Maxim Power Corp. Announces Second Quarter 2010 Results

August 11 2010 - 6:46PM

Marketwired Canada

Maxim Power Corp. ("MAXIM" or the "Corporation") (TSX:MXG) announced today that

it released its financial and operating results for the second quarter of 2010.

The unaudited consolidated financial statements, accompanying notes and

Management's Discussion and Analysis ("MD&A") will be available on SEDAR and

MAXIM's website on August 12, 2010. All figures reported herein are in Canadian

dollars unless otherwise stated.

FINANCIAL HIGHLIGHTS

----------------------------------------------------------------------------

Three Months Ended Six Months Ended

June 30, June 30,

2010 2009 2010 2009

----------------------------------------------------------------------------

($ in thousands except per share

amounts)

Revenue $ 32,659 $ 18,856 $ 83,432 $ 74,132

Adjusted EBITDA (1) 10,345 713 22,275 18,148

Net income (loss) 385 (4,227) 1,683 776

Per share-basic and diluted $ 0.01 ($ 0.08) $ 0.03 $ 0.01

Funds from (used in) operations 4,193 (1,015) 15,645 10,209

Per share-basic and diluted $ 0.08 ($ 0.02) $ 0.29 $ 0.19

Electricity Deliveries (MWh) 261,960 199,778 646,595 532,112

Net Generation Capacity (MW)(2) 809 773 809 773

Average Alberta Prices ($ per MWh) $ 81 $ 32 $ 61 $ 48

Average Milner Realized Electricity

Price ($ per MWh) $ 93 $ 33 $ 64 $ 52

(1) Select financial information was derived from the unaudited interim

consolidated financial statements and is prepared in accordance with

Canadian generally accepted accounting principles ("GAAP"), except

Adjusted EBITDA and Funds from operations ("FFO"). Adjusted EBITDA

is provided to assist management and investors in determining the

Corporation's approximate operating cash flows before interest, income

taxes, and depreciation and amortization and FFO is provided to assist

management and investors in determining the Corporation's cash flows

generated by operations before the cash impact of working capital

fluctuations. Adjusted EBITDA and FFO do not have any standardized

meaning prescribed by Canadian GAAP and may not be comparable to similar

measures presented by other companies. Refer to Non-GAAP measures in

MAXIM's MD&A for reconciliations between non-GAAP financial measures and

comparable measures calculated in accordance with Canadian GAAP.

(2) Generation capacity is manufacturer's nameplate capacity net of minority

ownership interests of third parties.

OPERATING RESULTS

During the second quarter of 2010, MAXIM increased its electrical generation

from 199,778 MWh in 2009 to 261,960 in 2010, an increase of 31%, resulting from

the increased production from MAXIM's Northeast US power plants. During the

quarter the average power price realized at HR Milner facility ("Milner") was

$93 per MWh in 2010 compared to $33 per MWh in 2009 for an increase of $60 per

MWh. MAXIM also benefited from a $1.4 million gain on the sale of carbon dioxide

emission credits generated but not required at Milner. As a result, revenue for

the quarter increased $13.8 million or 73% from $18.9 million in 2009 to $32.7

million in 2010, Adjusted EBITDA increased $9.6 million to $10.3 million in 2010

compared to $0.7 million in 2009, and net income increased $4.6 million to $0.4

million in 2010 compared to a loss to $4.2 million in 2009.

On May 25, 2010, MAXIM received an arbitration decision relating to the dispute

between its wholly-owned subsidiary, Milner Power Limited Partnership ("MPLP"),

and Coal Valley Resources Inc. ("CVRI") regarding the price MPLP pays for coal

purchased from CVRI. To date, MPLP's supply of thermal coal to Milner has

primarily been sourced from a CVRI mine located in Hinton, Alberta. In July of

2008, MPLP exercised its option to extend the term of the coal supply agreement

for an additional five years expiring on December 31, 2013. CVRI was of the view

that they had the right to initiate a price review for the extended term and

requested the price for coal be increased above the price provided for under

escalation provisions of the agreement. An independent arbitrator was appointed

to consider the matter and rendered two concurrent decisions. The arbitrator

firstly decided that a price review was warranted and secondly established the

price that MPLP is to pay for coal purchased from CVRI effective February 1,

2009. Based on these prices, MPLP was required to pay an additional $5.6 million

for 2009 and $3.4 million for purchases of coal up to May 25, 2010. In addition

to the arbitrated amount, MPLP settled with CVRI a dispute related to under

delivery of coal during 2007 and 2008. As a result, CVRI was required to pay

$1.4 million to MPLP.

