Stella-Jones Inc. (TSX: SJ) (“Stella-Jones” or the “Company”) today

announced financial results for its fourth quarter and year ended

December 31, 2021.

"Stella-Jones delivered a record performance on

many fronts in 2021, resulting in increased sales, strong EPS

growth and solid cashflows. We utilized our collective expertise

and longstanding industry relationships to successfully navigate

through complex procurement challenges and volatile lumber markets

to produce yet another successful year,” said Éric Vachon,

President and CEO of Stella-Jones. "We remained focused on building

on our strong fundamentals, completing two accretive acquisitions

and investing in our network to strengthen our capability to supply

the growing needs of our infrastructure customer base. The Company

also continued to return capital to its shareholders and announced

an 18th consecutive year of increased dividends."

"Looking to the next 3 years, we will focus on

pursuing acquisitions to complement our infrastructure-related

product offering and invest to increase capacity in utility poles

production to meet anticipated growth in demand. Acknowledging the

Company’s strong cash flow generation, we plan to return

approximately $500-$600 million to shareholders over the next 3

years, an increase of over 50% compared to cash returned over the

past 3 years. Our efforts will be devoted to leveraging our solid

business foundation to generate continued profitable growth,

further solidifying our leadership position in our core product

categories and enhancing shareholder value," concluded Mr.

Vachon.

|

Financial Highlights(in millions of Canadian

dollars, except per share data and margin) |

Q4-21 |

Q4-20 |

2021 |

2020 |

|

Sales |

545 |

533 |

2,750 |

2,551 |

|

Gross profit(1) |

65 |

85 |

456 |

446 |

|

Gross profit margin(1) |

11.9% |

15.9% |

16.6% |

17.5% |

|

EBITDA(1) |

52 |

70 |

400 |

385 |

|

EBITDA margin(1) |

9.5% |

13.1% |

14.5% |

15.1% |

|

Operating income |

32 |

50 |

326 |

309 |

|

Operating income margin(1) |

5.9% |

9.4% |

11.9% |

12.1% |

|

Net income for the period |

22 |

34 |

227 |

210 |

|

Earnings per share - basic and diluted |

0.34 |

0.52 |

3.49 |

3.12 |

|

Weighted average shares outstanding (basic, in ‘000s) |

64,292 |

66,654 |

65,002 |

67,260 |

|

(1) |

These are non-GAAP and other financial measures which are not

prescribed by IFRS and are not likely to be comparable to similar

measures presented by other issuers. Please refer to the section

"Non-GAAP and other financial measures" in this press release |

FOURTH QUARTER RESULTS

Sales for the fourth quarter of 2021 amounted to

$545 million, up from sales of $533 million for the same period in

2020. Excluding the contribution from the acquisitions of Cahaba

Pressure Treated Forest Products, Inc. ("Cahaba Pressure") and

Cahaba Timber, Inc. ("Cahaba Timber") of six million dollars and

the negative impact of the currency conversion of $14 million,

pressure-treated wood sales rose $26 million, or 5%, mainly driven

by higher volumes and pricing from utility poles as well as

improved pricing for railway ties. This growth was partially offset

by lower demand for residential lumber. The decrease in logs and

lumber sales mainly stemmed from the lower market price of

lumber.

On November 19, 2021, the Company acquired

Cahaba Pressure and Cahaba Timber and included its results of

operations as of the acquisition date. Cahaba Pressure

manufactures, distributes and sells treated and untreated wood

poles, crossties and posts and provides custom treating services.

Cahaba Timber is a producer of treated poles and pilings and

engages in raw material procurement.

Pressure-treated wood

products:

- Utility poles (42% of Q4-21

sales): Utility poles sales amounted to $227 million, up

from $201 million for the same period last year. Excluding the

contribution from acquisitions and the negative currency conversion

effect, sales increased 13%, primarily due to increased maintenance

and project-related demand and higher pricing.

- Railway ties (27% of Q4-21

sales): Sales of railway ties amounted to $147 million, in

line with last year. Excluding the negative currency conversion

effect, railway ties sales rose 3%, mainly driven by improved

pricing for both Class 1 and non-Class 1 business.

- Residential lumber (20% of

Q4-21 sales): Residential lumber sales totaled $107

million, down from $117 million of sales generated in the same

period in 2020. Despite the lower market price of lumber in the

fourth quarter of 2021, compared to the fourth quarter of 2020,

pricing for residential lumber remained unchanged. The decrease in

sales stems from lower sales volumes.

