Tanzanian Gold Corporation (TSX:TNX) (NYSE American:TRX) (TanGold

or the Company) today announced results for the first quarter of

2022 (“Q1 2022”). Financial results for Q1 2022 will be available

on the Company’s website and will be filed on SEDAR and provided on

EDGAR on January 14, 2022.

During Q1 2022, the Company continued its

successful execution towards a sustainable business plan in which

cash flow from operations funds value creating activities,

including exploration and sulphide project development.

Q1 Accomplishment and

Highlights

- Production Growth:

Positive operating cash flow at Buckreef Gold in December 2021 with

533 ounces of gold production, after successfully completing

construction and substantial commissioning of 360 tonnes per day

(“tpd”) processing plant. The 1,000+ tpd expansion is on track for

calendar Q2/Q3 2022 with two additional ball mills already having

arrived in Dar es Salaam.

- Exploration

Upside: Drilling has recommenced at Buckreef Gold with the

goal of expanding resources, discovering new resources and

converting resources to reserves. To date, a total of six

exploration holes (1,716 meters) have been completed, including

three holes (758 meters) in the northeast extension of the Buckreef

Main Zone. The Company plans to expand the exploration program in

2022, including a focus on the Anfield Zone.

-

Sulphide Development Project Advancement: Advanced

the metallurgical study, one of the longest lead items on the

Sulphide Development Project, which contains approximately 90% of

the Buckreef Gold resource. To date, a total of 19 holes (2,367

meters) have been completed for the metallurgical program. These

metallurgical sample holes have been logged and are in preparation

for shipment for metallurgical testing in Q2 2022. Exploration

drilling will also focus on infill drilling Inferred Mineral

Resources, which if successful, has the potential to increase

tonnes to the Indicated Mineral Resource category and add, if

economic, to the Mineral Reserves.

“It has been an extremely busy year. In

conjunction with our Tanzanian colleagues, contractors and

suppliers, we have successfully moved the Company to a position

where we have proven we can execute on a mine plan, build plants

and successfully produce gold to cover operating costs. As we

continue to expand production in 2022, we will move to a position

where value accretive activities including exploration and

unlocking the value of the Sulphide Development Project, will be

predominantly funded from anticipated positive operating cash flow.

2022 is setting up to be quite an exciting year, with a lot of

activity focused on our goal of making everything “Bigger”:

production growth, potential resource expansion through exploration

and unlocking the significant value of the sulphide project by

making it much larger than previously disclosed,” noted Stephen

Mullowney, Chief Executive Officer of TanGold.

Q1 Accomplishments &

Outlook

- Successfully

completed construction and substantial commissioning of the

expanded 360 tpd processing plant. Buckreef Gold was operating cash

flow positive for the first time in December 2021. The Company

continues to expect the 360 tpd throughput to increase production

to 750-800 oz of gold per month1 at a total average Cash Cost2 of

US$725-825/oz once steady state processing has been achieved in

fiscal Q2/Q3 2022. The larger 1,000+ tpd processing plant is

expected to be completed in calendar Q2/Q3 2022 and is forecast to

produce 15,000 – 20,000 oz of gold per year.

- Exploration

drilling has recommenced at Buckreef Gold and will be an increasing

area of focus and expanded throughout fiscal 2022. To date a total

of six exploration holes (1,716 meters) have been completed,

including three holes (758 meters) in the northeast extension of

the Buckreef Main Zone. These holes are following up on the

northern-most intersection of 50.0 meters at 1.8 g/t in hole

BMRCD308. TanGold believes that the property and immediate

surrounding area is highly prospective for economic gold

mineralization. Within the last six months the Anfield Zone was

discovered. The Anfield Zone lies ‘on-trend’ between a historical

mineral resource (the Eastern Porphyry) and an adjacent mining

facility with nearly 3 kilometers (“km”) of untested shear zone

located 500 meters to the east of the Buckreef Main Zone. High

grade fresh rock samples were retrieved from an artisanal mine

shaft. Geological assessment of the property and adjacent leases

continues and will pick up pace throughout fiscal 2022.

