Tanzanian Gold Corporation (TSX:TNX) (NYSE American:TRX) (TanGold

or the Company) today reported its results for the fourth quarter

(“Q4 2021”) and year end 2021. Financial results will be available

on the Company’s website on or before November 30, 2021.

Major Highlights Include:

-

Significant Exploration Potential: Discovery of

two new gold bearing shear zones in the Buckreef West and Anfield

Zones. Assuming successful exploration results from ongoing diamond

drilling, both new zones and the Buckreef Main Zone have the

potential to significantly add to the 2.0 million ounces of gold in

the measured and indicated mineral resources category and 0.6

million ounces of gold contained in inferred mineral resource

category.

- Low

Cost, High Return Production Expansions:

The capital cost of the 360 tpd gold processing plant expansion was

$1.6 million, which is expected to increase production to 750-800

ounces of gold per month1 at a total average Cash Cost2 of

US$725-825/oz once steady state processing has been achieved.

Assuming a gold price of US$1,750 per ounce, the project exhibits a

quick capital payback and high operating return. The 1,000+ tpd

expansion is estimated to have a capital cost of approximately

US$4.0 million, with a targeted completion in calendar Q2/Q3 2022.

The 360 tpd gold processing plant expansion was completed in-house

in approximately 5 months, on-time and on-budget.

- Improved

Liquidity Profile: Recapitalization of the Balance Sheet

and execution of low-cost, high return gold production expansion

projects.

-

De-risked Production: Achievement of +90% recovery

rates in the gold (oxide) test plant.

- Simple

Processing Technology: Preliminary metallurgical test work

on the sulphide project indicates a straightforward flowsheet

similar to the CIL plants currently in operation and at comparable

gold recovery rates.

- Solid

ESG Credentials: Buckreef Gold: (i) is connected to the

national electricity grid which primarily sources electricity from

hydroelectric facilities; (ii) recycles all water and has no water

discharge from operations; (iii) focuses on maximizing local

content; (iv) exhibits a ‘100 mile diet’ by sourcing food locally;

and (v) CSR activity is focused on local education and health

programs in partnership with regional and district councils for

‘win-win’ solutions.

- High

Performing Team: Reset of the management team with

significant mining backgrounds from high performing organizations,

including 100% Tanzanian team on the ground at Buckreef Gold.

“We closed 2021 on a strong note. Buckreef Gold

has been repositioned to have significant exploration potential

with an increasing production profile. We are enthusiastic about

continually developing our ‘high return - low cost’ projects and

are very excited about the drilling prospects at Anfield and

Buckreef West. The 1,000+ tpd mine plan only represents

approximately 10% of existing measured and indicated resources.

Consequently, we have considerable expansion potential,

particularly in the Buckreef Main Zone ‘sulphides,’ which accounts

for approximately 90% of our current measured and indicated mineral

resources. The Company has a safety-first, high-performance culture

in which we invest in the well-being of employees and the community

in which we operate. Along with our rejuvenated, results oriented,

experienced and energetic new team, I am extremely excited for

2022,” noted Stephen Mullowney, TanGold’s Chief Executive

Officer.

Fiscal 2022 Outlook

- The 360 tpd

processing plant is expected to increase production to 750-800

ounces of gold per month1 at a total average Cash Cost2 of

US$725-825/oz once steady state processing has been achieved.

- Operating cash

flow from the larger 360 tpd processing plant is anticipated to

mitigate the negative operating cash flow at Buckreef Gold from the

testing period of the 120 tpd test processing plant. Anticipated

cash flow generated from the larger plant will be reinvested in

Buckreef Gold with a focus on the following value enhancing

activities: (i) exploration and drilling; (ii) additional capital

programs focused on growth and efficiencies; and (iii) enhanced

CSR/ESG programs.

