Velan Inc. Reports Its First Quarter 2020/21 Financial Results

July 09 2020 - 1:22PM

Velan Inc. (TSX: VLN) (the “Company”), a world-leading manufacturer

of industrial valves, announced today its financial results for its

first quarter ended May 31, 2020.

Highlights

- Sales of US$76.7 million

for the quarter

- Net loss1

of US$1.9 million for the quarter

- Operating profit before

restructuring and transformation costs2 of US$0.7 million for the

quarter

- Adjusted EBITDA2 of US$3.8

million for the quarter

- Net new orders (“Bookings”)

of US$76.7 million for the quarter

- Order backlog of US$410.3

million at the end of the quarter, of which US$149.3 million is

scheduled for delivery beyond the next 12 months

- Net cash of US$44.6 million

at the end of the quarter

| |

|

| |

Three-month periods

ended |

|

|

May 31, |

May 31, |

| (millions of U.S. dollars,

excluding per share amounts) |

2020 |

2019 |

| |

|

|

| Sales |

$76.7 |

$83.8 |

| |

|

|

| Gross Profit |

18.4 |

16.1 |

| Gross profit % |

24.0% |

19.2% |

| |

|

|

| Net loss1 |

1.9 |

5.8 |

| Net loss1 per share – basic and

diluted |

0.09 |

0.27 |

| |

|

|

| Operating profit (loss) before

restructuring and transformation costs2 |

0.7 |

(6.8) |

| |

|

|

| Adjusted EBITDA2 |

3.8 |

(3.8) |

| Adjusted EBITDA2 per share –

basic and diluted |

0.18 |

(0.18) |

| |

|

|

First Quarter Fiscal 2021 (unless otherwise

noted, all amounts are in U.S. dollars and all comparisons are to

the first quarter of fiscal 2020):

- Sales amounted to $76.7 million, a

decrease of $7.1 million or 8.5% from the prior year. Sales were

negatively impacted by a decrease in shipments from the Company’s

North American and French operations, which was partially offset by

an increase in shipments from the Company’s Italian operations. The

decreased sales volume for the quarter is attributable to a lower

shippable backlog in the Company’s North American operations,

combined with the negative impact that the novel coronavirus

(“COVID-19”) pandemic had on the global economy. For example, the

Company had to manage many disruptions related to its supply chain

which caused significant delays on certain customer orders, and due

to travel restrictions, experienced difficulties in getting

inspection clearance to deliver certain large project orders.

Finally, the Company was able during the quarter to obtain

recognition by most governments of its status as supplier of

critical equipment to essential industries and as a result was able

to maintain its operations while managing through the

pandemic. However, the Company did nevertheless face

government mandated temporary shutdowns in reaction to the spread

of the virus in certain regions of the world, in particular in

India and Italy. The Company’s Italian operations, though faced

with these challenges, were able to deliver a strong quarter in

terms of large project orders shipments.

- Gross profit percentage increased

by 480 basis points from 19.2% to 24.0%. Despite the lower sales

volume, the increase in gross profit percentage was mainly

attributable to a product mix with a greater proportion of higher

margin product sales as well as labour and overhead savings

stemming from the Company’s restructuring and transformation

initiatives which started in the prior fiscal year. The increase is

also attributable to the Company’s qualification for $1.9 million

of wage subsidies. The subsidies were put in place by government

authorities to prevent further job losses in the context of the

COVID-19 pandemic by offering wages relief to companies negatively

impacted by the market distress caused by the virus. This increase

was partially offset by a lower gross profit percentage in the

Company’s French operations due to lower shipments of large project

orders for the quarter.

- Administration costs amounted to

$17.7 million, a decrease of $5.3 million or 23.0% compared to last

year. The decrease is primarily attributable to the on-going effort

to reduce administration overhead expenses under the V20 plan, a

$1.5 million reduction of administration employee salaries provided

by wage subsidies as well as a general reduction in administration

expenses, such as travel expenses and office maintenance costs,

caused principally by the downturn of the market conditions as well

as the lockdowns that were enforced in a majority of countries over

the course of the quarter. The Company had also recorded, in the

prior year, a $0.9 million final settlement relating to a

long-standing product claim that was filed against the

Company.