- Following up on

positive metallurgical results from the oxide operations (top of

Buckreef Main Zone deposit) and the preliminary metallurgical

testing for the sulphide portion of Buckreef Main Zone deposit

(three bottom of pit samples), metallurgical testing for sulphide

project development has moved to variability testing of the first

5-7 years of production and will continue into 2022 including

tailing characteristics for dry stack tailings. Geotechnical and

groundwater work will continue on identified areas (i.e. plant,

tailings, waste rock storage facility). To date, a total of 19

holes (2,367 meters) have been completed for the metallurgical

program. These metallurgical sample holes have been logged and are

in preparation for shipment for metallurgical testing in Q2

2022.

Processing and Mining

- Buckreef Gold

reported zero lost time incidents, two medical treatment incidents

and had no COVID-19 related cases at site in Q1 2022. For the

calendar year ended December 31st, 2021, including contractors,

Buckreef Gold recorded a safety incident frequency rate of 4.9 (per

million hours). Exclusive of contractors, Buckreef Gold recorded a

safety incident frequency rate of 0 (per million hours).

- Q1 2022

reflected an important transition for Buckreef Gold, moving from a

test plant to commissioning of Phase 1 of the 1,000+ tpd processing

plant. Buckreef Gold successfully completed construction and

substantial commissioning of the 360 tpd processing plant

expansion. The expanded processing plant construction was completed

in line with the scheduled completion date of September/October

2021 at a capital cost of US$1.6 million, within guidance. In-house

construction was completed by the Buckreef Gold and TanGold teams

in conjunction with key consultants/contractors, including: (i)

Ausenco; (ii) Solo Resources; and (iii) CSI Energy Group.

- Buckreef Gold

continued to operate the 120 tpd processing plant for the first two

months of Q1 2022. Following successful commissioning of the first

360 tpd processing plant and associated processing circuit by

October 31st, 2021, the existing 120 tpd processing plant was

integrated into the new circuit as a ‘regrind mill’. Run-of-mine

(“ROM”) mill feed commenced on November 6th, 2021 and management

continues to ramp up throughput and improve efficiencies. The

processing plant throughput continued to increase through the

ramp-up and commissioning period, predominantly with lower grade

ore, which is normal in the commissioning of any processing plant.

Buckreef Gold produced 589 oz for Q1 2022.

- This upward

trajectory continued into December 2021, with 533 oz of gold

produced, of which 494 oz was sold. The rapid advance of production

has resulted in Buckreef Gold becoming operating cash flow positive

in December - the first month in Buckreef Gold’s history. The 360

tpd processing plant achieved the following in December 2021: (i)

average throughput of 251 tpd; (ii) plant availability of 86.5%;

(iii) average recovery rate of 85.6% with consistent tailings

grade, regardless of head grade; (iv) average retention times of

26.3 hours; and (v) average grindability of 86.5% passing 75µ

(microns). It is important to note that in the commissioning and

ramp-up phase of the 360 tpd processing plant the Company utilized

low grade ore, including in the December period. The processing

plant’s positive trajectory is expected to continue throughout Q2

2022.

- Buckreef Gold

has continued to focus on optimizing all key operating metrics for

the 360 tpd processing plant. As such, Buckreef Gold has

implemented the following upgrades to the 360 tpd processing plant:

(i) installation of an eighth CIL tank (target completion - January

2022); (ii) installation of 1 megawatt genset (already installed);

and (iii) early expansion the elution circuit (target completion –

January 2022), which will also be utilized in the 1,000+ tpd

processing facility. These improvements will allow Buckreef Gold to

achieve higher: (i) retention times; (ii) plant availability; (iii)

throughput rates; and (iv) recovery rates. With these improvements,

Buckreef Gold anticipates achieving nameplate capacity of 360 tpd,

target 28 hour retention times and higher recovery rates in fiscal

Q2 2022.

