Tanzanian Gold Corporation (TSX:TNX) (NYSE American:TRX) (TanGold

or the Company) today announced results for the third quarter of

2021 (“Q3 2021”). Financial results for Q3 2021 will be available

on the Company’s website and will be filed on SEDAR and provided on

EDGAR on or before July 15, 2021. All figures are in Canadian

dollars unless otherwise expressed.

Highlights Overview

- Upgrade of 5 tph oxide test plant

to 15 tph oxide operation, which is anticipated to mitigate

negative cash flow on the 5 tph oxide test plant as well as

maintain continuity of workforce

- Cash flow generated will enable

reinvestment in the business and fund exploration, drilling and

capital expenditures at the Buckreef Gold level

- Discovery of Buckreef West and the

Anfield Zone further expands exploration potential

- Preliminary metallurgical report

sets the foundation for final feasibility study on the sulphide

project

- Additional Management changes at

TanGold and Buckreef Gold further reinvigorates operations

Stephen Mullowney, Chief Executive Officer of

TanGold stated: “The Company and Buckreef Gold have continued to

make significant progress this quarter. We developed and are

actively implementing a plan to mitigate the cash burn at the

Buckreef Gold operating level through an upgrade of the oxide test

plant circuit. This plan maintains the continuity of the core team

and ramps up mining activity in the short term. With the discovery

of Buckreef West and the Anfield Zone, and the continuing

exploration potential of the Buckreef Main Zone, we are developing

a robust exploration triangle. Finally, we were very pleased with

the excellent results from the preliminary metallurgical report,

providing what we believe is a solid foundation for the progression

of a final feasibility study on the sulphides.”

Accomplishments

and Highlights

Operations

- Buckreef Gold

reported zero lost time injuries, zero medical aid incidents and

had no COVID-19 related cases in Q3 2021. There were also no

reportable environmental or community related incidents in Q3

2021.

- The operation

of the 5 tonne per hour (“tph”) oxide test plant continued in the

third quarter, operating 7 days a week with two 12-hour shifts. The

testing period will conclude in the next couple of months and the

Company intends to upgrade the existing 5 tph oxide test plant to a

15 tph oxide operation, subject to various approvals (including

approval of an expanded tailings facility).

- The targeted

completion of the 15 tph oxide plant upgrade is expected in

September/October 2021 and is anticipated to mitigate the negative

cash flow on the 5 tph oxide test plant, while maintaining

continuity of the existing workforce. The cash flow generated from

the larger plant will enable reinvestment in the business and fund

exploration, drilling and capital expenditures at the Buckreef Gold

level.

- The 15 tph

oxide mine plan is based on the grade control and block model; the

mine plan has been reviewed by SGS Canada Inc. (“SGSC”). Based on

the mine plan and financial inputs from the 5 tph oxide test mining

operations, the Company anticipates the following operating

guidance for the 15 tph oxide mine operation over an 18-month

mining program:

|

Buckreef Gold Operating Guidance |

|

|

| |

|

|

| |

|

|

| 15 tph Oxide Plant |

Unit |

18-Month Estimate |

| |

|

(Monthly Average)1 |

| Gold Production |

oz |

750-800 |

| Cost of Sales |

US$/oz |

800-900 |

| Total Cash Costs2 |

US$/oz |

725-825 |

| Stripping Ratio (Waste:Ore) |

tonnes |

~3.5 |

| |

|

|

| Total Project Capital

Expenditures |

US$ (millions) |

1.3-1.6 |

- The

long-lead items for the 15 tph oxide operation, including the ball

mill, tailings facility liners and various plant upgrade components

have been ordered and are in transit. Earthworks for the 15 tph

oxide facility have also commenced.

- Buckreef Gold

will continue with plans to build a separate 40 tph oxide mine

operation while simultaneously operating the 15 tph oxide mine

operation. The Company is in the process of finalizing the 40 tph

oxide mine plan and financial models for this operation, and SGSC

is also reviewing this information. Buckreef Gold plans to operate

the 15 tph oxide plant for an initial 18 month period while

undergoing construction of the 40 tph oxide plant. The 40 tph and

15 tph oxide plants will be situated in different locations on the

Buckreef Special Mining License, and the Company in conjunction

with Buckreef Gold, will assess the possibility of an expanded 55

tph (40 tph + 15 tph) oxide mining operation over the medium to

long-term time horizon. The 40 tph oxide mining operation plans to

utilize dry stack tailings while the 15 tph oxide mining operations

will utilize wet tailings. The 40 tph oxide mine operations are

expected to be capable of producing 15,000 - 20,000 oz. of gold per

year based on the initial mine plan and grade profile.

