Quebecor Media Inc. Prices Offering of US$850 Million Senior Notes Due 2023 and C$500 Million Senior Notes Due 2023

October 03 2012 - 8:43PM

Marketwired

Quebecor Media Inc. today announced the pricing of its new issuance

of US$850 million aggregate principal amount of 5 3/4% Senior Notes

due 2023 (the "US$ Notes") and C$500 million aggregate principal

amount of 6 5/8% Senior Notes due 2023 (the "C$ Notes" and,

together with the US$ Notes, the "notes"). The notes will be sold

at par. The US$ Notes will carry a coupon of 5 3/4% and will mature

on January 15, 2023 and the C$ Notes will carry a coupon of 6 5/8%

and will mature on January 15, 2023. Quebecor Media intends to use

the proceeds of this offering to finance: (i) the repurchase for

cancellation from CDP Capital d'Amerique Investissements inc. ("CDP

Capital"), a subsidiary of Caisse de depot et placement du Quebec,

of approximately 20,351,307 common shares of Quebecor Media

(representing approximately 36.4% of CDP Capital's interest in

Quebecor Media), for an aggregate purchase price of $1 billion,

payable in cash, as part of the previously announced equity

transactions with CDP Capital; (ii) the repayment of a portion of

Quebecor Media's issued and outstanding 7 3/4% Senior Notes due

2016 issued in 2007; and, (iii) in each case, for the payment of

related transaction fees and expenses and, if applicable, to

finance the settlement and termination of related hedging

contracts.

The success of the offering which was aimed at completing a

strategic acquisition by Quebecor Media clearly demonstrates the

support of its investor's base established over the years. In fact,

this particular transaction represented the largest ever, in terms

of value, completed by Quebecor Media in the Canadian and U.S. High

Yield markets.

Any redemption of the 7 3/4 % Senior Notes due 2016 will be made

pursuant to a notice of redemption under the indenture governing

such notes.

This press release is not an offer to sell or the solicitation

of an offer to buy securities in any jurisdiction. The notes

mentioned herein have not been registered under the United States

Securities Act of 1933 or applicable state securities laws, and the

notes may not be offered or sold in the United States absent

registration or an applicable exemption from registration. The

notes have not been and will not be qualified for sale to the

public under applicable Canadian securities laws and, accordingly,

any offer and sale of the notes in Canada will be made on a basis

which is exempt from the prospectus and dealer registration

requirements of such securities laws.

About Quebecor Media Inc.

Quebecor Media Inc. is a subsidiary of Quebecor Inc. (TSX:QBR.A)

(TSX:QBR.B), one of Canada's most important holding companies

operating in the telecommunications and media businesses. With more

than 16,000 employees, Quebecor Media Inc., through its subsidiary

Videotron Ltd., is an integrated communications company engaged in

cable television, interactive multimedia development, Internet

access services, cable telephone services and mobile telephone

services. Through Sun Media Corporation, Quebecor Media Inc. is the

largest publisher of newspapers in Canada. It also operates

Canoe.ca and its network of English and French language Internet

properties in Canada. In the broadcasting sector, Quebecor Media

Inc. operates, through TVA Group Inc., the number one French

language general interest television network in Quebec, a number of

specialty channels and the SUN News English language channel.

Another subsidiary of Quebecor Media Inc., Nurun Inc., is a major

interactive technologies and communications agency with offices in

Canada, the United States, Europe and Asia. Quebecor Media Inc. is

also active in magazine publishing (TVA Publishing Inc.), book

publishing and distribution (Sogides Group Inc. and CEC Publishing

Inc.), the production, distribution and retailing of cultural

products (Archambault Group Inc. and TVA Films), video game

development (BlooBuzz Studios Inc.), DVD, Blu-ray disc and

videogame rental and retailing (Le SuperClub Videotron Ltd), the

printing and distribution of regional newspapers and flyers

(Quebecor Media Printing Inc. and Quebecor Media Network Inc.),

news content production and distribution (QMI Agency),

multiplatform advertising solutions (QMI Sales) and the publishing

of printed and online directories, through Quebecor

MediaPages(TM).

Forward-Looking Statements

The statements in this press release that are not historical

facts are forward-looking statements and are subject to significant

known and unknown risks, uncertainties and assumptions which could

cause Quebecor Media's actual results for future periods to differ

materially from those set forth in the forward-looking statements.

Forward-looking statements may be identified by the use of the

conditional or by forward-looking terminology such as the terms

"plans," "expects," "may," "anticipates," "intends," "estimates,"

"projects," "seeks," "believes" or similar terms, variations of

such terms or the negative of such terms. Certain factors that may

cause actual results to differ from current expectations include

seasonality (including seasonal fluctuations in customer orders),

operating risk (including fluctuations in demand for Quebecor

Media's products and pricing actions by competitors), insurance

risk, risks associated with capital investment (including risks

related to technological development and equipment availability and

breakdown), environmental risks, risks associated with labour

agreements, risks associated with commodities and energy prices

(including fluctuations in the cost and availability of raw

materials), credit risk, financial risks, debt risks, risks related

to interest rate fluctuations, foreign exchange risks, risks

associated with government acts and regulations, risks related to

changes in tax legislation, and changes in the general political

and economic environment. Investors and others are cautioned that

the foregoing list of factors that may affect future results is not

exhaustive and that undue reliance should not be placed on any

forward-looking statements. For more information on the risks,

uncertainties and assumptions that could cause Quebecor Media's

actual results to differ from current expectations, please refer to

Quebecor Media's public filings available at www.edgar.com and

www.quebecor.com including, in particular, the "Item 3. Key

Information - Risk Factors" as well as statements located elsewhere

in Quebecor Media's annual report on Form 20-F for the year ended

December 31, 2011.

The forward-looking statements in this press release reflect

Quebecor Media's expectations as of October 3, 2012, and are

subject to change after that date. Quebecor Media expressly

disclaims any obligation or intention to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by applicable

securities laws.

Contacts: Jean-Francois Pruneau Chief Financial Officer Quebecor

Media Inc. (514) 380-4144 Martin Tremblay Vice President, Public

Affairs Quebecor Media Inc. (514) 380-1985

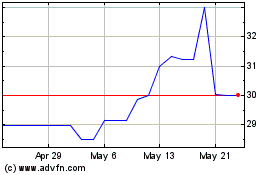

Quebecor (TSX:QBR.A)

Historical Stock Chart

From Jun 2024 to Jul 2024

Quebecor (TSX:QBR.A)

Historical Stock Chart

From Jul 2023 to Jul 2024