Trican Well Service Ltd. Q1 2014 Update and Outlook

CALGARY, ALBERTA--(Marketwired - Mar 31, 2014) - Trican Well

Service Ltd. ("Trican", the "Company", "we" or "our") (TSX:TCW)

anticipates that consolidated financial results for the first

quarter of 2014 will be negatively impacted by pricing pressure and

cost inflation in Canada and unfavorable weather conditions in the

United States.

We estimate consolidated operating income* for the first quarter

of 2014 to be between $30 million and $40 million. This estimate is

subject to completion of our first quarter interim financial

report, which we expect to release on May 7, 2014. Our Audit

Committee has reviewed the financial outlook and information

provided in this document.

Canadian Operations

We expect first quarter 2014 Canadian operating income to be up

slightly compared to the fourth quarter of 2013 on higher revenue

and activity levels, offset partially by lower operating margins.

Canadian financial results for the first quarter of 2014 are

expected to be negatively impacted by continued pricing pressure in

the region. Equipment utilization has been very strong throughout

the first quarter; however, lower pricing experienced at the end of

the fourth quarter in 2013 has been carried throughout all of the

first quarter of 2014. As a result, first quarter Canadian pricing

is expected to be down slightly on a sequential basis.

Additionally, cost increases for fuel and third party hauling

are expected to have a negative impact on first quarter Canadian

operating margins. As a percentage of revenue, fuel and third party

hauling expenses are consistent with the fourth quarter of 2013,

but are up substantially compared to the first quarter of 2013. A

weaker Canadian dollar, both sequentially and year-over-year, is

also expected to have a negative impact on operating margins as a

portion of our Canadian materials and operating costs are incurred

in U.S. dollars.

Despite the disappointing first quarter results in Canada, our

outlook for this region remains positive. Cash flows for our

customers are expected to increase due to higher commodity prices

combined with a strengthening U.S. dollar, which we expect will

lead to higher year-over-year activity in the second half of 2014.

With strong Canadian activity levels anticipated for the second

half of 2014, we expect to implement a pricing increase in the

second quarter that will be phased in for third quarter work

programs. Rising costs combined with lower pricing have led to

Canadian financial results that are below our return on capital

targets and we believe that a price increase is needed and

justified given the current operating environment in Canada.

US Operations

Weather related operational delays for our U.S. fracturing crews

in the Marcellus, Oklahoma and Permian regions negatively impacted

equipment utilization and financial results for January and

February. Despite these delays, first quarter U.S. financial

results are expected to increase sequentially due to utilization

improvements across several of our U.S. regions; however, operating

income, while improved relative to the fourth quarter of 2013, is

still expected to be slightly negative. Activity and utilization

for March has been strong for our U.S. operations and we believe

this indicates improving fundamentals for this region. We have also

seen operational improvements for our U.S. business during the

first quarter that are positively impacting our U.S. equipment

utilization. As a result, we expect to see sequential improvements

in U.S. operating margins throughout 2014.

International Operations

Russia and Kazakhstan comprise the majority of our international

results, and financial results for the first quarter of 2014 are

projected to meet expectations. As expected, activity in Russia has

been negatively impacted by cold weather throughout most of January

and February; however, first quarter Russian financial results are

expected to be consistent with the first quarter of 2013. In

addition, first quarter international results are expected to be

negatively impacted by start-up costs in Saudi Arabia and Colombia

as we will not be completing our first jobs in these regions until

early in the second quarter. We have been awarded contracts in

these regions and will be looking to add additional contracts as

the year progresses.

* Operating income is a measure that is not recognized under

International Financial Reporting Standards (IFRS). Management of

Trican believes that operating income is a useful supplemental

measure. Operating income provides investors with an indication of

earnings before depreciation, foreign exchange, other income

(loss), taxes and interest. Investors should be cautioned that

operating income should not be construed as an alternative to net

income (loss) and cash flow from operations determined in

accordance with IFRS as an indicator of Trican's performance.

Trican's method of calculating operating income may differ from

that of other companies and accordingly may not be comparable to

measures used by other companies.

FORWARD-LOOKING INFORMATION

This document contains certain forward-looking information and

financial outlook or future orientated financial information based

on Trican's current expectations, estimates, projections and

assumptions that were made by the Company in light of information

available at the time the statement was made. Forward-looking

information and financial outlook or future orientated financial

information that address expectations or projections about the

future, and other statements and information about the Company's

strategy for growth, expected and future expenditures, costs,

operating and financial results, future financing and capital

activities are forward-looking statements. Some forward-looking

information and financial outlook or future orientated financial

information are identified by the use of terms and phrases such as

"anticipate," "achieve", "achievable," "believe," "estimate,"

"expect," "intention", "plan", "planned", and other similar terms

and phrases. This forward-looking information and financial outlook

or future orientated financial information speak only as of the

date of this document, other than the update in respect of our

first quarter earnings per share and operating income that will be

provided upon the release of our complete financial results for the

first quarter of 2014, and we do not undertake to publicly update

this forward-looking information and financial outlook or future

orientated financial information except in accordance with

applicable securities laws. This forward-looking information and

financial outlook or future orientated financial information

includes, among others:

- The expectation that consolidated financial results for the

first quarter of 2014 will be negatively impacted by pricing

pressure and cost inflation in Canada and unfavorable weather

conditions in the United States;

- The expectation that consolidated operating income for the

first quarter of 2014 will be between $30 million and $40

million;

- The expectation that our first quarter interim financial report

will be released on May 7, 2014;