- Total ore mined

in Q1 2022 increased to 116 thousand tonnes (“kt”) from 9 kt in Q4

2021 and the strip ratio in Q1 2022 was 3.1 (ore:waste tonnes). The

increase is the result of recommencement of mining activities in Q1

2022 with the hiring of a Tanzanian mining contractor (FEMA) on a

two-year contract. Increased mining continued into December until

the holiday break period. The ROM pad stockpile balance as of

December 31st, 2021 was 3,526 oz of gold with an average grade of

2.0 g/t, which includes 2,001 oz of gold grading 3.7 g/t. The

increased stockpile balance provides support for the Company to

meet its production guidance in the upcoming quarters.

- In Q1 2022,

through FEMA, Buckreef Gold successfully and safely completed the

first two blasts in the Buckreef Main Zone. These blasts were in

high grade areas where transitional ore reached near surface

enabling access to high grade ore blocks.

- Geotechnical and

ground water studies related to the oxide material tailings storage

facility (“TSF”) successfully concluded and a permit to construct

the TSF was granted by the Mining Commission of Tanzania in Q1

2022. Excavations for the TSF continued through the latter part of

the Q1 2022 and into Q2 2022. The oxide material TSF is scheduled

to be operational in Q2 2022.

- During Q1 2022

Buckreef Gold continued to advance plans for construction of a

1,000+ tpd operation while simultaneously operating the 360 tpd

operation. Buckreef Gold has procured two additional 360 tpd ball

mills (from the same manufacturer), which have arrived at the port

in Dar es Salaam and are expected to be transported to site in

January 2022.

- Other long-lead

orders, such as ‘off the shelf’ crusher and cyclones will be placed

in January 2022. Geotechnical work for the expanded 1,000+ tpd

processing plant has been completed and earthworks have commenced.

Ausenco has been retained as TanGold’s owner engineer and the

process circuit will be primarily locally sourced and constructed

by the same local teams in a manner substantially similar to the

360 tpd processing plant expansion.

- The targeted

completion date of the 1,000+ tpd processing plant of calendar

Q2/Q3 2022 remains unchanged and the larger processing plant is

expected to produce 15,000 – 20,000 oz of gold per year based on

the initial mine plan and grade profile, which was developed in

conjunction with SGS Canada Inc. (“SGSC”). This initial mine plan

incorporates approximately 10% of the resources in the Buckreef

Main Zone. The Company continues to budget capital expenditures for

the expanded 1,000+ tpd processing plant of approximately US$4.0

million.

Exploration

- Exploration has

recommenced at Buckreef Gold with STAMICO being retained for

diamond drilling services for a 10,000 meter program, for both

exploration and metallurgical drilling.

- To date a total

of six exploration holes (1,716 meters) have been completed,

including three holes (758 meters) in the northeast extension of

the Buckreef Main Zone. These holes are following up on the

northern most intersection of 50.0 meters at 1.8 g/t in hole

BMRCD308. The above samples are currently being prepared for assay

at local accredited laboratories.

- Exploration will

be of increasing focus and expanded throughout fiscal 2022 in line

with the ramp-up of production. The initial focus will be on: (i)

extension of the Buckreef Main Zone in the northeast; (ii) initial

exploration in the Anfield Zone; and (iii) infill drilling in

Buckreef West and Buckreef Main Zones.

- As mentioned

previously, TanGold believes the property and immediate surrounding

area to be highly prospective for economic gold mineralization.

Within the last six months the Anfield Zone was discovered. The

Anfield Zone lies ‘on-trend’ between a historical mineral resource

(the Eastern Porphyry) and an adjacent mining facility with nearly

3km of untested shear zone located 500 meters to the east of the

Buckreef Main Zone. High grade fresh rock samples were retrieved

from an artisanal mine shaft. Geological assessment of the property

and adjacent leases continues and will pick up pace throughout

2022.