- Net loss1 amounted to $1.9 million

or $0.09 per share compared to $5.8 million or $0.27 per share last

year. The decrease in net loss1 is primarily attributable to the

Company’s improved gross profit as well as lowered administration

costs, which was partially offset by an increase in restructuring

and transformation costs combined with an unfavorable movement in

income taxes.

- Operating profit before

restructuring and transformation costs2 amounted to $0.7 million

compared to an operating loss before restructuring and

transformation costs2 of $6.8 million last year. Adjusted EBITDA2

amounted to $3.8 million or $0.18 per share compared to a negative

$3.8 million or a negative $0.18 per share last year. The

improvement in operating profit before restructuring and

transformation costs2 and adjusted EBITDA2 is primarily

attributable to a stronger gross profit, driven by a range of V20

initiatives and a better product mix, as well as lowered

administration costs.

- During the quarter, the Company

listed one of its Montreal plants for sale through the scope of its

restructuring and transformation plan. As a result, the

carrying value of this plant is presented as an asset held for

sale. Subsequent to the end of the quarter, the Company agreed to

the sale of its Montreal plant on MacArthur Street in

Saint-Laurent, Quebec, which will be effective on October 31, 2020.

The closing of the plant was planned as part of the V20

reconfiguration of the Company’s North American manufacturing

footprint. Gross proceeds will be $12.6M and are conditional upon

the submission of a clean Bill 72 environmental report to the

Quebec authorities. Additionally, the Company secured, shortly

after the end of the quarter, new financing in the form of a $22.5M

mortgage loan and a $65.0M revolving credit facility which will be

used to support the Company’s operations, to complete its

restructuring and transformation plan as well as to provide the

necessary capital to pursue future growth initiatives while

strengthening its balance sheet as the world economy enters a

period of uncertainty.

- Net new orders received

(“bookings”) amounted to $76.7 million, an increase of $12.5

million or 19.5% compared to last year. This increase is primarily

attributable to large project orders booked in the Company’s North

American, German, French and Italian operations, notably in the

liquified natural gas and nuclear markets. This increase was

partially offset by a decrease in the non-project orders booked in

the Company’s North American operations due to the unfavorable

market conditions caused by the COVID-19 pandemic affecting the

Company’s distribution channel. The Company was encouraged

nonetheless to record a 19.5% increase in bookings in the current

context when compared to last year.

- The Company ended the period with a

backlog of $410.3 million, an increase of $3.5 million or 0.9%

since the beginning of the current fiscal year. The increase in

backlog is primarily attributable to the strengthening of the euro

spot rate against the U.S. dollar over the course of the current

quarter.

- The Company ended the quarter with

net cash of $44.6 million, an increase of $13.6 million or 43.9%

since the beginning of the current fiscal year. This increase is

primarily attributable to cash provided by operating activities,

mainly due to strong working capital management, and the favorable

movements of the Euro and Canadian dollar spot rates, against the

U.S dollar, on the net cash balance of the Company over the course

of the current quarter. The increase was partially offset by

short-term investments, additions to property, plant and equipment,

dividend payments to shareholders and repayments of short‑term bank

loans, long‑term debt and long-term lease liabilities.

- Foreign currency impacts:

- Despite the increase of the Euro spot rate over the course of

the quarter, the average exchange rates of the Euro weakened 2.7%

against the U.S. dollar when compared to the same period last year.

This resulted in the Company’s net profits and bookings from its

European subsidiaries being reported as lower U.S. dollar amounts

in the current quarter.

- Based on average exchange rates, the Canadian dollar weakened

4.2% against the U.S. dollar when compared to the same period last

year. This resulted in the Company’s Canadian dollar expenses being

reported as lower U.S. dollar amounts in the current quarter.

- The net impact of the above currency swings was generally

favorable on the Company’s net loss1.

“Our first quarter presented us with a unique

set of challenges related to global COVID-19 pandemic and to the

rapid drop in the price of oil,” said Réjean Ostiguy, CFO of Velan

Inc. “While it did have a negative impact on our quarterly sales,

we managed our margins and reduced administration costs so as to

come close to an operating breakeven, even when including our

restructuring and transformation costs. We took actions to protect

our cash and balance sheet by suspending dividends, temporarily

rolling back wages, applying for COVID-19 subsidies and completing

the refinancing of our North American operations.”