- The request for

proposal process for the construction of the 40 tph oxide plant and

related infrastructure is complete. The Company has entered into a

letter of intent (“LOI”) with an Engineering, Procurement and

Construction (“EPC”) contractor and is in the process of finalizing

the agreements for the construction of this facility. The Company

has hired Ausenco Engineering Canada Inc. (“Ausenco”) as Management

Engineer to assist in management of the 40 tph oxide plant project.

More details will be released after this process is complete.

- Through its

testing program, Buckreef Gold has been able to substantiate the

grade control block model, confirm forecasted operating cost inputs

such as mining and processing costs for 15 tph and 40 tph oxide

mining operations, and develop a more comprehensive understanding

of oxide mill feed grind, processing of clays, retention times and

how to achieve higher recovery rates. More importantly, this

knowledge has been applied to the design of the 15 tph and 40 tph

oxide mine operations, substantially de-risking these

operations.

- In consultation

with SGSC Lakefield Inc. (“SGSL”) and Ausenco, Buckreef Gold has

continued to refine targeted recovery rates for the 15 tph and 40

tph oxide mining operations. The targeted recovery rates for these

operations are anticipated to be approximately 85%-90%. The final

phase of the 5 tph oxide test plant will focus on recovery rates

versus balancing output and recovery rates; this test phase has

already commenced with encouraging initial results (see Page 12 of

the Q3 Management’s Discussion and Analysis – 5 tph Oxide Test

Plant and Operations for more details). For the nine months ended

May 31, 2021, recovery rates at the 5 tph oxide test plant ranged

from 77% to 87%. In Q3 2021 the oxide test plant produced 446

ounces of pure gold and 1,440 ounces of pure gold on a year-to-date

basis.

1 The 15 tph Oxide Plant estimates have not been

prepared in accordance with the results of the Company’s 2018

Prefeasibility Study, reflected in the Company’s May 15, 2020

Updated Mineral Resource Estimate. The 18-Month mining plan

estimates are based upon an internal mine model reviewed by SGSC

and cost inputs as validated by actual mining and processing costs

from the 5 tph oxide test plan over the last 9 months. See ‘Forward

Looking Statements’ at the end of this Press Release.2 ‘Total Cash

Cost’ includes mine site operating costs such as mining, processing

and local administrative costs, royalties, production taxes, mine

standby costs and current inventory write downs, if any. Production

costs are exclusive of depreciation and depletion, reclamation,

capital and exploration costs. Total cash costs are net of

by-product sales and are divided by gold ounces sold to arrive at a

per ounce figure. Total Cash Costs is a non-IFRS financial

performance measure often used in conjunction with conventional

IFRS measures to evaluate performance. Total Cash Cost does not

have a standardized meaning under IFRS and therefore may not be

comparable to similar measures of performance disclosed by other

issuers; it is intended to provide additional information and

should not be considered in isolation or as a substitute for

measures of performance prepared in accordance with IFRS.

Feasibility Study and Exploration

-

Favourable Metallurgical Test Results: The Company

announced updated and highly favorable metallurgical test results

from the sulphide component of the Buckreef mineral resource. Three

diamond drill core samples were taken from the fresh rock

(‘sulphide’ mineral resource) of the Buckreef deposit for the

purposes of metallurgical test work. The study highlights include:

- The following intercepts and gold

recoveries have been confirmed in the report:

- MC01: 0.54 g/t Au over 78.88m –

94.1%

- MC02: 19.4 g/t Au over 27.99m –

95.4%

- MC03: 1.71 g/t Au over 52.53m –

85.3%

- A straightforward flowsheet

consisting of:

- Primary grinding to P80 = ~100-150

µm

- Rougher flotation

- Regrind of the rougher concentrate

to ~15-20 µm (P80)

- Cyanide leaching of the reground

flotation concentrate

- Cyanide leaching of the flotation

tailing

- No refractory association of gold

with arsenic sulphide was detected;

- The samples tested did not exhibit

any preg-robbing or other refractory characteristics;

- Clean tailings, high probability of

mine tailings not being acid generating, confirming the approach of

dry stack tailings going forward; and

- Further opportunities to improve

gold extraction from MC03 have been identified through diagnostic

leach testing.

