Velan Inc. (TSX: VLN) (the “Company”), a world-leading manufacturer

of industrial valves, announced today its financial results for its

third quarter ended November 30, 2020.

Highlights: Backlog and profitability

improving while sales slowed by pandemic-related factors and the

shift towards a new manufacturing model in North

America

- Order backlog of US$ 561.8

million, highest since November 30, 2012

- Solid book-to bill ratio of

2.34 for the quarter

- Maintaining strong

protective measures to ensure employees health and safety during

the novel coronavirus (“COVID-19”) pandemic

- Strong balance sheet

highlighted by a net cash balance US$ 73.0 million at the end of

the quarter

- Sales of US$71.6 million

for the quarter, hindered by pandemic-related factors and

inefficiencies experienced in reconfiguring the Canadian plants

under the V20 program

- Gross profit of US$ 22.0

million (or 30.7%, almost five points higher than last year) and

net earnings1 of US$ 9.5 million

for the quarter (including a net gain on the sale of a Montreal

plant)

- Operating profit before

restructuring and transformation costs2

of US$2.2 million and adjusted

EBITDA2 of US$ 5.6 million for

the quarter, both improvements over last year despite lower

sales

Yves Leduc, CEO of Velan Inc., said, “It’s been

a year like no other, where our employees celebrated Velan’s 70th

anniversary by rising to extraordinary challenges. We had to learn

how to drive bookings, run manufacturing operations, and carry out

our transformation plan while coping with a devastating global

pandemic: no book was ever written on this, but the speedy and

decisive deployment of safety protocols across all our global sites

was nothing short of exemplary. The fiscal year is not over yet,

but all things considered, there are many reasons to be impressed

by the Company’s achievements to date. It is true that MRO bookings

and sales, heavily dependent on a healthy downstream oil and gas

sector, were deeply affected by the recession, and COVID-related

disruptions in our Asian supply chain hindered our production and

shipments. Then again, our four other strategic businesses are

thriving, having grown our backlog by 40% to its highest level in

over eight years, with many breakthrough orders won thanks to our

strong market position in Europe, the Middle East, India, South

East Asia and China, in the nuclear, petrochemical and oil

production sectors. Business health sprang forward this year as we

are reaping the benefits of our V20 plan, evidenced by a

substantial reduction in production overhead, and even more

encouraging, in the impressive increase in project manufacturing

margins. Thanks to the acceleration of our V20 implementation, the

results in the quarter were helped by the sale of Plant 2-7 in

Montreal, six months earlier than originally planned. And finally,

at the beginning of the fourth quarter, based on our strong

bookings performance, and our success in eliminating structural

costs and improving margins under our V20 plan, we decided to end

the temporary salary reduction program that had been deployed

earlier in the year.

To conclude, the next few months will bring

their share of challenges, as the uncertainty caused by an

indefinite global economic crisis persists. Also the turbulence

brought about by the acceleration of the Montreal plant closure is

one of the factors affecting our production sites in North America

who are still adapting to a new manufacturing lay-out. But armed

with a near-record backlog and growing margins, we have gained much

headroom and are now turning a lot more attention on growing the

business. As I keep reminding our employees: we should aim to get

out of the storm stronger than before it hit the world economy, and

thanks to their unrelenting efforts, that goal is certainly within

range. To all of them, I say “Hats off!”. They all contributed to

elevating an otherwise memorable 70th anniversary to an outstanding

year on many fronts.”

Réjean Ostiguy, CFO of Velan Inc., said,

“In spite of the soft quarter in terms of sales, caused primarily

by the various challenges created by the COVID-19 pandemic, the

continued weakness in the MRO component of the oil and gas sector

and the temporary inefficiencies experienced during the

reconfiguration of the remaining Canadian plants under the V20

program, we were pleased to present improved results for the

quarter and the ninemonth period including margin improvements

driven by our V20 investment. We believe we have managed our

balance sheet well and our net cash continues to be at a healthy

level. We were also pleased to achieve a book-to-bill ratio of

2.34, which has resulted in our backlog closing the quarter at an

impressive level.”

