Federal Court of Australia Orders Convening of

Scheme Meeting and Dispatch of Scheme Booklet

Newmont Corporation (NYSE: NEM, TSX: NGT) has announced a

special meeting of stockholders and the filing of its definitive

proxy statement in connection with the Company’s proposed

acquisition of Newcrest Mining Limited (ASX, TSX, PNGX: NCM) by way

of a Scheme of Arrangement (“Scheme”). Newmont notified

stockholders that the meeting will take place virtually on

Wednesday, October 11, 2023, at 8:00 a.m. Mountain Daylight

Time.

Newmont stockholders will be asked to vote on, among other

proposals, the issuance of shares of Newmont common stock in

connection with the Scheme. Newmont’s Board of Directors

unanimously recommends that Newmont stockholders vote in favor of

each of the proposals that are included in the definitive proxy

statement.

Newcrest also announced that the Federal Court of Australia has

made orders:

- That Newcrest convene a meeting of Newcrest shareholders to

consider and vote on the Scheme (“Scheme Meeting”); and

- Approving the dispatch of an explanatory statement providing

information about the Scheme, together with the notice of Scheme

Meeting (together, the “Scheme Booklet”), to Newcrest

shareholders.

Newcrest’s shareholder vote will be held in person and online on

Friday, October 13, 2023, at 10:30 a.m. Australian Eastern Daylight

Time.

“Once approved, Newmont and Newcrest shareholders will own an

unmatched portfolio of gold and copper assets, including 10 Tier 1

operations, each with the scale, mine life and cost profile to

sustain profitable production and best-in-class sustainability

performance decades into the future,” said Tom Palmer, Newmont’s

President and Chief Executive Officer.

On May 14, Newmont announced its definitive agreement to acquire

Newcrest. The combination would create a world-class portfolio of

assets with the highest concentration of Tier 1 operations,

primarily in favorable, low-risk mining jurisdictions. Upon closing

of the transaction, the combined company would deliver a

multi-decade production profile from 10 large, long-life, low cost,

Tier 1 operations, and increased annual copper production primarily

from Australia and Canada. The combined business is anticipated to

generate annual pre-tax synergies of $500 million, expected to be

achieved within the first 24 months, while also targeting at least

$2 billion in cash improvements through portfolio optimization in

the first two years after closing.1

About Newmont

Newmont is the world’s leading gold company and a producer of

copper, silver, zinc and lead. The Company’s world-class portfolio

of assets, prospects and talent is anchored in favorable mining

jurisdictions in North America, South America, Australia and

Africa. Newmont is the only gold producer listed in the S&P 500

Index and is widely recognized for its principled environmental,

social and governance practices. The Company is an industry leader

in value creation, supported by robust safety standards, superior

execution and technical expertise. Newmont was founded in 1921 and

has been publicly traded since 1925.

At Newmont, our purpose is to create value and improve lives

through sustainable and responsible mining. To learn more about

Newmont’s sustainability strategy and initiatives, go to

www.newmont.com.

Additional Information about the Transaction and Where to

Find It

This communication is not an offer to purchase or exchange, nor

a solicitation of an offer to sell securities of Newmont

Corporation (“Newmont”) or Newcrest Mining Limited (“Newcrest”) nor

the solicitation of any vote or approval in any jurisdiction nor

shall there be any such issuance or transfer of securities of

Newmont or Newcrest in any jurisdiction in contravention of

applicable law. This communication is being made in respect of the

transaction involving Newmont and Newcrest pursuant to the terms of

a scheme implementation deed dated May 15, 2023, as amended by a

letter dated September 4, 2023 (the “Scheme Implementation Deed”)

