aspect of our performance is

the sustained growth in our margins. The quarter’s gross margin and

the first six months’ were the highest recorded in at least ten

years, at respectively 30.8% and 29.1%, compared to 25% and 24.4%

last year, and 23.3% at the end of fiscal year 2019 when our V20

plan was announced. Here again, there should be no surprise, as the

main goal of the plan was to drive our North American operations’

margins up. And we are indeed meeting the goal through the

elimination of significant structural costs in North America, the

now completed transfer of our small forged valve production to

India, and the much greater focus put on profitable orders from our

new strategic businesses. As a result of those improvements and the

growth in sales, to which each of our divisions is contributing,

our EBITDA after six months improved by close to $10 million

compared to the same period last year, despite lower Canadian

federal subsidies and higher liability costs than last year to

date.

In summary, thanks to the relentless efforts and

resilience of our employees in the last years, we are laying the

base for a return to profitable growth.

This does not mean we are out of the woods. On

the coronavirus front, the global pandemic is far from over and we

remain vigilant, committed to maintain our excellent record in

keeping our work environment as safe as possible for our employees.

Meanwhile, the negative effects of the economic crisis on global

logistics and the price of metals are affecting our operations

worldwide, and driving growth will require ruthless focus and

execution as industry demand remains soft.

Aware of those challenges, we take nothing for granted and are

moving ahead with confidence.”

Financial Highlights

|

Three-month periods ended |

|

Six-month periods ended |

|

|

(thousands of U.S. dollars, excluding per share amounts) |

August 31, 2021 |

|

August 31, 2020 |

|

August 31, 2021 |

|

August 31, 2020 |

|

|

|

|

|

|

|

| Sales |

$ |

101,893 |

|

$ |

68,340 |

|

$ |

176,422 |

|

$ |

144,993 |

|

| Gross profit |

|

31,391 |

|

|

17,053 |

|

|

51,385 |

|

|

35,445 |

|

| Gross profit % |

|

30.8 |

% |

|

25.0 |

% |

|

29.1 |

% |

|

24.4 |

% |

| Net income (loss)1 |

|

5,015 |

|

|

(5,112 |

) |

|

(58 |

) |

|

(6,998 |

) |

| Net income (loss)1 per share –

basic and diluted |

|

0.23 |

|

|

(0.24 |

) |

|

(0.00 |

) |

|

(0.32 |

) |

| EBITDA2 |

|

10,657 |

|

|

(2,497 |

) |

|

9,716 |

|

|

141 |

|

| EBITDA2 per share – basic and

diluted |

|

0.49 |

|

|

(0.12 |

) |

|

0.45 |

|

|

0.01 |

|

Second Quarter Fiscal 2022 (unless otherwise

noted, all amounts are in U.S. dollars and all comparisons are to

the second quarter of fiscal 2021):

- Sales amounted

to $101.9 million, an increase of $33.6 million or 49.1% for the

quarter. Sales were positively impacted by the Company’s North

American operations increased large project orders shipments

primarily destined for the petrochemical and power markets. Sales

were also positively impacted by the shipment of previously delayed

orders by the Company’s Italian operations. The delays were due to

various customer-related and global logistics factors.

- Bookings2

amounted to $81.6 million, a decrease of $19.7 million or 19.5% for

the quarter. This decrease is primarily attributable to lower large

project orders recorded by the Company’s French and North American

operations.

- Gross profit

amounted to $31.4 million, an increase of $14.3 million or 84.1%

for the quarter. The gross profit percentage for the quarter of

30.8% was an increase of 580 basis points compared to last year‘s

second quarter. The improvement in gross profit percentage for the

quarter is primarily attributable to the higher sales volume, which

helped to cover the Company’s fixed production overhead costs more

efficiently. The Company’s improved margins are also stemming from

the margin improvement activities implemented over the course of

the past fiscal years within the scope of the V20 restructuring and

transformation plan. Additionally, the Company’s gross profit also

benefited from favorable movements in unrealized foreign exchange

translation primarily attributable to the fluctuation of the U.S.

dollar against the euro and the Canadian dollar for the quarter

when compared to the prior year. Finally, the increase in gross

profit percentage was such that it could more than offset the

impact of a lower amount of CEWS of $1.7 million for the quarter

compared to last year. The subsidies are allocated between cost of

sales and administration costs.

