Quebecor Media Inc. Announces Cash Tender Offer for All of its

Outstanding 7 3/4% Senior Notes Due March 15, 2016

MONTREAL, QUEBEC--(Marketwired - Mar 26, 2014) - Quebecor Media

Inc. ("Quebecor Media") today announced the commencement of a cash

tender offer (the "Tender Offer") to purchase any and all of its

outstanding 7 3/4% Senior Notes due March 15, 2016 (CUSIP

74819RAK2) (the "Notes"). The Tender Offer is being made pursuant

to an Offer to Purchase dated March 26, 2014 and the related Letter

of Transmittal.

Upon the terms and subject to the conditions described in the

Offer to Purchase and the Letter of Transmittal, Quebecor Media is

offering to purchase for cash any and all outstanding Notes.

Tenders of the Notes may be withdrawn at any time at or prior to

5:00 p.m., New York City time, on April 8, 2014, unless extended or

earlier terminated (such date and time, as the same may be extended

or earlier terminated, the "Withdrawal Date"), but may not be

withdrawn thereafter. The Tender Offer will expire at 12:01 a.m.,

New York City time, on April 24, 2014 unless extended or earlier

terminated (such date and time, as the same may be extended or

earlier terminated, the "Expiration Date").

The consideration for each US$1,000.00 principal amount of Notes

validly tendered and accepted for purchase pursuant to the Tender

Offer will be US$972.50 (the "Tender Offer Consideration"), subject

to the terms and conditions of the Tender Offer. Holders of Notes

that are validly tendered at or prior to 5:00 p.m., New York City

time, on April 8, 2014, unless extended or earlier terminated (such

date and time, as the same may be extended or earlier terminated,

the "Early Participation Date") will, subject to the terms and

conditions of the Tender Offer, receive the Tender Offer

Consideration plus US$30.00 (the "Early Participation Amount") for

each US$1,000.00 principal amount of Notes purchased pursuant to

the Tender Offer. Holders of Notes tendered after the Early

Participation Date but at or prior to the Expiration Date will,

subject to the terms and conditions of the Tender Offer, receive

the Tender Offer Consideration, but not the Early Participation

Amount, for each US$1,000.00 principal amount of Notes purchased

pursuant to the Tender Offer. In addition, all holders of Notes

accepted for purchase in the Tender Offer will also receive accrued

and unpaid interest on such purchased Notes from the last interest

payment date up to, but not including, the payment date.

The Tender Offer is not conditioned on any minimum amount of

Notes being tendered. However, Quebecor Media's obligation to

accept for purchase and to pay for the Notes pursuant to the Tender

Offer is subject to the satisfaction or waiver of a number of

conditions, including the completion by Videotron Ltd.

("Videotron"), a wholly-owned subsidiary of Quebecor Media, on or

prior to the Expiration Date, of a financing transaction, on terms

reasonably satisfactory to Videotron, pursuant to which Videotron

receives aggregate gross proceeds of no less than US$500 million

(or the equivalent in other currencies), exclusive of fees,

expenses and discounts. The Tender Offer may be amended, extended

or terminated. Following consummation of the Tender Offer, the

Notes that are purchased in the Tender Offer will be retired and

cancelled and no longer remain outstanding obligations.

Notes that are tendered and accepted for purchase at or prior to

the Early Participation Date will be settled only on the date that

we refer to as the "Early Payment Date", which will promptly follow

the Early Participation Date. Quebecor Media anticipates that the

Early Payment Date for the Notes will be within two business days

following the Early Participation Date. Notes that are tendered and

accepted for purchase after the Early Participation Date but before

the Expiration Date will be settled only on the date that we refer

to as the "Final Payment Date", which will promptly follow the

Expiration Date. Quebecor Media anticipates that the Final Payment

Date for the Notes will be within two business days following the

Expiration Date. If no additional Notes are tendered after the

Early Participation Date and/or if the Tender Offer is fully

subscribed as of the Early Participation Date, there will be no

Final Payment Date.

None of Quebecor Media or its board of directors, the dealer

managers or the tender and information agent, or the trustee for

the Notes makes any recommendation that holders tender or refrain

from tendering all or any portion of the principal amount of their

Notes, and no one has been authorized by us or any of them to make

such a recommendation. Holders must make their own decision as to

whether to tender their Notes, and, if so, the principal amount of

Notes to tender.

All the Notes are held in book-entry form through the facilities

of The Depository Trust Company. If you hold Notes through a

broker, dealer, bank, trust company or other intermediary or

nominee (an "Intermediary"), you must contact such Intermediary if

you wish to tender Notes in the Tender Offer. You should check with

such Intermediary to determine whether such Intermediary will

charge you a fee for tendering Notes on your behalf. You should

also confirm with the Intermediary any deadlines by which you must

provide your tender instructions, because the relevant deadline set

by such Intermediary will be earlier than the deadlines set forth

herein.