- Buckreef Gold

will advance and construct a 1,000+ tpd operation while

simultaneously operating the 360 tpd operation. Project capital

expenditures for an expanded 1,000+ tpd processing plant are

estimated to be approximately US$4.0 million with a targeted

completion in calendar Q2/Q3 2022. Buckreef Gold has procured two

additional 360 tpd ball mills (from the same manufacturer). The two

additional ball mills have been shipped and scheduled to arrive in

Tanzania by calendar year end. The 1,000+ tpd operation is expected

to be capable of producting 15,000 – 20,000 ounces of gold per year

based on the initial mine plan and grade profile.

- The anticipated

increase in cash flow from the 1,000+ processing plant will fund

value enhancing activities at Buckreef Gold, which are similar to

those mentioned above for the 360 tpd processing plant, including

but not limited to: (i) further expansion of the exploration

program in the Buckreef Main Zone, Buckreef West and the newly

discovered Anfield Zone, which if successful, may expand mineral

reserves and mineral resources; and (ii) additional capital

expansion programs to increase the Company’s production profile;

and (iii) further investments in CSR/ESG initiatives.

- The Company has

retained STAMICO for diamond drilling services for a 10,000 meter

program, which will cover:

- PQ/HQ size holes for testing metallurgical variability in the

top 150 meters of the sulphide deposit;

- Infill drilling on the inferred mineral resource, which if

successful will upgrade that resource to the measured or indicated

mineral resource category, and;

- Exploration of the Main Zone deposit to the north-east /

south-west, and to commence drilling on the recently discovered

Anfield Zone.

- Metallurgical

testing for sulphide project development moved to variability

testing of the first 5-7 years of production and will continue into

2022, including tailing characteristics for dry stack tailings.

Geotechnical and groundwater work will continue on identified areas

(i.e. plant, tailings, waste rock storage facility). To date, the

metallurgical program of 18 holes (2,337 meters) has been completed

and the holes are being logged in preparation for shipment for

metallurgical testing. The drill program has now switched to the

exploration phase.

- The land

compensation process is expected to be completed by the end of

calendar 2021 and has been fully accrued in the Company’s financial

statements. As of November 29, 2021, approximately 95% of project

affected persons have been paid representing 91% of the overall

dollar amount.

- Geological work

has commenced in evaluating the full extent of exploration

potential at the Buckreef Project. Analysis of Inferred Mineral

Resources, exploration targets, advanced exploration, geophysical

data, geochemical data, and grassroots exploration through to

conceptual targets have been evaluated. The Company will provide

updates on its exploration targets and strategy which will be

finalized and provided in Q1-2022, including the Anfield Zone.

- The Company

will continue a review of its broader exploration portfolio and

strategy to meet core strategic objectives, including consideration

of acquiring new licenses and/or partnerships. The Buckreef Project

licenses cover highly prospective ground with many geochemical and

soil anomalies. The Company is located in highly favorable Archean

geological terrane in the prospective and producing Lake Victoria

Greenstone Belt, where numerous anomalous gold bearing shear zones

have been identified.

Accomplishments During Fiscal Year Ended

August 31, 2021

Operations

- Buckreef Gold

reported zero lost time injuries, zero medical aid incidents and

had no COVID-19 related cases in 2021. There were also no

reportable environmental or community related incidents in

2021.

- During October

2021, the Company completed construction of a 360 tpd processing

plant expansion. Buckreef Gold also continued to operate the 120

tpd processing plant subsequent to concluding the test period,

which achieved a 90% gold recovery rate as reported in September

2021. The existing 120 tpd processing plant has been integrated

into the new processing plant circuit as a ‘regrind mill’. The new

processing plant construction was completed in line with the

scheduled completion date of late September/October 2021 at a

capital cost of US$1.6 million, also within guidance. The

run-of-mine mill feed commenced on November 6th, 2021 and continues

to ramp up throughput. The 360 tpd throughput is expected to

increase production to 750-800 ounces of gold per month1 at a total

average Cash Cost2 of US$725-825/oz once steady state processing

has been achieved. The 360 tpd processing plant was completed by

the Buckreef Gold and TanGold teams in conjunction with key

consultants/contractors, including: (i) Ausenco; (ii) Solo

Resources; and (iii) CSI Energy Group. Anticipated operating cash

flow from the new processing plant is expected to mitigate the

negative cash flow from the testing period of the 120 tpd test

processing plant.