- Net income1 for

the quarter amounted to $5.0 million or $0.23 per share compared to

a net loss1 of $5.1 million or $0.24 per share last year. EBITDA2

for the quarter amounted to $10.7 million or $0.49 per share

compared to a negative $2.5 million or $0.12 per share last year.

The improvement in EBITDA2 for the quarter is primarily

attributable to an increase in gross profit, thanks to the reasons

mentioned above, the absence of restructuring and transformation

costs in the current fiscal year which totaled $1.7 million in the

previous quarter and a reduction in other expenses of $1.4 million

for the quarter due to land clean-up costs of a former factory

incurred in the second quarter of the prior year. On the other

hand, these improvements were partially offset by an increase in

administration costs of $4.3 million or 21.8% for the quarter which

is primarily attributable to a decrease of $1.4 million in CEWS

received by the Company compared to last year, an increase in sales

commissions due to the higher sales volume and a general increase

in administration expenses that had been significantly lowered when

the global pandemic broke out last year. The subsidies are

allocated between cost of sales and administration costs. The

favorable movement in the Company’s net income1 for quarter was

primarily attributable to the same factors as explained above

coupled with an unfavorable movement in income taxes.

First Six months Fiscal 2022 (unless otherwise

noted, all amounts are in U.S. dollars and all comparisons are to

the first six months of fiscal 2021):

- Sales amounted

to $176.4 million, an increase of $31.4 million or 21.7% for the

six-month period. Sales were positively impacted by the Company’s

North American operations increased large project orders shipments

primarily destined for the petrochemical and power markets. For the

six-month period, the Company’s French operations were able to show

an improved sales volume due to their strong performance in the

first quarter of the current fiscal year. Finally, the Company’s

MRO sales for the six-month period were negatively affected by the

persistent unfavorable market conditions triggered by the novel

coronavirus (“COVID-19”) global pandemic which has significantly

affected the Company’s distribution channels’ bookings in the

previous fiscal year. The lower distribution channels’ bookings in

the latter part of the prior year translated in lower shipments of

such orders in the first quarter of the current year.

- Bookings2

amounted to $197.9 million, an increase or $19.9 million of 11.2%

for the six-month period. The increase is primarily attributable to

large project orders recorded by the Company’s Italian and North

American operations, notably in the marine and oil and gas markets.

The increase is also attributable to higher MRO orders recorded by

the Company’s North American operations. The Company is encouraged

by the recovery of its MRO order bookings, which were severely

impacted by the global pandemic at the end of the prior fiscal

year, and ultimately adversely affected the sales of its current

fiscal year as explained in the prior paragraph. The increase in

bookings for the six-month period was partially offset by a

reduction in large project orders recorded by the Company’s French

operations.

- As a result of

bookings outpacing sales in the current six-month period, the

Company’s book-to-bill ratio2 was 1.12 for the period. Furthermore,

the total backlog2 increased by $13.3 million or 2.4% since the

beginning of the fiscal year, amounting to $575.8 million as at

August 31, 2021.

- Gross profit

amounted to $51.4 million, an increase of $15.9 million or 45.0%

for the six-month period. The gross profit for the first six-month

period of 29.1% represented an increase of 470 basis points

compared to the same period last year and is also the highest in

recent history. The improvement in gross profit percentage is

primarily attributable to the higher sales volume, which helped to

cover the Company’s fixed production overhead costs more

efficiently. The Company’s improved margins are also stemming from

the margin improvement activities implemented over the course of

the past fiscal years within the scope of the V20 restructuring and

transformation plan. Additionally, the Company’s gross profit also

benefited from favorable movements in unrealized foreign exchange

translation primarily attributable to the fluctuation of the U.S.

dollar against the euro and the Canadian dollar for the six-month

period when compared to the prior year. Finally, the increase in

gross profit percentage was such that it could more than offset the

impact of a lower amount of CEWS of $3.1 million for the six-month

period compared to last year. The subsidies are allocated between

cost of sales and administration costs.

- Net loss1 for

the six-month period amounted to $0.1 million or $0.00 per share

compared to a net loss1 of $7.0 million or $0.32 per share in the

prior period. EBITDA2 for the six-month period amounted to $9.7

million or $0.45 per share compared to $0.1 million or $0.01 per

share in the prior period. The improvement in EBITDA2 for the

six-month period is primarily attributable to and improved gross

profit, primarily due to an increased sales volume, while

reflecting the notably improved product mix and margins resulting

from the Company’s targeted efforts under V20, described earlier.