Yves Leduc, CEO of Velan Inc., said, “As

supplier of critical equipment to essential industries, we were

spared the harshest consequences of the global recession that

struck early in the quarter, and we responded extremely swiftly in

protecting our employees and ensuring the continuity of our global

supply chain, while delivering much improved results over last

year. Going forward, we are advantaged by a healthy and

well-balanced business portfolio, the accelerated margin growth

under our V20 plan, as well as the broad set of recent measures

that have increased our company’s resilience and agility. These are

hard times but there is business momentum, and, more importantly,

our employees, with whom Bruno and I have communicated every single

week since the pandemic broke out, are responding admirably well to

the challenge. I thank them for their resolve and leadership.”

Dividend

At the end of the fiscal year ended February 29,

2020, the Board of Directors deemed appropriate to suspend the

quarterly dividend. The decision remains unchanged and will

be reviewed on a quarterly basis.

Conference call

Financial analysts, shareholders, and other

interested individuals are invited to attend the first quarter

conference call to be held on Friday, July 10, 2020, at 11:00 a.m.

(EDT). The toll free call-in number is 1-800-905-9496, access code

21965457. A recording of this conference call will be available for

seven days at 1-416-626-4144 or 1-800-997-6910, access code

21965457.

About Velan

Founded in Montreal in 1950, Velan Inc.

(www.velan.com) is one of the world’s leading manufacturers of

industrial valves, with sales of US$371.6 million in its last

reported fiscal year. The Company employs over 1,775 people and has

manufacturing plants in 9 countries. Velan Inc. is a public company

with its shares listed on the Toronto Stock Exchange under the

symbol VLN.

Safe harbour statement

This news release may include forward-looking

statements, which generally contain words like “should”, “believe”,

“anticipate”, “plan”, “may”, “will”, “expect”, “intend”, “continue”

or “estimate” or the negatives of these terms or variations of them

or similar expressions, all of which are subject to risks and

uncertainties, which are disclosed in the Company’s filings with

the appropriate securities commissions. While these statements are

based on management’s assumptions regarding historical trends,

current conditions and expected future developments, as well as

other factors that it believes are reasonable and appropriate in

the circumstances, no forward-looking statement can be guaranteed

and actual future results may differ materially from those

expressed herein. The Company disclaims any intention or obligation

to update or revise any forward-looking statements contained herein

whether as a result of new information, future events or otherwise,

except as required by the applicable securities laws. The

forward-looking statements contained in this news release are

expressly qualified by this cautionary statement.

Non-IFRS measures

In this press release, the Company presented

measures of performance and financial condition that are not

defined under International Financial Reporting Standards

(“non-IFRS measures”) and are therefore unlikely to be comparable

to similar measures presented by other companies. These measures

are used by management in assessing the operating results and

financial condition of the Company. In addition, they provide

readers of the Company’s consolidated financial statements with

enhanced understanding of its results and financial condition, and

increase transparency and clarity into the operating results of its

core business. Reconciliations of these measures can be found on

the following page.

Operating profit (loss) before

restructuring and transformation costs and Adjusted net earnings

(loss) before interest, taxes, depreciation and amortization

("EBITDA")

|

|

|

|

| |

Three-monthperiod endedMay 31, |

Three-monthperiod endedMay 31, |

| |

2020 |

2019 |

| |

|

|

| Operating loss |

(0.5) |

(7.3) |

|

|

|

|

| Adjustment for: |

|

|

| Restructuring and

transformation costs |

1.2 |

0.5 |

| Operating profit

(loss) before restructuring and transformation costs |

0.7 |

(6.8) |

| |

|

|

|

Net loss1 |

(1.9) |

(5.8) |

| |

|

|

| Adjustments for: |

|

|

| Depreciation of property,

plant and equipment |

2.5 |

2.6 |

| Amortization of intangible

assets |

0.6 |

0.4 |

| Finance costs – net |

0.3 |

0.3 |

| Income taxes |

1.1 |

(1.8) |

| EBITDA |

2.6 |

(4.3) |

| |

|

|

| Adjustment for: |

|

|

| Restructuring and

transformation costs |

1.2 |

0.5 |

| |

|

|

| Adjusted

EBITDA |

3.8 |

(3.8) |

| |

|

|

The term “operating profit or loss before

restructuring and transformation costs” is defined as operating

profit or loss plus restructuring and transformation costs. The

forward-looking statements contained in this news release are

expressly qualified by this cautionary statement.

