Spartan Delta Corp. (“

Spartan” or

the “

Company”) (TSX:SDE) is pleased to announce

its preliminary guidance for 2025, an accelerated West Shale Basin

Duvernay (the “

Duvernay”) development program, and

a $50.0 million bought deal equity financing led by National Bank

Financial Inc., as lead underwriter and sole bookrunner (the

“

Equity Offering”).

2025 BUDGET AND PRELIMINARY

GUIDANCE

Spartan is pleased to provide its preliminary

financial and operating guidance for 2025, focused on delivering

significant growth in oil and liquids production and Adjusted Funds

Flow per Share.

For 2025, Spartan’s Board has approved an

initial capital budget of $300 to $325 million to drill 35 (32 net)

wells, targeting estimated annualized production of approximately

40,000 BOE/d, a 5% increase compared to 2024 guidance.

Additionally, Spartan forecasts its 2025 crude oil and condensate

production to increase by approximately 75% compared to 2024

guidance.

DUVERNAY

In 2024, Spartan brought on-stream 4.0 (3.4 net)

wells at an average peak IP30 rate of 1,132 BOE/d (87% liquids) in

the Willesden Green Duvernay (“Willesden Green”),

significantly exceeding internal expectations and exhibiting top

tier regional performance. In December 2024, the Company’s Duvernay

position exceeded 250,000 net acres and production exceeded 5,000

BOE/d (77% liquids).

Building off the success achieved in 2024,

Spartan is allocating approximately $200 to $215 million of capital

in the Duvernay in 2025, targeting an annualized production growth

rate of 180%. Spartan anticipates drilling 16 (14 net) wells and

completing and bringing on-stream 17 (15 net) wells in the Duvernay

in 2025. Additionally, the Company continues to allocate capital to

expand its water infrastructure to accommodate future growth as

Spartan targets production growth to 25,000 BOE/d in the

Duvernay.

DEEP BASIN

In 2025, Spartan is allocating approximately

$100 to $110 million of capital, focusing on liquids-rich targets

in the first half of 2025. The Company anticipates drilling,

completing, and bringing on-stream 19 (18 net) wells in the Deep

Basin in 2025. Additionally, Spartan is preserving the versatility

to increase the capital budget in the second half of 2025 in

response to improvements in natural gas prices.

2025 GUIDANCE

Based on forecast average commodity pricing of

US$72.00/bbl WTI crude oil and $2.20/GJ AECO natural gas, Spartan

expects to generate:

- Adjusted Funds

Flow of approximately $219 million in 2025, an increase of 37%

compared to 2024 guidance.

- Adjusted Funds

Flow per Share accretion of 27% in 2025 compared to 2024 guidance,

inclusive of the Equity Offering.

- Operating

Netback, before hedging of $18.39/BOE, an increase of 61% compared

to 2024 guidance, as a result of growing crude oil and condensate

production by 75%.

- Spartan has

hedged 78,362 GJ/d of its 2025 natural gas production at an average

price of $2.22/GJ and 2,450 bbl/d of its 2025 crude oil and

condensate production at an average price of $99.59/bbl.