-

Buckreef West Discovery: The Company announced the

discovery of Buckreef West, which lies in close proximity to the

Buckreef Main Zone, defining a near vertical shear zone, over a

strike length of 400 meters (“m”), with interpreted gold

mineralization shallowly plunging to the northeast. The mineralized

zone remains open to the south and at depth. Highlights include:

- Shallow depth: All reported

intercepts are at shallow depth on a well-defined structure which

is interpreted as a splay off the Buckreef Main Zone;

- Open at depth and along strike:

Over 400m of strike length has been drilled to date and the deposit

remains open at depth and along strike in both directions; and

- Select intercepts:

- Hole BWDD017 intersected

4.57m @ 6.4 g/t Au from 44.9m;

- Hole BWDD015, on the same line as

Hole BWDD017, had two intersections: 2.18m @ 1.24

g/t Au from 86.9m and (ii) 2.49m @1.3 g/t

Au from 105.1m;

- Hole BWDD012 intersected

5.57m @ 4.95 g/t Au from 98.4m and 4.0m @

2.19 g/t Au from 92.0m;

- Hole BWDD013, on the same line as

Hole BWDD012 intersected 1.5m @ 2.2 g/t Au from

59.5m;

- BWDD0018 intersected 7.0m @

2.03 g/t Au from 44.0m and 3.85m @ 2.86

g/t from 56.0m; and

- BWDD0031 intersected 2.5m @

7.29 g/t Au from 46.1m.

- Anfield

Zone Discovery: The Company announced that it has made a

new discovery of three closely spaced parallel, gold bearing

structures at Buckreef, collectively now known as the Anfield Zone.

Follow-up field work and diamond drilling is planned for 2021 and

2022. Highlights include:

- The new prospective gold

mineralized zones, totaling a combined 2.9 kilometer (km) strike

length were identified through geological (field) mapping, sampling

and examination of artisanal workings. Collectively, they have been

named the Anfield Zone;

- Grab samples of mineralized bed

(fresh) rock have been assayed, with highlights of:

- 37.52 g/t

- 28.55 g/t

- 14.42 g/t

- Located approximately 500m to the

east of the Buckreef Main Zone; and

- Aligns with and trends towards the

Eastern Porphyry Mineral Resource.

Management

- On March 1st,

2021, the Company appointed Michael P. Leonard, CPA, CA as Chief

Financial Officer. He was previously at Barrick Gold Corporation in

a series of progressively senior financial leadership positions and

brings a wealth of experience in investor relations and corporate

global finance. He will fill a vital role for the Company’s

strategy moving forward including use of state-of-the-art

technology and development and implementation of financial models,

financial controls and procedures for financial management.

- On March 4th,

2021, the Company, through Buckreef Gold, appointed Isaac Bisansaba

and Gaston Mujwahuzi as Co-Acting General Managers for Buckreef, on

an alternating basis. Mr. Bisansaba and Mr. Mujwahuzi are directly

responsible for monitoring and improving the mining and processing

operations at Buckreef Gold. Mr. Bisansaba has a BS.Geo, Masters in

Mining Engineering, Mineral Resources Evaluation, and twenty years

of experience in the gold mining industry. Mr. Mujwahuzi has a BS,

Mineral Processing Engineering, and over sixteen years of

experience in the gold mining industry. Collectively, their

experience encompasses all aspects of gold mining operations,

including managing mining, process plant and exploration

activities. Their prior experience includes roles with AngloGold

Ashanti, Barrick Gold, Teranga Gold, PanAust Limited and various

consulting firms. Together, they possess the knowledge and

experience Buckreef Gold requires going forward, as well as strong

team leadership capabilities for safe, smooth and ongoing

management of on-site operations.