The Company’s gross profit also benefited from favorable movements

in unrealized foreign exchange translation for the six-month period

when compared to the prior year. The improvement is also

attributable to the absence of restructuring and transformation

costs in the current fiscal year which totaled $2.9 million in the

previous six-month period as well as a reduction in other expenses

of $1.4 million for the six-month period primarily due to land

clean-up costs of a former factory incurred in the second quarter

of the prior year. On the other hand, these improvements were

partially offset by an increase in administration costs of $10.4

million or 27.8% for the six-month period, primarily attributable

to a decrease of $2.5 million in CEWS received by the Company

compared to last year, an increase in sales commissions due to the

improved sales volume for the period, a general increase in

administration expenses that had been significantly lowered when

the global pandemic broke out last year as well as an increase of

$1.4 million in the costs recognized in connection with the

Company’s ongoing asbestos litigation. The favorable movements in

the Company’s net loss1 for the six-month period was primarily

attributable to the same factors as explained above coupled with an

unfavorable movement in income taxes.

Dividend

At the end of fiscal 2020, the Board of

Directors deemed appropriate to suspend the quarterly dividend. The

decision remains unchanged and will be reviewed on a quarterly

basis.

Conference call

Financial analysts, shareholders, and other

interested individuals are invited to attend the second quarter

conference call to be held on Thursday, October 7, 2021, at 04:00

p.m. (EDT). The toll free call-in number is 1-800-768-2878, access

code 21998213. A recording of this conference call will be

available for seven days at 1-416-626-4100 or 1-800-558-5253,

access code 21998213.

About Velan

Founded in Montreal in 1950, Velan Inc.

(www.velan.com) is one of the world’s leading manufacturers of

industrial valves, with sales of US$302.1 million in its last

reported fiscal year. The Company employs close to 1,700 people and

has manufacturing plants in 9 countries. Velan Inc. is a public

company with its shares listed on the Toronto Stock Exchange under

the symbol VLN.

Safe harbour statement

This news release may include forward-looking

statements, which generally contain words like “should”, “believe”,

“anticipate”, “plan”, “may”, “will”, “expect”, “intend”, “continue”

or “estimate” or the negatives of these terms or variations of them

or similar expressions, all of which are subject to risks and

uncertainties, which are disclosed in the Company’s filings with

the appropriate securities commissions. While these statements are

based on management’s assumptions regarding historical trends,

current conditions and expected future developments, as well as

other factors that it believes are reasonable and appropriate in

the circumstances, no forward-looking statement can be guaranteed

and actual future results may differ materially from those

expressed herein. The Company disclaims any intention or obligation

to update or revise any forward-looking statements contained herein

whether as a result of new information, future events or otherwise,

except as required by the applicable securities laws. The

forward-looking statements contained in this news release are

expressly qualified by this cautionary statement.

Non-IFRS and supplementary financial

measures

In this press release, the Company has presented

measures of performance or financial condition which are not

defined under IFRS (“non-IFRS measures”) and are, therefore,

unlikely to be comparable to similar measures presented by other

companies. These measures are used by management in assessing the

operating results and financial condition of the Company and are

reconciled with the performance measures defined under IFRS.

Company has also presented supplementary financial measures which

are defined at the end of this report. Reconciliation and

definition can be found on the next page.

Net earnings (loss) before interest,

taxes, depreciation and amortization ("EBITDA")

