TeraGo Posts Continued Revenue, EBITDA Increases in 2013

Data centre operations contributing to revenue growth, Vancouver

facility acquired

TORONTO, ONTARIO--(Marketwired - Feb 26, 2014) - TeraGo Inc.

(TSX:TGO) (www.terago.ca) today announced financial and operating

results for the year ended December 31, 2013.

Stewart Lyons,

President and CEO, TeraGo Inc., commented, "TeraGo has completed a

year of continued progress and growth, and our forward strategy is

aligned with the needs of the small and medium business customer.

We envision 2014 as a year of transition and transformation into an

IT services company, leveraging our leading position in broadband

access services with the continued growth of a complementary data

centre services capability. Key steps in this transformation

include rounding out our operational and business development team,

evolving our go to market strategy, and expanding our data centre

footprint and services suites to win a greater share of both

existing and new customers' needs. Our aim is to drive improved

returns on assets for our shareholders through accelerating growth

over time."

2013 Financial and

Operational Highlights

- Continued increase in annual revenue of $51.4 million in 2013,

up 5% over 2012;

- Q4 2013 revenue of $12.9 million increased 3% over Q4

2012;

- EBITDA was $16.5 million for the full year 2013, compared to

$15.3 million in 2012, an increase of 8%.

- Q4 2013 EBITDA of $3.0 million declined 23% from the same

period in 2012, principally due to $1.3 million related to a costs

incurred for a departing executive and related recruiting expenses

for a replacement, cost of services and costs related to the

Vancouver data centre purchase;

- Gross profit margin for the full year and Q4 2013 were 78.0%

and 77.0% respectively, compared to 77.6% and 77.9% for the same

periods in 2012;

- Net earnings for 2013 decreased 11% to $4.3 million compared to

$4.9 million in 2012; Net loss for Q4 2013 was $0.7 million

compared to net earnings of $3.2 million for the same period in

2012. This was principally due to $1.3 million related to costs

incurred for a departing executive and related recruiting expenses

for a replacement, cost of services and costs related to the

Vancouver data centre purchase in the Q4 2013, combined with an

income tax recovery of $2.5 million recorded in Q4 2012;

- Basic and diluted earnings per share of $0.38 and $0.36,

respectively, for the full year compared to $0.43 and $0.41,

respectively, in 2012; Q4 2013 basic and diluted loss per share

were $0.06 and $0.06 respectively, compared to $0.29 and $0.27,

respectively, for the same period in 2012;

- Ended the year with 6,453 net access customer locations in

service compared to 6,575 at the end of 2012;

- Net access customer locations decreased by 80 in Q4 2013,

compared to an increase of 73 of the same period in 2012, primarily

due to increased competition in higher capacity services;

- Average revenue per access customer location ("ARPU") for the

full year and Q4 2013 was $625 and $621, respectively, compared to

$622 and $625, respectively, in 2012;

- Average monthly unit churn rate for 2013 and Q4 2013 increased

to 1.28% and 1.50% respectively, compared to 1.05% and 0.86% for

the same periods in 2012. This was primarily due to increased

competition in higher capacity services and a large low ARPU

multisite (41 sites) customer cancellation that occurred in Q4

2013. Excluding this cancellation, the churn rates for 2013 and Q4

2013 would have been approximately 1.23% and 1.28%

respectively;

- Ended 2013 with $2.6 million of cash, cash equivalents and

short-term investments and access to the $19.6 million undrawn

portion of the Company's $41.8 million credit facilities;

- Data centre services generated $1.6 million in revenue in 2013.

The integration of Data Centers Canada ("DCC") with the company's

core business is progressing as planned and data centre services

will continue to contribute to the Company's growth.

2013 Key

Developments

- In April 2013, TeraGo secured additional credit facilities with

RBC of $27.0 million on terms substantially consistent with the

existing term debt. The total debt facility stands at $41.8

million, of which $19.6 million remains undrawn.

- On May 31, 2013, the Company completed its share purchase

transaction to acquire DCC which supports the strategy to offer

complementary services. Purchase price adjustments resulted in

final consideration paid of $9.1 million, net of cash

acquired.

- As part of its strategy to expand its data centre services to

major Canadian urban centres, on December 23, 2013, TeraGo acquired

all the assets and assumed the lease of a 5,058 square feet data

centre facility, with options to expand, in Vancouver, British

Columbia that will serve the greater Vancouver area. The facility,

which provides data centre solutions, including colocation and

disaster recovery to businesses, enterprises, public sector and

technology service providers.

- Michael Martin, Richard Brekka, Jim Sanger, Nicole German and

Jim Nikopoulos were appointed to the Company's Board of

Directors.