Sulphide Development Project

- The Sulphide

Development Project, in which the ‘sulphide ore’ encompasses

approximately 90% of the Buckreef Main Zone’s 2.0 MT Measured and

Indicated resources, is a key value driver for the Company.

Unlocking this value is an important objective of the Company, the

Sulphide Development Project will evaluate the options for a high

return large scale project to pre-feasibility (“PFS”) or

feasibility study (“FS”) level work. It is the goal of the Company

to substantially exceed all metrics as outlined in the Technical

Report, including annual production and strip ratio. We continue to

work with our principal consultants on the Sulphide Development

Project, including re-visiting the Technical Report mine plan in

calendar Q2/Q3 2022.

- In 2021 the

Company identified, with Ausenco, the overarching mine

infrastructure layout (plant, tailing storage facility, waste rock

dump and camp). Following this work, the Company will now advance

each area with geotechnical and ground water studies, along with

site wide water balances.

- Geotechnical

characterization of the 2 km long open pit will also commence in

2022. To this end, in Q1, the company has made arrangements with

its consultants SGSC and Terrane Geoscience to commence site work

during calendar Q2/Q3 2022 (COVID-19 permitting).

- The Technical

Report mine plan is scheduled to be re-visited during Q2/Q3

2022.

- One of the

longest lead items for the Sulphide Development Project, is the

variability metallurgical study for the first 5-7 years of

potential production of the Sulphide Development Project. To date,

a total 19 metallurgical holes (2.367 meters) have been completed

along the entire strike of the Buckreef Main deposit and the holes

have been logged and are in preparation for shipment for

metallurgical testing.

- Exploration

drilling will also focus on infill drilling Inferred Mineral

Resources, which if successful, has the potential to increase

tonnes to the Indicated Mineral Resource category and add, if

economic, to the Mineral Reserves.

Environmental,

Social and Corporate Governance (“ESG”)

- The Company is

committed to working to the highest ESG standards and has initiated

several programs, whilst developing a broader framework and

policies. There were also no reportable environmental or community

related incidents during the first quarter. Buckreef Gold continues

to expand its CSR / ESG program, successfully partnering with the

District and Regional Commissioners on school, water and health

projects.

- Buckreef Gold

continues to work with the Geita District Council and local Wards

to collaboratively identify key programs that focus on short to

long term educational needs, which in turn is aligned with Buckreef

Gold’s local hiring practices and includes Science, Technology,

Engineering and Mathematics (“STEM”) and gender goals. A Memorandum

of Understanding will be signed in calendar Q2 2022, and the

Company will continue to focus on local hires at Buckreef Gold and

with associated contractors.

- Buckreef Gold’s

operations: (i) are connected to the Tanzanian national electricity

grid and utilizes grid power which is sourced from hydroelectric

facilities in Tanzania; (ii) recycles all water used in its

operations; (iii) do not discharge water from its operations; (iv)

workforce are 100% Tanzanian citizens; (v) development and building

activities are focused on maximizing local content; (vi) exhibit a

‘100 mile diet’ by procuring all food locally; and (vii) sulphide

development is expected to utilize dry stack tailings.

- The Company

supports local procurement in all activities by first sourcing

within the immediate wards, then out to district, region and

nation. Only those items or services not available within country

are purchased externally from Tanzania, first prioritizing East

Africa, Africa then globally.

Other

- During 2021,

TanGold through Buckreef Gold hired a surveying consultant

(Property Matrix Company Limited) to commence the land compensation

process required under Tanzanian mining law. The land compensation

process has been fully accrued in the Company’s financial

statements and as of January 13, 2022, approximately 96% of project

affect persons have been paid representing 94% of the overall

dollar amount. It is expected that the remaining 4% of project

affected persons will be compensated by the end of Q2 2022.

