Velan Inc. (TSX: VLN) (the “Company”), a world-leading manufacturer

of industrial valves, announced today its financial results for its

first quarter ended May 31, 2021.

Highlights: Sales remained flat and

results decreased due to higher administrative costs and other

temporary factors, but the Company is encouraged by the notably

improved margins of its global operations and its strengthening

backlog.

- Order backlog1

of US$ 607.2 million at the end of the quarter representing the

highest backlog1 for the Company since August 2012. The portion of

the current backlog1 deliverable in the next nine months is

expected to be $323.1 million.

- Net new orders

(“bookings”)1 of $116.4 million for the quarter, an increase of

$39.6 million or 51.7%, which translated in a strong book-to-bill

ratio1 of 1.56 obtained primarily by the recording of significant

orders in the marine, mining, and downstream oil and gas

sectors.

- Sales for the

quarter amounted to $74.5 million, a decrease of $2.1 million or

2.8% compared to the same quarter of the previous fiscal year.

Quarterly sales can vary greatly based on the timing of the

delivery of large project orders which are expected to be greater

in the latter part of fiscal 2022; in particular, the shipment of

some important large project orders by the Company’s Italian

operations, originally planned for this quarter, have shifted into

the second quarter.

- Gross profit for

the quarter of $20.0 million, an increase of $1.6 million or 280

basis points from the same quarter of the previous year driven by

the margin improvement activities performed over the past fiscal

years in the scope of the V20 restructuring and transformation

plan.

- Net loss2 of

$5.1 million and negative EBITDA1 of 0.9$ million for the quarter

primarily attributable to an increase in administration costs and

lower Canadian federal subsidies («CEWS»); these are the main two

factors that drive lower results in the quarter compared to the

previous year despite notably improved margins at similar sales

level.

- The Company’s

net cash amounted to $71.2 million at the end of the quarter, an

increase of $8.3 million since the beginning of the fiscal year,

highlighting the Company’s healthy financial position.

Yves Leduc, CEO of Velan Inc., said, “First I

want to welcome Benoit Alain, who officially became our CFO on

June 1; he is off to a terrific start and I will speak on his

behalf today as this closing quarter occurred before his

tenure.

On the coronavirus front, the situation is

stable, aside from the situation in India which is being closely

monitored. Our first concern is the wellbeing of our Indian

employees, and so, we have implemented necessary measures to

protect them. Meanwhile, the situation is seemingly coming back to

normal after the Indian government announced a national three-day

lockdown in May. Generally speaking, we observe a slow return to

normality with the North American market showing early signs of a

recovery by the end of the year; but the world’s economy is still

hampered by the pandemic and constant disruptions in global

logistics continue to affect our supply chain. We are not out of

the woods yet, but our employees are doing a fantastic job dealing

with the situation and our sales and operations have adapted

incredibly well.

Our first quarter results were mixed: sales were

flat for the quarter, caused primarily by temporary shipment delays

and lower distribution channels orders in previous quarters. For

example, our Italian operations, who are efficiently executing a

record backlog, saw shipments of a few large orders delayed by

customers or disruptions in global logistics, but are expected to

deliver a notably improved performance in the upcoming part of the

year. We are extremely encouraged by the company’s gross margin

surging near 27% almost three points above last year, thanks in

large part to our V20 program whose primary aim was precisely to

drive North American operations’ margins up. We were nonetheless

disappointed by the several non-operational factors that increased

our administration costs to a notably higher level than last year,

thereby overshadowing the improved business health of our global

operations. Speaking of business health, we project our sales to

grow thanks to another strong quarter in terms of bookings, as

reflected by a 1.56 book-to-bill ratio, driving up our backlog to

the highest level since August 2012. Our five strategic businesses

are experiencing good success thanks to increased focus and

inter-divisional cooperation, notably in the nuclear, mining, and

downstream oil and gas sectors, as well in India and China, where

our manufacturing operations are thriving.

In summary, thanks to our program of strategic

initiatives undertaken in the last two years, we are advancing on

the path of bringing back the company to sustained profitability.

