Stella-Jones Inc. (TSX:SJ) today announced financial results for

its first quarter ended March 31, 2013. This represents the first

full quarter that includes the operating results of McFarland

Cascade Holdings, Inc. ("McFarland"), acquired on November 30,

2012.

"First-quarter results showed sustained demand for Stella-Jones'

core railway tie and utility pole products, although seasonal

patterns proved more normal in 2013, compared to last year. The

operating facilities acquired from McFarland produced solid

revenues. As anticipated, lower margins from these operations

resulted in a reduction of operating income as a percentage of

sales. We are progressing according to plan in regards to the

integration of McFarland's activities into our network, as well as

with the construction and ramp-up of our new wood treating facility

in Cordele, Georgia. These initiatives will further enhance our

presence in the market for treated wood products," said Brian

McManus, President and Chief Executive Officer.

----------------------------------------------------------------------------

Financial highlights Quarters ended March 31,

(in thousands of Canadian dollars, except per

share data) 2013 2012

----------------------------------------------------------------------------

Sales 217,039 158,795

Operating income 29,671 24,090

Net income for the period 18,757 15,006

Per share - basic and diluted ($) 1.09 0.94

Cash flow from operating activities (1) 34,339 27,180

Weighted average shares outstanding (basic, in

'000s) 17,169 15,959

----------------------------------------------------------------------------

(1) Before changes in non-cash working capital components and interest and

income tax paid.

FIRST QUARTER RESULTS

Sales reached $217.0 million, an increase of $58.2 million, or

36.7%, over last year's sales for the same period of $158.8

million. The operating facilities acquired from McFarland

contributed sales of approximately $65.0 million, while the

conversion effect from fluctuations in the value of the Canadian

dollar, Stella-Jones' reporting currency, versus the U.S. dollar,

had a positive impact of $0.5 million on the value of U.S. dollar

denominated sales when compared with the previous year's first

quarter. Excluding these factors, sales decreased approximately

$7.3 million, as a result of a slower start for rail related

industrial products and more traditional seasonal demand patterns

for utility poles and residential lumber in the first quarter of

2013, compared with the same period last year.

Railway tie sales amounted to $96.5 million, an increase of 0.5%

over sales of $96.0 million a year earlier, reflecting steady

market demand. Utility pole sales amounted to $90.8 million, up

from $43.5 million in the corresponding period last year. The

increase is mainly attributable to utility pole sales of $50.7

million from the McFarland operations. Industrial product sales

reached $11.9 million, compared with $15.2 million last year,

mainly as a result of a slower start in rail projects requiring

industrial products, as compared to the first quarter of last year.

Finally, sales in the residential lumber category totalled $17.9

million, up from $4.2 million a year earlier. The increase reflects

additional residential lumber sales of $14.1 million from the

McFarland operations.

Operating income amounted to $29.7 million, or 13.7% of sales,

versus $24.1 million, or 15.2% of sales a year earlier. The

increase in absolute dollars essentially reflects the addition of

the McFarland operations, while the decrease as a percentage of

sales mainly stems from lower margins at the McFarland

facilities.

Net income for the first quarter of 2013 totalled $18.8 million,

or $1.09 per share, fully diluted, versus $15.0 million, or $0.94

per share, fully diluted, in the first quarter of 2012,

representing a year-over-year increase of 25.0%. Cash flow from

operating activities before changes in non-cash working capital

components and interest and income tax paid rose 26.3% to $34.3

million.

SOUND FINANCIAL POSITION

As at March 31, 2013, Stella-Jones' financial position remained

healthy with total debt of $382.6 million. At that same date, the

ratio of total debt to total capitalization was 0.44:1, stable in

comparison with December 31, 2012.

Reflecting higher business activity near the end of the first

quarter as per historical seasonal demand patterns, accounts

receivable rose to $128.5 million as at March 31, 2013, up from

$89.6 million three months earlier. Inventories stood at $425.6

million as at March 31, 2013, versus $413.4 million as at December

31, 2012, due to the normal seasonal inventory build-up ahead of

peak demand in the second and third quarters.

QUARTERLY DIVIDEND OF $0.20 PER SHARE

On May 1, 2013, the Board of Directors declared a quarterly

dividend of $0.20 per common share payable on June 28, 2013 to

shareholders of record at the close of business on June 3,

2013.

OUTLOOK

"Stella-Jones' role as a supplier of basic infrastructure will

continue to serve us well and we expect demand for our core

products to remain healthy for the remainder of 2013. In the

short-term, the integration of the McFarland operations into our

network and the ramp-up of our new facility in Georgia are our main

priorities. We will use our enhanced abilities from an expanded

network to better serve our customers and capture new business

opportunities. Over the long run, we remain committed to our

disciplined approach to network expansion, as well as to unlocking

synergies and achieving maximum efficiency from such initiatives.

Precise execution of this strategy will create further value for

our shareholders," concluded Mr. McManus.

CONFERENCE CALL

Stella-Jones will hold a conference call to discuss these

results on Thursday, May 2, 2013, at 1:30 PM Eastern Time.

Interested parties can join the call by dialling 647-427-7450

(Toronto or overseas) or 1-888-231-8191 (elsewhere in North

America). Parties unable to call in at this time may access a tape

recording of the meeting by calling 1-855-859-2056 and entering the

passcode 34056092. This tape recording will be available on

Thursday, May 2, 2013 as of 5:30 PM Eastern Time until 11:59 PM

Eastern Time on Thursday, May 9, 2013.

NON-IFRS FINANCIAL MEASURES

Operating income and cash flow from operations are financial

measures not prescribed by IFRS and are not likely to be comparable

to similar measures presented by other issuers. Management

considers these measures to be useful information to assist

knowledgeable investors in evaluating the cash generating

capabilities of the Company.

ABOUT STELLA-JONES

Stella-Jones Inc. (TSX:SJ) is a leading producer and marketer of

pressure treated wood products. The Company supplies North

America's railroad operators with railway ties, timbers and

recycling services; and the continent's electrical utilities and

telecommunications companies with utility poles. Stella-Jones also

provides industrial products and services for construction and

marine applications, as well as residential lumber to retailers and

wholesalers for outdoor applications. The Company's common shares

are listed on the Toronto Stock Exchange.

Except for historical information provided herein, this press

release may contain information and statements of a forward-looking

nature concerning the future performance of the Company. These

statements are based on suppositions and uncertainties as well as

on management's best possible evaluation of future events. Such

factors may include, without excluding other considerations,

fluctuations in quarterly results, evolution in customer demand for

the Company's products and services, the impact of price pressures

exerted by competitors, the ability of the Company to raise the

capital required for acquisitions, and general market trends or

economic changes. As a result, readers are advised that actual

results may differ from expected results.

Note to readers: Complete unaudited first-quarter financial

statements are available on Stella-Jones' website at

www.stella-jones.com

Contacts: Source: Stella-Jones Inc. Contacts: Eric Vachon, CPA,

CA Senior Vice-President and Chief Financial Officer (514)

940-3903evachon@stella-jones.com Martin Goulet, CFA MaisonBrison

(514) 731-0000martin@maisonbrison.com

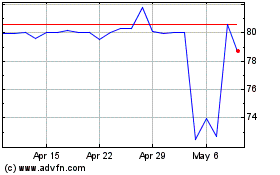

Stella Jones (TSX:SJ)

Historical Stock Chart

From Jun 2024 to Jul 2024

Stella Jones (TSX:SJ)

Historical Stock Chart

From Jul 2023 to Jul 2024