- TeraGo's ranking on the Branham Top 250 Canadian Technology

Companies improved for the sixth consecutive year to 84th; it was

ranked as one of the top 10 Canadian Wireless Solutions Companies

for 2013; and was selected as one of Canada's top employers for

young people for 2013 by Mediacorp Canada Inc. for the second

consecutive year.

Events subsequent to

December 31, 2013

- TeraGo's Board of Directors appointed Stewart Lyons, President

and CEO and a member of the Board of Directors effective January

16, 2014. Mr. Lyons replaces Charles Allen, who has served as

Interim President and CEO since the November 2013 departure of

Bryan Boyd.

- Joe Prodan was appointed Chief Financial Officer effective

February 4, 2014. Bosco Chan, who served as Interim CFO since the

May 2013 departure of Scott Browne, will continue as Vice

President, Finance.

- Ian Thorburn was appointed Vice President, Legal effective

January 13, 2014. The position has been vacant since Jim Nikopoulos

left the company in September 2013.

- In February 2014, the Company received notice that a new

wireless entrant customer may be disconnecting their services

during 2014.

- The Company announced that it has established a fibre-optic

core in Western Canada through the acquisition of fibre facilities

in downtown Vancouver, British Columbia. This fibre connects the

Company's Vancouver data centre facility with several buildings,

ensuring secure broadband connectivity between customer locations

and the data centre.

|

| Key Financial & Operational Highlights |

| (All financial results are in thousands, except gross

profit margin, earnings per share and operating metrics) |

|

|

|

|

Three months ended December 31 |

|

|

Year ended December 31 |

|

|

|

|

2013 |

|

|

2012 |

|

|

2013 |

|

|

2012 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

|

$ |

12,909 |

|

|

$ |

12,567 |

|

|

$ |

51,426 |

|

|

$ |

49,168 |

|

| Gross

profit margin |

|

|

77.0 |

% |

|

|

77.9 |

% |

|

|

78.0 |

% |

|

|

77.6 |

% |

|

EBITDA* |

|

$ |

3,043 |

|

|

$ |

3,967 |

|

|

$ |

16,506 |

|

|

$ |

15,272 |

|

|

Earnings (loss) from operations |

|

$ |

(327 |

) |

|

$ |

924 |

|

|

$ |

4,174 |

|

|

$ |

3,120 |

|

| Net

earnings (loss) |

|

$ |

(734 |

) |

|

$ |

3,245 |

|

|

$ |

4,309 |

|

|

$ |

4,857 |

|

| Basic

earnings (loss) per share |

|

$ |

(0.06 |

) |

|

$ |

0.29 |

|

|

$ |

0.38 |

|

|

$ |

0.43 |

|

|

Diluted earnings (loss) per share |

|

$ |

(0.06 |

) |

|

$ |

0.27 |

|

|

$ |

0.36 |

|

|

$ |

0.41 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Churn

rate* |

|

|

1.50 |

% |

|

|

0.86 |

% |

|

|

1.28 |

% |

|

|

1.05 |

% |

|

Customer locations in service |

|

|

6,453 |

|

|

|

6,575 |

|

|

|

6,453 |

|

|

|

6,575 |

|

|

ARPU* |

|

$ |

621 |

|

|

$ |

625 |

|

|

$ |

625 |

|

|

$ |

622 |

|

|

Number of employees |

|

|

191 |

|

|

|

189 |

|

|

|

191 |

|

|

|

189 |

|

* See Key

Performance Indicators, Additional GAAP and Non-GAAP Measures

below

Financial results

for DCC are included from the date of acquisition, May 31, 2013.

Operating results related to churn rate, customer locations in

service and ARPU exclude results for DCC.

The table below

reconciles net earnings to EBITDA for the three months and year

ended December 31, 2013 and 2012.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (in thousands of dollars) |

|

|

Three months |

|

|

|

Year ended |

|

|

|

|

ended Dec 31 |

|

|

|

December 31 |

|

|

|

|

2013 |

|

|

|

2012 |

|

|

|

2013 |

|

|

|

2012 |

|

| Net earnings (loss) for the period |

|

$ |

(734 |

) |

|

$ |

3,245 |

|

|

$ |

4,309 |

|

|

$ |

4,857 |

|

| Foreign exchange loss (gain) |

|

|

34 |

|

|

|

11 |

|

|

|

63 |

|

|

|

(14 |

) |

| Finance costs |

|

|

352 |

|

|

|

197 |

|

|

|

1,126 |

|

|

|

828 |

|

| Finance income |

|

|

(5 |

) |

|

|

(9 |

) |

|

|

(36 |

) |

|

|

(31 |

) |

| Income tax( recovery) expense |

|

|

26 |

|

|

|

(2,520 |

) |

|

|

(1,288 |

) |

|

|

(2,520 |

) |

| Earnings (loss) from operations |

|

|

(327 |

) |

|

|

924 |

|

|

|

4,174 |

|

|

|

3,120 |

|

| Add: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation of network assets, property and equipment and