|

Three-month periods ended |

|

Six-month periods ended |

|

|

(thousands, except amount per shares) |

August 31, 2021$ |

August 31, 2020$ |

|

August 31, 2021$ |

|

August 31, 2020$ |

|

|

|

|

|

|

|

| Net income (loss)1 |

5,015 |

(5,112 |

) |

(58 |

) |

(6,998 |

) |

| |

|

|

|

|

| Adjustments for: |

|

|

|

|

| Depreciation of property, plant

and equipment |

2,394 |

2,450 |

|

4,808 |

|

4,975 |

|

| Amortization of intangible

assets |

451 |

626 |

|

1,009 |

|

1,194 |

|

| Finance costs – net |

526 |

44 |

|

1,055 |

|

362 |

|

|

Income taxes |

2,271 |

(505 |

) |

2,902 |

|

608 |

|

|

|

|

|

|

|

| EBITDA |

10,657 |

(2,497 |

) |

9,716 |

|

141 |

|

| EBITDA per share |

|

|

|

|

|

Basic and diluted |

0.49 |

(0.12 |

) |

0.45 |

|

0.01 |

|

The term “EBITDA” is defined as net income or

loss attributable to Subordinate and Multiple Voting Shares plus

depreciation of property, plant & equipment, plus amortization

of intangible assets, plus net finance costs plus income tax

provision. The terms “EBITDA per share” is obtained by dividing

EBITDA by the total amount of subordinate and multiple voting

shares. The forward-looking statements contained in this press

release are expressly qualified by this cautionary statement.

Definitions of supplementary financial

measures

The term “Net new orders” or “bookings” is

defined as firm orders, net of cancellations, recorded by the

Company during a period. Bookings are impacted by the fluctuation

of foreign exchange rates for a given period. The measure provides

an indication of the Company’s sales operation performance for a

given period as well as well as an expectation of future sales and

cash flows to be achieved on these orders.

The term “backlog” is defined as the buildup of

all outstanding bookings to be delivered by the Company. The

Company’s backlog is impacted by the fluctuation of foreign

exchange rates for a given period. The measure provides an

indication of the future operational challenges of the Company as

well as an expectation of future sales and cash flows to be

achieved on these orders.

The term “book-to-bill” is obtained by dividing

bookings by sales. The measure provides an indication of the

Company’s performance and outlook for a given period.

The forward-looking statements contained in this

press release are expressly qualified by this cautionary

statement.

1 Net earnings or loss refer to net income or loss attributable

to Subordinate and Multiple Voting Shares2 Non-IFRS and

supplementary financial measures – see explanation above.