- Buckreef Gold

will continue with plans and construction to advance a 1,000+ tpd

operation while simultaneously operating the 360 tpd operation. It

was determined that the most cost effective and timely approach to

building a 1,000+ tpd processing plant was to self-construct this

operation, in effect, as an expansion to the 360 tpd processing

plant. Project capital expenditures for an expanded 1,000+ tpd

processing plant is estimated to be approximately US$4.0 million,

which includes an upgraded elution circuit and other capital

equipment to accommodate the increased throughput. Ausenco has been

retained as TanGold’s owner engineer and the process circuit will

be primarily locally sourced and constructed by the same local

teams in a manner similar to the 360 tpd processing plant

expansion. The targeted completion of the 1,000+ tpd operation is

calendar Q2/Q3 2022 and is expected to produce 15,000 – 20,000

ounces of gold per year based on the initial mine plan and grade

profile.

- The operation

of the 120 tpd test plant continued in the fourth quarter 2021,

operating 7 days a week with two 12-hour shifts. Through the

testing phase, objectives related to oxide mill feed grind,

processing of clays, retention times and optimized recovery rates

have been achieved. Consequently, the testing phase concluded in

September 2021. The 120 tpd test plant produced 396 ounces of pure

gold in the fourth quarter and 1,836 ounces of pure gold on a

year-to-date basis.

- During the year

ended August 31, 2021, the Company attained recovery rates of 90%

on a consistent basis at the 120 tpd oxide test plant. During the

test phase, the Company established that a grind size of 80%

passing 75 microns and a retention time of approximately 30 hours

led to consistent gold recovery of greater than 90%.

- Through its

testing program in 2021, Buckreef Gold has been able to

substantiate the grade control block model, confirm forecasted

operating cost inputs such as mining and processing costs for 360

tpd and 1,000+ tpd oxide mining operations, and develop a

comprehensive understanding of oxide mill feed grind, processing of

clays, retention times and how to optimize recovery rates. This

knowledge has been applied to the design of the 360 tpd and 1,000+

tpd mine operations, substantially de-risking these

operations.

- During the year

the Company hired a Tanzanian mining contractor (FEMA) on a

two-year contract to mine ore, waste and a tailings storage

facility at Buckreef. During October and November 2021, the

Company, through FEMA, successfully and safely completed two blasts

in high grade areas where transitional ore reached near surface

enabling access to high grade ore blocks.

- During the

year, TanGold through Buckreef Gold hired a surveying consultant

(Property Matrix Company Limited) to commence the land compensation

process required under Tanzanian mining law. The land compensation

survey has been completed, and to date, the land compensation

process is approximately 90% complete. Land Compensation has been

fully accrued and is anticipated to be finalized by the end of

calendar 2021.

- As previously

disclosed, TanGold and STAMICO agreed in principle to amendments to

the Buckreef Joint Venture Agreement (the “JV Agreement”) to bring

the JV Agreement in line with recent changes in Tanzanian mining

laws and to modernize the working arrangement between the parties

(the original JV Agreement was entered into in 2011). Discussions

between the Company and STAMICO remain ongoing and are expected to

continue.

Sulphide Development and Exploration

-

Favourable Metallurgical Test Results: The Company

announced updated and highly favorable metallurgical test results

from the sulphide component of the Buckreef mineral resource. Three

diamond drill core samples were taken from the fresh rock

(‘sulphide’ mineral resource) of the Buckreef deposit for the

purposes of metallurgical test work. Highlights include:

- The following intercepts and gold

recoveries have been confirmed in the report:

- MC01: 0.54 g/t Au over 78.88m –

94.1%

- MC02: 19.4 g/t Au over 27.99m –

95.4%

- MC03: 1.71 g/t Au over 52.53m –

85.3%

- A straightforward flowsheet

consisting of:

- Primary grinding to P80 = ~100-150

µm

- Rougher flotation

- Regrind of the rougher concentrate

to ~15-20 µm (P80)

- Cyanide leaching of the reground

flotation concentrate

- Cyanide leaching of the flotation

tailing

- No refractory association of gold with arsenic sulphide was

detected;

- The samples tested did not exhibit any preg-robbing or other

refractory characteristics;

- Clean tailings, high probability of mine tailings not being

acid generating, confirming the approach of dry stack tailings

going forward; and

- Further opportunities to improve gold extraction from MC03 have

been identified through diagnostic leach testing.