|

ANNUAL GUIDANCE |

2024 |

2025 |

Variance (1) |

|

|

Guidance |

Guidance (1) |

Amount |

% |

|

Average Production (BOE/d) |

38,000 |

39,000 – 41,000 |

2,000 |

5 |

|

% Liquids |

33% |

38% |

5 |

15 |

|

Natural gas (mmcf/d) |

154 |

148 |

(6) |

(4) |

|

NGLs (bbls/d) |

9,200 |

9,700 |

500 |

5 |

|

Crude oil and condensate (bbls/d) |

3,200 |

5,600 |

2,400 |

75 |

|

Benchmark Average Commodity Prices |

|

|

|

|

|

WTI crude oil price (US$/bbl) |

75.00 |

72.00 |

(3.00) |

(4) |

|

AECO 7A natural gas price ($/GJ) |

1.35 |

2.20 |

0.85 |

63 |

|

Average exchange rate (US$/CA$) |

1.37 |

1.43 |

0.06 |

4 |

|

Operating Netback, before hedging ($/BOE) (2) |

11.43 |

18.39 |

6.95 |

61 |

|

Adjusted Funds Flow ($MM) (2) |

160 |

219 |

59 |

37 |

|

Adjusted Funds Flow per Share ($/sh) (2) |

0.92 |

1.17 |

0.25 |

27 |

|

Capital Expenditures, before A&D ($MM) (2) |

164 |

300 - 325 |

149 |

91 |

|

Net Debt, end of year ($MM) (2) |

156 |

197 |

41 |

26 |

|

Common shares outstanding, end of year (MM) |

174 |

187 |

13 |

7 |

(1) The financial performance

measures included in the Company’s preliminary guidance for 2025 is

based on the midpoint of the average production and capital

expenditure forecast.(2) “Operating Netback”,

“Adjusted Funds Flow”, “Capital Expenditures, before A&D”, and

“Net Debt” do not have standardized meanings under IFRS Accounting

Standards, see “Reader Advisories – Non-GAAP Measures and

Ratios”.

EQUITY OFFERING

Spartan has entered into an agreement with a

syndicate of underwriters (the “Underwriters”) led

by National Bank Financial Inc., as lead underwriter and sole

bookrunner, pursuant to which the Underwriters have agreed to

purchase for resale to the public, on a bought deal basis,

13,090,000 common shares (“Common Shares”) of

Spartan at a price of $3.82 per Common Share for aggregate gross

proceeds of approximately $50.0 million. The Underwriters will have

an option to purchase up to an additional 15% of the Common Shares

issued under the Equity Offering at a price of $3.82 per Common

Share to cover over allotments exercisable in whole or in part at

any time until 30 days after the closing of the Equity Offering. It

is anticipated that certain directors, officers, and employees of

the Company will subscribe for approximately $5.4 million of the

Equity Offering.

The Common Shares offered in the Equity Offering

will be offered by way of short form prospectus in all provinces of

Canada except Quebec. The Common Shares may also be placed

privately in the United States to Qualified Institutional Buyers

(as defined under Rule 144A under the United States Securities Act

of 1933, as amended (the “U.S. Securities Act”)),

pursuant to an exemption under Rule 144A, and may be distributed

outside Canada and the United States on a basis which does not

require the qualification or registration of any of the Company’s

securities under domestic or foreign securities laws. The

completion of the Equity Offering is subject to customary closing

conditions, including the receipt of all necessary regulatory

approvals, including approval of the Toronto Stock Exchange

(“TSX”). Closing of the Equity Offering is

expected to occur on or around January 30, 2025 (the

“Closing Date”).

Spartan will use the net proceeds from the

Equity Offering to fund the acceleration of the development program

in the Duvernay as the Company targets Duvernay production growth

to 25,000 BOE/d and general corporate purposes. The acceleration of

the Duvernay will deliver significant growth in oil and liquids

production and material accretion to Adjusted Funds Flow per

Share.

Stikeman Elliott LLP is acting as legal counsel

to Spartan in respect of the Equity Offering. Burnet, Duckworth

& Palmer LLP is acting as legal counsel to the Underwriters in

respect of the Equity Offering.

ABOUT SPARTAN DELTA CORP.

Spartan is committed to creating value for its

shareholders, focused on sustainability both in operations and

financial performance. The Company’s culture is centered on

generating Free Funds Flow through responsible oil and gas

exploration and development. The Company has established a

portfolio of high-quality production and development opportunities

in the Deep Basin and the Duvernay. Spartan will continue to focus

on the execution of the Company’s organic drilling program across

its portfolio, delivering operational synergies in a respectful and

responsible manner to the environment and communities it operates

in. The Company is well positioned to continue pursuing

optimization in the Deep Basin, participate in the consolidation of

the Deep Basin fairway, and continue growing and developing its

Duvernay asset.

FOR ADDITIONAL INFORMATION PLEASE

CONTACT:

|

Fotis Kalantzis |

Spartan Delta Corp. |

|

President and Chief Executive Officer |

1600, 308 – 4th Avenue SW |

|

|

Calgary, Alberta, Canada T2P 0H7 |

|

|

Email: IR@SpartanDeltaCorp.com |

|

|

www.spartandeltacorp.com |

|

|

|

READER ADVISORIES

This press release is not an offer of

the securities for sale in the United States. The securities

offered have not been, and will not be, registered under the U.S.

Securities Act or any U.S. state securities laws and may not be

offered or sold in the United States absent registration or an

available exemption from the registration requirement of the U.S.

Securities Act and applicable U.S. state securities laws. This

press release shall not constitute an offer to sell or the

solicitation of an offer to buy, nor shall there be any sale of

these securities, in any jurisdiction in which such offer,

solicitation or sale would be unlawful.