amortization of intangible assets |

|

|

3,240 |

|

|

|

2,821 |

|

|

|

12,279 |

|

|

|

10,674 |

|

|

Loss

on disposal of network assets |

|

|

121 |

|

|

|

106 |

|

|

|

202 |

|

|

|

276 |

|

|

Stock-based compensation expense (recovery) |

|

|

9 |

|

|

|

116 |

|

|

|

(149 |

) |

|

|

1,202 |

|

| EBITDA |

|

|

3,043 |

|

|

|

3,967 |

|

|

|

16,506 |

|

|

|

15,272 |

|

|

Special Charges |

|

|

- |

|

|

|

438 |

|

|

|

- |

|

|

|

699 |

|

| EBITDA excluding special charges |

|

$ |

3,043 |

|

|

$ |

4,405 |

|

|

$ |

16,506 |

|

|

$ |

15,971 |

|

2013 Results of

Operations

Revenue

Total revenue for

the year ended December 31, 2013 increased 5% to $51.4 million

compared to $49.2 million for 2012. Fourth quarter 2013 revenue of

$12.9 million was up 3% from $12.6 million for the same period in

2012. The increase largely resulted from data centre revenue of

$1.6 million and $0.7 million for the full year and Q4 2013,

respectively, as well as existing customers upgrading their

Internet and data connections. Approximately 98% of total 2013

revenue was recurring service revenue.

Customer

locations

713 new access

customer additions in 2013 (1,118 in 2012) resulted in a decrease

of 122 net access customer locations as compared to 2012. Net

access customer locations decreased by 80 in Q4 2013, compared to

an increase of 73 of the same period in 2012. Both the annual and

quarterly declines were primarily due to increased competition in

higher capacity services. The year ended with 6,453 customer

locations in service compared to 6,575 at the end of 2012.

Churn

rate

The average monthly

churn rate in 2013 was 1.28% compared to 1.05% in 2012. The fourth

quarter 2013 average monthly churn rate was 1.50%, compared to

0.86% for the same period in 2012. The average monthly churn rates

for both the year and fourth quarter increased primarily due to

increased competition in higher capacity services and a large low

multisite (41 sites) customer with low ARPU ($162) cancellation

during Q4 2013. Excluding this cancellation, the churn rates for

2013 and for Q4 2013 would have been approximately 1.23% and 1.28%

respectively. Management continues to strive for lower churn rates

by focusing on network quality, customer service, and customer

creditworthiness.

ARPU

Average monthly

revenue per access customer location, or ARPU, increased to $625 in

2013, compared with $622 in 2012. The increase was primarily a

result of service capacity upgrades by existing customers, a higher

proportion of new customers choosing higher capacity services or

voice services, early termination fees, and lower credits partially

offset by lower usage revenue. Fourth quarter 2013 ARPU decreased

to $621 compared to $625 for the same period in 2012, driven

primarily by lower usage revenue in the quarter.

Gross

margin

The gross profit

margin for 2013 remained strong at 78.0% compared to 77.6% for

2012. The increase is primarily due to savings recognized from

telecommunication and maintenance costs partially offset by annual

increases in property access costs and spectrum costs. Fourth

quarter gross profit margin was 77.0% compared to 77.9% for the

same period in 2012. The decrease is primarily due to an increase

in property access costs and spectrum costs.

SG&A

SG&A (Salaries

and related costs - Other, and Other operating items) expenses

remained consistent, totalling $23.7 million for both 2013 and

2012. Lower stock-based compensation and lower salaries and bonus

were offset by higher utility and facilities expenses from the

operations of the data centre, costs incurred for a departing

senior executive and related recruiting expenses for replacement

and a charge of $681 thousand related to due diligence and other

acquisition costs for the acquisition of DCC and the Vancouver data

centre. SG&A expenses increased to $7.0 million in Q4 2013 from

$5.6 million in Q4 2012, primarily due to higher utility and

facilities expenses from the operations of the data centre, and

approximately $1.3 million related to costs incurred for a

departing senior executive and related recruiting expenses for

replacement, and cost of services and costs related to the

Vancouver data centre purchase. TeraGo had 31 direct sales

personnel at year end, the same as a year earlier.