-

Buckreef West Discovery: The Company announced the

discovery of Buckreef West, which lies in close proximity to the

Buckreef Main Zone, defining a near vertical shear zone, over a

strike length of 400 meters (“m”), with interpreted gold

mineralization shallowly plunging to the northeast. The mineralized

zone remains open to the south and at depth. Highlights include:

- Shallow depth: All reported

intercepts are at shallow depth on a well-defined structure which

is interpreted as a splay off the Buckreef Main Zone;

- Open at depth and along strike:

Over 400m of strike length has been drilled to date and the deposit

remains open at depth and along strike in both directions; and

- Select intercepts:

- Hole BWDD017 intersected

4.57m @ 6.4 g/t Au from 44.9m;

- Hole BWDD015, on the same line as

Hole BWDD017, had two intersections: 2.18m @ 1.24

g/t Au from 86.9m and (ii) 2.49m @1.3 g/t

Au from 105.1m;

- Hole BWDD012 intersected

5.57m @ 4.95 g/t Au from 98.4m and 4.0m @

2.19 g/t Au from 92.0m;

- Hole BWDD013, on the same line as

Hole BWDD012 intersected 1.5m @ 2.2 g/t Au from

59.5m;

- BWDD0018 intersected 7.0m @

2.03 g/t Au from 44.0m and 3.85m @ 2.86

g/t from 56.0m; and

- BWDD0031 intersected 2.5m @

7.29 g/t Au from 46.1m.

- Anfield

Zone Discovery: The Company announced that it has made a

new discovery of three closely spaced parallel, gold bearing

structures at Buckreef, collectively now known as the Anfield Zone.

Follow-up field work and diamond drilling is planned for 2021 and

2022. Highlights include:

- The new prospective gold

mineralized zones, totaling a combined 2.9-kilometer (km) strike

length were identified through geological (field) mapping, sampling

and examination of artisanal workings. Collectively, they have been

named the Anfield Zone;

- Grab samples of mineralized bed

(fresh) rock have been assayed, with highlights of:

- 37.52 g/t

- 28.55 g/t

- 14.42 g/t

- Located approximately 500m to the

east of the Buckreef Main Zone; and

- Aligns with and trends towards the

Eastern Porphyry Mineral Resource.

Management

- Appointed on

December 1, 2020, Mr. Stephen Mullowney, CPA, CA, CFA as Chief

Executive Officer (CEO) of Tanzanian Gold Corporation. He also

accepted an appointment to the Board of Directors of the Company.

Mr. Mullowney was previously a Partner and Managing Director of

PricewaterhouseCoopers LLP (PwC) and PwC Canada’s mining deals

leader. He has an extensive mining background, working with miners,

Governments, and institutional investors across the world and

supporting them in making key strategic business, financing, and

policy decisions.

- On February 8,

2021, the Company appointed Andrew Cheatle, P.Geo., MBA, FGS, ARSM

as Chief Operating Officer of Tanzanian Gold Corporation. A

graduate of the Royal School of Mines, Imperial College, London,

his 30-plus-years international career has encompassed

operations/production, development, and exploration in both the

senior & junior mining sectors. His considerable operational

and project management experience includes senior positions with

the development of (at that time) Anglo American Corporation’s Moab

Khotsong Gold Mine, JCI’s South Deep Project and major expansions

of Placer Dome’s/Goldcorp’s Musselwhite Mine.

- On March 1,

2021, the Company appointed Michael P. Leonard, CPA, CA as Chief

Financial Officer. He was previously at Barrick Gold Corporation in

a series of progressively senior financial leadership positions and

brings a wealth of experience in investor relations and corporate

global finance. He will fill a vital role for the Company’s

strategy moving forward including use of state-of-the-art

technology and development and implementation of financial models,

financial controls and procedures for financial

management.