Non-GAAP Measures and

Ratios

This press release contains certain financial

measures and ratios which do not have standardized meanings

prescribed by International Financial Reporting Standards

(“IFRS Accounting Standards”) or Generally

Accepted Accounting Principles (“GAAP”). As these

non-GAAP financial measures and ratios are commonly used in the oil

and gas industry, Spartan believes that their inclusion is useful

to investors. The reader is cautioned that these amounts may not be

directly comparable to measures for other companies where similar

terminology is used.

The non-GAAP measures and ratios used in this

press release, represented by the capitalized and defined terms

outlined below, are used by Spartan as key measures of financial

performance, and are not intended to represent operating profits

nor should they be viewed as an alternative to cash provided by

operating activities, net income or other measures of financial

performance calculated in accordance with IFRS Accounting

Standards.

The definitions below should be read in

conjunction with the “Non-GAAP Measures and Ratios” section of the

Company’s Management’s Discussion and Analysis dated November 5,

2024, which includes discussion of the purpose and composition of

the specified financial measures and detailed reconciliations to

the most directly comparable GAAP financial measures.

Operating Income and Operating

Netback

Operating Income, a non-GAAP financial measure,

is a useful supplemental measure that provides an indication of the

Company’s ability to generate cash from field operations, prior to

administrative overhead, financing, and other business expenses.

“Operating Income, before hedging” is calculated

by Spartan as oil and gas sales, net of royalties, plus processing

and other revenue, less operating and transportation expenses.

“Operating Income, after hedging” is calculated by

adjusting Operating Income for realized gains or losses on

derivative financial instruments including settlements on acquired

derivative financial instrument liabilities (together a non-GAAP

financial measure “Settlements on Commodity Derivative

Contracts”). The Company refers to Operating Income

expressed per unit of production as an “Operating

Netback” and reports the Operating Netback before and

after hedging, both of which are non-GAAP financial ratios. Spartan

considers Operating Netback an important measure to evaluate its

operational performance as it demonstrates its field level

profitability relative to current commodity prices.

Adjusted Funds Flow and Free Funds

Flow

Cash provided by operating activities is the

most directly comparable measure to Adjusted Funds Flow.

“Adjusted Funds Flow” is a non-GAAP financial

measure reconciled to cash provided by operating activities by

excluding changes in non-cash working capital, adding back

transaction costs on acquisitions and dispositions, and deducting

the principal portion of lease payments. Spartan utilizes Adjusted

Funds Flow as a key performance measure in the Company’s annual

financial forecasts and public guidance. Transaction costs, which

primarily include legal and financial advisory fees, regulatory and

other expenses directly attributable to execution of acquisitions

and dispositions, are added back because the Company’s definition

of Free Funds Flow excludes capital expenditures related to

acquisitions and dispositions. For greater clarity, incremental

overhead expenses related to ongoing integration and restructuring

post-acquisition are not adjusted and are included in Spartan’s

general and administrative expenses. Lease liabilities are not

included in Spartan’s definition of Net Debt therefore lease

payments are deducted in the period incurred to determine Adjusted

Funds Flow.

“Free Funds Flow” is a non-GAAP

financial measure calculated by Spartan as Adjusted Funds Flow less

Capital Expenditures before A&D. Spartan believes Free Funds

Flow provides an indication of the amount of funds the Company has

available for future capital allocation decisions such as to repay

current and long-term debt, reinvest in the business or return

capital to shareholders.

Adjusted Funds Flow per

share

Adjusted Funds Flow (“AFF”) per

share is a non-GAAP financial ratio used by the Company as a key

performance indicator. AFF per share is calculated using the same

methodology as net income per share (“EPS”),

however the diluted weighted average common shares (“WA

Shares”) outstanding for AFF may differ from the diluted

weighted average determined in accordance with IFRS Accounting

Standards for purposes of calculating EPS due to non-cash items

that impact net income only. The dilutive impact of stock options

and share awards is more dilutive to AFF than EPS because the

number of shares deemed to be repurchased under the treasury stock

method is not adjusted for unrecognized share-based compensation

expense as it is non-cash (see also, “Share Capital”).

Capital Expenditures, before

A&D

“Capital Expenditures before

A&D” is a non-GAAP financial measure used by Spartan

to measure its capital investment level compared to the Company’s

annual budgeted capital expenditures for its organic drilling

program. It includes capital expenditures on exploration and

evaluation assets and property, plant and equipment, before

acquisitions and dispositions. The directly comparable GAAP measure

to Capital Expenditures before A&D is cash used in investing

activities.