- Industrial products (5% of

Q4-21 sales): Industrial product sales amounted to $25

million, slightly up compared to the $23 million of sales generated

a year ago, primarily due to the mix of project-related bridge

work.

Logs and lumber:

- Logs and lumber (6% of

Q4-21 sales): Logs and lumber sales totaled $39 million,

down 13% compared to the same period last year, mainly due to the

lower market price of lumber.

Gross profit was $65 million in the fourth

quarter of 2021, versus $85 million, in the fourth quarter of 2020,

representing a margin of 11.9% and 15.9% respectively. The decrease

was primarily attributable to the higher inventory cost of

residential lumber at the end of the third quarter. Given the time

lag in contractual price adjustments, the rise in costs during the

quarter outpaced sales price increases across all product

categories. This further contributed to the lower gross profit in

the fourth quarter of 2021, compared to the same period last

year.

Similarly, operating income totaled $32 million

in the fourth quarter of 2021 versus operating income of $50

million in the corresponding period of 2020, while EBITDA decreased

to $52 million, down 26%, compared to $70 million reported in the

fourth quarter of 2020.

As a result, net income for the fourth quarter

of 2021 was $22 million, or $0.34 per share, compared to net income

of $34 million, or $0.52 per share, in the corresponding period of

2020.

2021 RESULTS

Sales for the year ended December 31, 2021 were

up 8% to $2,750 million, compared to sales of $2,551 million in

2020, despite a $127 million negative impact from currency

conversion. Excluding the impact of the currency conversion and the

contribution from acquisitions, pressure-treated wood sales rose

$232 million, or 10% and sales of logs and lumber increased by $88

million. The increase in sales was driven by organic growth across

all product categories.

Pressure-treated wood

products:

- Utility poles (34% of 2021 sales): Utility

poles sales increased to $925 million in 2021, compared to sales of

$888 million in 2020. Excluding the contribution from the

acquisition of Cahaba Pressure and Cahaba Timber in November 2021

and the currency conversion effect, utility poles sales increased

by $83 million, or 9%, driven by strong maintenance demand for

distribution poles, favourable price adjustments in response to raw

material cost increases and a better sales mix, including the

impact of incremental fire-resistant wrapped pole sales volumes.

This growth was partially attenuated by less project-related

volumes.

- Railway ties (25% of 2021 sales): Railway ties

sales were $700 million in 2021, compared to sales of $733 million

in 2020. Excluding the currency conversion effect, railway ties

sales increased $13 million, or 2%, largely attributable to higher

non-Class 1 sales compared to 2020, as continued strong demand

outweighed the pricing pressures in the first half of the year.

Sales for Class 1 customers remained relatively stable

year-over-year.

- Residential lumber (28% of 2021 sales): Sales

in the residential lumber category rose to $773 million in 2021,

compared to sales of $665 million in 2020. Excluding the currency

conversion effect, residential lumber sales increased $127 million,

or 19%, driven by the exceptional rise in the market price of

lumber during the first six months of the year. This increase was

partially offset by lower sales volumes attributable to softer

consumer demand compared to last year.

- Industrial products (5% of 2021 sales):

Industrial product sales were relatively unchanged at $121 million

in 2021 compared to sales of $119 million in 2020. Excluding the

currency conversion effect, industrial product sales increased $9

million or 8%, largely due to more timber and piling projects

compared to 2020, offset in part by lower project-related bridge

and crossing sales.

Logs and lumber:

- Logs and lumber (8% of 2021

sales): Sales in the logs and lumber product category were

$231 million in 2021, up 60% compared to $146 million in 2020. The

increase is due to the exceptional rise in the market price of

lumber in the first half of the year.

Driven by sales growth, gross profit grew to

$456 million, compared to $446 million in 2020, and EBITDA

increased to a record $400 million, from $385 million in 2020. The

increase in gross profit and EBITDA was primarily driven by the

rise in sales prices for residential lumber, which exceeded the

higher cost of lumber, as well as, improved pricing, sales mix and

volumes for utility poles. This increase was partially offset by a

decrease in residential lumber demand, lower railway ties pricing

and the unfavourable impact of the depreciation of the U.S. dollar.