The term “adjusted EBITDA” is defined as net

income or loss attributable to Subordinate and Multiple Voting

Shares plus restructuring and transformation costs, depreciation of

property, plant & equipment, plus amortization of intangible

assets, plus net finance costs plus income tax provision. The

forward-looking statements contained in this news release are

expressly qualified by this cautionary statement.

__________________________1 Net earnings or loss refers to net

income or loss attributable to Subordinate and Multiple Voting

Shares.2 Non-IFRS measures – see explanation above.

|

|

|

|

|

Velan Inc. |

|

|

|

Condensed Interim Consolidated Statements of Financial

Position |

|

|

(Unaudited) |

|

|

|

(in thousands of U.S. dollars) |

|

|

| |

|

|

| As

At |

May

31, |

February 29, |

| |

2020 |

2020 |

| |

$ |

$ |

|

Assets |

|

|

| |

|

|

|

Current assets |

|

|

| Cash and

cash equivalents |

84,426 |

75,327 |

| Short-term

investments |

1,764 |

627 |

| Accounts

receivable |

117,312 |

135,242 |

| Income taxes

recoverable |

7,980 |

8,747 |

|

Inventories |

166,042 |

170,265 |

| Deposits and

prepaid expenses |

6,217 |

5,191 |

| Derivative

assets |

124 |

555 |

| Assets held

for sale |

3,512 |

- |

| |

387,377 |

395,954 |

| |

|

|

|

Non-current assets |

|

|

| Property,

plant and equipment |

94,661 |

98,179 |

| Intangible

assets and goodwill |

17,036 |

17,148 |

| Deferred

income taxes |

25,986 |

26,702 |

| Other

assets |

529 |

513 |

| |

|

|

| |

138,212 |

142,542 |

| |

|

|

|

Total assets |

525,589 |

538,496 |

| |

|

|

| |

|

|

|

Liabilities |

|

|

| |

|

|

|

Current liabilities |

|

|

| Bank

indebtedness |

39,786 |

44,317 |

| Short-term

bank loans |

397 |

1,379 |

| Accounts

payable and accrued liabilities |

63,893 |

74,271 |

| Income taxes

payable |

1,965 |

1,493 |

| Customer

deposits |

51,086 |

47,208 |

|

Provisions |

15,608 |

14,963 |

| Provision

for performance guarantees |

20,604 |

21,127 |

| Derivative

liabilities |

2,006 |

1,169 |

| Current

portion of long-term lease liabilities |

1,617 |

1,621 |

| Current

portion of long-term debt |

8,013 |

8,311 |

| |

204,975 |

215,859 |

| |

|

|

|

Non-current liabilities |

|

|

| Long-term

lease liabilities |

13,729 |

13,722 |

| Long-term

debt |

10,410 |

10,986 |

| Income taxes

payable |

1,576 |

1,576 |

| Deferred

income taxes |

2,758 |

2,869 |

| Other

liabilities |

8,280 |

8,623 |

| |

|

|

| |

36,753 |

37,776 |

| |

|

|

|

Total liabilities |

241,728 |

253,635 |

| |

|

|

|

Total equity |

283,861 |

284,861 |

| |

|

|

|

Total liabilities and equity |

525,589 |

538,496 |

| |

|

|

|

Velan Inc. |

|

Condensed Interim Consolidated Statements of Loss |

|

(Unaudited) |

|

(in thousands of U.S. dollars, excluding number of shares and per

share amounts) |

| |

|

|

| |

Three-month

periods endedMay 31 |

| |

2020 |

2019 |

| |

$ |

$ |

| |

|

|

| |

|

|

|

Sales |

76,653 |

|

83,816 |

|

| |

|

|

| Cost

of sales |

58,261 |

|

67,722 |

|

| |

|

|

|

Gross profit |

18,392 |

|

16,094 |

|

| |

|

|

|

Administration costs |

17,667 |

|

22,954 |

|

|

Restructuring and transformation costs |

1,176 |

|

509 |

|

| Other

expense (income) |

24 |

|

(57 |

) |

| |

|

|

|

Operating loss |

(475 |

) |

(7,312 |

) |

| |

|

|

| Finance

income |

116 |

|

140 |

|

| Finance

costs |

434 |

|

467 |

|

| |

|

|

| Finance

costs – net |

(318 |

) |

(327 |

) |

| |

|

|

| Loss

before income taxes |

(793 |

) |

(7,639 |

) |

| |

|

|

| Income

Taxes |

1,113 |

|

(1,819 |

) |

| |

|

|

| Net

loss for the period |

(1,906 |

) |

(5,820 |

) |

| |

|

|

| Net

loss attributable to: |

|

|

|

Subordinate Voting Shares and Multiple Voting

Shares |

(1,886 |

) |

(5,824 |

) |

|

Non-controlling interest |

(20 |

) |

4 |

|

| |

(1,906 |

) |

(5,820 |

) |

| |

|

|

| Net

loss per Subordinate and Multiple Voting Share |

|

|

| Basic |

(0.09 |

) |

(0.27 |

) |

| Diluted |

(0.09 |

) |

(0.27 |

) |

| |

|

|

| |

|

|

|

Dividends declared per Subordinate and Multiple Voting

Share |

- |

0.02 |

|

|

(CA$ - ) |

(CA$0.03) |

| |

|

|

| |

|

|

| |

|

|

| Total weighted average number of Subordinate and

Multiple Voting Shares |

|

|

| Basic |

21,585,635 |

|

21,621,935 |

|

| Diluted |

21,585,635 |

|

21,621,935 |

|

| |

|

|

|

Velan Inc. |

|

Condensed Interim Consolidated Statements of Comprehensive

Loss |

|

(Unaudited) |

|

(in thousands of U.S. dollars) |

|

|

|

|

|

|

Three-month periods endedMay 31 |

|

|

2020 |

|

2019 |

|

|

|

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

Comprehensive loss |

|

|

|

|

|

|

|

Net loss for the period |

(1,906 |

) |

(5,820 |

) |

|

|

|

|

|

Other comprehensive income (loss) |

|

|

|

Foreign currency translation adjustment on foreign operations whose

functional currency is other than the reporting currency (U.S.