- The expectation that first quarter 2014 Canadian operating

income will be up slightly compared to the fourth quarter of 2013

on higher revenue and activity levels, offset partially by lower

operating margins;

- The expectation that Canadian financial results for the first

quarter of 2014 will be negatively impacted by continued pricing

pressure in the region;

- The expectation that first quarter Canadian pricing will be

down slightly on a sequential basis;

- The expectation that cost increases for fuel and third party

hauling will have a negative impact on first quarter Canadian

operating margins;

- The expectation that a weaker Canadian dollar, both

sequentially and year-over-year, will have a negative impact on

Canadian operating margins;

- The expectation that cash flows for our customers will increase

due to higher commodity prices combined with a strengthening U.S.

dollar;

- The expectation that higher cash flows for our Canadian

customers will lead to higher year-over-year Canadian activity in

the second half of 2014;

- The expectation that we will implement a pricing increase in

the second quarter that will be phased in for third quarter work

programs;

- The belief that a price increase is needed and justified given

the current operating environment in Canada;

- The expectation that, despite weather-related delays, first

quarter U.S. financial results will increase sequentially due to

utilization improvements across several of our U.S. regions;

- The expectation that U.S. operating income, while improved

relative to the fourth quarter of 2013, will be slightly

negative;

- The belief that strong activity and utilization for our U.S.

operations in March indicates improving fundamentals for this

region;

- The expectations that in U.S. operating margins will improve

sequentially throughout 2014;

- The expectation that financial results for our Russian and

Kazakhstan regions will meet expectations;

- The expectation that Russian financial results will be

consistent with the first quarter of 2013;

- The expectation that first quarter international results will

be negatively impacted by start-up costs in Saudi Arabia and

Colombia as we will not be completing our first jobs in these

regions until early in the second quarter;

- The intention to add contracts in Saudi Arabia and Colombia as

the year progresses.

Forward-looking information and financial outlook or future

orientated financial information is based on current expectations,

estimates, projections and assumptions, which we believe are

reasonable but which may prove to be incorrect. Trican's actual

results may differ materially from those expressed or implied and

therefore such forward-looking information and financial outlook or

future orientated financial information should not be unduly relied

upon. In addition to other factors and assumptions which may be

identified in this document, assumptions have been made regarding,

among other things: industry activity; the general stability of the

economic and political environment; effect of market conditions on

demand for the Company's products and services; the ability to

obtain qualified staff, equipment and services in a timely and cost

efficient manner; the ability to operate its business in a safe,

efficient and effective manner; the performance and characteristics

of various business segments; the effect of current plans; the

timing and costs of capital expenditures; future oil and natural

gas prices; currency, exchange and interest rates; the regulatory

framework regarding royalties, taxes and environmental matters in

the jurisdictions in which the Company operates; and the ability of

the Company to successfully market its products and services.

Forward-looking information and financial outlook or future

orientated financial information is subject to a number of risks

and uncertainties, which could cause actual results to differ

materially from those anticipated. These risks and uncertainties

include: fluctuating prices for crude oil and natural gas; changes

in drilling activity; general global economic, political and

business conditions; weather conditions; regulatory changes; the

successful exploitation and integration of technology; customer

acceptance of technology; success in obtaining issued patents; the

potential development of competing technologies by market

competitors; and availability of products, qualified personnel,

manufacturing capacity and raw materials. The foregoing important

factors are not exhaustive. In addition, actual results could

differ materially from those anticipated in forward-looking

information and financial outlook or future orientated financial

information provided herein as a result of the risk factors set

forth under the section entitled "Risks Factors" in our Annual

Information Form dated March 21, 2014. Readers are also referred to

the risk factors and assumptions described in other documents filed

by the Company from time to time with securities regulatory

authorities.

Any financial outlook or future oriented financial information

in this document, as defined by applicable securities legislation,

has been approved by management. Such financial outlook or future

oriented financial information is based on assumptions that

management believes to be reasonable under the circumstances and is

provided for the purpose of providing information about

management's current expectations and plans relating to the future.

Readers are cautioned that reliance on such information may not be

appropriate for other purposes.

Additional information regarding Trican including Trican's most

recent annual information form is available under Trican's profile

on SEDAR (www.sedar.com).

Headquartered in Calgary, Alberta, Trican has operations in

Canada, the United States, Russia, Kazakhstan, Australia, Algeria,

Norway, Colombia and Saudi Arabia. Trican provides a comprehensive

array of specialized products, equipment and services that are used

during the exploration and development of oil and gas reserves.

Requests for shareholder information should be directed

to:Trican Well Service Ltd.Dale DusterhoftChief Executive

Officerddusterhoft@trican.caTrican Well Service Ltd.Michael

BaldwinSenior Vice President, Finance &

CFOmbaldwin@trican.caTrican Well Service Ltd.Gary SummachDirector

of Reporting and Investor Relationsgsummach@trican.caTrican Well

Service Ltd.2900, 645 - 7th Avenue S.W.Calgary, Alberta T2P

4G8(403) 266 - 0202(403) 237 - 7716www.trican.ca

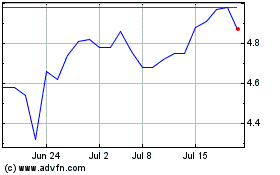

Trican Well Service (TSX:TCW)

Historical Stock Chart

From Jun 2024 to Jul 2024

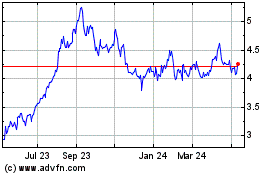

Trican Well Service (TSX:TCW)

Historical Stock Chart

From Jul 2023 to Jul 2024