Increases over the first half of 2010 compared to 2009 in revenue, adjusted

EBITDA, and net income were primarily due to the increase in the average Milner

realized power price, $64 per MWh in 2010 compared to $52 per MWh in 2009, and

the increase in electrical generation in 2010 compared to 2009. Production for

the first half of 2010 totaled 646,595 MWh compared to 532,112 MWh in 2009

reflecting the increase in generation at MAXIM's Northeast US facilities.

GROWTH INITIATIVES

Mine 14 Project

During 2009, MAXIM obtained a permit to develop the Mine 14 coal leases and

commence commercial operations. MAXIM considers this resource to be valuable

both as a fuel source for its existing Milner facility, its planned Milner

Expansion, and for the sale of metallurgical coal commencing as early as Q4

2011. During the second quarter of 2010, MAXIM continued the evaluation of

options to advance the development and financing of Mine 14.

Deerland Peaking Station

As previously announced, MAXIM has received regulatory approvals from the

Alberta Utilities Commission and Alberta Environment to construct and operate

the Deerland Peaking Station, a 190 MW natural gas-fired peaking facility. The

station is to be located immediately adjacent to the existing Deerland high

voltage substation in Alberta's industrial heartland, an area expected to

experience significant growth in electrical demand. Construction of the facility

is expected to take approximately twelve months once key commercial arrangements

have been concluded.

Milner Expansion

MAXIM continues to propose to construct and operate a 500 MW coal-fired

generation facility adjacent to its existing Milner facility. The regulatory

review process has commenced and is expected to conclude late 2010.

Buffalo Atlee

MAXIM acquired the Buffalo Atlee Power Project ("Buffalo Atlee"), situated near

Brooks, Alberta, through an amalgamation with EarthFirst Canada Inc. This

project has the potential for development of over 200 MW of wind generation

capacity. Wind data has been collected on the site for approximately four years

and Buffalo Atlee holds an exploratory Crown land permit with a term of five

years, expiring on January 1, 2016. The addition of wind generation to MAXIM's

existing portfolio of assets will diversify MAXIM's generation fuel types and

provides the potential to offset the impact of proposed carbon legislation.

MAXIM plans to advance the development of this project once greater clarity on

carbon policy is provided by the government.

2010 Guidance

MAXIM is confirming guidance issued on May 25, 2010 for projected 2010 Adjusted

EBITDA, Net Income and Funds from Operations.

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Guidance Provided

($000's, except per share amounts) on May 25, 2010

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Adjusted EBITDA (1) 40,000

Funds from operations (1) 30,900

Funds from operations per share - basic and diluted (1)(2) $ 0.57

Net income 4,500

Net income per share - basic and diluted (2) $ 0.08

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1) The following measures are not measures under Canadian Generally

Accepted Accounting Principles ("GAAP") and may not be comparable to

similar measures presented by other companies. Refer to Non-GAAP

measures section of the MD&A for an explanation and reconciliation.

-- Adjusted EBITDA is a measure of earnings before interest, taxes,

depreciation and amortization, and certain other expenses

-- Funds from operations is a measure of cash flow from operations

before working capital requirements

(2) Per share amounts are calculated using an estimated 54,030,000 average

weighted shares outstanding for 2010

MAXIM's results are significantly impacted by Alberta spot power prices. In

preparing its guidance, management uses Alberta forward electricity prices as a

proxy for expected future Alberta sport electricity prices. The market for

forward contracts is relatively illiquid and forward prices may not be a good

predictor of settled prices as they may not factor in events such as unplanned

outages that can cause a significant increase in settled power prices.

Notwithstanding, MAXIM prepares its guidance using forward electricity prices

from independent sources. The above guidance incorporates an average 2010

Alberta power price of $59.07 per MWh.