EBITDA

2013 EBITDA

increased to $16.5 million compared to $15.3 million in 2012, an

improvement of 8.0%. Fourth quarter EBITDA decreased to $3.0

million from $4.0 million for the same period in 2012. Excluding

the due diligence and other acquisition costs associated with DCC

and the costs related to a departing senior executive, EBITDA for

2013 and for Q4 2013 was $18.4 million and $4.3 million,

respectively. The increase in EBITDA is in line with management's

expectation as the Company continues to increase revenue while

focusing on cost management. For the full year and fourth quarter

of 2012, EBITDA includes special charges of $0.7 million and $0.4

million, respectively, relating to the Company's strategic

review.

Income tax

recovery

In the second

quarter of 2013, management reviewed the tax implications as a

result of the acquisition and subsequent amalgamation of DCC. A tax

benefit of $1.3 million associated with previously unrecognized tax

losses was recognized in the second quarter as management

considered it probable that future taxable profits would be

available against which they can be utilized. The deferred tax

asset was determined based on existing laws, estimates of future

probability based on financial forecasts, and tax planning

strategies. Management performed the deferred tax assets review on

a consistent basis and concluded no further change is needed for

the three months ended December 31, 2013.

Net earnings

(loss)

TeraGo achieved net

earnings for 2013 of $4.3 million compared to $4.9 million in 2012.

For the fourth quarter of 2013, net loss was $0.7 million compared

to net earnings of $3.2 million for the same period in 2012. Basic

and diluted earnings per share of, respectively, $0.38 and $0.36

for the full year compared to $0.43 and $0.41 in 2012. Q4 2013

basic and diluted loss per share were $0.06 and $0.06 respectively,

compared to EPS of $0.29 and $0.27 for the same period in 2012;

Capital

resources

At year end 2013,

the Company had cash, cash equivalents and short-term investments

of $2.6 million and access to the $19.6 million undrawn portion of

its $41.8 million credit facilities. Management believes the

Company's current cash, short-term investments, anticipated cash

from operations, access to the undrawn portion of debt facilities

and its access to additional financing in the form of debt or

equity will be sufficient to meet its working capital and capital

expenditure requirements for the foreseeable future.

Share

Capital

As of December 31,

2013, TeraGo had 11,458,611 Common Shares and two Class B Shares

outstanding.

TeraGo's

spectrum portfolio

TeraGo owns 76

spectrum licences in the 24 GHz and 38 GHz bands, covering Canadian

markets with a population base of more than 24.5 million and plans

to use this spectrum to provide Ethernet-based broadband links for

businesses, government and cellular backhaul, as part of the

Company's growth strategy.

Conference Call

and Webcast

Management will host

a conference call on Wednesday, February 26, 2014, at 9:00 am EST

to discuss these results. To access the conference call, please

dial 416-340-9534 or 1-877-440-9795. The call will also be

available via webcast at at www.terago.ca or

http://www.investorcalendar.com/IC/CEPage.asp?ID=172221. An

archived recording of the conference call will be available until

February 26, 2015 at midnight EST. To listen to this recording,

call 905-694-9451 or 1-800-408-3053 and enter passcode 7576825.

TeraGo's audited

financial statements for the three months and year ended December

31, 2013, and the notes thereto, and its Management Discussion and

Analysis for the same period, have been filed on SEDAR at

www.sedar.com.

Key Performance

Indicators, Additional GAAP and Non-GAAP Measures

Non-GAAP Measures

EBITDA

The term "EBITDA"

refers to earnings before deducting interest, taxes, depreciation

and amortization. EBITDA is a term commonly used to evaluate

operating results. We believe that EBITDA is useful additional

information to management, the Board and Investors as it provides

an indication of the operational results generated by our business

activities prior to taking into consideration how those activities

are financed and taxed and also prior to taking into consideration

asset depreciation and amortization. We also exclude foreign

exchange gain or loss, finance costs, finance income, gain or loss

on disposal of network assets, property and equipment and

stock-based compensation from our calculation of EBITDA. Investors

are cautioned that EBITDA should not be construed as an alternative

to operating earnings or net earnings determined in accordance with

IFRS as an indicator of our financial performance or as a measure

of our liquidity and cash flows. EBITDA does not take into account

the impact of working capital changes, capital expenditures, debt

principal reductions and other sources and uses of cash, which are

disclosed in the consolidated statements of cash flows. Our method

of calculating EBITDA may differ from other issuers and,

accordingly, EBITDA may not be comparable to similar measures

presented by other issuers.

