Stella-Jones Inc. (TSX: SJ)

-- Sales of $161.3 million compared with $104.7 million last year

-- Organic revenue growth of approximately 18.0%

-- Gross profit up 49.3% to $29.3 million

-- Net income of $12.2 million or $0.77 per share, fully diluted, up from

$8.3 million a year ago

Stella-Jones Inc. (TSX: SJ) today announced financial results

for its third quarter and nine-month period ended September 30,

2010.

--------------------------------------------------------------------------

Financial highlights (unaudited)

(in thousands of dollars, except per share data)

Quarters ended Nine months ended

Sept. 30, Sept. 30,

2010 2009 2010 2009

--------------------------------------------------------------------------

Sales 161,298 104,671 427,975 345,729

Gross profit 29,324 19,636 76,378 66,055

Cash flow from operations (1) 15,206 10,315 34,796 34,238

Net earnings for the period 12,218 8,320 23,642 27,028

Per share - basic ($) 0.77 0.66 1.59 2.14

Per share - diluted ($) 0.77 0.65 1.59 2.13

Weighted average shares

outstanding (basic, in '000s) 15,901 12,679 14,840 12,623

--------------------------------------------------------------------------

(1) Before changes in non-cash working capital components.

THIRD-QUARTER RESULTS

Sales were $161.3 million, an increase of $56.6 million, or

54.1% from last year's sales of $104.7 million. The acquisition of

Tangent Rail Corporation ("Tangent"), effective April 1, 2010,

contributed sales of approximately $41.2 million. Changes in the

value of the Canadian dollar, Stella-Jones' reporting currency,

versus the U.S. dollar, decreased the value of U.S. dollar

denominated sales by about $3.6 million when compared with the same

period a year earlier. Adjusting for year-over-year currency

fluctuations, sales excluding Tangent increased approximately 18.0%

versus last year's third quarter, reflecting higher railway tie

sales in the United States and greater utility pole sales in both

the United States and Canada.

Railway tie sales increased $40.2 million, or 91.2%, to $84.3

million, as a result of a $27.1 million contribution from Tangent

and increased market penetration. Excluding Tangent, year-over-year

tie sales rose $13.1 million, net of a $1.8 million decrease due to

currency translation effect. Sales of utility poles totalled $42.7

million, up 15.6% from $36.9 million a year ago. This increase

mainly reflects higher sales of distribution poles, partially

offset by lower sales of transmission poles as well as a $0.7

million decrease in sales from the year-over-year currency

translation effect. Industrial product sales rose to $24.7 million,

up from $12.4 million a year earlier, driven by the contribution of

Tangent's coal tar distillation and used tie pickup and disposal

operations. Further capitalizing on efficiencies from

consolidation, all coal tar distillation is now being carried out

at Stella-Jones' Memphis, Tennessee facility. Accordingly,

Stella-Jones sold certain assets relating to its coal tar

distillation business at the Terre Haute, Indiana facility at the

end of October. Finally, consumer lumber sales decreased 15.4% to

$9.5 million.

"Stella-Jones reported strong operating results in the third

quarter with solid organic growth in our core product categories,"

said Brian McManus, President and Chief Executive Officer of

Stella-Jones. "The integration of Tangent continues to further

enhance our market penetration, as we leverage the strengths and

competencies of our expanded North American network. Greater

efficiencies from operational optimization initiatives and

synergies are also driving profitability improvements throughout

the organization."

Gross profit was $29.3 million or 18.2% of sales, up from $19.6

million or 18.8% of sales last year. The 49.3% increase in gross

profit dollars essentially reflects the contribution of the Tangent

operations partially offset by a lower average rate applied to

convert gross profit from U.S. dollar denominated sales. The

reduction in gross profit as a percentage of sales mainly stems

from a different product mix more heavily weighted towards railway

ties.

Net earnings for the period stood at $12.2 million or $0.77 per

share, fully diluted, compared with $8.3 million or $0.65 per

share, fully diluted, last year. Stella-Jones generated solid cash

flow from operating activities before changes in non-cash working

capital components of $15.2 million, up from $10.3 million in the

same period a year ago.

Stella-Jones' balance sheet further improved as at September 30,

2010. Long-term debt, including the current portion, was $147.3

million, representing a ratio of total long-term debt to

shareholders' equity of 0.53:1, down from 0.57:1 three months

earlier.