- On March 17th,

2021, the Company appointed Shubo Rakhit, CPA, CA to the Board of

Directors of Tanzanian Gold Corporation. His 30+ year career has

included positions at several large investment banks and advisory

firms including Canada’s major bank owned investment banks, Bank of

America Securities, KPMG Corporate Finance and Echelon Wealth

Partners where he most recently served as Managing Director, Head

of Mergers and Acquisitions. His career includes leading over $80B

of M&A transactions and over $100 billion of global capital

markets issuance including many complex strategic and capital

solutions. His background and experience will assist the Company in

broadening its access to capital markets at a time of rapid growth

for the organization.

- On April 27,

2021, TanGold announced that Mr. Sinclair turned 80 years old and

retired as Executive Chairman to continue service as Chairman of

the Board of Directors of the Company. TanGold has had the

privilege of being founded and directed since 2000 by the

leadership of the renowned James E. Sinclair. It is with profound

gratitude that the Company acknowledges his contribution to the

present success and long-term resilience of our enterprise.

- On June 1st,

2021, the Company appointed Khalaf Rashid as Senior Vice President,

Tanzania and as Managing Director of the Company’s wholly owned

subsidiary in Tanzania, Tanzam2000. Mr. Rashid is a Tanzanian

citizen and resident and joins the TanGold Executive Team bringing

a wealth of experience and family history in Tanzanian business,

politics and Government that dates back to the formation of the

country. He is highly respected and recognized in the business

community having held senior executive positions in multiple

sectors including industrials, education and marketing

communications.

- The Company changed its nominees to

the Buckreef Gold board to: (i) Stephen Mullowney; (ii) Andrew

Cheatle; (iii) Michael Leonard; and (iv) Shubo Rakhit to better

reflect the new management team and vision for the Company. Stephen

Mullowney was nominated Chairman of Buckreef Gold.

Financing

- As at May 31,

2021, the Company had net working capital of $15.0 million,

including cash of $21.3 million. This reflects a significant

improvement in in overall liquidity and financial flexibility

compared to August 31, 2020 and is primarily due to the completion

of two capital raises in Q2 2021.

Other

- A mine-based

assay / chemical laboratory has arrived at site and is currently

being installed at Buckreef. The laboratory has commenced test work

and is in the process of being fully commissioned.

- The Company,

through Buckreef Gold procured and donated 300 school desks to the

Kaseme Secondary School in Geita District.

Outlook

- The Company

will conclude the test phase of the 5 tph oxide test plant in the

next couple months. Through its testing program, objectives related

to oxide mill feed grind, processing of clays, retention times and

how to achieve higher recovery rates have been achieved. Buckreef

Gold has also been able to substantiate the grade control block

model and confirm forecasted operating cost inputs such as mining

and processing costs for 15 tph and 40 tph oxide mining operations.

More importantly, this knowledge has been applied to the design of

the 15 tph and 40 tph oxide mine operations, substantially

de-risking these operations.

- The Company

intends to upgrade the existing 5 tph test plant to a 15 tph oxide

operation, subject to various approvals (including approval of an

expanded tailings facility). The long-lead items for the 15 tph

oxide operation including the ball mill, tailings facility liners

and various plant upgrade components have been ordered, and are in

transit. Earthworks for the 15 tph oxide facility have also

commenced. The targeted completion of the 15 tph oxide plant

upgrade is expected in September/October 2021 and is anticipated to

mitigate the negative cash flow on the 5 tph oxide test plant,

while maintaining continuity of the existing workforce. The cash

flow generated from the larger plant will enable reinvestment in

the business and fund exploration, drilling and capital

expenditures at the Buckreef Gold level. The capital cost for this

plant upgrade is expected to range between US$1.3-US$1.6 million,

of which approximately 1/3 has already been incurred.

- As mentioned

above, the tender process with prospective EPC contractors to

re-submit their bids for a 40 tph oxide material CIL process plant

was undertaken in Q3 2021. The Company completed an internal

assessment and adjudication of the bids in partnership with its JV

partner, STAMICO. Buckreef Gold has entered into a LOI with an EPC

contractor and expects to finalize the contract in Q4 2021. The

Company, through Buckreef Gold, will commence site preparation and

construction of the 40 tph oxide processing plant. The Company has

retained Ausenco to act as Management Engineer with regards to the

construction of the 40 tph oxide facility.

