McEwen Mining Inc. (NYSE:MUX)(TSX:MUX) is pleased to announce the

results of an updated Preliminary Economic Assessment ("PEA") on

its 100% owned Los Azules Copper Project (the "Project") in San

Juan Province, Argentina. The results from the PEA demonstrate that

Los Azules has the potential to become one of the largest, lowest

cost copper mines in the world. In addition, there remains

excellent exploration potential to further expand the size of the

existing mineral resource. Highlights from the PEA are shown

below:

PEA Study Highlights(i)

($3.00/lb Copper and $1,300/oz Gold)

-- Pre-tax Net Present Value ("NPV") of $3.0 billion (8% discount rate) and

an Internal Rate of Return ("IRR") of 17.6%.

-- After-tax NPV of $1.7 billion (8% discount rate) and an IRR of 14.3%.

-- Annual copper production during years 1-5 to average 255,000 tonnes (563

million lbs), which would have placed it in the top 3%1 of copper mines

in the world during 2012. Life of mine ("LOM") annual copper production

to average 171,000 tonnes (377 million lbs) over 35 years.

-- Cash operating costs during years 1-5 to average $0.87/lb copper (net of

gold by-product), placing it in the bottom 14%(1 ) in the world during

2012. Cash operating costs over entire mine life to average $1.08/lb

copper (net of gold by-product).

-- Indicated resource of 5.4 billion pounds of copper and 0.8 million

ounces of gold and Inferred resource of 14.3 billion pounds of copper

and 2.6 million ounces of gold (please see Table 2 below for resource

details).

-- Initial capital costs to construct the mine and a 120,000 tonnes per day

("tpd") process plant have been estimated at $3.9 billion.

-- Capital payback on a pre-tax basis has been estimated at 3.8 years at

$3.00/lb copper and $1,300/oz gold.

(1) Based on internal market data.

"Our updated PEA is the result of a very successful exploration

program which has significantly increased our resources. Combined

with a change in the process method the estimated mine life has

increased by 37%, total copper production by 44%, and production

costs per pound of copper remain low. The new PEA includes plans

for producing a copper cathode at site, which will greatly reduce

export taxes and project risk by eliminating the need for a slurry

pipeline," stated Rob McEwen, Chief Owner.

The updated PEA contemplates the construction of a mine and

process plant operating over a 35 year mine life at a throughput of

120,000 tonnes per day. The mine would produce a copper cathode via

a pressure oxidative leach process, in addition to heap leaching

the lower grade mineralized material. Compared to the previous PEA

released in December 2010, there have been two significant

improvements to the project:

1. Resource Size: Indicated and Inferred resources have increased by 184%

and 55% respectively, which were slightly offset with decreases in

respective grades of 14% and 12%. Overall, this has led to a 37%

increase in mine life and 44% increase in total copper production.

2. Process Methodology: The current PEA plans to produce copper cathode at

site whereas the 2010 PEA contemplated producing copper concentrate and

transporting it via pipeline through Chile. The main advantages of

producing copper cathode at site are that it eliminates this previously

planned pipeline through Chile, which was a substantial risk for the

project, as well as an overall increase in recovered metal, both copper

and gold. Additional benefits include: i) a reduction in export taxes

(5% payable on cathode versus 10% on concentrate) and, ii) the removal

of treatment and refining charges from the smelting process.

Table 1: Pertinent Details of the PEA

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Pre-tax NPV ($3.00/lb Cu, 8% discount rate) $3.02 billion