Net Debt and Adjusted Working

Capital

References to “Net Debt”

includes long-term debt under Spartan’s revolving credit facility,

net of Adjusted Working Capital. Net Debt and Adjusted Working

Capital are both non-GAAP financial measures. “Adjusted

Working Capital” is calculated as current assets less

current liabilities, excluding derivative financial instrument

assets and liabilities, lease liabilities, and current debt (if

applicable). The Adjusted Working Capital deficit includes cash and

cash equivalents, restricted cash, accounts receivable, prepaid

expenses and deposits, accounts payable and accrued liabilities,

dividends payable, and the current portion of decommissioning

obligations.

Spartan uses Net Debt as a key performance

measure to manage the Company’s targeted debt levels. The Company

believes its presentation of Adjusted Working Capital and Net Debt

are useful as supplemental measures because lease liabilities and

derivative financial instrument assets and liabilities relate to

contractual obligations for future production periods. Lease

payments and cash receipts or settlements on derivative financial

instruments are included in Spartan’s reported Adjusted Funds Flow

in the production month to which the obligation relates to.

OTHER MEASUREMENTS

All dollar figures included herein are presented

in Canadian dollars, unless otherwise noted.

This press release contains various references

to the abbreviation “BOE” which means barrels of

oil equivalent. Where amounts are expressed on a BOE basis, natural

gas volumes have been converted to oil equivalence at six thousand

cubic feet (Mcf) per barrel (bbl). The term BOE may be misleading,

particularly if used in isolation. A BOE conversion ratio of six

thousand cubic feet per barrel is based on an energy equivalency

conversion method primarily applicable at the burner tip and does

not represent a value equivalency at the wellhead and is

significantly different than the value ratio based on the current

price of crude oil and natural gas. This conversion factor is an

industry accepted norm and is not based on either energy content or

current prices.

References to “oil” in this press release

include light crude oil and medium crude oil, combined. National

Instrument 51-101 – Standards of Disclosure for Oil and Gas

Activities (“NI 51-101”) includes condensate

within the product type of “natural gas liquids”. References to

“natural gas liquids” or “NGLs” include pentane, butane, propane,

and ethane. References to “gas” or “natural gas” relates to

conventional natural gas.

References to “liquids” includes crude oil,

condensate and NGLs.

ASSUMPTIONS FOR 2025

GUIDANCE

The significant assumptions used in the forecast

of Operating Netbacks and Adjusted Funds Flow for 2025 are

summarized below. These key performance measures expressed per BOE

are based on the calendar year average production guidance for 2025

of approximately 40,000 BOE/d.

|

2025 FINANCIAL GUIDANCE ($/BOE) |

|

|

Guidance |

|

Oil and gas sales |

|

|

30.57 |

|

|

Processing and other revenue |

|

|

0.25 |

|

|

Royalties |

|

|

(4.12 |

) |

|

Operating expenses |

|

|

(6.20 |

) |

|

Transportation expenses |

|

|

(2.11 |

) |

|

Operating Netback, before hedging |

|

|

18.39 |

|

|

Settlements on Commodity Derivative Contracts |

|

|

(0.10 |

) |

|

Operating Netback, after hedging |

|

|

18.29 |

|

|

General and administrative expenses |

|

|

(1.34 |

) |

|

Cash financing expenses |

|

|

(0.95 |

) |

|

Settlements of decommissioning obligations |

|

|

(0.18 |

) |

|

Lease payments |

|

|

(0.79 |

) |

|

Adjusted Funds Flow |

|

|

15.03 |

|

Changes in forecast commodity prices, exchange

rates, differences in the amount and timing of capital

expenditures, and variances in average production estimates can

have a significant impact on the key performance measures included

in Spartan’s guidance. The Company's actual results may differ

materially from these estimates. Holding all other assumptions

constant, a US$5/bbl increase (decrease) in the forecasted average

WTI crude oil price for 2025 would increase Adjusted Funds Flow by

approximately $10 million (decrease by $10 million). An increase

(decrease) of CA$0.25/GJ in the forecasted average AECO natural gas

price for 2025, holding the NYMEX-AECO basis differential and all

other assumptions constant, would increase Adjusted Funds Flow by

approximately $8 million (decrease by $8 million). Holding U.S.

dollar benchmark commodity prices and all other assumptions

constant, an increase (decrease) of $0.05 in the US$/CA$ exchange

rate would increase Adjusted Funds Flow by approximately $7 million

(decrease by $7 million). Assuming capital expenditures are

unchanged, the impact on Free Funds Flow would be equivalent to the

increase or decrease in Adjusted Funds Flow. An increase (decrease)

in Free Funds Flow will result in an equivalent decrease (increase)

in the forecasted Net Debt (Surplus).

