PolyMet Mining Corp. (TSX: POM)(NYSE Amex: PLM) ("PolyMet" or the

"Company") today reported its financial results for the three

months ended April 30, 2011, which have been filed at

www.polymetmining.com and on SEDAR and EDGAR.

The Canadian Accounting Standards Board requires all public

companies to adopt International Financial Reporting Standards

("IFRS") for interim and annual financial statements relating to

fiscal years beginning on or after January 1, 2011. These are

PolyMet's first condensed interim consolidated financial statements

prepared in accordance with IFRS. All amounts are in U.S.

funds.

PolyMet controls 100% of the development-stage NorthMet

copper-nickel-precious metals ore-body and the nearby Erie Plant,

located near Hoyt Lakes in the established mining district of the

Mesabi Iron Range in northeastern Minnesota.

Financial Highlights

-- Reconciliation from Canadian GAAP to IFRS: The most significant changes

relate to the Asset Retirement Obligation. Under IFRS, the future

obligation is discounted using a liability specific risk-free interest

rate as opposed to a higher, company credit adjusted risk-free interest

rate. The affect of this is to increase the book value of the Erie Plant

with a slightly larger increase in the long-term environmental liability

at the time of the acquisition - the difference being a larger accretion

expense. The fair value of the convertible debt and slightly different

accounting for subsequent extension of the term of the debt also cause

minor some changes. The net affect is to reduce total equity at January

31, 2011 by $0.323 million to $102.295 million and to increase the total

comprehensive loss in the year ended January 31, 2011 by $0.401 million

to $7.761 million.

-- At April 30, 2011 PolyMet had cash and cash equivalents of $5.909

million compared with $10.361 million at January 31, 2011. In November

2010, Glencore AG ("Glencore") agreed to purchase 15 million shares of

PolyMet common stock at $2.00 per share for gross net proceeds of $30

million. The first tranche of this private placement, comprising 5

million shares, closed on January 17, 2011. The second tranche of 5

million shares is scheduled to close on or before October 17, 2011 and

the final tranche of 5 million shares is scheduled to close on or before

October 15, 2012.

-- During the three months ended April 30, 2011, PolyMet made scheduled

repayments of $0.5 million notes payable to Cliffs Natural Resources,

Inc. related to the acquisition of the Erie Plant.

-- Loss for the three months ended April 30, 2011 was $1.319 million

compared with $0.918 million in the prior year period. General and

administrative expenses were $1.183 million compared with $0.851 million

for the prior year period. Excluding non-cash stock-based compensation,

general and administrative expense was $0.647 million compared with

$0.841 million for the prior period, reflecting the Company's continued

cost-cutting efforts during the past year.

-- PolyMet invested $2.914 million into its NorthMet project during the

three months ended April 30, 2011, compared with $4.775 million in the

prior year period. As of April 30, 2011 PolyMet had spent $33.648

million on environmental review and permitting, of which $27.223 million

has been spent since the NorthMet project moved from exploration to

development stage.

Douglas Newby, PolyMet's Chief Financial Officer stated, "The

transition to IFRS has gone smoothly and I am pleased that we have

completed these interim statements ahead of the regulatory

schedule. I believe that we have taken the necessary actions to

ensure that we comply with reporting timelines in the future.

"We expect to finalize timing of the second tranche of the

November 2010 private placement with Glencore imminently," he

continued.

Key Statistics - unaudited

(in '000 US dollars, except per share amounts)

---------------------------------------------------------------------------

Balance Sheet April 30, 2011 January 31, 2011

---------------------------------------

Cash and equivalents 5,909 10,361

Working capital 693 4,199

Total assets 155,975 156,614

Long term liabilities 43,773 43,717

Shareholders' equity 102,172 102,295

---------------------------------------------------------------------------

Three months ended

April 30,

---------------------------------------

Income Statement 2011 2010

---------------------------------------

General and administrative

(expense) (1,183) (851)

Other income (loss) (136) (67)

Income (loss) (1,319) (918)

Income (loss) per share (0.01) (0.01)

---------------------------------------------------------------------------

Investing Activities

NorthMet Property 2,914 4,775

---------------------------------------------------------------------------

Weighted average shares outstanding 154,913,235 148,989,218

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Minnesota State Government

Most State of Minnesota government functions ceased operations

on July 1, 2011 owing to a budget impasse between the Governor and

the Minnesota Legislature. This shutdown has placed a temporary

halt on the work of the Minnesota Department of Natural Resources

("MDNR"), which is the lead State agency responsible for PolyMet's

Supplemental Draft Environmental Impact Statement (SDEIS).