----------------------------------------------------------------------------

After-tax NPV $1.68 billion

----------------------------------------------------------------------------

Pre-tax IRR 17.6%

----------------------------------------------------------------------------

After-tax IRR 14.3%

----------------------------------------------------------------------------

Initial Capital Expenditure $3.92 billion

----------------------------------------------------------------------------

LOM Sustaining Capital $1.47 billion

----------------------------------------------------------------------------

LOM Average Operating Costs $8.65/t ore

----------------------------------------------------------------------------

First 5 Years Average C-1(1) Cash Costs (net of by-

product credits) $0.87/lb Cu

----------------------------------------------------------------------------

LOM Average C-1 Cash Costs (net of by-product credits) $1.08/lb Cu

----------------------------------------------------------------------------

Nominal Mill Capacity 120,000 tpd

----------------------------------------------------------------------------

Average Tonnes of Mineralized Material Processed

Annually - Mill 43 million tonnes

----------------------------------------------------------------------------

Average Tonnes of Mineralized Material Processed

Annually - Heap Leach 6 million tonnes

----------------------------------------------------------------------------

Mine Life 34.9 years

----------------------------------------------------------------------------

LOM Strip Ratio 0.76

----------------------------------------------------------------------------

LOM average annual copper production 171,000t or 377m lbs

----------------------------------------------------------------------------

First 5 years average annual copper production 255,000t or 563m lbs

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1) C-1 cash costs include at-mine cash operating costs, treatment and

refining charges, mine reclamation and closure costs, and copper cathode and

gold dore transportation and freight costs.

In comparing the economics to the 2010 PEA, the pre-tax NPV

discounted at 8% has increased from $2.8 billion to $3.0 billion

and the IRR has decreased from 21.4% to 17.6%. In addition, the

payback of pre-production capital has increased from 3.1 years to

3.8 years from the start of production. The previous PEA did not

include economics that were calculated on an after-tax basis.

The PEA contains a cash flow model based upon the geological and

engineering work completed to date and technical and cost inputs

developed by Samuel Engineering, Inc., Ausenco Vector, WLR

Consulting, Inc., and MTB Project Management Professionals, Inc.

The base case was developed using long term forecast metal prices

of $3.00/lb for copper and $1,300/oz for gold. The Canadian

National Instrument 43-101 ("NI 43-101") technical report

summarizing the results of the updated PEA will be filed on SEDAR

and the Company's website within 45 days of this press release.

Table 2: Los Azules Mineral Resource Estimate

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Tonnage Au Grade

Cut-off Grade (million Cu Grade Cu lbs (grams per Au Oz

(Cu%) tonnes) (%) (billions) tonne) (millions)

----------------------------------------------------------------------------

Indicated Resource

----------------------------------------------------------------------------

0.35 389 0.63 5.39 0.07 0.84

----------------------------------------------------------------------------

Inferred Resource

----------------------------------------------------------------------------

0.35 1,397 0.46 14.3 0.06 2.58

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(i) The PEA is preliminary in nature and includes the use of

inferred resources which are considered too speculative

geologically to have the economic considerations applied to them

that would enable them to be categorized as mineral reserves.

Mineral resources that are not mineral reserves do not have

demonstrated economic viability. Thus, there is no certainty that

the results of the PEA will be realized. Actual results may vary,

perhaps materially. The level of accuracy for the estimates

contained within the PEA is approximately +/- 35%.

The following chart shows the sensitivity of the base case's

pre-tax NPV (8% discount rate) and IRR to changes in the copper

price: http://media3.marketwire.com/docs/MUXChart1.pdf.

The following chart shows the sensitivity to copper price,

operating costs, and capital costs. The graph shows that the

project pre-tax NPV is much more sensitive to copper price than to

capital or operating costs:

http://media3.marketwire.com/docs/MUXChart-2.pdf.

ABOUT MCEWEN MINING (www.mcewenmining.com)

The goal of McEwen Mining is to qualify for inclusion in the

S&P 500 by creating a high growth gold producer focused in the

Americas. McEwen Mining's principal assets consist of the San Jose

mine in Santa Cruz, Argentina (49% interest); the El Gallo 1 mine

and El Gallo 2 project in Sinaloa, Mexico; the Gold Bar project in

Nevada, US; the Los Azules project in San Juan, Argentina and a

large portfolio of exploration properties in Argentina, Mexico and

Nevada.

McEwen Mining has 297,114,359 shares issued and outstanding at

September 13, 2013. Rob McEwen, Chairman, President and Chief

Owner, owns 25% of the shares of the Company (assuming all

outstanding Exchangeable Shares are exchanged for an equivalent

amount of Common Shares).

TECHNICAL INFORMATION

The information presented in this press release has been

reviewed and approved by Richard Kunter, FAusIMM CP, QP, Steven

Pozder, PE, Robert Sim, P.Geo., Bruce Davis, PhD, FAusIMM, James K.