Our backlog is strong and growing, our increasingly flexible global

manufacturing capacity is becoming a highly effective competitive

advantage, and most notably, margins are at the highest level in

recent memory. All of this allows us to turn a lot more attention

to our growth strategy. »

Financial Highlights

| |

Three-month periods ended |

|

|

(thousands of U.S. dollars, excluding per share amounts) |

May 31,2021 |

|

May 31,2020 |

|

| |

|

|

|

Sales |

$ |

74,529 |

|

$ |

76,653 |

|

|

Gross profit |

|

19,994 |

|

|

18,392 |

|

|

Gross profit % |

|

26.8 |

% |

|

24.0 |

% |

|

Net loss2 |

|

(5,073 |

) |

|

(1,886 |

) |

|

Net loss2 per share – basic and diluted |

|

(0.24 |

) |

|

(0.09 |

) |

|

EBITDA1 |

|

(941 |

) |

|

2,638 |

|

|

EBITDA1 per share – basic and diluted |

|

(0.04 |

) |

|

0.12 |

|

|

|

|

|

|

|

|

|

First Quarter Fiscal 2022 (unless otherwise

noted, all amounts are in U.S. dollars and all comparisons are to

the first quarter of fiscal 2021):

- Sales decreased

by $2.1 million or 2.8% for the quarter. Sales were negatively

impacted by temporary shipment delays in the Company’s Italian

operations due to various customer-related and global logistics

factors. As a result, the shipment of some large orders by the

Company’s Italian operations, whose backlog is currently at a

record high, is expected to shift into the second quarter of the

current fiscal year. The shift had a negative impact on comparative

sales given last year’s very high first quarter sales by the

Company’s Italian operations. On the other hand, the increase in

shipments from the Company’s French operations partly offset the

negative impact of the sales shift in Italy. Additionally, the

Company’s non-project sales for the quarter were negatively

affected by the persistent unfavorable market conditions triggered

by the novel coronavirus (“COVID-19”) global pandemic which has

significantly affected the Company’s distribution channels’

bookings in the previous fiscal year. The lower distribution

channels’ bookings in the latter part of the prior year translated

in lower shipments of such orders in the current quarter.

- Bookings1

increased by $39.6 million or 51.7% compared to last year. This

increase is primarily attributable to large project orders recorded

by the Company’s North American and Italian operations, notably in

the marine, mining, and downstream oil and gas markets.

- As a result of

bookings1 outpacing sales in the current quarter, the Company’s

book-to-bill ratio1 was a strong 1.56 for the period. Furthermore,

the total backlog1 increased by $44.7 million or 7.9% since the

beginning of the fiscal year, amounting to $607.2 million as at May

31, 2021.

- Gross profit

increased by $1.6 million or 8.7% compared to the same quarter last

year, while the gross profit percentage of 26.8% was an increase of

280 basis points from last year’s 24.0%. The increase in gross

profit percentage was such that it could more than offset the

impact of a $1.3 million lower amount of Canada Emergency Wage

Subsidies (“CEWS”) compared to last year The subsidies were

allocated between cost of sales and administration costs. The

improvement in gross profit percentage was mainly attributable to a

product mix with a greater proportion of higher margin product

sales as well as improved margins stemming from the margin

improvement activities implemented by the Company over the course

of the past fiscal years in the scope of the V20 restructuring and

transformation plan.

- Net loss2

amounted to $5.1 million or $0.24 per share compared to $1.9

million or $0.09 per share last year. EBITDA1 amounted to a

negative $0.9 million or $0.04 per share compared to a positive

$2.6 million or $0.12 per share last year. The unfavorable movement

in net loss1 and EBITDA1 overshadows the improved profitability and

margins of the Company’s global operations. Despite sales being

essentially flat compared to last year, the Company’s gross profit

percentage increased, reflecting the notably improved product mix

and margins resulting from the Company’s targeted efforts under

V20. The Company also benefitted from a $1.2 million reduction of

restructuring and transformation cost, also reflecting the progress

made last year in the deployment of the Company’s V20 program.