- As mentioned

above, TanGold through Buckreef Gold hired a surveying consultant

(Property Matrix Company Limited) to commence the land compensation

process required under Tanzanian mining law. The Land Compensation

Survey has been completed and the report submitted to Buckreef Gold

management. The Land Compensation process requires various

Government approvals and is anticipated to be finalized by fiscal

2021.

- The final

feasibility study for the ‘sulphide mine’ will continue; in Q4 2021

metallurgical testing will move to variability testing of the first

5-7 years of production, including tailing characteristics for dry

stack tailings. Site layout will be confirmed, and geotechnical and

groundwater work will commence on identified areas (i.e. plant,

tailings, waste rock storage facility). The Company is also

interviewing potential ‘Owner’s Engineer’ service providers to

assist with the management of the final feasibility study.

- Geological work

has commenced in evaluating the full extent of exploration

potential at the Buckreef Project. Analysis of Inferred Mineral

Resources, Exploration Targets, advanced exploration, and

grassroots exploration through to conceptual targets have been

evaluated. The Company will provide updates on its exploration

targets and strategy which will be finalized and provided in Q4

2021.

- The Company,

through Buckreef Gold, will commence drilling of exploration

targets and mineral resource upgrade drilling in fiscal 2021.

- The Company

will continue a review of its broader exploration portfolio and

strategy to meet core strategic objectives, including consideration

of new licenses and/or partnerships. The Buckreef Project licenses

cover highly prospective ground with many geochemical and soil

anomalies. The Company is located in highly favourable Archean

geological terrane in the prospective and producing Lake Victoria

Greenstone Belt, where numerous anomalous gold bearing shear zones

have been identified.

- Management has

undertaken a comprehensive review of the Company’s design and

procedures around financial reporting, internal controls and cash

management. As the Company transitions from an exploration and

evaluation stage organization, Management plans to

continuously upgrade the accounting systems, chart of accounts,

internal controls and financial policies and procedures in advance

of becoming a commercially producing organization with the 40 tph

oxide plant.

- As previously

disclosed, TanGold and STAMICO agreed in principle to amendments to

the Buckreef Joint Venture Agreement (the “JV Agreement”) to bring

the JV Agreement in line with recent changes in Tanzanian mining

laws and to modernize the working arrangement between the parties

(the original JV Agreement was entered into in 2011). The Company

anticipates finalizing the agreement by year-end fiscal 2021.

About Tanzanian Gold Corporation

Tanzanian Gold Corporation along with its joint

venture partner, STAMICO is building a significant gold project at

Buckreef in Tanzania that is based on an expanded Mineral Resource

base and the treatment of its mineable Mineral Reserves in two

standalone plants. Measured Mineral Resource now stands at 19.98MT

at 1.99g/t gold containing 1,281,161 ounces of gold and Indicated

Mineral Resource now stand at 15.89MT at 1.48g/t gold containing

755,119 ounces of gold for a combined tonnage of 35.88MT at 1.77g/t

gold containing 2,036,280 ounces of gold. The Buckreef Project also

contains an Inferred Mineral Resource of 17.8MT at 1.11g/t gold for

contained gold of 635,540 ounces of gold. The Company is actively

investigating and assessing multiple exploration targets on its

property. Please refer to the Company’s Updated Mineral Resources

Estimate for Buckreef Gold Project, dated May 15, 2020, for more

information.

Tanzanian Gold Corporation is advancing on three

value-creation tracks:

- Strengthening its balance sheet by

expanding near-term production to 15,000 - 20,000 oz. of gold per

year from the processing of oxide material from an expanded oxide

plant.

- Advancing the Final Feasibility

Study for a stand-alone sulphide treating plant that is

substantially larger than previously modelled and targeting

significant annual gold production.

- Continuing with a drilling program

to further test the potential of its property, Exploration Targets

and Mineral Resource base by: (i) identifying new prospects; (ii)

drilling new oxide/sulphide targets; (iii) infill drilling to

upgrade Mineral Resources currently in the Inferred category; and

(iv) a step-out drilling program in the Northeast Extension.

Andrew M. Cheatle, P.Geo. is the Company’s

Qualified Person as defined by the NI 43-101 who has verified the

data disclosed in this news release and has otherwise reviewed and

assumes responsibility for the technical content of this press

release.