Given, however, the time lag in contractual sales price

adjustments, the increase in costs outpaced price increases and

EBITDA margin decreased to 14.5% compared to a margin of 15.1% in

the prior year.

Net income in 2021 was $227 million, an increase

of 8% versus net income of $210 million in 2020. Earnings per share

in 2021 were $3.49, an increase of 12% compared to earnings per

share of $3.12 in 2020. Earnings per share was positively impacted

by the increase in net income and the Company’s repurchase of

shares through its normal course issuer bids.

STRONG LIQUIDITY AND CAPITAL

RESOURCES

During the year ended December 31, 2021,

Stella-Jones generated operating cash flows of $251 million. The

Company invested $129 million in strategic acquisitions, $64

million in its property, plant and equipment and intangible assets,

and returned $155 million of capital to shareholders through the

payment of dividends and the repurchase of shares. As at December

31, 2021, the Company maintained a healthy financial position with

a net debt-to-EBITDA ratio of 2.2x and available liquidity of $329

million.

NORMAL COURSE ISSUER BID

On November 8, 2021, the Toronto Stock Exchange

("TSX") accepted Stella-Jones’ Notice of Intention to Make a normal

course issuer bid ("NCIB') to purchase for cancellation, up to

4,000,000 common shares during the 12-month period commencing

November 12, 2021 and ending November 11, 2022, representing

approximately 8% of the public float of its common shares.

("2021-2022" NCIB)

In the three-month period ended December 31,

2021, the Company repurchased 721,548 common shares for

cancellation in consideration of $30 million, under its NCIB. In

2021, the Company repurchased in total 2,447,419 common shares for

cancellation in consideration of $108 million, under the NCIB’s

then in effect.

Subsequent to year-end, on March 8, 2022, the

Company received approval from the TSX to amend its NCIB in order

to increase the maximum number of common shares that may be

repurchased for cancellation by the Company during the 12-month

period ending November 11, 2022, from 4,000,000 to 5,000,000 common

shares, representing approximately 10% of the public float of its

common shares as at the October 31, 2021. The amendment to the NCIB

will be effective on March 14, 2022 and will continue until

November 11, 2022 or such earlier date as Stella-Jones has acquired

the maximum number of common shares permitted under the NCIB. All

other terms and conditions of the NCIB remained unchanged.

Purchases under the NCIB are made on behalf of Stella-Jones by a

registered broker through the facilities of the TSX.

QUARTERLY DIVIDEND INCREASED 11% TO

$0.20 PER SHARE

On March 8, 2022 the Board of Directors

declared a quarterly dividend of $0.20 per common share,

representing an increase of 11% over the previous quarterly

dividend, on the outstanding common shares of the Company, payable

on April 22, 2022 to shareholders of record at the close of

business on April 4, 2022. This dividend is designated to be

an eligible dividend.

OUTLOOK

To better reflect its business dynamics, the

Company is shifting its financial guidance to a three-year outlook.

Over the next 3 years, Stella-Jones anticipates continued sales and

EBITDA growth. It expects to generate an annual sales growth rate

in the mid-single digit range from the 2019 pre-pandemic levels and

continues to target EBITDA margin of approximately 15% for the

2022-2024 period.

By core product categories for 2022-2024:

- The Company will expand its capital

expenditure program and invest an additional $90 to $100 million to

support the anticipated high single-digit organic growth in the

utility poles category;

- The Company continues to project

growth in the railway ties category in the low single-digits;

and

- For residential lumber, the Company

anticipates stable long-term demand but believes the market price

of lumber will normalize. As a result, the Company expects its

residential lumber sales to decrease compared to 2021 and assumes

sales in the 2022-2024 period will be approximately 35% above the

2019 pre-pandemic levels.

With the anticipated normalization of lumber

prices and expected growth in the Company's infrastructure-related

businesses, the sales of utility poles, railway ties and industrial

product categories are expected to represent 75-80% of total sales,

while the relative proportion of residential lumber sales is

projected to stabilize to 20-25% by 2024.

Based on its current business model, the Company

projects returning to shareholders approximately $500 to $600

million in the 2022-2024 period.

The Company plans to pursue acquisitions that

further support growth in its infrastructure-related products

categories. It also plans to evaluate growth opportunities in

adjacent businesses where it can leverage its core knowledge and

key attributes to generate continued strong cash flow. For

strategic acquisitions, the Company anticipates increasing its

leverage to finance such opportunities. As per its capital

allocation strategy, the Company targets a leverage ratio of

2.0x-2.5x and may temporarily deviate and exceed its target to

pursue acquisitions.