These improvements could only partially offset the negative impact

of the shift in shipments in the Company’s Italian operations and

an increase in administration costs of $6.1 million or 34.6%. The

increase in administration costs was primarily attributable to an

increase of $2.1 million in the costs recognized in connection with

the Company’s ongoing asbestos litigation, a decrease of $1.1

million in CEWS received by the Company compared to last year’s

first quarter and a general increase in administration expenses

that had been significantly lowered when the global pandemic broke

out last year. The fluctuation in asbestos costs for the quarter is

due to the timing of settlements in these two periods rather than

to changes in long-term trends. The subsidies received by the

Company were allocated between cost of sales and administration

costs.

- Foreign currency

impacts:

- Based on average

exchange rates, the euro strengthened 9.7% against the U.S. dollar

when compared to the same period last year. This strengthening

resulted in the Company’s net profits and bookings from its

European subsidiaries being reported as higher U.S. dollar amounts

in the current quarter.

- Based on average

exchange rates, the Canadian dollar strengthened 12.7% against the

U.S. dollar when compared to the same period last year. This

weakening resulted in the Company’s Canadian dollar expenses being

reported as lower U.S. dollar amounts in the current quarter.

- The net impact

of the above currency swings was generally unfavourable on the

Company’s results.

Dividend

At the end of fiscal 2020, the Board of

Directors deemed appropriate to suspend the quarterly dividend. The

decision remains unchanged and will be reviewed on a quarterly

basis.

Conference call

Financial analysts, shareholders, and other

interested individuals are invited to attend the first quarter

conference call to be held on Wednesday, July 14, 2021, at 11:00

a.m. (EDT). The toll free call-in number is 1-800-747-9564, access

code 21995868. A recording of this conference call will be

available for seven days at 1-416-626-4100 or 1-800-558-5253,

access code 21995868.

About Velan

Founded in Montreal in 1950, Velan Inc.

(www.velan.com) is one of the world’s leading manufacturers of

industrial valves, with sales of US$302.1 million in its last

reported fiscal year. The Company employs close to 1,700 people and

has manufacturing plants in 9 countries. Velan Inc. is a public

company with its shares listed on the Toronto Stock Exchange under

the symbol VLN.

Safe harbour statement

This news release may include forward-looking

statements, which generally contain words like “should”, “believe”,

“anticipate”, “plan”, “may”, “will”, “expect”, “intend”, “continue”

or “estimate” or the negatives of these terms or variations of them

or similar expressions, all of which are subject to risks and

uncertainties, which are disclosed in the Company’s filings with

the appropriate securities commissions. While these statements are

based on management’s assumptions regarding historical trends,

current conditions and expected future developments, as well as

other factors that it believes are reasonable and appropriate in

the circumstances, no forward-looking statement can be guaranteed

and actual future results may differ materially from those

expressed herein. The Company disclaims any intention or obligation

to update or revise any forward-looking statements contained herein

whether as a result of new information, future events or otherwise,

except as required by the applicable securities laws. The

forward-looking statements contained in this news release are

expressly qualified by this cautionary statement.

Non-IFRS and supplementary financial

measures

In this press release, the Company has presented

measures of performance or financial condition which are not

defined under IFRS (“non-IFRS measures”) and are, therefore,

unlikely to be comparable to similar measures presented by other

companies. These measures are used by management in assessing the

operating results and financial condition of the Company and are

reconciled with the performance measures defined under IFRS.

Company has also presented supplementary financial measures which

are defined at the end of this report. Reconciliation and

definition can be found on the next page.

Net earnings (loss) before interest,

taxes, depreciation and amortization ("EBITDA")

|

Three-month periods ended |

|

|

(thousands, except amount per shares) |

May 31,2021$ |

|

May 31,2020$ |

|

|

|

|

|

| Net loss2 |

(5,073 |

) |

(1,886 |

) |

| |

|

|

| Adjustments for: |

|

|

| Depreciation of property,

plant and equipment |

2,414 |

|

2,525 |

|

| Amortization of intangible

assets |

558 |

|

568 |

|

| Finance costs – net |

529 |

|

318 |

|

| Income

taxes |

631 |

|

1,113 |

|

| |

|

|

| EBITDA |

(941 |

) |

2,638 |

|

| EBITDA per share |

|

|

|

- Basic and diluted |

(0.04 |

) |

0.12 |

|

|

|

|

|

|

|

The term “EBITDA” is defined as net income or

loss attributable to Subordinate and Multiple Voting Shares plus

depreciation of property, plant & equipment, plus amortization

of intangible assets, plus net finance costs plus income tax

provision. The terms “EBITDA per share” is obtained by dividing

EBITDA by the total amount of subordinate and multiple voting

shares. The forward-looking statements contained in this press

release are expressly qualified by this cautionary statement.