- On March 4,

2021, the Company, through Buckreef Gold, appointed Isaac Bisansaba

and Gaston Mujwahuzi as Co-Acting General Managers for Buckreef, on

an alternating basis. Mr. Bisansaba and Mr. Mujwahuzi are directly

responsible for monitoring and improving the mining and processing

operations at Buckreef Gold. Mr. Bisansaba has a BS.Geo, Masters in

Mining Engineering, Mineral Resources Evaluation, and twenty years

of experience in the gold mining industry. Mr. Mujwahuzi has a BS,

Mineral Processing Engineering, and over sixteen years of

experience in the gold mining industry. Collectively, their

experience encompasses all aspects of gold mining operations,

including managing mining, process plant and exploration

activities. Their prior experience includes roles with AngloGold

Ashanti, Barrick Gold, Teranga Gold, PanAust Limited and various

consulting firms. Together, they possess the knowledge and

experience Buckreef Gold requires going forward, as well as strong

team leadership capabilities for safe, smooth and ongoing

management of on-site operations.

- On March 17,

2021, the Company appointed Shubo Rakhit, CPA, CA to the Board of

Directors of Tanzanian Gold Corporation. His 30+ year career has

included positions at several large investment banks and advisory

firms including Canada’s major bank owned investment banks, Bank of

America Securities, KPMG Corporate Finance and Echelon Wealth

Partners where he most recently served as Managing Director, Head

of Mergers and Acquisitions. His career includes leading over

$80B of M&A transactions and over $100 billion of global

capital markets issuance including many complex strategic and

capital solutions. His background and experience will assist the

Company in broadening its access to capital markets at a time of

rapid growth for the organization.

- On April 27,

2021, TanGold announced that Mr. Sinclair turned 80 years old and

retired as Executive Chairman to continue service as Chairman of

the Board of Directors of the Company. TanGold has had the

privilege of being founded and directed since 2000 by the

leadership of the renowned James E. Sinclair. It is with profound

gratitude that the Company acknowledges his contribution to the

present success and long-term resilience of our enterprise.

- On June 1,

2021, the Company appointed Khalaf Rashid as Senior Vice President,

Tanzania and as Managing Director of the Company’s wholly owned

subsidiary in Tanzania, Tanzam2000. Mr. Rashid is a Tanzanian

citizen and resident and joins the TanGold Executive Team bringing

a wealth of experience and family history in Tanzanian business,

politics and Government that dates back to the formation of the

country. He is highly respected and recognized in the business

community having held senior executive positions in multiple

sectors including industrials, education and marketing

communications.

- The Company

changed its nominees to the Buckreef Gold Board of Directors to:

(i) Stephen Mullowney; (ii) Andrew Cheatle; (iii) Michael Leonard;

and (iv) Shubo Rakhit to better reflect the new management team and

vision for the Company. Stephen Mullowney was nominated Chairman of

Buckreef Gold.

Financing

- As at August

31, 2021, the Company had cash of $13.4 million and net working

capital of $8.0 million. After adjusting for $2.1 million in

derivative liabilities, working capital on an adjusted basis is

$10.1 million. This reflects a significant improvement in in

overall liquidity and financial flexibility compared to August 31,

2020.

- On February 11,

2021, the Company completed the sale of 32,923,078 common shares

together with warrants to purchase 16,461,539 common shares for

$21.4 million in the aggregate. The common shares and warrants were

issued at $0.65 for each common share and a one-half purchase

warrant with the right of each whole warrant to purchase one common

share at $0.80 for a period of five years from the issue date. The

Company also issued 1,152,307 broker warrants with the same

terms.On December 23, 2020, the Company completed the sale of

5,554,588 common shares together with warrants to purchase

2,777,268 common shares for $3.0 million in the aggregate. The

common shares and warrants were issued at $0.54 for each common

share and a one-half purchase warrant with the right of each whole

warrant to purchase one common share at $1.50 for a period of three

years from the issue date.