The information contained herein summarizes details reported in

the interim financial statements of the Company for the period

ended May 31, 2021, and management’s discussion and analysis

thereof. Interested parties are encouraged to review those filings

in their entirety by visiting the Company’s profile at

www.sedar.com.

For further information, please contact Michael Martin, Investor

Relations, m.martin@tangoldcorp.com, 860-248-0999, or visit the

Company website at www.tangoldcorp.com

The Toronto Stock Exchange and NYSE American

have not reviewed and do not accept responsibility for the adequacy

or accuracy of this release.

U.S. Investors are urged to consider closely the

disclosure in our SEC filings. You can review and obtain copies of

these filings from the SEC's website at

http://www.sec.gov/edgar.shtml.

Forward-Looking Statements

This press release contains certain

forward-looking statements as defined in the applicable securities

laws. All statements, other than statements of historical facts,

are forward-looking statements. Forward-looking statements are

frequently, but not always, identified by words such as “expects”,

“anticipates”, “believes”, “hopes”, “intends”, “estimated”,

“potential”, “possible” and similar expressions, or statements that

events, conditions or results “will”, “may”, “could” or “should”

occur or be achieved. Forward-looking statements relate to future

events or future performance and reflect TanGold management’s

expectations or beliefs regarding future events and include, but

are not limited to, statements with respect to the estimation of

mineral reserves and resources, recoveries, subsequent project

testing, success and viability of mining operations, the timing and

amount of estimated future production, and capital expenditure.

Although TanGold believes the expectations

expressed in such forward-looking statements are based on

reasonable assumptions, such statements are not guarantees of

future performance. The actual achievements of TanGold or other

future events or conditions may differ materially from those

reflected in the forward-looking statements due to a variety of

risks, uncertainties and other factors. These risks, uncertainties

and factors include general business, legal, economic, competitive,

political, regulatory and social uncertainties; actual results of

exploration activities and economic evaluations; fluctuations in

currency exchange rates; changes in costs; future prices of gold

and other minerals; mining method, production profile and mine

plan; delays in exploration, development and construction

activities; changes in government legislation and regulation; the

ability to obtain financing on acceptable terms and in a timely

manner or at all; contests over title to properties; employee

relations and shortages of skilled personnel and contractors; the

speculative nature of, and the risks involved in, the exploration,

development and mining business. These risks are set forth under

Item 3.D in TanGold’s Form 20-F for the year ended August 31, 2020,

as amended, as filed with the SEC.

Without limiting the generality of the

foregoing, investors are specifically cautioned that information

contained herein relating to the costs of the proposed 15 tph oxide

test plant include information which constitutes ‘financial

outlook’. While management has carefully considered assumptions

related to the 15 tph plant, actual results may vary from the

projections contained herein for a variety of reasons, including

technical, political or environmental. The most significant

assumptions used in the preparation of the projected costs of the

15 tph plant related to the extrapolation of actual mining and

processing costs from the current 5 tph oxide test plan over the

past 9 months to estimate 15 tph costs.

The information contained in this press release

is as of the date of the press release and TanGold assumes not duty

to update such information.

Note to U.S. Investors

US investors are advised that the mineral

resource and mineral reserve estimated disclosed in this press

release have been calculated pursuant to Canadian standards which

use terminology consistent with the requirements CRIRSCO reporting

standards. For its fiscal year ending August 31, 2021, and

thereafter, the Company will follow new SEC regulations which uses

a CRIRSCO based template for mineral resources and mineral

reserves, that includes definitions for inferred, indicated, and

measured mineral resources.

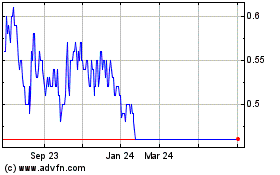

TRX Gold (TSX:TNX)

Historical Stock Chart

From Nov 2024 to Dec 2024

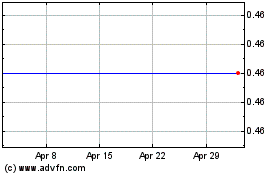

TRX Gold (TSX:TNX)

Historical Stock Chart

From Dec 2023 to Dec 2024