by and among Newmont, Newmont Overseas Holdings Pty Ltd, an

Australian proprietary company limited by shares, an indirect

wholly owned subsidiary of Newmont, and Newcrest and may be deemed

to be soliciting material relating to the transaction. In

furtherance of the pending transaction and subject to future

developments, Newmont filed a definitive proxy statement with the

Securities and Exchange Commission (the “SEC”) on September 5, 2023

and may file other documents with the SEC. This communication is

not a substitute for the proxy statement, the scheme booklet or

other document Newmont or Newcrest has filed or may file with the

SEC or Australian regulators in connection with the pending

transaction. INVESTORS AND SECURITY HOLDERS OF NEWMONT AND NEWCREST

ARE URGED TO READ THE PROXY STATEMENT, SCHEME BOOKLET AND OTHER

DOCUMENTS FILED WITH THE SEC CAREFULLY IN THEIR ENTIRETY BEFORE

MAKING ANY VOTING OR INVESTMENT DECISION WITH RESPECT TO THE

TRANSACTION AS THEY DO AND WILL CONTAIN IMPORTANT INFORMATION ABOUT

THE PENDING TRANSACTION AND THE PARTIES TO THE TRANSACTION. The

definitive proxy statement will be mailed to Newmont stockholders.

Investors and security holders may obtain a free copy of the proxy

statement, the filings with the SEC that were or will be

incorporated by reference into the proxy statement and other

documents containing important information about the transaction

and the parties to the transaction, filed by Newmont with the SEC

at the SEC’s website at www.sec.gov. The disclosure documents and

other documents that are filed with the SEC by Newmont may also be

obtained on

https://www.newmont.com/investors/reports-and-filings/default.aspx

or by contacting Newmont’s Investor Relations department at

Daniel.Horton@newmont.com or by calling 303-837-5484.

Participants in the Transaction Solicitation

Newmont, Newcrest and certain of their respective directors and

executive officers and other employees may be deemed to be

participants in any solicitation of proxies from Newmont

shareholders in respect of the pending transaction between Newmont

and Newcrest. Information regarding Newmont’s directors and

executive officers is available in its Annual Report on Form 10-K

for the year ended December 31, 2022, filed with the SEC on

February 23, 2023, as updated by the current report on Form 8-K,

filed with the SEC on July 20, 2023, and its proxy statement for

its 2023 Annual Meeting of Stockholders, which was filed with the

SEC on March 10, 2023. Information about Newcrest’s directors and

executive officers is set forth in Newcrest’s latest annual

financial report dated August 11, 2023, as updated from time to

time via announcements made by Newcrest on the Australian

Securities Exchange (“ASX”). Additional information regarding the

interests of these participants in such proxy solicitation and a

description of their direct and indirect interests, by security

holdings or otherwise, are contained in the definitive proxy

statement filed with the SEC on September 5, 2023 and other

relevant materials that have been or will be filed with the SEC in

connection with the pending transaction.

Cautionary Statement Regarding Forward-Looking

Statements

This communication contains “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, which are intended to be covered by the safe harbor

created by such sections and other applicable laws and

“forward-looking information” within the meaning of applicable

Australian securities laws. Where a forward-looking statement

expresses or implies an expectation or belief as to future events

or results, such expectation or belief is expressed in good faith

and believed to have a reasonable basis. However, such statements

are subject to risks, uncertainties and other factors, which could

cause actual results to differ materially from future results

expressed, projected or implied by the forward-looking statements.

Forward-looking statements often address our expected future

business and financial performance and financial condition; and

often contain words such as “anticipate,” “intend,” “plan,” “will,”

“would,” “estimate,” “expect,” “pending,” “proposed” or

“potential.” Forward-looking statements may include, without

limitation, statements relating to (i) the pending transaction to

acquire the share capital of Newcrest, timing and closing of the

pending transaction, including receipt of required approvals and

satisfaction of other customary closing conditions; (ii) estimates

of expected synergies; (iii) estimates of expected incremental cash

flow generation and portfolio optimization opportunities; and (iv)

other expectations regarding the combined business.