- During the year

ended August 31, 2021 $7.0 million of Tranche A Convertible

Debentures, representing the entire outstanding balance, were

converted and retired resulting in the issuance of 12,150,447

common shares of the Company.

ESG

- The Company is

committed to working to the highest ESG standards and has initiated

several programs, whilst developing a broader framework and

policies.

- Buckreef Gold’s

operations: (i) are connected to the Tanzanian national electricity

grid and utilizes grid power which is sourced from hydroelectric

facilities in Tanzania; (ii) recycles all water used in its

operations; (iii) do not discharge water from its operations; (iv)

workforce are 100% Tanzanian citizens; (v) development and building

activities are focused on maximizing local content; (vi) exhibit a

‘100 mile diet’ by procuring all food locally; and (vii) sulphide

development is expected to utilize dry stack tailings.

- The Company is

actively working with the Geita District Council and local Wards to

collaboratively identify key programs that focus on short to

long-term educational needs, which in turn aligned with the

Company’s local hiring practices, which includes STEM and gender

goals.

- The Company,

through Buckreef Gold, procured and donated 300 school desks to the

Kaseme Secondary School in Geita District. The desks were sourced

from local artisans.

- The Buckreef

Gold Mine site has a 100% Tanzanian workforce.

- The Company

supports local procurement in all activities by first sourcing

within the immediate wards, then out to district, region and

nation. Only those items or services not available within country

are purchased externally from Tanzania, first prioritizing East

Africa, Africa then globally.

Other

- A mine-based

assay / chemical laboratory has been installed at Buckreef Gold.

The laboratory has commenced test work and is in the process of

being fully commissioned.

- The

accommodations and camp facilities at Buckreef Gold have been

upgraded and renovated during fiscal 2021.

About Tanzanian Gold Corporation

TanGold along with its joint venture partner,

STAMICO, is building a significant gold project at Buckreef in

Tanzania that is based on an expanded Mineral Resource. Measured

Mineral Resource is 19.98MT at 1.99g/t gold containing 1,281,161

ounces of gold and Indicated Mineral Resource is 15.89MT at 1.48g/t

gold containing 755,119 ounces of gold for a combined tonnage of

35.88MT at 1.77g/t gold containing 2,036,280 ounces of gold. The

Buckreef Gold Project also contains an Inferred Mineral Resource of

17.8MT at 1.11g/t gold for contained gold of 635,540 ounces of

gold. The Company is actively investigating and assessing multiple

exploration targets on its property. Please refer to the Company’s

Updated Mineral Resources Estimate for Buckreef Gold Project, dated

May 15, 2020, for more information.

Tanzanian Gold Corporation is advancing on three

value-creation tracks:

- Strengthening its balance sheet by

expanding near-term production to 15,000 - 20,000 oz. of gold per

year from the expanded 1,000+ tpd plant.

- Advancing Sulphide Development that

is substantially larger than previously modelled and targeting

significant annual gold production.

- Continuing with a drilling program

to further test the potential of its property, exploration targets

and Mineral Resource base by: (i) infill drilling to upgrade

Mineral Resources currently in the Inferred category in Buckreef

Main; (ii) step-out drilling in the northeast extension of Buckreef

Main; (iii) infill drilling program of Buckreef West; (iv) develop

exploration program for the newly discovered Anfield Zone; (v)

upgrade historical resources at Bingwa and Tembo; (vi)

identification of new prospects at Buckreef Gold Project and in the

region.

For further information, please contact Michael Martin, Investor

Relations, m.martin@tangoldcorp.com, 860-248-0999, or visit the

Company website at www.tangoldcorp.com

Andrew M. Cheatle, P.Geo., the Company’s COO and

Director, is the Qualified Person as defined by the NI 43-101 who

has reviewed and assumes responsibility for the technical content

of this press release.

The Toronto Stock Exchange and NYSE American

have not reviewed and do not accept responsibility for the adequacy

or accuracy of this release.