Definitions of supplementary financial

measures

The term “Net new orders” or “bookings” is

defined as firm orders, net of cancellations, recorded by the

Company during a period. Bookings are impacted by the fluctuation

of foreign exchange rates for a given period. The measure provides

an indication of the Company’s sales operation performance for a

given period as well as well as an expectation of future sales and

cash flows to be achieved on these orders.

The term “backlog” is defined as the buildup of

all outstanding bookings to be delivered by the Company. The

Company’s backlog is impacted by the fluctuation of foreign

exchange rates for a given period. The measure provides an

indication of the future operational challenges of the Company as

well as an expectation of future sales and cash flows to be

achieved on these orders.

The term “book-to-bill” is obtained by dividing

bookings by sales. The measure provides an indication of the

Company’s performance and outlook for a given period.

The forward-looking statements contained in this

press release are expressly qualified by this cautionary

statement.

__________________________

1 Non-IFRS and supplementary financial measures – see

explanation above.2 Net earnings or loss refer to net income or

loss attributable to Subordinate and Multiple Voting Shares

|

|

|

Consolidated Statements of Financial Position |

|

(Unaudited) |

|

(in thousands of U.S. dollars) |

|

As at |

|

|

May 31,2021 |

February 28,2021 |

|

|

$ |

$ |

|

Assets |

|

|

|

|

|

|

|

Current assets |

|

|

|

Cash and cash equivalents |

80,356 |

74,688 |

|

Short-term investments |

471 |

285 |

|

Accounts receivable |

120,906 |

135,373 |

|

Income taxes recoverable |

4,738 |

3,798 |

|

Inventories |

236,585 |

204,161 |

|

Deposits and prepaid expenses |

11,231 |

8,670 |

|

Derivative assets |

194 |

196 |

|

|

454,481 |

427,171 |

|

|

|

|

|

Non-current assets |

|

|

|

Property, plant and equipment |

93,628 |

96,327 |

|

Intangible assets and goodwill |

17,206 |

17,319 |

|

Income taxes recoverable |

5,927 |

5,927 |

|

Deferred income taxes |

33,366 |

33,140 |

|

Other assets |

906 |

949 |

|

|

|

|

|

|

151,033 |

153,662 |

|

|

|

|

|

Total assets |

605,514 |

580,833 |

|

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

|

Current liabilities |

|

|

|

Bank indebtedness |

9,119 |

11,735 |

|

Accounts payable and accrued liabilities |

106,290 |

90,840 |

|

Income taxes payable |

1,474 |

1,609 |

|

Customer deposits |

71,177 |

62,083 |

|

Provisions |

29,382 |

29,515 |

|

Derivative liabilities |

71 |

303 |

|

Current portion of long-term lease liabilities |

1,635 |

1,578 |

|

Current portion of long-term debt |

9,303 |

9,902 |

|

|

228,451 |

207,565 |

|

|

|

|

|

Non-current liabilities |

|

|

|

Long-term lease liabilities |

12,669 |

12,649 |

|

Long-term debt |

55,562 |

48,189 |

|

Income taxes payable |

1,410 |

1,410 |

|

Deferred income taxes |

2,479 |

2,545 |

|

Other liabilities |