Duff, P.Geo., William Rose, PE, and Scott Elfen, PE, all of whom

are qualified persons and all of whom but James K. Duff are

considered independent of McEwen Mining, as defined by Canadian

National Instrument 43-101 "Standards of Disclosure for Mineral

Projects" ("NI 43-101"). The PEA has been prepared in accordance

with the standards set out in NI 43-101 and was prepared by the

following consortium of independent professionals and technical

firms:

----------------------------------------------------------------------------

Consultant Contribution

----------------------------------------------------------------------------

PEA study manager, provided input on project

infrastructure, owner's costs, mine capital

and operating costs (in collaboration with

MTB Project Management William Rose of WLR Consulting), and cash

Professionals, Inc. flow modeling.

----------------------------------------------------------------------------

Richard Kunter of Samuel Review of metallurgical testing and mineral

Engineering, Inc. processing.

----------------------------------------------------------------------------

Review of cash flow modeling, project

Steven Pozder of Samuel infrastructure, operating costs and economic

Engineering, Inc. evaluation.

----------------------------------------------------------------------------

Robert Sim of SIM Geological,

Inc.

Bruce Davis of BD Resource

Consulting Mineral resource estimate.

----------------------------------------------------------------------------

Bruce Davis of BD Resource Quality control for the assaying of the Los

Consulting Azules drill core.

----------------------------------------------------------------------------

William Rose of WLR Consulting, Development of the mine plan and production

Inc. schedule.

----------------------------------------------------------------------------

Project infrastructure, geotechnical

facilities design, capital and operating

Scott Elfen of Ausenco Vector costs.

----------------------------------------------------------------------------

Information about the geology and

mineralization, exploration, and

environmental liabilities, studies and

James K. Duff permitting.

----------------------------------------------------------------------------

All drill core samples were collected in accordance with

industry standards. Splits from the drill core samples were

submitted to the ACME sample preparation laboratory in Mendoza,

Argentina, and then transferred to ACME's laboratory in Santiago,

Chile for fire assay and ICP analysis. Accuracy of results is

tested through the systematic inclusion of standards, blanks and

check assays.

For further information about the current Los Azules Mineral

Resource, see the Company's news release titled "McEwen Mining

Continues to Expand Los Azules' Large, High-Grade, Mineral

Resource, dated February 5, 2013. The mineral resource estimate

referenced in this news release was prepared in January 2013 by

Robert Sim, P.Geo. and Bruce Davis, PhD, FAusIMM, each a qualified

person and independent of McEwen Mining, as defined by NI 43-101.

The foregoing mineral resource estimate was employed in the

preparation of the PEA that is the subject matter of this news

release and is the current mineral resource on the Los Azules

Copper Project. For additional non-resource information about the

Los Azules project see the technical Report titled "Los Azules

Porphyry Copper Project, San Juan Province, Argentina" dated August

1, 2012, with an effective date of June 15, 2012, prepared by D.

Ernest Winkler, PE, Robert Sim, P.Geo., Bruce Davis, PhD, FAusIMM

and James K. Duff, P.Geo., all of whom are qualified persons and

all of whom but James K. Duff are independent of McEwen Mining,

each as defined by NI 43-101.

The foregoing news release and technical report are available

under the Corporation's profile on SEDAR (www.sedar.com).

The 2010 PEA is included for comparative purposes as it

represents the most recent economic analysis completed on the Los

Azules Copper Project prior to the PEA disclosed herein. Readers

are cautioned that the 2010 PEA was superseded by the technical

report and news release referenced immediately above. Historic

information pertaining to the economic analysis disclosed in the

2010 PEA should not be relied upon. The 2010 PEA was disclosed in a

technical report titled "Canadian National Instrument 43-101

Technical Report Updated Preliminary Assessment, Los Azules

Project, San Juan Province, Argentina" with an effective date of

December 1, 2010 (released December 16, 2010) was prepared by

Kathleen Altman, Ph.D., PE, Robert Sim, P.Geo,. Bruce Davis, PhD,

FAusIMM, Richard Jemielita, Ph.D., MIMMM, William Rose, PE, and

Scott Elfen, PE. Each of the authors was at the time of publication

independent of Minera Andes Inc. (now McEwen Mining Inc.) and

Qualified Persons, as defined by NI 43-101. The 2010 PEA is

available under the Minera Andes Inc.'s (acquired by McEwen Mining

Inc. in 2012) profile on SEDAR (www.sedar.com).