Financial Highlights

| (millions of U.S.

dollars, excluding per share amounts) |

Three-month periods endedNovember 30 |

|

Nine-month periods endedNovember 30 |

|

|

2020 |

|

|

2019 |

|

|

|

2020 |

|

|

2019 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales |

$ |

71.6 |

|

$ |

88.7 |

|

|

$ |

216.6 |

|

$ |

258.0 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross Profit |

|

22.0 |

|

|

22.2 |

|

|

|

57.5 |

|

|

60.2 |

|

| Gross profit % |

|

30.7 |

% |

|

25.0 |

% |

|

|

26.5 |

% |

|

23.3 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net earnings (loss)1 |

|

9.5 |

|

|

(0.8 |

) |

|

|

2.5 |

|

|

(5.3 |

) |

| Net earnings (loss)1 per share –

basic and diluted |

|

0.44 |

|

|

(0.04 |

) |

|

|

0.12 |

|

|

(0.24 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating profit (loss) before

restructuring and transformation costs2 |

|

2.2 |

|

|

1.0 |

|

|

|

(1.1 |

) |

|

(3.2 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA2 |

|

5.6 |

|

|

4.3 |

|

|

|

8.6 |

|

|

6.2 |

|

| Adjusted EBITDA2 per share –

basic and diluted |

|

0.26 |

|

|

0.20 |

|

|

|

0.40 |

|

|

0.29 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Third Quarter Fiscal 2021 (unless otherwise

noted, all amounts are in U.S. dollars and all comparisons are to

the third quarter of fiscal 2020):

- The Company ended the quarter with

a backlog of $561.8 million, an increase of $155.0 million or 38.1%

since the beginning of the current fiscal year. The backlog was

positively impacted by the higher book-tobill ratio and the

strengthening of the euro spot rate against the U.S. dollar over

the course of the nine-month period. The backlog also increased for

the period due to the delays in shipments created by the COVID19

pandemic and the reconfiguration of the Canadian plants under the

V20 program.

- Bookings amounted to $167.6

million, an increase of $70.4 million or 72.4% compared to last

year. This increase is primarily attributable to strong booking

performances by the Company’s Italian and French operations. The

Company’s Italian operations achieved a record high for the

subsidiary of $48.9 million net new orders destined to the

downstream oil and gas market while the Company’s French operations

recorded $48.6 million of bookings for the quarter, primarily

destined to the nuclear market. The increase for the quarter was

also attributable to large project orders recorded by the Company’s

North American operation.

- This strong quarter in terms of

bookings has been one of the main drivers that has allowed the

Company to present a solid 2.34 book-tobill ratio, despite another

soft quarter in terms of non-project orders booked in the Company’s

North American operations.

- Sales amounted to $71.6 million, a

decrease of $17.1 million or 19.3% from the prior year. Sales were

again negatively impacted by the reduction of non-project orders

recorded by the Company’s North American operations due to the

unfavorable market conditions triggered by the COVID-19 pandemic,

as well as the drop in the oil price, which have significantly

affected the Company’s distribution channel. The Company’s reduced

quarterly shipments are also attributable to continued supply chain

issues created by the COVID19 pandemic as well as inefficiencies

experienced in reconfiguring the Canadian plants under the V20

program that caused production delays. This decrease in sales was

partially offset by increased shipments in the Company’s Italian

operations thanks to the delivery of previously delayed

orders.

- Gross profit percentage increased

by 570 basis points from 25.0% to 30.7%. The increase in the gross

profit percentage, which made up for the lower sales volume, was

primarily attributable to the delivery of a product mix with a

greater proportion of higher margin product sales, and from margin

improvements resulting from the labour and overhead savings brought

by the Company’s restructuring and transformation initiatives. The

increase is also attributable to the reversal of a $1.6 million

warranty provision due to a customer’s withdrawal of his claim and

the recording of $1.5 million of wage subsidies. The subsidies were

put in place by government authorities to prevent further staff

lay-offs in the context of the COVID-19 pandemic by offering wage

relief to companies negatively impacted by the virus.

- Operating profit before

restructuring and transformation costs2 amounted to $2.2 million

compared to $1.0 million last year. Adjusted EBITDA2 amounted to

$5.6 million or $0.26 per share compared to $4.3 million or $0.20

per share last year. The increase in operating profit before

restructuring and transformation costs2 and adjusted EBITDA2 is

primarily attributable to an improved gross profit percentage

partially offset by a lower sales volume. The Company’s results

were improved by the cost reductions related to the V20 program, as

well as the recording of wage subsidies which in turn permitted the

Company to avoid potentially significant lay-offs that otherwise

would have been necessary to blunt the financial impact of the

pandemic.

- Net earnings1 amounted to $9.5

million or $0.44 per share compared to a net loss1 of $0.8 million

or $0.04 per share last year. The increase in net earnings1 is

primarily attributable to a $9.6 million gain recognized on the

disposal of one of the Company’s Montreal plants, a vital part of

the North American manufacturing footprint optimization plan which

was planned in the scope of V20. The disposed plant’s production

has been transferred within the remaining North American plants and

the Company’s Indian operations. The Company’s results were

improved by the recording of $2.9 million of wage subsidies which

were allocated between cost of sales, administration expenses and

restructuring and transformation costs. This increase was partially

offset by a $1.3 million unfavorable movement in income taxes.