| Velan

Inc. |

| Consolidated

Statements of Financial Position |

|

(Unaudited) |

| (in

thousands of U.S. dollars) |

|

As at |

|

|

|

August 31, 2021 |

February 28, 2021 |

|

|

|

$ |

$ |

| Assets |

|

|

|

| |

|

|

|

| Current

assets |

|

|

|

| Cash and cash equivalents |

|

76,448 |

74,688 |

| Short-term investments |

|

1,703 |

285 |

| Accounts receivable |

|

126,075 |

135,373 |

| Income taxes

recoverable |

|

3,590 |

3,798 |

| Inventories |

|

240,225 |

204,161 |

| Deposits and prepaid

expenses |

|

9,969 |

8,670 |

|

Derivative assets |

|

74 |

196 |

| |

|

458,084 |

427,171 |

| |

|

|

|

| Non-current

assets |

|

|

|

| Property, plant and

equipment |

|

91,826 |

96,327 |

| Intangible assets and

goodwill |

|

16,890 |

17,319 |

| Income taxes

recoverable |

|

5,927 |

5,927 |

| Deferred income taxes |

|

32,397 |

33,140 |

| Other

assets |

|

854 |

949 |

| |

|

|

|

|

|

|

147,894 |

153,662 |

| |

|

|

|

|

Total assets |

|

605,978 |

580,833 |

| |

|

|

|

| |

|

|

|

|

Liabilities |

|

|

|

| |

|

|

|

| Current

liabilities |

|

|

|

| Bank indebtedness |

|

8,317 |

11,735 |

| Accounts payable and accrued

liabilities |

|

101,856 |

90,840 |

| Income taxes payable |

|

1,479 |

1,609 |

| Customer deposits |

|

79,738 |

62,083 |

| Provisions |

|

27,241 |

29,515 |

| Derivative liabilities |

|

9 |

303 |

|

Current portion of long-term lease liabilities |

|

1,595 |

1,578 |

| Current

portion of long-term debt |

|

8,711 |

9,902 |

| |

|

228,946 |

207,565 |

| |

|

|

|

| Non-current

liabilities |

|

|

|

|

Long-term lease liabilities |

|

12,197 |

12,649 |

| Long-term debt |

|

56,522 |

48,189 |

| Income taxes payable |

|

1,244 |

1,410 |

| Deferred income taxes |

|

2,405 |

2,545 |

| Other

liabilities |

|

8,235 |

8,254 |

| |

|

|

|

|

|

|

80,603 |

73,047 |

| |

|

|

|

|

Total liabilities |

|

309,549 |

280,612 |

| |

|

|

|

|

Total equity |

|

296,429 |

300,221 |

| |

|

|

|

|

Total liabilities and equity |

|

605,978 |

580,833 |

| |

|

|

|

|

Velan Inc. |

|

|

Consolidated Statements of Income

(Loss) |

|

|

(Unaudited) |

|

| (in

thousands of U.S. dollars, excluding number of shares and per share

amounts) |

|

|

Three-month periods ended |

|

|

Six-month periods ended |

|

|

|

August 31, 2021 |

|

August 31, 2020 |

|

|

August 31, 2021 |

|

August 31, 2020 |

|

|

|

$ |

|

$ |

|

|

$ |

|

$ |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

Sales |

101,893 |

|

68,340 |

|

|

176,422 |

|

144,993 |

|

| |

|

|

|

|

|

|

|

|

|

|

Cost of sales |

70,502 |

|

51,287 |

|

|

125,037 |

|

109,548 |

|

| |

|

|

|

|

|

|

|

|

|

| Gross

profit |

31,391 |

|

17,053 |

|

|

51,385 |

|

35,445 |

|

| |

|

|

|

|

|

|

|

|

|

| Administration costs |

23,977 |

|

19,687 |

|

|

47,756 |

|

37,354 |

|

|

Restructuring and transformation costs |

- |

|

1,723 |

|

|

- |

|

2,899 |

|

| Other

expense (income) |

(79 |

) |

1,369 |

|

|

42 |

|

1,393 |

|

| |

|

|

|

|

|

|

|

|

|

|

Operating profit (loss) |

7,493 |

|

(5,726 |

) |

|

3,587 |

|

(6,201 |

) |

| |

|

|

|

|

|

|

|

|

|

| Finance income |

118 |

|

298 |

|

|

290 |

|

414 |

|

| Finance

costs |

(644 |

) |

(342 |

) |

|

(1,345 |

) |

(776 |

) |

| |

|

|

|

|

|

|

|

|

|

| Finance

costs – net |

(526 |

) |

(44 |

) |

|

(1,055 |

) |

(362 |

) |

| |

|

|

|

|

|

|

|

|

|

|

Income (loss) before income taxes |

6,967 |

|

(5,770 |

) |

|

2,532 |

|

(6,563 |

) |

| |

|

|

|

|

|

|

|

|

|

| Income

tax expense (recovery) |

2,271 |

|

(505 |

) |

|

2,902 |

|

608 |

|

| |

|

|

|

|

|

|

|

|

|

|

Net income (loss) for the period |

4,696 |

|

(5,265 |

) |

|

(370 |

) |

(7,171 |

) |

| |

|

|

|

|

|

|

|

|

|

| Net income (loss)

attributable to: |

|

|

|

|

|

|

|

|

|

| Subordinate Voting

Shares and Multiple Voting Shares |

5,015 |

|

(5,112 |

) |

|

(58 |

) |

(6,998 |

) |

|

Non-controlling interest |

(319 |

) |

(153 |

) |

|

(312 |

) |

(173 |

) |

| |

|

|

|

|

|

|

|

|

|

|

Net income (loss) for the period |

4,696 |

|

(5,265 |

) |

|

(370 |

) |

(7,171 |

) |

| |

|

|

|

|

|

|

|

|

|

| Net income (loss) per

Subordinate and Multiple Voting Share |

|

|

|

|

|

|

|

|

|

| Basic

and diluted |

0.23 |

|

(0.24 |

) |

|

(0.00 |

) |

(0.32 |

) |

| |

|

|

|

|

|

|

|

|

|

| Total weighted average

number of Subordinate and |

|

|

|

|

|

|

|

|

|

|

Multiple Voting

Shares |

|

|

|

|

|

|

|

|

|

| Basic

and diluted |

21,585,635 |

|

21,585,635 |

|

|

21,585,635 |

|

21,585,635 |

|

| Velan

Inc. |

|

| Consolidated

Statements of Comprehensive Income

(Loss) |

|

| (Unaudited)

|

|

| (in

thousands of U.S. dollars)

|

|

|

Three-month periods ended |

|

|

Six-month periods ended |

|

|

|

August 31, 2021 |

|

August 31, 2020 |

|

|

August 31, 2021 |

|

August 31, 2020 |

|

|

|

$ |

|

$ |

|

|

$ |

|

$ |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Comprehensive income

(loss) |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Net income (loss) for

the period |

4,696 |

|

(5,265 |

) |

|

(370 |

) |

(7,171 |

) |

| |

|

|

|

|

|

|

|

|

|

| Other comprehensive

income (loss) |

|

|

|

|

|

|

|

|

|

| Foreign

currency translation adjustment on foreign operations whose

functional currency is other than the reporting currency (U.S.