CAUTIONARY NOTE TO US INVESTORS REGARDING RESOURCE

ESTIMATION

McEwen Mining prepares its resource estimates in accordance with

standards of the Canadian Institute of Mining, Metallurgy and

Petroleum referred to in Canadian National Instrument 43-101 (NI

43-101). These standards are different from the standards generally

permitted in reports filed with the SEC. Under NI 43-101, McEwen

Mining reports measured, indicated and inferred resources,

measurements, which are generally not permitted in filings made

with the SEC. The estimation of measured resources and indicated

resources involve greater uncertainty as to their existence and

economic feasibility than the estimation of proven and probable

reserves. U.S. investors are cautioned not to assume that any part

of measured or indicated resources will ever be converted into

economically mineable reserves. The estimation of inferred

resources involves far greater uncertainty as to their existence

and economic viability than the estimation of other categories of

resources.

CAUTION CONCERNING FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements

and information, including "forward-looking statements" within the

meaning of the Private Securities Litigation Reform Act of 1995.

The forward-looking statements and information expressed, as at the

date of this news release, McEwen Mining Inc.'s (the "Company")

estimates, forecasts, projections, expectations or beliefs as to

future events and results. Forward-looking statements and

information are necessarily based upon a number of estimates and

assumptions that, while considered reasonable by management, are

inherently subject to significant business, economic and

competitive uncertainties, risks and contingencies, and there can

be no assurance that such statements and information will prove to

be accurate. Therefore, actual results and future events could

differ materially from those anticipated in such statements and

information. Risks and uncertainties that could cause results or

future events to differ materially from current expectations

expressed or implied by the forward-looking statements and

information include, but are not limited to, factors associated

with fluctuations in the market price of precious metals, mining

industry risks, political, economic, social and security risks

associated with foreign operations, the ability of the corporation

to receive or receive in a timely manner permits or other approvals

required in connection with operations, risks associated with the

construction of mining operations and commencement of production

and the projected costs thereof, risks related to litigation, the

state of the capital markets, environmental risks and hazards,

uncertainty as to calculation of mineral resources and reserves and

other risks. Readers should not place undue reliance on

forward-looking statements or information included herein, which

speak only as of the date hereof. The Company undertakes no

obligation to reissue or update forward-looking statements or

information as a result of new information or events after the date

hereof except as may be required by law. See McEwen Mining's Annual

Report on Form 10-K for the fiscal year ended December 31, 2012 and

other filings with the Securities and Exchange Commission, under

the caption "Risk Factors", for additional information on risks,

uncertainties and other factors relating to the forward-looking

statements and information regarding the Company. All

forward-looking statements and information made in this news

release are qualified by this cautionary statement.

The NYSE and TSX have not reviewed and do not accept

responsibility for the adequacy or accuracy of the contents of this

news release, which has been prepared by management of McEwen

Mining Inc.

Contacts: McEwen Mining Inc. Sheena Scotland Investor Relations

(647) 258-0395 ext 410 or Toll Free: (866) 441-0690 (647) 258-0408

(FAX) Mailing Address McEwen Mining Inc. 181 Bay Street Suite 4750

Toronto, ON M5J 2T3 PO box 792info@mcewenmining.com Facebook:

www.facebook.com/mcewenrob Twitter: www.twitter.com/mcewenmining

www.mcewenmining.com

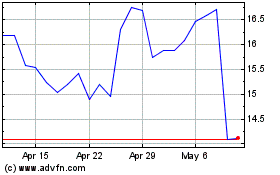

McEwen Mining (TSX:MUX)

Historical Stock Chart

From Apr 2024 to May 2024

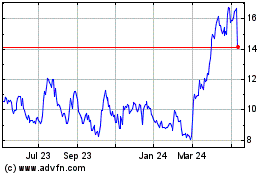

McEwen Mining (TSX:MUX)

Historical Stock Chart

From May 2023 to May 2024