First Nine Months Fiscal 2021

(unless otherwise noted, all amounts are in U.S. dollars and all

comparisons are to the first nine months of fiscal 2020):

- The Company ended the period with

net cash of $73.0 million, an increase of $42.0 million or 135.5%

since the beginning of the year. The available net cash and unused

credit facilities, along with future cash flows generated from

operations, is sufficient for the Company to meet its financial

obligations, increase its capacity of liquidity, satisfy its

working capital requirements, and execute its business strategy.

The increase in net cash is primarily attributable to proceeds on

the disposal of a manufacturing plant, increase in longterm debt

and short term bank loans and positive non-cash working capital

movements, partially offset by investments in property, plant and

equipment, long-term debt repayments and V20 related disbursements.

Net cash was positively impacted by the strengthening of the euro

spot rate against the U.S. dollar over the course of the period. In

light of the ongoing pandemic and receipt of government subsidies,

the Company has suspended the payment of all dividends as well as

share buybacks this fiscal year.

- Bookings amounted to $345.7

million, an increase of $93.6 million or 37.1% compared to last

year. This increase is primarily attributable to large project

orders booked in the Company’s French, Italian and North American

operations, notably in the nuclear, downstream oil and gas and

process markets. This increase was partially offset by a decrease

in non-project orders booked in the Company’s North American

operations.

- Sales amounted to $216.6 million, a

decrease of $41.4 million or 16.0% from the prior year. The

decreased sales volume for the period is attributable to the

negative impact the COVID-19 pandemic had on the global economy,

especially on the Company’s distribution channel. The reduction in

sales is also attributable to production delays caused by the

inefficiencies experienced while reconfiguring the Canadian plants

under the V20 program.

- Gross profit percentage increased

by 320 basis points from 23.3% to 26.5%. Despite the lower sales

volume, the increase in gross profit percentage is primarily

attributable to the delivery of a product mix with a greater

proportion of higher margin product sales, and from margin

improvements resulting from labour and overhead savings brought by

the Company’s restructuring and transformation initiatives. The

gross profit percentage was also improved by the Company’s

recording of $5.7 million of wage subsidies. The subsidies were put

in place by government authorities to prevent further staff

lay-offs in the context of the COVID-19 pandemic by offering wage

relief to companies negatively impacted by the virus. This increase

was partially offset by unrealized foreign exchange losses

primarily attributable to the weakening of the U.S. dollar against

the euro incurred over the course of the period.

- Administration costs amounted to

$55.9 million, a decrease of $7.8 million or 12.2% compared to last

year. The decrease is primarily attributable to a $4.7 million

reduction of administration salary costs provided by wage subsidies

combined with the on-going effort to reduce administration overhead

expenses including travel expenses and office maintenance costs,

caused principally by the downturn of the market conditions as well

as the travel restrictions and social distancing measures that were

enforced in a majority of countries over the course of the period.

The Company also instituted select temporary salary reductions

during the period. The decrease in administration costs was

partially offset by a $1.2 million increase in the costs recognized

in connection with the Company’s ongoing asbestos litigation. The

fluctuation in asbestos costs for the period is due more to the

timing of settlements in these two periods rather than to changes

in longterm trends.

- Operating loss before restructuring

and transformation costs2 amounted to $1.1 million compared to $3.2

million last year. Adjusted EBITDA2 amounted to $8.6 million or

$0.40 per share compared to $6.2 million or $0.29 per share last

year. The improvement in operating loss before restructuring and

transformation costs2 and adjusted EBITDA2 is primarily

attributable to lowered administration costs and the Company’s

recording of wage subsidies which in turn permitted the Company to

avoid lay-offs that otherwise would have been necessary to blunt

the financial impact of the pandemic, partially offset by an

increase in unrealized foreign exchange losses, a lower gross

profit and higher other expenses.

- Net earnings1 amounted to $2.5

million or $0.12 per share compared to a net loss1 of $5.3 million

or $0.24 per share last year. The increase in net earnings1 is

primarily attributable to a $9.6 million gain recognized on the

disposition of one of the Company’s Montreal plants and a reduction

in administration costs. This increase was partially offset by a

lower gross profit, an increase in other expenses and

restructuration and transformation costs combined with a $2.9

million unfavorable movement in income taxes. The Company’s results

were improved by the recording of $10.7 million of wage subsidies

which were allocated between cost of sales, administration expenses

and restructuring and transformation costs but were reduced by $2.1

million of unrealized foreign exchange losses incurred over the

course of the period.