SHARE CAPITAL

As of the date hereof, there are 174 million

Common Shares outstanding. Pro forma completion of the Equity

Offering, there will be 187 million Common Shares

outstanding. There are no preferred shares or special

preferred shares outstanding. The following securities are

outstanding as of the date of this press release: 3.5 million

restricted share awards; and 1.4 million stock options outstanding

with an average exercise price of $3.25 per Common Share and

average remaining term of 4.1 years.

FORWARD-LOOKING AND CAUTIONARY

STATEMENTS

Certain statements contained within this press

release constitute forward-looking statements within the meaning of

applicable Canadian securities legislation. All statements other

than statements of historical fact may be forward-looking

statements. Forward-looking statements are often, but not always,

identified by the use of words such as “anticipate”, “budget”,

“plan”, “endeavor”, “continue”, “estimate”, “evaluate”, “expect”,

“forecast”, “monitor”, “may”, “will”, “can”, “able”, “potential”,

“target”, “intend”, “consider”, “focus”, “identify”, “use”,

“utilize”, “manage”, “maintain”, “remain”, “result”, “cultivate”,

“could”, “should”, “believe” and similar expressions. Spartan

believes that the expectations reflected in such forward-looking

statements are reasonable as of the date hereof, but no assurance

can be given that such expectations will prove to be correct and

such forward-looking statements should not be unduly relied upon.

Without limitation, this press release contains forward-looking

statements pertaining to: the business plan, objectives, cost model

and strategy of Spartan; the completion of the Equity Offering, the

anticipated use of proceeds of the Equity Offering and the timing

of closing of the Equity Offering; the Company's 2025 capital

program, budget and guidance; continued optimization of its Deep

Basin asset, participation in the consolidation of the Deep Basin

fairway and advancing and accelerating its Duvernay strategy; the

Company’s drilling strategy in the Deep Basin; expected drilling

and completions in the Duvernay; Spartan’s strategies to deliver

strong operational performance and to generate significant

shareholder returns; the ability of the Company to achieve drilling

success consistent with management’s expectations; being well

positioned to take advantage of opportunities in the current

business environment; risk management activities, including

hedging; to continue pursuing immediate production optimization and

responsible future growth with organic drilling, and to continue to

execute on building an extensive position in the Duvernay.

The forward-looking statements and information

are based on certain key expectations and assumptions made by

Spartan, including, but not limited to, expectations and

assumptions concerning the business plan of Spartan, the timing of

and success of future drilling, development and completion

activities, the growth opportunities of Spartan’s Duvernay acreage,

the performance of existing wells, the performance of new wells,

the availability and performance of facilities and pipelines, the

geological characteristics of Spartan’s properties, the successful

application of drilling, completion and seismic technology,

prevailing weather conditions, prevailing legislation affecting the

oil and gas industry, prevailing commodity prices, price

volatility, future commodity prices, price differentials and the

actual prices received for the Company’s products, anticipated

fluctuations in foreign exchange and interest rates, impact of

inflation on costs, royalty regimes and exchange rates, the

application of regulatory and licensing requirements, the

availability of capital, labour and services, the creditworthiness

of industry partners, general economic conditions, and the ability

to source and complete acquisitions.

Although Spartan believes that the expectations

and assumptions on which such forward-looking statements and

information are based are reasonable, undue reliance should not be

placed on the forward-looking statements and information because

Spartan can give no assurance that they will prove to be correct.

By its nature, such forward-looking information is subject to

various risks and uncertainties, which could cause the actual

results and expectations to differ materially from the anticipated

results or expectations expressed. These risks and uncertainties

include, but are not limited to, fluctuations in commodity prices;

changes in industry regulations and legislation (including, but not

limited to, tax laws, royalties, and environmental regulations);

the risk that the new U.S. administration imposes tariffs on

Canadian goods, including crude oil and natural gas, and that such

tariffs (and/or the Canadian government’s response to such tariffs)

adversely affect the demand and/or market price for the Company’s

products and/or otherwise adversely affects the Company; changes in

the political landscape both domestically and abroad, wars

(including Russia’s military actions in Ukraine and the

Israel-Hamas conflict in Gaza), hostilities, civil insurrections,

foreign exchange or interest rates, increased operating and capital

costs due to inflationary pressures (actual and anticipated), risks

associated with the oil and gas industry in general, stock market

and financial system volatility, impacts of pandemics, the

retention of key management and employees, risks with respect to

unplanned third-party pipeline outages and risks relating to

inclement and severe weather events and natural disasters,

including fire, drought, and flooding, including in respect of

safety, asset integrity and shutting-in production.