Key Performance

Indicators

ARPU

The term "ARPU"

refers to our average revenue per access customer location. We

believe that ARPU is useful supplemental information as it provides

an indication of our revenue from an individual customer location

on a per month basis. ARPU is not a recognized measure under IFRS

and, accordingly, investors are cautioned that ARPU should not be

construed as an alternative to revenue determined in accordance

with IFRS as an indicator of our financial performance. We

calculate ARPU by dividing our service revenue by the average

number of customer locations in service during the period and we

express ARPU as a rate per month. Our method of calculating ARPU

may differ from other issuers and, accordingly, ARPU may not be

comparable to similar measures presented by other issuers.

Churn

The term "churn" or

"churn rate" is a measure, expressed as a percentage, of customer

locations terminated in a particular month. Churn represents the

number of customer locations disconnected per month as a percentage

of total number of customer locations in service during the month.

The Company calculates churn by dividing the number of customer

locations disconnected during a period by the total number of

customer locations in service during the period. Churn and churn

rate are not recognized measures under IFRS and, accordingly,

investors are cautioned in using it. TeraGo's method of calculating

churn and churn rate may differ from other issuers and,

accordingly, churn may not be comparable to similar measures

presented by other issuers.

Additional GAAP

Measures

Earnings (loss)

from operations

Earnings (loss) from

operations exclude foreign exchange gain (loss), income taxes,

finance costs and finance income. We include earnings (loss) from

operations as an additional GAAP measure in our consolidated

statement of earnings. We consider earnings (loss) from operations

to be representative of the activities that would normally be

regarded as operating for the Company. We believe this measure

provides relevant information that can be used to assess the

consolidated performance of the Company and therefore, provides

meaningful information to investors.

Forward-Looking

Statements

This news release

includes certain forward-looking statements that are made as of the

date hereof and that are based upon current expectations, which

involve risks and uncertainties associated with our business and

the economic environment in which the business operates. All such

statements are made pursuant to the 'safe harbour' provisions of,

and are intended to be forward-looking statements under, applicable

Canadian securities laws. Any statements contained herein that are

not statements of historical facts may be deemed to be

forward-looking statements. For example, the words anticipate,

believe, plan, estimate, expect, intend, should, may, could,

objective and similar expressions are intended to identify

forward-looking statements. By their nature, forward-looking

statements require us to make assumptions and are subject to

inherent risks and uncertainties. We caution readers of this news

release not to place undue reliance on our forward-looking

statements as a number of factors could cause actual results,

conditions, actions or events to differ materially from the

targets, expectations, estimates or intentions expressed with the

forward-looking statements. When relying on forward-looking

statements to make decisions with respect to the Company, investors

and others should carefully consider the risks set forth in the

2013 MD&A and 2013 Annual Information Form that can be found on

SEDAR at www.sedar.com and other uncertainties and potential

events. Except as may be required by applicable Canadian securities

laws, we do not intend, and disclaim any obligation to update or

revise any forward-looking statements whether in words, oral or

written as a result of new information, future events or

otherwise.

About TeraGo

Networks

TeraGo Networks Inc.

provides businesses across Canada with carrier-grade broadband,

data and voice communications services. Colocation and disaster

recovery solutions are also provided by Data Centers Canada, a

division of TeraGo Networks. The national service provider owns and

manages its IP network servicing over 6,400 customer locations in

46 major markets across Canada including Toronto, Montreal,

Calgary, Edmonton, Vancouver and Winnipeg. TeraGo Networks is a

Competitive Local Exchange Carrier (CLEC) and is a wholly owned

subsidiary of TeraGo Inc. (TSX:TGO). More information about TeraGo

is available at www.terago.ca.

TeraGo Inc.Stewart LyonsPresident and

CEO1-877-982-3688IR@terago.caTeraGo Inc.Joe ProdanChief Financial

Officer1-877-982-3688IR@terago.cawww.terago.caLHAJody

Burfening212-838-3777LHACarolyn

Capaccio212-838-3777ccapaccio@lhai.com

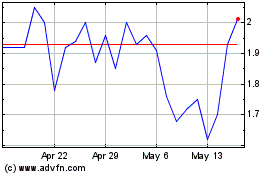

TeraGo (TSX:TGO)

Historical Stock Chart

From Jun 2024 to Jul 2024

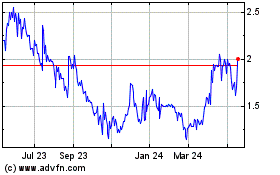

TeraGo (TSX:TGO)

Historical Stock Chart

From Jul 2023 to Jul 2024