- The net impact of currency swings

for the period was generally unfavourable on the Company’s net

earnings1, although it was generally favourable on the Company’s

equity.

Dividend

At the end of the fiscal year ended February 29,

2020, the Board of Directors deemed appropriate to suspend the

quarterly dividend. The decision remains unchanged and will be

reviewed on a quarterly basis.

Conference call

Financial analysts, shareholders, and other

interested individuals are invited to attend the second quarter

conference call to be held on Thursday, January 14, 2021, at 11:00

a.m. (EDT). The toll free call-in number is 18009450427, access

code 21989207. A recording of this conference call will be

available for seven days at 14166264100 or 18005585253, access code

21989207.

About Velan

Founded in Montreal in 1950, Velan Inc.

(www.velan.com) is one of the world’s leading manufacturers of

industrial valves, with sales of US$371.6 million in its last

reported fiscal year. The Company employs close to 1,700 people and

has manufacturing plants in 9 countries. Velan Inc. is a public

company with its shares listed on the Toronto Stock Exchange under

the symbol VLN.

Safe harbour statement

This news release may include forward-looking

statements, which generally contain words like “should”, “believe”,

“anticipate”, “plan”, “may”, “will”, “expect”, “intend”, “continue”

or “estimate” or the negatives of these terms or variations of them

or similar expressions, all of which are subject to risks and

uncertainties, which are disclosed in the Company’s filings with

the appropriate securities commissions. While these statements are

based on management’s assumptions regarding historical trends,

current conditions and expected future developments, as well as

other factors that it believes are reasonable and appropriate in

the circumstances, no forward-looking statement can be guaranteed

and actual future results may differ materially from those

expressed herein. The Company disclaims any intention or obligation

to update or revise any forward-looking statements contained herein

whether as a result of new information, future events or otherwise,

except as required by the applicable securities laws. The

forward-looking statements contained in this news release are

expressly qualified by this cautionary statement.

Non-IFRS measures

In this press release, the Company presented

measures of performance and financial condition that are not

defined under International Financial Reporting Standards

(“non-IFRS measures”) and are therefore unlikely to be comparable

to similar measures presented by other companies. These measures

are used by management in assessing the operating results and

financial condition of the Company. In addition, they provide

readers of the Company’s consolidated financial statements with

enhanced understanding of its results and financial condition, and

increase transparency and clarity into the operating results of its

core business. Reconciliations of these amounts can be found on the

following page.

Operating profit (loss) before

restructuring and transformation costs and Adjusted net earnings

(loss) before interest, taxes, depreciation and amortization

("EBITDA")

| |

|

Three-month period ended November 30, |

Three-month period ended November 30, |

Nine-month period ended November 30, |

Nine-month period ended November 30, |

|

|

|

2020 |

2019 |

2020 |

2019 |

|

|

|

|

|

|

|

|

Operating profit (loss) |

|

10.4 |

|

(0.4 |

) |

4.2 |

|

(5.7 |

) |

|

|

|

|

|

|

|

| Adjustments for: |

|

|

|

|

|

| Restructuring and

transformation costs |

|

1.4 |

|

1.4 |

|

4.3 |

|

2.5 |

|

| Gain on disposal of Montreal

plant |

|

(9.6 |

) |

- |

|

(9.6 |

) |

- |

|

| Operating profit

(loss) before restructuring and transformation costs |

|

2.2 |

|

1.0 |

|

(1.1 |

) |

(3.2 |

) |

| |

|

|

|

|

|

| Net earnings (loss)1 |

|

9.5 |

|

0.8 |

|

2.5 |

|

(5.3 |

) |

| |

|

|

|

|

|

| Adjustments for: |

|

|

|

|

|

| Depreciation of property,

plant and equipment |

|

2.5 |

|

2.9 |

|

7.5 |

|

8.1 |

|

| Amortization of intangible

assets |

|

0.7 |

|

0.5 |

|

1.9 |

|

1.5 |

|

| Finance costs – net |

|

0.2 |

|

0.7 |

|

0.5 |

|

0.8 |

|

| Provision for (Recovery of)

income taxes |

|

0.9 |

|

(0.4 |

) |

1.5 |

|

(1.4 |

) |

| EBITDA |

|

13.8 |

|

2.9 |

|

13.9 |

|

3.7 |

|

| |

|

|

|

|

|

| Adjustments for: |

|

|

|

|

|

| Restructuring and

transformation costs |

|

1.4 |

|

1.4 |

|

4.3 |

|

2.5 |

|

| Gain on disposal of Montreal

plant |

|

(9.6 |

) |

- |

|

(9.6 |

) |

- |

|

| |

|

|

|

|

|

| Adjusted

EBITDA |

|

5.6 |

|

4.3 |

|

8.6 |

|

6.2 |

|

| |

|

|

|

|

|

|

|

|

|

The term “operating profit or loss before

restructuring and transformation costs” is defined as operating

profit or loss plus restructuring and transformation costs less the

gain on the disposal of a manufacturing plant. The forwardlooking

statements contained in this news release are expressly qualified

by this cautionary statement.