- On November 30,

2021, Buckreef Gold entered into a Gold Purchase and Sale Agreement

with Auramet International LLC (“Auramet”) through which Buckreef

Gold will, at its discretion, sell up to 100% of the gold produced

from Buckreef Gold to Auramet at market rates, for a period of one

year, with an option to extend for success periods. In 2021, gold

produced from the 120 tpd test plant had been sold locally whereby

the Purchase and Sale Agreement with Auramet will accommodate sale

of the larger expected gold output from the 1,000+ tpd processing

plant. Auramet is a global physical metals merchant providing a

full range of services including metal merchant, merchant banking,

structured finance and advisory services.

Financing

- As at November

30, 2021, the Company had cash of $7.9 million and net working

capital of $4.2 million. After adjusting for $1.9 million in

derivative liabilities, working capital on an adjusted basis is

$6.1 million.

- December 2021

record production and sales (533 oz and 494 oz, respectively) has

resulted in Buckreef Gold being operating cash flow positive in

December, the first month in Company history. This positive

trajectory is expected to continue throughout Q2 2022.

- As the Company

advances and the production profile expands, management continually

evaluates its liquidity requirements and available sources of

financing including but not limited to: (i) cash flow from

operations; (ii) corporate debt; (iii) project specific debt; (iv)

off-take financing; and (v) equity financing. The Company will be

prudent in how it capitalizes the Company over the short, medium

and long-term with shareholder value being an overarching

consideration.

- Subsequent to Q1

2022, the Company entered into a purchase agreement with Lincoln

Park Capital Fund, LLC (“Lincoln Park”). Under the terms of the

purchase agreement, TanGold, in its sole discretion, will have the

right from time to time over a 36-month period to sell up to $10

million of its shares to Lincoln Park, subject to certain

conditions. TanGold will control the timing and amount of any sales

to Lincoln Park, and Lincoln Park is obligated to make purchases in

accordance with the purchase agreement. Any common shares that is

sold to Lincoln Park will occur at a purchase price that is based

on prevailing market prices at the time of each sale and with no

upper limits to the price Lincoln Park may pay to purchase common

shares.Importantly, Lincoln Park has also agreed not to cause or

engage in any direct or indirect short selling or hedging of the

Company’s common shares. No warrants are being issued in this

transaction, and there are no limitations on our use of proceeds

from sales to Lincoln Park under the purchase agreement.

Furthermore, the purchase agreement does not contain any rights of

first refusal, participation rights, penalties or liquidated

damages provisions in favor of any party. The agreement may be

terminated by TanGold at any time, in its sole discretion, without

any additional cost or penalty.

About Tanzanian Gold Corporation

TanGold along with its joint venture partner,

STAMICO is advancing a significant gold project at Buckreef in

Tanzania. Buckreef is anchored by an expanded Mineral Resource

published in May 2020. Measured Mineral Resource is 19.98 million

tonnes (“MT”) at 1.99 grams per tonne (“g/t”) gold (“Au”)

containing 1,281,161 ounces (“oz”) of gold and Indicated Mineral

Resource is 15.89 MT at 1.48 g/t gold containing 755,119 ounces of

gold for a combined tonnage of 35.88 MT at 1.77 g/t gold containing

2,036,280 oz of gold. The Buckreef Gold Project also contains an

Inferred Mineral Resource of 17.8 MT at 1.11g/t gold for contained

gold of 635,540 oz of gold. The Company is actively investigating

and assessing multiple exploration targets on its property. Please

refer to the Company’s Updated Mineral Resources Estimate for

Buckreef Gold Project, dated May 15, 2020 and filed under the

Company’s profile on SEDAR on June 23, 2020 (the “Technical

Report”), for more information. Buckreef is being advanced in a

value accretive sustainable manner through:

Expanding Production Profile: A

360 tonne per day (“tpd”) processing plant is being expanded to

1,000+ tpd, enabling a near term production profile of 15,000 -

20,000 oz of gold per year. Positive operating cash flow will be

utilized for value enhancing activities, including exploration and

Sulphide Project Development.