The Company’s financial guidance is based on its

current outlook and takes into account a number of economic and

market assumptions. Please refer to the Company's Management’s

Discussion and Analysis for a complete list of assumptions.

CONFERENCE CALL

Stella-Jones will hold a conference call to

discuss these results on March 9, 2022, at 10:00 a.m. Eastern

Standard Time. Interested parties can join the call by dialing

1-438-803-0545 (Toronto or overseas) or 1-888-440-2194 (elsewhere

in North America). Parties unable to call in at this time may

access a recording by calling 1-800-770-2030 and entering the

passcode 4899896. This recording will be available on Wednesday,

March 9, 2022 as of 1:30 p.m. until 11:59 p.m. on Wednesday,

March 16, 2022.

ABOUT STELLA-JONES

Stella-Jones Inc. (TSX: SJ) is North America’s

leading producer of pressure-treated wood products. It supplies all

the continent’s major electrical utilities and telecommunication

companies with wood utility poles and North America’s Class 1,

short line and commercial railroad operators with railway ties and

timbers. Stella-Jones also provides industrial products, which

include wood for railway bridges and crossings, marine and

foundation pilings, construction timbers and coal tar-based

products. Additionally, the Company manufactures and distributes

premium residential lumber and accessories to Canadian and American

retailers for outdoor applications, with a significant portion of

the business devoted to servicing the Canadian market through its

national manufacturing and distribution network. The Company’s

common shares are listed on the Toronto Stock Exchange.

CAUTION REGARDING FORWARD-LOOKING

INFORMATION

Except for historical information provided

herein, this press release may contain information and statements

of a forward-looking nature concerning the future performance of

the Company. These statements are based on suppositions and

uncertainties as well as on management's best possible evaluation

of future events. Such factors may include, without excluding other

considerations, general economic and business conditions (including

the impact of the coronavirus pandemic), evolution in customer

demand for the Company's products and services, product selling

prices, availability and cost of raw materials, changes in foreign

currency rates, and the ability of the Company to raise capital. As

a result, readers are advised that actual results may differ from

expected results. Unless required to do so under applicable

securities legislation, the Company does not assume any obligation

to update or revise forward-looking statements to reflect new

information, future events or other changes after the date

hereof.

Note to readers: The

audited consolidated financial statements for the year ended

December 31, 2021 as well as management’s discussion and analysis

are available on Stella-Jones’ website at

www.stella-jones.com.

|

Head Office3100 de la Côte-Vertu Blvd., Suite

300Saint-Laurent, QuébecH4R 2J8 Tel.: (514) 934-8666Fax: (514)

934-5327 |

Exchange ListingsThe Toronto Stock ExchangeStock

Symbol: SJTransfer Agent and

RegistrarComputershare Investor Services Inc. |

Investor RelationsSilvana TravagliniSenior

Vice-President and Chief Financial OfficerTel.: (514) 940-8660Fax:

(514) 934-5327stravaglini@stella-jones.com |

|

Source: |

Stella-Jones Inc. |

|

| |

|

|

| Contacts: |

Silvana Travaglini, CPA,

CA |

Pierre Boucher, CPA,

CMA |

| |

Senior Vice-President and Chief

Financial Officer Stella-Jones |

MaisonBrison Communications |

| |

Tel.: (514) 940-8660 |

Tel.: (514) 731-0000 |

| |

stravaglini@stella-jones.com |

pierre@maisonbrison.com |

|

Stella-Jones Inc. |

| Consolidated

Statements of Income |

| (expressed in millions of Canadian dollars, except earnings per

common share) |

| |

For thethree-month

periodsended December 31, |

|

For theyearsended

December 31, |

|

|

2021 |

|

2020 |

|

2021 |

2020 |

|

|

$ |

|

$ |

|

$ |

$ |

| Sales |

545 |

|

533 |

|

2,750 |

2,551 |

| |

|

|

|

|

|

| Expenses |

|

|

|

|

|

| |

|

|

|

|

|

|

Cost of sales (including depreciation and amortization (3 months -

$17 (2020 - $16) and 12 months - $63 (2020 - $62)) |

480 |

|

448 |

|

2,294 |

2,105 |

|

Selling and administrative (including depreciation and amortization

(3 months - $3 (2020 - $4) and 12 months - $11 (2020 - $14)) |

32 |

|

32 |

|

127 |

125 |

| Other losses, net |

1 |

|

3 |

|

3 |

12 |

| |

513 |

|

483 |

|

2,424 |

2,242 |

| Operating

income |

32 |

|

50 |

|

326 |

309 |

| |

|

|

|

|

|

| Financial

expenses |

6 |

|

5 |

|

23 |

25 |

| |

|

|

|

|

|

| |

|

|

|

|

|

| Income before income

taxes |

26 |

|

45 |

|

303 |

284 |

| |

|

|

|

|

|

| Provision for income

taxes |

|

|

|

|

|

| Current |

(4 |

) |

8 |

|

64 |

66 |

| Deferred |

8 |

|

3 |

|

12 |

8 |

| |

|

|

|

|

|

| |

4 |

|

11 |

|

76 |

74 |

| |

|

|

|

|

|

| Net income for the

year |

22 |

|

34 |

|

227 |

210 |

| |

|

|

|

|

|

| Basic and diluted

earnings per common share |

0.34 |

|

0.52 |

|

3.49 |

3.12 |

|

Stella-Jones Inc. |

| Consolidated

Statements of Financial Position |

|

(expressed in millions of Canadian dollars) |

|

|

2021 |

2020 |

| |

$ |

$ |

| Assets |

|

|

| |

|

|

| Current

assets |

|

|

| Accounts receivable |

230 |

208 |

| Inventories |

1,106 |

1,075 |

| Income taxes receivable |

9 |

— |

| Other current assets |

43 |

36 |

| |

1,388 |

1,319 |

| Non-current

assets |

|

|

| Property, plant and

equipment |

629 |

574 |

| Right-of-use assets |

138 |

135 |

| Intangible assets |

158 |

115 |

| Goodwill |

341 |

280 |

| Derivative financial

instruments |

3 |

— |

| Other non-current assets |

8 |

3 |

| |

2,665 |

2,426 |

| Liabilities and

Shareholders’ Equity |

|

|

| Current

liabilities |

|

|

| Accounts payable and accrued

liabilities |

162 |

137 |

| Income taxes payable |

1 |

19 |

| Derivative financial

instruments |

— |

2 |

| Current portion of long-term

debt |

33 |

11 |

| Current portion of lease

liabilities |

35 |

33 |

| Current portion of provisions

and other long-term liabilities |

11 |

16 |

| |

242 |

218 |

| Non-current

liabilities |

|

|

| Long-term debt |

701 |

595 |

| Lease liabilities |

109 |

106 |

| Deferred income taxes |

137 |

104 |

| Provisions and other long-term

liabilities |

15 |

15 |

| Employee future benefits |

13 |

15 |

| |

1,217 |

1,053 |

| Shareholders’