The term “adjusted EBITDA” is defined as net

income or loss attributable to Subordinate and Multiple Voting

Shares plus restructuring and transformation costs, plus

depreciation of property, plant & equipment, plus amortization

of intangible assets, plus net finance costs, plus income tax

provision less the gain on the disposal of a manufacturing plant,.

The forward-looking statements contained in this news release are

expressly qualified by this cautionary statement.

________________________________1 Net earnings

or loss refers to net income or loss attributable to Subordinate

and Multiple Voting Shares.2 Non-IFRS measures – see explanation

above.

|

|

|

|

|

|

|

|

Velan Inc. |

|

|

|

|

|

| Condensed Interim

Consolidated Statements of Financial Position |

|

|

|

|

| (Unaudited) |

|

|

|

|

|

| (in

thousands of U.S. dollars) |

|

|

|

|

|

| |

|

|

|

|

|

| As At |

|

November 30, |

|

February 29, |

|

| |

|

2020 |

|

2020 |

|

| |

|

$ |

|

$ |

|

| Assets |

|

|

|

|

|

| |

|

|

|

|

|

| Current

assets |

|

|

|

|

|

| Cash and cash equivalents |

|

79,961 |

|

75,327 |

|

| Short-term investments |

|

827 |

|

627 |

|

| Accounts receivable |

|

119,859 |

|

135,242 |

|

| Income taxes recoverable |

|

9,794 |

|

8,747 |

|

| Inventories |

|

191,894 |

|

170,265 |

|

| Deposits and prepaid

expenses |

|

8,174 |

|

5,191 |

|

| Derivative assets |

|

1 |

|

555 |

|

| |

|

410,510 |

|

395,954 |

|

| |

|

|

|

|

|

| Non-current

assets |

|

|

|

|

|

| Property, plant and

equipment |

|

97,821 |

|

98,179 |

|

| Intangible assets and

goodwill |

|

17,626 |

|

17,148 |

|

| Deferred income taxes |

|

28,157 |

|

26,702 |

|

| Other assets |

|

948 |

|

513 |

|

| |

|

|

|

|

|

| |

|

144,552 |

|

142,542 |

|

| |

|

|

|

|

|

| Total

assets |

|

555,062 |

|

538,496 |

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

| |

|

|

|

|

|

| Current

liabilities |

|

|

|

|

|

| Bank indebtedness |

|

6,941 |

|

44,317 |

|

| Short-term bank loans |

|

5,915 |

|

1,379 |

|

| Accounts payable and accrued

liabilities |

|

79,676 |

|

74,271 |

|

| Income taxes payable |

|

612 |

|

1,493 |

|

| Customer deposits |

|

57,594 |

|

47,208 |

|

| Provisions |

|

11,950 |

|

14,963 |

|

|

Provision for performance guarantees |

|

21,056 |

|

21,127 |

|

| Derivative liabilities |

|

336 |

|

1,169 |

|

|

Current portion of long-term lease liabilities |

|

1,609 |

|

1,621 |

|

| Current portion of long-term

debt |

|

7,796 |

|

8,311 |

|

| |

|

193,485 |

|

215,859 |

|

| |

|

|

|

|

|

| Non-current

liabilities |

|

|

|

|

|

|

Long-term lease liabilities |

|

13,828 |

|

13,722 |

|

| Long-term debt |

|

35,945 |

|

10,986 |

|

| Income taxes payable |

|

1,411 |

|

1,576 |

|

| Deferred income taxes |

|

2,774 |

|

2,869 |

|

| Other liabilities |

|

9,230 |

|

8,623 |

|

| |

|

|

|

|

|

| |

|

63,188 |

|

37,776 |

|

| |

|

|

|

|

|

| Total

liabilities |

|

256,673 |

|

253,635 |

|

| |

|

|

|

|

|

| Total

equity |

|

298,389 |

|

284,861 |

|

| |

|

|

|

|

|

| Total liabilities and

equity |

|

555,062 |

|

538,496 |

|

| |

|

|

|

|

|