Exploration: Continuing with a

drilling program with the goal of expanding resources, discovering

new resources and converting resources to reserves, by: (i)

step-out drilling in the northeast extension of Buckreef Main; (ii)

infill drilling to upgrade Mineral Resources currently in the

Inferred category in Buckreef Main; (iii) infill drilling program

of Buckreef West; (iv) develop exploration program for the newly

discovered Anfield Zone; (v) upgrade historical mineral resources

at Bingwa and Tembo; (vi) identification of new prospects at

Buckreef Gold Project, and in the East African region.

Sulphide Development Project:

Unlocking the value of the Sulphide Project in which the ‘sulphide

ore’ encompasses approximately 90% of the Resources. It is the goal

of the Company to substantially exceed all metrics as outlined in

the Technical Report, including annual production and strip

ratio.

For further information, please contact Michael Martin, Investor

Relations, m.martin@tangoldcorp.com, 860-248-0999, or visit the

Company website at www.tangoldcorp.com

Andrew M. Cheatle, P.Geo., the Company’s COO and

Director, is the Qualified Person as defined by the NI 43-101 who

has reviewed and assumes responsibility for the technical content

of this press release.

The Toronto Stock Exchange and NYSE American

have not reviewed and do not accept responsibility for the adequacy

or accuracy of this release. Tanzanian Gold Corporation is

providing the reference of the research report in this press

release for information only.

Forward-Looking Statements

This press release contains certain

forward-looking statements as defined in the applicable securities

laws. All statements, other than statements of historical facts,

are forward-looking statements. Forward-looking statements are

frequently, but not always, identified by words such as “expects”,

“anticipates”, “believes”, “hopes”, “intends”, “estimated”,

“potential”, “possible” and similar expressions, or statements that

events, conditions or results “will”, “may”, “could” or “should”

occur or be achieved. Forward-looking statements relate to future

events or future performance and reflect TanGold management’s

expectations or beliefs regarding future events and include, but

are not limited to, statements with respect to the continued

operating cash flow, expansion of its process plant, estimation of

mineral resources, recoveries, subsequent project testing, success,

scope and viability of mining operations, the timing and amount of

estimated future production, and capital expenditure.

Although TanGold believes the expectations

expressed in such forward-looking statements are based on

reasonable assumptions, such statements are not guarantees of

future performance. The actual achievements of TanGold or other

future events or conditions may differ materially from those

reflected in the forward-looking statements due to a variety of

risks, uncertainties and other factors. These risks, uncertainties

and factors include general business, legal, economic, competitive,

political, regulatory and social uncertainties; actual results of

exploration activities and economic evaluations; fluctuations in

currency exchange rates; changes in costs; future prices of gold

and other minerals; mining method, production profile and mine

plan; delays in exploration, development and construction

activities; changes in government legislation and regulation; the

ability to obtain financing on acceptable terms and in a timely

manner or at all; contests over title to properties; employee

relations and shortages of skilled personnel and contractors; the

speculative nature of, and the risks involved in, the exploration,

development and mining business. These risks are set forth in

reports that Tanzanian Gold files with the SEC. You can review and

obtain copies of these filings from the SEC's website at

http://www.sec.gov/edgar.shtml .

The information contained in this press release

is as of the date of the press release and TanGold assumes no duty

to update such information.

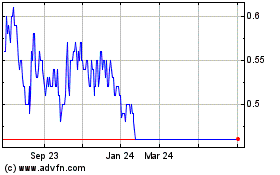

TRX Gold (TSX:TNX)

Historical Stock Chart

From Nov 2024 to Dec 2024

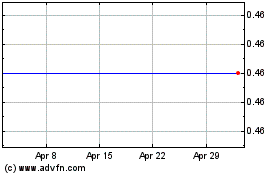

TRX Gold (TSX:TNX)

Historical Stock Chart

From Dec 2023 to Dec 2024