Please refer to Spartan’s Management’s

Discussion and Analysis for the period ended September 30, 2024,

and annual information form for the year ended December 31, 2023,

for discussion of additional risk factors relating to the Company,

which can be accessed either on Spartan’s website at

www.spartandeltacorp.com or under Spartan’s SEDAR+ profile on

www.sedarplus.ca. Readers are cautioned not to place undue reliance

on this forward-looking information, which is given as of the date

hereof, and to not use such forward-looking information for

anything other than its intended purpose. Spartan undertakes no

obligation to update publicly or revise any forward-looking

information, whether as a result of new information, future events

or otherwise, except as required by law.

This press release contains future-oriented

financial information and financial outlook information

(collectively, "FOFI") about the Company's 2025

capital program, budget and guidance, Spartan's prospective results

of operations and production (including 2025 annualized production

of 40,000 BOE and targeted Duvernay production of 25,000 BOE/d),

Free Funds Flow, Adjusted Funds Flow, operating costs, Capital

Expenditures before A&D, Operating Netback, Net Debt,

annualized production, organic growth, capital efficiency

improvements and components thereof, all of which are subject to

the same assumptions, risk factors, limitations, and qualifications

as set forth in the above paragraphs. FOFI contained in this

document was approved by management as of the date of this document

and was provided for the purpose of providing further information

about Spartan's future business operations. Spartan and its

management believe that FOFI has been prepared on a reasonable

basis, reflecting management's best estimates and judgments, and

represent, to the best of management's knowledge and opinion, the

Company's expected course of action. However, because this

information is highly subjective, it should not be relied on as

necessarily indicative of future results. Spartan disclaims any

intention or obligation to update or revise any FOFI contained in

this document, whether as a result of new information, future

events or otherwise, unless required pursuant to applicable law.

Readers are cautioned that the FOFI contained in this document

should not be used for purposes other than for which it is

disclosed herein. Changes in forecast commodity prices, differences

in the timing of capital expenditures, and variances in average

production estimates can have a significant impact on the key

performance measures included in Spartan's 2025 guidance. The

Company's actual results may differ materially from these

estimates.

References in this press release to peak rates,

initial production rates, test rates, average 30-day production and

other short-term production rates are useful in confirming the

presence of hydrocarbons, however such rates are not determinative

of the rates at which such wells will commence production and

decline thereafter and are not indicative of long-term performance

or of ultimate recovery. While encouraging, readers are cautioned

not to place reliance on such rates in calculating the aggregate

production of Spartan. The Company cautions that such results

should be considered preliminary.

| ABBREVIATIONS |

| |

|

|

| A&D |

|

acquisitions and dispositions |

| bbl |

|

barrel |

| bbls/d |

|

barrels per day |

| BOE/d |

|

barrels of oil equivalent per day |

| CA$ or CAD |

|

Canadian dollar |

| GJ |

|

gigajoule |

| GJ/d |

|

gigajoule per day |

| mcf |

|

one thousand cubic feet |

| mcf/d |

|

one thousand cubic feet per day |

| Mbbls |

|

thousand barrels |

| MBOE |

|

thousand barrels of oil equivalent |

| MMbtu |

|

one million British thermal units |

| MMcf |

|

one million cubic feet |

| MM |

|

millions |

| $MM |

|

millions of dollars |

| US$ or USD |

|

United States dollar |

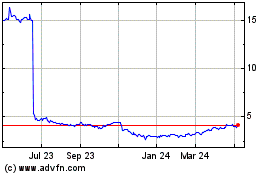

Spartan Delta (TSX:SDE)

Historical Stock Chart

From Feb 2025 to Mar 2025

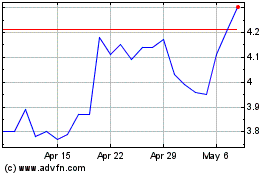

Spartan Delta (TSX:SDE)

Historical Stock Chart

From Mar 2024 to Mar 2025