The federal co-lead agencies, the US Army Corps of Engineers and

the US Forest Service, are providing oversight for the EIS process.

The third party contractor responsible for drafting the SDEIS is

continuing to work during the shutdown, as will PolyMet's EIS

contractors. PolyMet expects that the SDEIS process will continue

to advance, although a prolonged state shutdown could affect the

timing of completion of the SDEIS.

About PolyMet

PolyMet Mining Corp. (www.polymetmining.com) is a

publicly-traded mine development company that controls 100% of the

NorthMet copper-nickel-precious metals ore body through a long-term

lease and owns 100% of the Erie Plant, a large processing facility

located approximately six miles from the ore body in the

established mining district of the Mesabi Range in northeastern

Minnesota. PolyMet Mining Corp. has completed its Definitive

Feasibility Study and is seeking environmental and operating

permits to enable it to commence production. The NorthMet project

is expected to require approximately one-and-a-quarter million

hours of construction labor and create approximately 360 long-term

jobs, a level of activity that will have a significant multiplier

effect in the local economy.

POLYMET MINING CORP.

Joe Scipioni, CEO

This news release contains certain forward-looking statements

concerning anticipated developments in PolyMet's operations in the

future. Forward-looking statements are frequently, but not always,

identified by words such as "expects," "anticipates," "believes,"

"intends," "estimates," "potential," "possible," "projects,"

"plans," and similar expressions, or statements that events,

conditions or results "will," "may," "could," or "should" occur or

be achieved or their negatives or other comparable words. These

forward-looking statements may include statements regarding our

beliefs related to the expected proceeds and closing of the

registered direct offering, exploration results and budgets,

reserve estimates, mineral resource estimates, work programs,

capital expenditures, actions by government authorities, including

changes in government regulation, the market price of natural

resources, costs, or other statements that are not a statement of

fact. Forward-looking statements address future events and

conditions and therefore involve inherent risks and uncertainties.

Actual results may differ materially from those in the

forward-looking statements due to risks facing PolyMet or due to

actual facts differing from the assumptions underlying its

predictions. PolyMet's forward-looking statements are based on the

beliefs, expectations and opinions of management on the date the

statements are made, and PolyMet does not assume any obligation to

update forward-looking statements if circumstances or management's

beliefs, expectations and opinions should change.

Specific reference is made to PolyMet's most recent Annual

Report on Form 20-F for the fiscal year ended January 31, 2011 and

in our other filings with Canadian securities authorities and the

Securities and Exchange Commission, including our Report on Form

6-K providing information with respect to our operations for the

year ended January 31, 2011 for a discussion of some of the risk

factors and other considerations underlying forward-looking

statements.

The TSX has not reviewed and does not accept responsibility for

the adequacy or accuracy of this release.

Contacts: PolyMet Mining Corp. - Corporate Douglas Newby Chief

Financial Officer +1 (212) 867-1834 dnewby@polymetmining.com

PolyMet Mining Corp. - Media LaTisha Gietzen VP Public, Gov't &

Environmental Affairs +1 (218) 225-4417 +1 (218) 225-4429 (FAX)

lgietzen@polymetmining.com PolyMet Mining Corp. - Investors Crystal

Agresti +1 (845) 742-8153 cagresti@polymetmining.com PolyMet Mining

Corp. Alex Macdougall +1 (226) 663-3000

amacdougall@polymetmining.com www.polymetmining.com

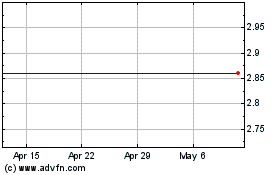

Polymet Mining (TSX:POM)

Historical Stock Chart

From Jun 2024 to Jul 2024

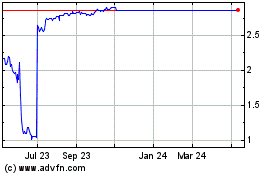

Polymet Mining (TSX:POM)

Historical Stock Chart

From Jul 2023 to Jul 2024