8,393 |

8,254 |

|

|

|

|

|

|

80,513 |

73,047 |

|

|

|

|

|

Total liabilities |

308,964 |

280,612 |

|

|

|

|

|

Total equity |

296,550 |

300,221 |

|

|

|

|

|

Total liabilities and equity |

605,514 |

580,833 |

|

|

|

|

|

Consolidated Statements of Loss |

|

(Unaudited) |

|

(in thousands of U.S. dollars, excluding number of shares and per

share amounts) |

| Three-month

periods ended |

|

|

|

May 31,2021 |

|

May 31,2020 |

|

|

|

$ |

|

$ |

|

| |

|

|

| |

|

|

|

Sales |

74,529 |

|

76,653 |

|

| |

|

|

|

Cost of sales |

54,535 |

|

58,261 |

|

| |

|

|

|

Gross profit |

19,994 |

|

18,392 |

|

| |

|

|

|

Administration costs |

23,779 |

|

17,667 |

|

|

Restructuring and transformation costs |

- |

|

1,176 |

|

|

Other expense |

121 |

|

24 |

|

| |

|

|

|

Operating loss |

(3,906 |

) |

(475 |

) |

| |

|

|

| Finance

income |

172 |

|

116 |

|

|

Finance costs |

(701 |

) |

(434 |

) |

| |

|

|

|

Finance costs – net |

(529 |

) |

(318 |

) |

| |

|

|

| Loss

before income taxes |

(4,435 |

) |

(793 |

) |

| |

|

|

|

Income Taxes |

631 |

|

1,113 |

|

| |

|

|

|

Net loss for the period |

(5,066 |

) |

(1,906 |

) |

| |

|

|

| Net

loss attributable to: |

|

|

|

Subordinate Voting Shares and Multiple Voting

Shares |

(5,073 |

) |

(1,886 |

) |

|

Non-controlling interest |

7 |

|

(20 |

) |

| |

|

|

|

Net loss for the period |

(5,066 |

) |

(1,906 |

) |

| |

|

|

| Net

loss per Subordinate and Multiple Voting Share |

|

|

|

Basic and diluted |

(0.24 |

) |

(0.09 |

) |

| |

|

|

|

Total weighted average number of Subordinate

and |

|

|

|

Multiple Voting

Shares |

|

|

|

Basic and diluted |

21,585,635 |

|

21,585,635 |

|

| |

|

|

|

Consolidated Statements of Comprehensive Loss |

|

(Unaudited) |

|

(in thousands of U.S. dollars) |

|

Three-month periods ended |

|

|

|

May 31,2021 |

|

May 31,2020 |

|

|

|

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

Comprehensive loss |

|

|

|

|

|

|

|

Net loss for the period |

(5,066 |

) |

(1,906 |

) |

|

|

|

|

|

Other comprehensive income |

|

|

|

Foreign currency translation adjustment on foreign operations whose

functional currency is other than the reporting currency (U.S.

dollar) |

1,395 |

|

906 |

|

|

|

|

|

|

Comprehensive loss |

(3,671 |

) |

(1,000 |

) |

|

|

|

|

|

Comprehensive loss attributable to: |

|

|

|

Subordinate Voting Shares and Multiple Voting Shares |

(3,702 |

) |

(930 |

) |

|

Non-controlling interest |

31 |

|

(70 |

) |

|

|

|

|

|

Comprehensive loss |

(3,671 |

) |

(1,000 |

) |

|

|

|

|

|

Other comprehensive loss is composed solely of items that may be

reclassified subsequently to the consolidated statement of

loss. |

|

|

|

|

|

Consolidated Statements of Changes in Equity |

|

(Unaudited) |

|

(in thousands of U.S. dollars, excluding number of shares) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity attributable to the Subordinate and Multiple Voting