dollar) |

906 |

|

(2,851 |

) |

|

|

|

|

|

Comprehensive loss |

(1,000 |

) |

(8,671 |

) |

|

|

|

|

|

Comprehensive loss attributable to: |

|

|

|

Subordinate Voting Shares and Multiple Voting Shares |

(930 |

) |

(8,537 |

) |

|

Non-controlling interest |

(70 |

) |

(134 |

) |

|

|

|

|

|

|

(1,000 |

) |

(8,671 |

) |

|

|

|

|

|

Other comprehensive income (loss) is composed solely of items that

may be reclassified subsequently to the consolidated statement of

loss. |

|

|

|

|

| Velan

Inc. |

| Condensed Interim

Consolidated Statements of Changes in Equity |

| (Unaudited) |

|

(in thousands of U.S. dollars, excluding number of shares) |

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

Equity attributable to the Subordinate and Multiple Voting

shareholders |

|

|

| |

Number of shares |

Share capital |

Contributed surplus |

Accumulatedothercomprehensiveincome (loss) |

Retainedearnings |

Total |

Non-controllinginterest |

Total equity |

| |

|

|

|

|

|

|

|

|

|

Balance - February 28, 2019 |

21,621,935 |

73,090 |

6,074 |

(28,990 |

) |

254,606 |

|

304,780 |

|

4,053 |

|

308,833 |

|

| |

|

|

|

|

|

|

|

|

| Net loss for

the year |

- |

- |

- |

- |

|

(5,824 |

) |

(5,824 |

) |

4 |

|

(5,820 |

) |

| Other

comprehensive loss |

- |

- |

- |

(2,713 |

) |

- |

|

(2,713 |

) |

(138 |

) |

(2,851 |

) |

| |

|

|

|

|

|

|

|

|

| Effect of

share-based compensation |

- |

- |

1 |

- |

|

- |

|

1 |

|

- |

|

1 |

|

|

Dividends |

|

|

|

|

|

|

|

|

|

Multiple Voting Shares |

- |

- |

- |

- |

|

(346 |

) |

(346 |

) |

- |

|

(346 |

) |

|

Subordinate Voting Shares |

- |

- |

- |

- |

|

(135 |

) |

(135 |

) |

- |

|

(135 |

) |

| |

|

|

|

|

|

|

|

|

|

Balance - May 31, 2019 |

21,621,935 |

73,090 |

6,075 |

(31,703 |

) |

248,301 |

|

295,763 |

|

3,919 |

|

299,682 |

|

| |

|

|

|

|

|

|

|

|

|

Balance - February 29, 2020 |

21,585,635 |

72,695 |

6,260 |

(34,047 |

) |

236,269 |

|

281,177 |

|

3,684 |

|

284,861 |

|

| |

|

|

|

|

|

|

|

|

| Net loss for

the year |

- |

- |

- |

- |

|

(1,886 |

) |

(1,886 |

) |

(20 |

) |

(1,906 |

) |

| Other

comprehensive income (loss) |

- |

- |

- |

956 |

|

- |

|

956 |

|

(50 |

) |

906 |

|

| |

|

|

|

|

|

|

|

|

|

Balance - May 31, 2020 |

21,585,635 |

72,695 |

6,260 |

(33,091 |

) |

234,383 |

|

280,247 |

|

3,614 |

|

283,861 |

|

| |

|

|

|

|

|

|

|

|

|

Velan Inc. |