Forward-Looking Information

Certain information in this press release is forward-looking and is subject to

important risks and uncertainties. The results or events predicted in this

information including the aforementioned guidance for 2010 and prospects

relating to capitalization and operation of Mine 14 may differ materially from

actual results or events. Factors which could cause actual results or events to

differ materially from current expectations include the ability of the

Corporation to implement its strategic initiatives, the availability and price

of energy commodities, government and regulatory decisions, plant availability,

competitive factors in the power industry and prevailing economic conditions in

the regions that the Corporation operates. Forward-looking statements are often,

but not always, identified by the use of words such as "anticipate", "expected",

"plan", "estimate", "may", "project", "predict", "potential", "could", "might",

"should" and other similar expressions. The Corporation disclaims any intention

or obligation to update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise except as required

pursuant to applicable securities laws.

Readers are cautioned that management's expectations, estimates, projections and

assumptions used in the preparation of such information, although considered

reasonable at the time or preparation, may prove to be imprecise and, as such,

undue reliance should not be placed on forward-looking statements.

RESIGNATION OF MR. WILLIAM GALLACHER

On August 11, 2010 MAXIM's Board of Directors accepted the resignation of Mr.

William (Bill) Gallacher from the Company's board of directors. Mr. Gallacher

has served as an independent director since 2000. MAXIM's board, employees and

shareholders thank Mr. Gallacher for his service and wish him all the best in

his ongoing endeavors.

CONFERENCE CALL FOR SECOND QUARTER 2010 RESULTS

MAXIM will host a conference call for analysts and investors on August 24, 2010

at 9:00 a.m. MT (11:00 a.m. ET). The call will be hosted by John R. Bobenic,

MAXIM's President and Chief Executive Officer and Michael R. Mayder, MAXIM's

Vice President, Finance and Chief Financial Officer.

To participate in this conference call, please dial (877) 240-9772 or (416)

340-8530 in the Toronto area. It is recommended that participants call at least

ten minutes prior to start time.

A recording of the conference call will be available from 2:00 p.m. MT (4:00

p.m. ET) on August 24, 2010 until September 2, 2010 at 9:59 p.m. MT (11:59 p.m.

ET). To access this replay, please dial (800) 408-3053 or (416) 695-5800

followed by the passcode 8215413. In addition, the webcast will be available in

the Investor Relations section of MAXIM's web site at www.maximpowercorp.com.

About MAXIM

Based in Calgary, Alberta, MAXIM is an independent power producer, which

acquires or develops, owns and operates innovative and environmentally

responsible power projects. MAXIM currently owns and operates 44 power plants in

western Canada, United States and France, having 809 MW of electric and 117 MW

of thermal net generating capacity. Approximately 80% of MAXIM's current

portfolio is comprised of clean burning natural gas, high efficiency

cogeneration, waste heat and landfill gas fuelled generation. MAXIM trades on

the TSX under the symbol "MXG". For more information about MAXIM, visit our

website at www.maximpowercorp.com.

Statements in this release which describe MAXIM's intentions, expectations or

predictions, or which relate to matters that are not historical facts are

forward-looking statements. These forward-looking statements involve known and

unknown risks and uncertainties which may cause the actual results, performances

or achievements of MAXIM to be materially different from any future results,

performances or achievements expressed in or implied by such forward-looking

statements. MAXIM may update or revise any forward-looking statements, whether

as a result of new information, future events or changing market and business

conditions and will update such forward-looking statements as required pursuant

to applicable securities laws.

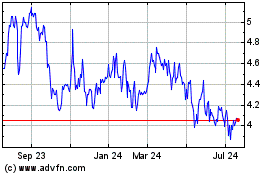

Maxim Power (TSX:MXG)

Historical Stock Chart

From Jun 2024 to Jul 2024

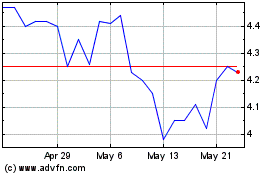

Maxim Power (TSX:MXG)

Historical Stock Chart

From Jul 2023 to Jul 2024