"Further to the ongoing reduction in long-term debt, a strong

cash flow generation and better working capital resulted in a

substantial decrease in short-term bank indebtedness to $22.5

million as at September 30, 2010, from $47.6 million at the end of

the previous quarter," said George Labelle, Senior Vice-President

and Chief Financial Officer.

NINE-MONTH RESULTS

For the nine-month period ended September 30, 2010, sales were

$428.0 million, up from $345.7 million in the first nine months of

2009. In addition to Tangent's six-month contribution of $83.3

million, sales increased organically by approximately 6.0%, while

changes in the value of the Canadian dollar versus the U.S. dollar

decreased the value of U.S. dollar denominated sales by about $21.8

million when compared with the same period a year earlier.

Gross profit reached $76.4 million, or 17.8% of sales, versus

$66.1 million, or 19.1% last year. Net earnings for the period

stood at $23.6 million, or $1.59 per share, fully diluted, versus

$27.0 million, or $2.13 per share, fully diluted, in the

corresponding period a year earlier. Cash flow from operating

activities before changes in non-cash working capital components

reached $34.8 million, compared with $34.2 million last year.

Year-to-date results include approximately $7.5 million in

non-recurring expenses, mainly consisting of asset impairment

charges for the Spencer, West Virginia facility and the Ripley,

West Virginia U.S. corporate office, severance expenses, a

provision for an unfavourable legal judgment, as well as general

and administrative expenses directly related to the Tangent

acquisition.

OUTLOOK

"We expect current trends to continue to benefit fourth quarter

results. We are observing further signs of improvement in the core

railway tie market resulting from increased freight volume. These

positive developments could lead to greater investment in rail

infrastructure as railway operators constantly seek to optimize

efficiencies. Meanwhile, utility pole demand should hold with

regular maintenance projects providing a stable business flow.

Through our enlarged network, greater market penetration and

stronger competitive position, we are strategically positioned to

benefit from any opportunity that may arise," concluded Mr.

McManus.

CONFERENCE CALL

Stella-Jones will hold a conference call to discuss these

results on Friday, November 12, 2010, at 10:00 AM Eastern Time.

Interested parties can join the call by dialling 1-647-427-7450

(Toronto or overseas) or 1-888-231-8191 (elsewhere in North

America). Parties unable to call in at this time may access a tape

recording of the meeting by calling 1-800-642-1687 and entering the

passcode 19292542. This tape recording will be available on Friday,

November 12, 2010 as of 1:00 PM Eastern Time until 11:59 PM Eastern

Time on Friday, November 19, 2010.

NON-GAAP MEASURE

Cash flow from operations is a financial measure not prescribed

by Canadian generally accepted accounting principles ("GAAP") and

is not likely to be comparable to similar measures presented by

other issuers. Management considers it to be useful information to

assist knowledgeable investors in evaluating the cash generating

capabilities of the Company.

ABOUT STELLA-JONES

Stella-Jones Inc. (TSX: SJ) is a leading producer and marketer

of pressure treated wood products. The Company supplies North

America's railroad operators with railway ties, timbers and

recycling services; and the continent's electrical utilities and

telecommunications companies with utility poles. Stella-Jones also

provides industrial products and services for construction and

marine applications, as well as consumer lumber to retailers and

wholesalers for outdoor applications. The Company's common shares

are listed on the Toronto Stock Exchange.

Except for historical information provided herein, this press

release may contain information and statements of a forward-looking

nature concerning the future performance of the Company. These

statements are based on suppositions and uncertainties as well as

on management's best possible evaluation of future events. Such

factors may include, without excluding other considerations,

fluctuations in quarterly results, evolution in customer demand for

the Company's products and services, the impact of price pressures

exerted by competitors, the ability of the Company to raise the

capital required for acquisitions, and general market trends or

economic changes. As a result, readers are advised that actual

results may differ from expected results.

Note to readers: Complete unaudited third-quarter and nine-month

financial statements are available on Stella-Jones' website at

www.stella-jones.com

Contacts: Stella-Jones Inc. George T. Labelle, CA Senior

Vice-President and Chief Financial Officer 514-934-8665

glabelle@stella-jones.com MaisonBrison Martin Goulet, CFA

514-731-0000 martin@maisonbrison.com

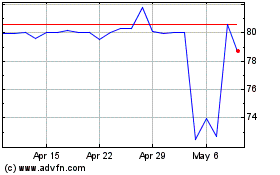

Stella Jones (TSX:SJ)

Historical Stock Chart

From Jun 2024 to Jul 2024

Stella Jones (TSX:SJ)

Historical Stock Chart

From Jul 2023 to Jul 2024