Quebecor Media has retained BofA Merrill Lynch and Citigroup to

serve as dealer managers for the Tender Offer, and Global

Bondholder Services Corporation to serve as the tender and

information agent for the Tender Offer.

For additional information regarding the terms of the Tender

Offer, please contact BofA Merrill Lynch at (888) 292-0070 (toll

free) or (980) 388-3646 (collect) or Citigroup at (800) 558-3745

(toll free) or (212) 723-6106. Requests for a copy of the Offer to

Purchase and the Letter of Transmittal relating to the Notes, and

questions regarding the tender of the Notes may be directed to

Global Bondholder Services Corporation at (866) 470-4200 (toll

free) or (212) 430-3774 (collect).

This announcement does not constitute an offer to buy or

sell, or the solicitation of an offer to buy or sell securities in

any jurisdiction or in any circumstances in which such offer or

solicitation is unlawful. In those jurisdictions where the

securities laws require the Tender Offer to be made by a licensed

broker or dealer, the Tender Offer will be deemed to be made by the

Dealer Managers or one or more registered brokers or dealers

licensed under the laws of such jurisdiction. The securities

mentioned herein have not been registered under the United States

Securities Act of 1933 or applicable state securities laws, and the

securities may not be offered or sold in the United States absent

registration or an applicable exemption from registration. The

securities mentioned herein have not been and will not be qualified

for sale to the public under applicable Canadian securities laws

and, accordingly, any offer and sale of the securities in Canada

will be made on a basis which is exempt from the prospectus and

dealer registration requirements of such securities laws.

About Quebecor Media

Quebecor, a Canadian telecommunications, entertainment and news

media leader, is one of the best-performing integrated

communications companies in the industry. Driven by their

determination to deliver the best possible customer experience, all

of Quebecor's subsidiaries and brands are differentiated by their

high-quality, multiplatform, convergent products and services.

Quebecor (TSX:QBR.A)(TSX:QBR.B) is firmly based in Québec. It

holds a 75.36% interest in Quebecor Media, which employs more than

15,000 people in Canada.

A family business founded in 1950, Quebecor is strongly

committed to the community. Every year, it actively supports people

working with more than 400 organizations in the vital fields of

culture, health, education, the environment and

entrepreneurship.

Visit our website: www.quebecor.com

Follow us on Twitter: www.twitter.com/QuebecorMedia

Forward-Looking Statements

This news release contains "forward-looking information" within

the meaning of applicable Canadian securities legislation and

"forward-looking statements" within the meaning of United States

federal securities legislation (collectively, "forward-looking

statements"). All statements other than statements of historical

facts included in this press release, including statements

regarding our industry and our prospects, plans, financial position

and business strategy, may constitute forward-looking statements.

These forward-looking statements are based on current expectations,

estimates, forecasts and projections about the industries in which

we operate as well as beliefs and assumptions made by our

management. Such statements include, in particular, statements

about our plans, prospects, financial position and business

strategies. Words such as "may," "will," "expect," "continue,"

"intend," "estimate," "anticipate," "plan," "foresee," "believe" or

"seek" or the negatives of these terms or variations of them or

similar terminology are intended to identify such forward-looking

statements. Although we believe that the expectations reflected in

these forward-looking statements are reasonable, these statements,

by their nature, involve risks and uncertainties and are not

guarantees of future performance. Such statements are also subject

to assumptions concerning, among other things: our anticipated

business strategies; anticipated trends in our business;

anticipated reorganizations of any of our segments or businesses,

and any related restructuring provisions or impairment charges; and

our ability to continue to control costs. We can give no assurance

that these estimates and expectations will prove to have been

correct. Actual outcomes and results may, and often do, differ from

what is expressed, implied or projected in such forward-looking

statements, and such differences may be material. For additional

information regarding some important factors that could cause

actual results to differ materially from those expressed in these

forward-looking statements and other risks and uncertainties, and

the assumptions underlying the forward-looking statements, you are

encouraged to read "Item 3. Key Information - Risk Factors" as well

as statements located elsewhere in Quebecor Media's annual report

on Form 20-F for the year ended December 31, 2013. Each of these

forward-looking statements speaks only as of the date of this press

release. We will not update these statements unless applicable

securities laws require us to do so.

Jean-Francois PruneauSenior Vice President and Chief Financial

OfficerQuebecor Media514-380-4144

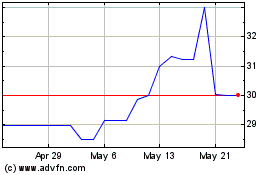

Quebecor (TSX:QBR.A)

Historical Stock Chart

From Jun 2024 to Jul 2024

Quebecor (TSX:QBR.A)

Historical Stock Chart

From Jul 2023 to Jul 2024