| Velan

Inc. |

|

|

|

|

|

|

Condensed Interim Consolidated Statements of Income (Loss) |

|

|

|

| (Unaudited) |

|

|

|

|

|

| (in

thousands of U.S. dollars, excluding number of shares and per share

amounts) |

|

|

|

| |

|

|

|

|

|

| |

Three-month periods ended November 30 |

|

Nine-month periods ended November 30 |

|

|

2020 |

|

2019 |

|

|

2020 |

|

2019 |

|

| |

$ |

|

$ |

|

|

$ |

|

$ |

|

| |

|

|

|

|

|

| Sales |

71,560 |

|

88,701 |

|

|

216,553 |

|

257,984 |

|

| |

|

|

|

|

|

| Cost of

sales |

49,538 |

|

66,548 |

|

|

159,086 |

|

197,755 |

|

| |

|

|

|

|

|

| Gross

profit |

22,022 |

|

22,153 |

|

|

57,467 |

|

60,229 |

|

| |

|

|

|

|

|

| Administration costs |

19,288 |

|

21,275 |

|

|

55,911 |

|

63,659 |

|

|

Restructuring and transformation costs (income) |

(8,119 |

) |

1,406 |

|

|

(5,220 |

) |

2,480 |

|

| Other expense (income) |

411 |

|

(118 |

) |

|

2,535 |

|

(171 |

) |

| |

|

|

|

|

|

|

Operating profit (loss) |

10,442 |

|

(410 |

) |

|

4,241 |

|

(5,739 |

) |

| |

|

|

|

|

|

| Finance income |

161 |

|

135 |

|

|

575 |

|

870 |

|

| Finance costs |

322 |

|

833 |

|

|

1,098 |

|

1,709 |

|

| |

|

|

|

|

|

| Finance costs – net |

161 |

|

698 |

|

|

523 |

|

839 |

|

| |

|

|

|

|

|

|

Income (Loss) before income taxes |

10,281 |

|

(1,108 |

) |

|

3,718 |

|

(6,578 |

) |

| |

|

|

|

|

|

| Provision for (Recovery of)

income taxes |

881 |

|

(400 |

) |

|

1,489 |

|

(1,368 |

) |

| |

|

|

|

|

|

| Net income (loss) for

the period |

9,400 |

|

(708 |

) |

|

2,229 |

|

(5,210 |

) |

| |

|

|

|

|

|

| Net income (loss)

attributable to: |

|

|

|

|

|

| Subordinate Voting

Shares and Multiple Voting Shares |

9,527 |

|

(819 |

) |

|

2,529 |

|

(5,274 |

) |

| Non-controlling interest |

(127 |

) |

111 |

|

|

(300 |

) |

64 |

|

| |

9,400 |

|

(708 |

) |

|

2,229 |

|

(5,210 |

) |

| |

|

|

|

|

|

| Net income

(loss) per Subordinate and Multiple Voting Share |

|

|

|

|

| Basic |

0.44 |

|

(0.04 |

) |

|

0.12 |

|

(0.24 |

) |

| Diluted |

0.44 |

|

(0.04 |

) |

|

0.12 |

|

(0.24 |

) |

| |

|

|

|

|

|

| Dividends declared per

Subordinate and Multiple |

- |

|

0.02 |

|

- |

|

0.07 |

|

Voting

Share |

(CA$ - ) |

(CA$0.03) |

|

(CA$-) |

(CA$0.09) |

| |

|

|

|

|

|

| Total weighted average

number of Subordinate and |

|

|

|

|

|

|

Multiple Voting

Shares |

|

|

|

|

|

| Basic |

21,585,635 |

|

21,617,207 |

|

|

21,585,635 |

|

21,616,543 |

|

| Diluted |

21,585,635 |

|

21,617,207 |

|

|

21,585,635 |

|

21,616,543 |

|

| |

|

|

|

|

|

| Velan

Inc. |

|

|

|

|

|

|

| Condensed Interim

Consolidated Statements of Comprehensive Income (Loss) |

|

| (Unaudited) |

|

|

|

|

|

|

| (in

thousands of U.S. dollars) |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| |

Three-month periods ended November 30 |

|

Nine-month periods ended November 30 |

|

|

|

|

|

|

|

|

|

|

|

|

|

2020 |

|

2019 |

|

|

2020 |

|

2019 |

|

| |

$ |

|

$ |

|

$ |

$ |

| Comprehensive income

(loss) |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Net income (loss) for