equity |

|

|

| Capital stock |

208 |

214 |

| Retained earnings |

1,161 |

1,079 |

| Accumulated other

comprehensive income |

79 |

80 |

| |

|

|

| |

1,448 |

1,373 |

| |

2,665 |

2,426 |

|

Stella-Jones Inc. |

| Consolidated

Statements of Cash Flows |

|

(expressed in millions of Canadian dollars) |

|

|

2021 |

|

2020 |

|

| |

$ |

|

$ |

|

| Cash flows provided by

(used in) |

|

|

| Operating

activities |

|

|

| Net income for the year |

227 |

|

210 |

|

| Adjustments for |

|

|

| Depreciation of property,

plant and equipment |

25 |

|

26 |

|

| Depreciation of right-of-use

assets |

38 |

|

38 |

|

| Amortization of intangible

assets |

11 |

|

12 |

|

| Gain on derivative financial

instruments |

— |

|

(2 |

) |

| Financial expenses |

23 |

|

25 |

|

| Current income taxes

expense |

64 |

|

66 |

|

| Deferred income taxes |

12 |

|

8 |

|

| Provisions and other long-term

liabilities |

(7 |

) |

14 |

|

| Other |

(5 |

) |

5 |

|

| |

388 |

|

402 |

|

| |

|

|

| Changes in non-cash working

capital components |

|

|

| Accounts receivable |

(19 |

) |

(32 |

) |

| Inventories |

(21 |

) |

(123 |

) |

| Other current assets |

(7 |

) |

(2 |

) |

| Accounts payable and accrued

liabilities |

24 |

|

1 |

|

| |

(23 |

) |

(156 |

) |

| Interest paid |

(23 |

) |

(26 |

) |

| Income taxes paid |

(91 |

) |

(42 |

) |

| |

251 |

|

178 |

|

| Financing

activities |

|

|

| Proceeds from short-term

debt |

125 |

|

— |

|

| Repayment of short-term

debt |

(123 |

) |

— |

|

| Net change in revolving credit

facilities |

(13 |

) |

20 |

|

| Proceeds from long-term

debt |

247 |

|

— |

|

| Repayment of long-term

debt |

(105 |

) |

(8 |

) |

| Repayment of lease

liabilities |

(35 |

) |

(35 |

) |

| Dividends on common

shares |

(47 |

) |

(40 |

) |

| Repurchase of common

shares |

(108 |

) |

(60 |

) |

| Other |

1 |

|

(1 |

) |

| |

(58 |

) |

(124 |

) |

| Investing

activities |

|

|

| Business acquisitions |

(129 |

) |

— |

|

| Purchase of property, plant

and equipment |

(48 |

) |

(42 |

) |

| Additions of intangible

assets |

(16 |

) |

(13 |

) |

| Other |

— |

|

1 |

|

| |

(193 |

) |

(54 |

) |

| Net change in cash and

cash equivalents during the year |

— |

|

— |

|

| Cash and cash

equivalents – Beginning of year |

— |

|

— |

|

| Cash and cash

equivalents – End of year |

— |

|

— |

|

NON-GAAP AND OTHER FINANCIAL

MEASURES

This section includes information required by

National Instrument 52-112 – Non-GAAP and Other Financial Measures

Disclosure in respect of “specified financial measures” (as defined

therein).

Non-GAAP financial measures include:

- Gross profit:

Sales less cost of sales

- EBITDA: Operating

income before depreciation of property, plant and equipment,

depreciation of right-of-use assets and amortization of intangible

assets (also referred to as earnings before interest, taxes,

depreciation and amortization)

- Net debt: Sum of

long-term debt and lease liabilities (including the current

portion)

Non-GAAP ratios include:

- Gross profit

margin: Gross profit divided by sales for the

corresponding period

- EBITDA margin:

EBITDA divided by sales for the corresponding period

- Net

debt-to-EBITDA: Net debt divided by EBITDA

Other specified financial measures include:

- Operating income

margin: Operating income divided by sales for the

corresponding period

Management considers these non-GAAP and other

financial measures to be useful information to assist knowledgeable

investors to understand the Company’s operating results, financial

position and cash flows as they provide a supplemental measure of

its performance. Management uses these non-GAAP and other financial

measures in order to facilitate operating and financial performance

comparisons from period to period, to prepare annual budgets and to

assess the Company’s ability to meet future debt service, capital

expenditure and working capital requirements. Management uses net

debt to calculate the Company’s indebtedness level, future cash

needs and financial leverage ratios.

The following tables present the reconciliations

of non-GAAP financial measures to their most comparable GAAP

measures.

|

Reconciliation of operating income to EBITDA(in

millions of dollars) |

Three-month periods endedDecember

31, |

Years endedDecember 31, |

|

|

2021 |

2020 |

2021 |

2020 |

|

Operating income |

32 |

50 |

326 |

309 |

|

Depreciation and amortization |

20 |

20 |

74 |

76 |

|

EBITDA |

52 |

70 |

400 |

385 |

|

Reconciliation of Long-Term Debt to Net Debt(in

millions of dollars) |

Years ended December 31, |

|

|

2021 |

2020 |

|

Long-term debt, including current portion |

734 |

606 |

|

Add: |

|

|

|

Lease liabilities, including current portion |

144 |

139 |

|

Net Debt |

878 |

745 |

|

EBITDA |

400 |

385 |

|

Net Debt-to-EBITDA |

2.2 |

1.9 |

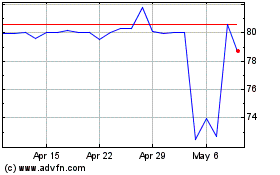

Stella Jones (TSX:SJ)

Historical Stock Chart

From Jun 2024 to Jul 2024

Stella Jones (TSX:SJ)

Historical Stock Chart

From Jul 2023 to Jul 2024