Endnotes

1 The 360 tpd Plant estimates have not been

prepared in accordance with the results of the Company’s 2018

Prefeasibility Study, reflected in the Company’s May 15, 2020

Updated Mineral Resource Estimate. The 18-Month mining plan

estimates are based upon an internal mine model reviewed by SGSC

and cost inputs as validated by actual mining and processing costs

from the 120 tpd test plan over the 9 months ended May 31, 2021. No

assurance can be given that the 18-Month Estimate (Monthly Average)

will reflect actual results. See “Cautionary Note Regarding

Forward-Looking Statements”.

2 ‘Total Cash Cost’ includes mine site operating

costs such as mining, processing and local administrative costs,

royalties, production taxes, mine standby costs and current

inventory write downs, if any. Production costs are exclusive of

depreciation and depletion, reclamation, capital and exploration

costs. Total cash costs are net of by-product sales and are divided

by gold ounces sold to arrive at a per ounce figure. Total Cash

Costs is a non-IFRS financial performance measure often used in

conjunction with conventional IFRS measures to evaluate

performance. Total Cash Cost does not have a standardized meaning

under IFRS and therefore may not be comparable to similar measures

of performance disclosed by other issuers; it is intended to

provide additional information and should not be considered in

isolation or as a substitute for measures of performance prepared

in accordance with IFRS.

Forward-Looking Statements

This press release contains certain

forward-looking statements as defined in the applicable securities

laws. All statements, other than statements of historical facts,

are forward-looking statements. Forward-looking statements are

frequently, but not always, identified by words such as “expects”,

“anticipates”, “believes”, “hopes”, “intends”, “estimated”,

“potential”, “possible” and similar expressions, or statements that

events, conditions or results “will”, “may”, “could” or “should”

occur or be achieved. Forward-looking statements relate to future

events or future performance and reflect TanGold management’s

expectations or beliefs regarding future events and include, but

are not limited to, statements with respect to the estimation of

mineral reserves and resources, recoveries, subsequent project

testing, success, scope and viability of mining operations, the

timing and amount of estimated future production, and capital

expenditure. No assurance can be given that Tanzanian Gold will be

able to achieve the same level of gold recovery in the future as it

did at the test oxide test plant during the months of July and

August 2021.

Although TanGold believes the expectations

expressed in such forward-looking statements are based on

reasonable assumptions, such statements are not guarantees of

future performance. The actual achievements of TanGold or other

future events or conditions may differ materially from those

reflected in the forward-looking statements due to a variety of

risks, uncertainties and other factors. These risks,

uncertainties and factors include general business, legal,

economic, competitive, political, regulatory and social

uncertainties; actual results of exploration activities and

economic evaluations; fluctuations in currency exchange rates;

changes in costs; future prices of gold and other minerals; mining

method, production profile and mine plan; delays in exploration,

development and construction activities; changes in government

legislation and regulation; the ability to obtain financing on

acceptable terms and in a timely manner or at all; contests over

title to properties; employee relations and shortages of skilled

personnel and contractors; the speculative nature of, and the risks

involved in, the exploration, development and mining business.

These risks are set forth in reports that Tanzanian Gold files with

the SEC. You can review and obtain copies of these filings from the

SEC's website at http://www.sec.gov/edgar.shtml. In addition, this

press release refers to Measured, Indicated and Inferred Resources

at the Company’s Buckreef gold project. No assurance can be given

that the Buckreef gold project has the amount of the mineral

resources indicated or that such mineral resources may be

economically extracted.

The information contained in this press release

is as of the date of the press release and TanGold assumes not duty

to update such information.

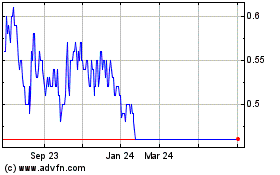

TRX Gold (TSX:TNX)

Historical Stock Chart

From Dec 2024 to Jan 2025

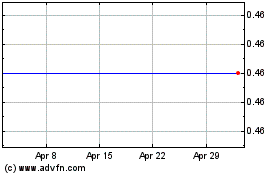

TRX Gold (TSX:TNX)

Historical Stock Chart

From Jan 2024 to Jan 2025