the period |

9,400 |

|

(708 |

) |

|

2,229 |

|

(5,210 |

) |

| |

|

|

|

|

|

|

| Other comprehensive

income (loss) |

|

|

|

|

|

|

| Foreign currency translation

adjustment on foreign operations |

|

|

|

|

|

|

|

whose functional currency is other than the reporting |

|

|

|

|

|

|

|

currency (U.S. dollar) |

490 |

|

(124 |

) |

|

11,299 |

|

(4,694 |

) |

| |

|

|

|

|

|

|

| Comprehensive income

(loss) |

9,890 |

|

(832 |

) |

|

13,528 |

|

(9,904 |

) |

| |

|

|

|

|

|

|

| Comprehensive income

(loss) attributable to: |

|

|

|

|

|

|

| Subordinate Voting Shares and

Multiple Voting Shares |

9,886 |

|

(1,002 |

) |

|

13,663 |

|

(9,855 |

) |

| Non-controlling interest |

4 |

|

170 |

|

|

(135 |

) |

(49 |

) |

| |

|

|

|

|

|

|

| |

9,890 |

|

(832 |

) |

|

13,528 |

|

(9,904 |

) |

| |

|

|

|

|

|

|

| Other

comprehensive income (loss) is composed solely of items that may be

reclassified subsequently to the |

|

| consolidated statement of

income (loss). |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Velan

Inc. |

|

|

|

|

|

|

|

|

| Condensed Interim

Consolidated Statements of Changes in Equity |

|

|

|

| (Unaudited) |

|

|

|

|

|

|

|

|

| (in

thousands of U.S. dollars, excluding number of shares) |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

Equity attributable to the Subordinate and Multiple Voting

shareholders |

|

|

| |

Number of shares |

Share capital |

Contributed surplus |

Accumulated other comprehensive income (loss) |

Retained earnings |

Total |

Non-controlling interest |

Total equity |

| |

|

|

|

|

|

|

|

|

|

Balance - February 28, 2019 |

21,621,935 |

|

73,090 |

|

6,074 |

(28,990 |

) |

254,606 |

|

304,780 |

|

4,053 |

|

308,833 |

|

| |

|

|

|

|

|

|

|

|

| Net income (loss) for the

period |

- |

|

- |

|

- |

- |

|

(5,274 |

) |

(5,274 |

) |

64 |

|

(5,210 |

) |

| Other comprehensive loss |

- |

|

- |

|

- |

(4,581 |

) |

- |

|

(4,581 |

) |

(113 |

) |

(4,694 |

) |

| |

|

|

|

|

|

|

|

|

| Effect of share-based

compensation |

- |

|

- |

|

2 |

- |

|

- |

|

2 |

|

- |

|

2 |

|

| Share repurchase |

(16,900 |

) |

(184 |

) |

94 |

- |

|

- |

|

(90 |

) |

- |

|

(90 |

) |

| Dividends |

|

|

|

|

|

|

|

|

|

Multiple Voting Shares |

- |

|

- |

|

- |

- |

|

(1,048 |

) |

(1,048 |

) |

- |

|

(1,048 |

) |

|

Subordinate Voting Shares |

- |

|

- |

|

- |

- |

|

(413 |

) |

(413 |

) |

- |

|

(413 |

) |

| |

|

|

|

|

|

|

|

|

|

Balance - November 30, 2019 |

21,605,035 |

|

72,906 |

|

6,170 |

(33,571 |

) |

247,871 |

|

293,376 |

|

4,004 |

|

297,380 |

|

| |

|

|

|

|

|

|

|

|

|

Balance - February 29, 2020 |

21,585,635 |

|

72,695 |

|

6,260 |

(34,047 |

) |

236,269 |

|

281,177 |

|

3,684 |

|

284,861 |

|

| |

|

|

|

|

|

|

|

|

| Net income (loss) for the

period |

- |

|

- |

|

- |

- |

|

2,529 |

|

2,529 |

|

(300 |

) |

2,229 |

|

|

Other comprehensive income |

- |

|

- |

|

- |

11,134 |

|

- |

|

11,134 |

|

165 |

|

11,299 |

|

| |

|

|

|

|

|

|

|

|

|

Balance - November 30, 2020 |

21,585,635 |

|

72,695 |

|

6,260 |

(22,913 |

) |

238,798 |

|

294,840 |

|

3,549 |

|

298,389 |

|

| |

|

|

|

|

|

|

|

|

| Velan

Inc. |

|

|

|

|

|

| Condensed Interim

Consolidated Statements of Cash Flow |

|

|

|

| (Unaudited) |

|

|

|

|

|

| (in

thousands of U.S. dollars) |

|

|

|

|

|

| |

|

|

|

|

|

| |

Three-month periods ended November 30 |

|

Nine-month periods ended November 30 |

|

|

2020 |

|

2019 |

|

|

2020 |

|

2019 |

|

| |

$ |

|

$ |

|

|

$ |

|

$ |

|

| |

|

|

|

|

|

| Cash flows

from |

|

|

|

|

|

| |

|

|

|

|

|

| Operating

activities |

|

|

|

|

|

| Net income (loss) for the

period |

9,400 |

|

(708 |

) |

|

2,229 |

|

(5,210 |

) |

| Adjustments to reconcile net

income (loss) to cash provided (used) by operating activities |

(6,096 |

) |

3,590 |

|

|

(837 |

) |

10,503 |

|

| Changes in non-cash working

capital items |

(14,657 |

) |

7,536 |

|

|

6,358 |

|

8,080 |

|

| Cash provided (used)