Estimates or expectations of future events or results are based

upon certain assumptions, which may prove to be incorrect. Risks

relating to forward looking statements in regard to the combined

business and future performance may include, but are not limited

to, gold and other metals price volatility, currency fluctuations,

operational risks, increased production costs and variances in ore

grade or recovery rates from those assumed in mining plans,

political risk, community relations, conflict resolution,

governmental regulation and judicial outcomes and other risks. In

addition, material risks that could cause actual results to differ

from forward-looking statements include: the inherent uncertainty

associated with financial or other projections; the prompt and

effective integration of Newmont’s and Newcrest’s businesses and

the ability to achieve the anticipated synergies and value-creation

contemplated by the pending transaction; the risk associated with

Newmont’s and Newcrest’s ability to obtain the approval of the

pending transaction by their shareholders required to consummate

the pending transaction and the timing of the closing of the

pending transaction, including the risk that the conditions to the

pending transaction are not satisfied on a timely basis or at all

and the failure of the pending transaction to close for any other

reason; the risk that a consent or authorization that may be

required for the pending transaction is not obtained or is obtained

subject to conditions that are not anticipated; the outcome of any

legal proceedings that may be instituted against the parties and

others related to the Scheme Implementation Deed; unanticipated

difficulties or expenditures relating to the pending transaction,

the response of business partners and retention as a result of the

announcement and pendency of the transaction; risks relating to the

value of the scheme consideration to be issued in connection with

the pending transaction; the anticipated size of the markets and

continued demand for Newmont’s and Newcrest’s resources and the

impact of competitive responses to the announcement of the

transaction; and the diversion of management time on pending

transaction-related issues. For a more detailed discussion of such

risks and other factors, see Newmont’s Annual Report on Form 10-K

for the year ended December 31, 2022, filed with the SEC on

February 23, 2023, as updated by the current report on Form 8-K,

filed with the SEC on July 20, 2023, as well as Newmont’s other SEC

filings, including the definitive proxy statement, filed with the

SEC on September 5, 2023, available on the SEC website or

www.newmont.com. Newcrest’s most recent annual financial report for

the fiscal year ended June 30, 2023 as well as Newcrest’s other

filings made with Australian securities regulatory authorities are

available on ASX (www.asx.com.au) or www.newcrest.com. Newmont and

Newcrest do not undertake any obligation to release publicly

revisions to any “forward-looking statement,” including, without

limitation, outlook, to reflect events or circumstances after the

date of this communication, or to reflect the occurrence of

unanticipated events, except as may be required under applicable

securities laws. Investors should not assume that any lack of

update to a previously issued “forward-looking statement”

constitutes a reaffirmation of that statement. Continued reliance

on “forward-looking statements” is at investors’ own risk.

Synergies and value creation as used herein are management

estimates provided for illustrative purposes and should not be

considered a GAAP or non-GAAP financial measure. Synergies

represent management’s combined estimate of pre-tax synergies,

supply chain efficiencies and Full Potential improvements, as a

result of the integration of Newmont’s and Newcrest’s businesses

that have been monetized for the purposes of the estimation.

Because synergies estimates reflect differences between certain

actual costs incurred and management estimates of costs that would

have been incurred in the absence of the integration of Newmont’s

and Newcrest’s businesses, such estimates are necessarily imprecise

and are based on numerous judgments and assumptions. Synergies are

“forward-looking statements” subject to risks, uncertainties and

other factors which could cause actual value creation to differ

from expected or past synergies.

As used herein, Tier 1 / World-class asset is defined as +500k

GEO’s/year consolidated, average AISC/oz in the lower half of the

industry cost curve and a mine life >10 years in countries that,

on average, are classified in the A and B rating ranges by Moody’s,

S&P or Fitch.

1 See cautionary statement for additional information.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230907620317/en/

Media Contact Omar Jabara

720.212.9651 omar.jabara@newmont.com

Investor Contact Daniel Horton

303.837.5468 daniel.horton@newmont.com

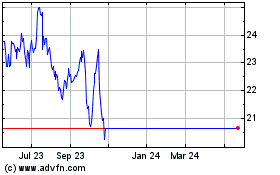

Newcrest Mining (TSX:NCM)

Historical Stock Chart

From Jan 2025 to Feb 2025

Newcrest Mining (TSX:NCM)

Historical Stock Chart

From Feb 2024 to Feb 2025