dollar) |

(4,817 |

) |

9,903 |

|

|

(3,422 |

) |

10,809 |

|

| |

|

|

|

|

|

|

|

|

|

|

Comprehensive income (loss) |

(121 |

) |

4,638 |

|

|

(3,792 |

) |

3,638 |

|

| |

|

|

|

|

|

|

|

|

|

| Comprehensive income

(loss) attributable to: |

|

|

|

|

|

|

|

|

|

| Subordinate Voting Shares and

Multiple Voting Shares |

254 |

|

4,707 |

|

|

(3,448 |

) |

3,777 |

|

|

Non-controlling interest |

(375 |

) |

(69 |

) |

|

(344 |

) |

(139 |

) |

| |

|

|

|

|

|

|

|

|

|

|

Comprehensive income (loss) |

(121 |

) |

4,638 |

|

|

(3,792 |

) |

3,638 |

|

| |

|

|

|

|

|

|

|

|

|

| Other

comprehensive income (loss) is composed solely of items that may be

reclassified subsequently to the consolidated statement of income

(loss). |

| |

|

|

|

|

|

|

|

|

|

| Velan

Inc. |

|

| Consolidated

Statements of Changes in Equity |

|

|

(Unaudited) |

|

| (in

thousands of U.S. dollars, excluding number of

shares) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Equity attributable to the Subordinate and Multiple Voting

shareholders |

|

|

|

|

|

Share capital |

Contributed surplus |

Accumulated other comprehensive loss |

|

Retained earnings |

|

Total |

|

Non-controlling interest |

|

Total equity |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance - February 29, 2020 |

72,695 |

6,260 |

(34,047 |

) |

236,269 |

|

281,177 |

|

3,684 |

|

284,861 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss for the period |

- |

- |

- |

|

(6,998 |

) |

(6,998 |

) |

(173 |

) |

(7,171 |

) |

| Other

comprehensive income |

- |

- |

10,775 |

|

- |

|

10,775 |

|

34 |

|

10,809 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance - August 31, 2020 |

72,695 |

6,260 |

(23,272 |

) |

229,271 |

|

284,954 |

|

3,545 |

|

288,499 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance - February 28, 2021 |

72,695 |

6,260 |

(21,007 |

) |

239,136 |

|

297,084 |

|

3,137 |

|

300,221 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss for the period |

- |

- |

- |

|

(58 |

) |

(58 |

) |

(312 |

) |

(370 |

) |

|

Other comprehensive loss |

- |

- |

(3,390 |

) |

- |

|

(3,390 |

) |

(32 |

) |

(3,422 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance - August 31, 2021 |

72,695 |

6,260 |

(24,397 |

) |

239,078 |

|

293,636 |

|

2,793 |

|

296,429 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Velan

Inc. |

|

| Consolidated

Statements of Cash

Flow |

|

|

(Unaudited) |

|

| (in

thousands of U.S.