by operating activities |

(11,353 |

) |

10,418 |

|

|

7,750 |

|

13,373 |

|

| |

|

|

|

|

|

| Investing

activities |

|

|

|

|

|

| Short-term investments |

327 |

|

2,207 |

|

|

(200 |

) |

569 |

|

| Additions to property, plant

and equipment |

(3,575 |

) |

(5,711 |

) |

|

(7,511 |

) |

(7,425 |

) |

| Additions to intangible

assets |

(470 |

) |

(175 |

) |

|

(993 |

) |

(308 |

) |

| Proceeds on disposal of

property, plant and equipment, and |

|

|

|

|

|

|

intangible assets |

12,683 |

|

109 |

|

|

13,712 |

|

148 |

|

| Net change in other

assets |

63 |

|

(156 |

) |

|

(426 |

) |

(1,484 |

) |

| Cash provided (used)

by investing activities |

9,028 |

|

(3,726 |

) |

|

4,582 |

|

(8,500 |

) |

| |

|

|

|

|

|

| Financing

activities |

|

|

|

|

|

| Dividends paid to Subordinate

and Multiple Voting shareholders |

- |

|

(495 |

) |

|

(482 |

) |

(1,457 |

) |

| Repurchase of shares |

- |

|

(90 |

) |

|

- |

|

(90 |

) |

| Short-term bank loans |

5,913 |

|

(146 |

) |

|

4,536 |

|

(638 |

) |

|

Net change in revolving credit facility |

(9,537 |

) |

- |

|

|

10,798 |

|

- |

|

| Increase in long-term

debt |

- |

|

- |

|

|

14,305 |

|

1,122 |

|

| Repayment of long-term

debt |

(873 |

) |

(579 |

) |

|

(2,931 |

) |

(2,438 |

) |

|

Repayment of long-term lease liabilities |

(428 |

) |

(485 |

) |

|

(1,284 |

) |

(1,143 |

) |

|

Cash provided (used) by financing activities |

(4,925 |

) |

(1,795 |

) |

|

24,942 |

|

(4,644 |

) |

| |

|

|

|

|

|

| Effect of exchange

rate differences on cash |

(430 |

) |

(779 |

) |

|

4,736 |

|

(2,067 |

) |

| |

|

|

|

|

|

| Net change in cash

during the period |

(7,680 |

) |

4,118 |

|

|

42,010 |

|

(1,838 |

) |

| |

|

|

|

|

|

| Net cash – Beginning

of the period |

80,700 |

|

34,910 |

|

|

31,010 |

|

40,866 |

|

| |

|

|

|

|

|

| Net cash – End of the

period |

73,020 |

|

39,028 |

|

|

73,020 |

|

39,028 |

|

| |

|

|

|

|

|

| Net cash is composed of: |

|

|

|

|

|

|

Cash and cash equivalents |

79,961 |

|

77,143 |

|

|

79,961 |

|

77,143 |

|

|

Bank indebtedness |

(6,941 |

) |

(38,115 |

) |

|

(6,941 |

) |

(38,115 |

) |

| |

|

|

|

|

|

| |

73,020 |

|

39,028 |

|

|

73,020 |

|

39,028 |

|

| |

|

|

|

|

|

| Supplementary

information |

|

|

|

|

|

| Interest paid |

(482 |

) |

(480 |

) |

|

(945 |

) |

(938 |

) |

| Income taxes paid |

(3,039 |

) |

(1,025 |

) |

|

(5,548 |

) |

(4,532 |

) |

| |

|

|

|

|

|

For further information please contact:Yves

Leduc, Chief Executive OfficerorRéjean Ostiguy, Chief Financial

OfficerTel: (514) 748-7743Fax: (514) 748-8635Web:

www.velan.com

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/d349c652-ff1a-483d-8b99-9b662dd59a85

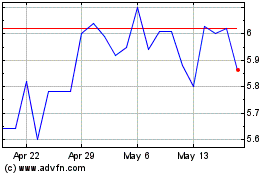

Velan (TSX:VLN)

Historical Stock Chart

From Dec 2024 to Jan 2025

Velan (TSX:VLN)

Historical Stock Chart

From Jan 2024 to Jan 2025