|

|

| Condensed

Interim Consolidated Statements of Cash Flow |

|

|

|

(Unaudited) |

|

|

|

(in thousands of U.S. dollars) |

|

|

| |

|

|

| |

Three-month

periods endedMay 31 |

|

|

2020 |

|

2019 |

|

| |

$ |

|

$ |

|

| |

|

|

| |

|

|

| Cash

flows from |

|

|

| |

|

|

|

Operating activities |

|

|

| Net loss for

the period |

(1,906 |

) |

(5,820 |

) |

| Adjustments

to reconcile net loss to cash provided by operating activities |

4,626 |

|

2,683 |

|

| Changes in

non-cash working capital items |

16,523 |

|

4,859 |

|

| Cash

provided by operating activities |

19,243 |

|

1,722 |

|

| |

|

|

|

Investing activities |

|

|

| Short-term

investments |

(1,137 |

) |

(4 |

) |

| Additions to

property, plant and equipment |

(2,531 |

) |

(748 |

) |

| Additions to

intangible assets |

(257 |

) |

(22 |

) |

| Proceeds on

disposal of property, plant and equipment, and intangible assets

intangible assets |

40 |

|

32 |

|

| Net change

in other assets |

(22 |

) |

13 |

|

| Cash

used by investing activities |

(3,907 |

) |

(729 |

) |

| |

|

|

|

Financing activities |

|

|

| Dividends

paid to Subordinate and Multiple Voting shareholders |

(482 |

) |

(476 |

) |

| Short-term

bank loans |

(982 |

) |

(439 |

) |

| Repayment of

long-term debt |

(759 |

) |

(716 |

) |

| Repayment of

long-term lease liabilities |

(431 |

) |

(396 |

) |

| Cash

used by financing activities |

(2,654 |

) |

(2,027 |

) |

| |

|

|

|

Effect of exchange rate differences on cash |

948 |

|

(435 |

) |

| |

|

|

| Net

change in cash during the period |

13,630 |

|

(1,469 |

) |

| |

|

|

| Net

cash – Beginning of the period |

31,010 |

|

40,866 |

|

| |

|

|

| Net

cash – End of the period |

44,640 |

|

39,397 |

|

| |

|

|

| Net cash is

composed of: |

|

|

|

Cash and cash equivalents |

84,426 |

|

72,597 |

|

|

Bank indebtedness |

(39,786 |

) |

(33,200 |

) |

| |

|

|

| |

44,640 |

|

39,397 |

|

| |

|

|

|

Supplementary information |

|

|

| Interest

received (paid) |

(348 |

) |

279 |

|

| Income taxes

reimbursed (paid) |

(555 |

) |

1,831 |

|

| |

|

|

For further information please contact:Yves Leduc, Chief

Executive OfficerorRéjean Ostiguy, Chief Financial OfficerTel:

(514) 748-7743Fax: (514) 748-8635Web: www.velan.com

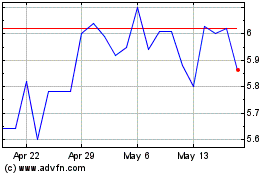

Velan (TSX:VLN)

Historical Stock Chart

From Dec 2024 to Jan 2025

Velan (TSX:VLN)

Historical Stock Chart

From Jan 2024 to Jan 2025