dollars) |

|

|

Three-month periods ended |

|

|

Six-month periods ended |

|

|

|

August 31, 2021 |

|

August 31, 2020 |

|

|

August 31, 2021 |

|

August 31, 2020 |

|

|

|

$ |

|

$ |

|

|

$ |

|

$ |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Cash flows

from |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Operating

activities |

|

|

|

|

|

|

|

|

|

| Net income (loss) for the

period |

4,696 |

|

(5,265 |

) |

|

(370 |

) |

(7,171 |

) |

| Adjustments to reconcile net

income (loss) to cash provided (used) by operating activities |

3,645 |

|

633 |

|

|

6,057 |

|

5,259 |

|

|

Changes in non-cash working capital items |

(6,808 |

) |

4,492 |

|

|

(3,259 |

) |

21,015 |

|

|

Cash provided (used) by operating activities |

1,533 |

|

(140 |

) |

|

2,428 |

|

19,103 |

|

| |

|

|

|

|

|

|

|

|

|

| Investing

activities |

|

|

|

|

|

|

|

|

|

| Short-term investments |

(1,232 |

) |

610 |

|

|

(1,418 |

) |

(527 |

) |

| Additions to property, plant and

equipment |

(1,830 |

) |

(1,405 |

) |

|

(3,569 |

) |

(3,936 |

) |

| Additions to intangible

assets |

(522 |

) |

(266 |

) |

|

(810 |

) |

(523 |

) |

| Proceeds on disposal of property,

plant and equipment, and intangible assets |

- |

|

989 |

|

|

3,132 |

|

1,029 |

|

|

Net change in other assets |

(15 |

) |

(467 |

) |

|

(27 |

) |

(489 |

) |

|

Cash used by investing activities |

(3,599 |

) |

(539 |

) |

|

(2,692 |

) |

(4,446 |

) |

| |

|

|

|

|

|

|

|

|

|

| Financing

activities |

|

|

|

|

|

|

|

|

|

| Dividends paid to Subordinate and

Multiple Voting shareholders |

- |

|

- |

|

|

- |

|

(482 |

) |

| Short-term bank loans |

- |

|

(395 |

) |

|

- |

|

(1,377 |

) |

|

Net change in revolving credit facility |

(3,378 |

) |

- |

|

|

6,248 |

|

- |

|

| Increase in long-term debt |

5,889 |

|

14,305 |

|

|

5,889 |

|

14,305 |

|

| Repayment of long-term debt |

(1,379 |

) |

(1,299 |

) |

|

(4,546 |

) |

(2,058 |

) |

|

Repayment of long-term lease liabilities |

(444 |

) |

(425 |

) |

|

(857 |

) |

(856 |

) |

|

Cash provided by financing activities |

688 |

|

12,186 |

|

|

6,734 |

|

9,532 |

|

| |

|

|

|

|

|

|

|

|

|

|

Effect of exchange rate differences on

cash |

(1,728 |

) |

4,218 |

|

|

(1,292 |

) |

5,166 |

|

| |

|

|

|

|

|

|

|

|

|

| Net change in cash during

the period |

(3,106 |

) |

15,725 |

|

|

5,178 |

|

29,355 |

|

| |

|

|

|

|

|

|

|

|

|

|

Net cash – Beginning of the period |

71,237 |

|

44,640 |

|

|

62,953 |

|

31,010 |

|

| |

|

|

|

|

|

|

|

|

|

|

Net cash – End of the period |

68,131 |

|

60,365 |

|

|

68,131 |

|

60,365 |

|

| |

|

|

|

|

|

|

|

|

|

| Net cash is composed of: |

|

|

|

|

|

|

|

|

|

| Cash and cash

equivalents |

76,448 |

|

86,894 |

|

|

76,448 |

|

86,894 |

|

|

Bank indebtedness |

(8,317 |

) |

(26,529 |

) |

|

(8,317 |

) |

(26,529 |

) |

| |

|

|

|

|

|

|

|

|

|

|

Net cash – End of the period |

68,131 |

|

60,365 |

|

|

68,131 |

|

60,365 |

|

| |

|

|

|

|

|

|

|

|

|

| Supplementary

information |

|

|

|

|

|

|

|

|

|

| Interest received (paid) |

(484 |

) |

(115 |

) |

|

(834 |

) |

(463 |

) |

| Income taxes reimbursed

(paid) |

(463 |

) |

(1,954 |

) |

|

(1,584 |

) |

(2,509 |

) |

| |

|

|

|

|

|

|

|

|

|

For further information please contact:Yves Leduc,

Chief Executive OfficerTel: (438) 817-9917orBenoit Alain, Chief

Financial OfficerTel: (514) 917-6454

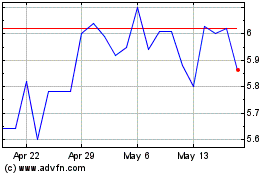

Velan (TSX:VLN)

Historical Stock Chart

From Dec 2024 to Jan 2025

Velan (TSX:VLN)

Historical Stock Chart

From Jan 2024 to Jan 2025