shareholders |

|

|

|

|

Share capital |

Contributedsurplus |

Accumulatedothercomprehensiveloss |

Retainedearnings |

Total |

Non-controllinginterest |

Total equity |

|

|

|

|

|

|

|

|

|

|

Balance - February 29, 2020 |

72,695 |

6,260 |

(34,047 |

) |

236,269 |

|

281,177 |

|

3,684 |

|

284,861 |

|

|

|

|

|

|

|

|

|

|

|

Net loss for the year |

- |

- |

- |

|

(1,886 |

) |

(1,886 |

) |

(20 |

) |

(1,906 |

) |

|

Other comprehensive income (loss) |

- |

- |

956 |

|

- |

|

956 |

|

(50 |

) |

906 |

|

|

|

|

|

|

|

|

|

|

|

Balance - May 31, 2020 |

72,695 |

6,260 |

(33,091 |

) |

234,383 |

|

280,247 |

|

3,614 |

|

283,861 |

|

|

|

|

|

|

|

|

|

|

|

Balance - February 28, 2021 |

72,695 |

6,260 |

(21,007 |

) |

239,136 |

|

297,084 |

|

3,137 |

|

300,221 |

|

|

|

|

|

|

|

|

|

|

|

Net loss for the year |

- |

- |

- |

|

(5,073 |

) |

(5,073 |

) |

7 |

|

(5,066 |

) |

|

Other comprehensive income |

- |

- |

1,371 |

|

- |

|

1,371 |

|

24 |

|

1,395 |

|

|

|

|

|

|

|

|

|

|

|

Balance - May 31, 2021 |

72,695 |

6,260 |

(19,636 |

) |

234,063 |

|

293,382 |

|

3,168 |

|

296,550 |

|

|

|

|

|

|

|

|

|

|

|

Consolidated Statements of Cash Flow |

|

(Unaudited) |

|

(in thousands of U.S. dollars) |

|

Three-month periods ended |

|

|

|

May 31,2021 |

|

May 31,2020 |

|

|

|

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

Cash flows from |

|

|

|

|

|

|

|

Operating activities |

|

|

|

Net loss for the period |

(5,066 |

) |

(1,906 |

) |

|

Adjustments to reconcile net loss to cash provided by operating

activities |

2,412 |

|

4,626 |

|

|

Changes in non-cash working capital items |

3,549 |

|

16,523 |

|

|

Cash provided by operating activities |

895 |

|

19,243 |

|

|

|

|

|

|

Investing activities |

|

|

|

Short-term investments |

(186 |

) |

(1,137 |

) |

|

Additions to property, plant and equipment |

(1,739 |

) |

(2,531 |

) |

|

Additions to intangible assets |

(288 |

) |

(257 |

) |

|

Proceeds on disposal of property, plant and equipment, and

intangible assets |

3,132 |

|

40 |

|

|

Net change in other assets |

(12 |

) |

(22 |

) |

|

Cash provided (used) by investing activities |

907 |

|

(3,907 |

) |

|

|

|

|

|

Financing activities |

|

|

|

Dividends paid to Subordinate and Multiple Voting shareholders |

- |

|

(482 |

) |

|

Short-term bank loans |

- |

|

(982 |

) |

|

Net change in revolving credit facility |

9,626 |

|

- |

|

|

Repayment of long-term debt |

(3,167 |

) |

(759 |

) |

|

Repayment of long-term lease liabilities |

(413 |

) |

(431 |

) |

|

Cash provided (used) by financing activities |

6,046 |

|

(2,654 |

) |

|

|

|

|

|

Effect of exchange rate differences on cash |

436 |

|

948 |

|

|

|

|

|

|

Net change in cash during the period |

8,284 |

|

13,630 |

|

|

|

|

|

|

Net cash – Beginning of the period |

62,953 |

|

31,010 |

|

|

|

|

|

|

Net cash – End of the period |

71,237 |

|

44,640 |

|

|

|

|

|

|

Net cash is composed of: |

|

|

|

Cash and cash equivalents |

80,356 |

|

84,426 |

|

|

Bank indebtedness |

(9,119 |

) |

(39,786 |

) |

|

|

|

|

|

Net cash – End of the period |

71,237 |

|

44,640 |

|

|

|

|

|

|

Supplementary information |

|

|

|

Interest received (paid) |

(350 |

) |

(348 |

) |

|

Income taxes reimbursed (paid) |

(1,121 |

) |

(555 |

) |

|

|

|

|

|

|

For further information please contact:Yves Leduc, Chief

Executive OfficerorBenoit Alain, Chief Financial OfficerTel: (514)

748-7743Fax: (514) 748-8635Web: www.velan.com

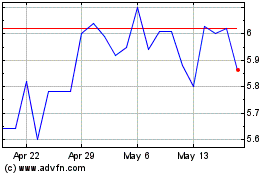

Velan (TSX:VLN)

Historical Stock Chart

From Dec 2024 to Jan 2025

Velan (TSX:VLN)

Historical Stock Chart

From Jan 2024 to Jan 2025