Madison Pacific Properties Inc. Announces Six Months Results

August 14 2009 - 3:12PM

Marketwired

Madison Pacific Properties Inc. (TSX: MPC)(TSX: MPC.C), a

Vancouver-based real estate company, announces the results of

operations for the six months ended June 30, 2009.

The Company is reporting net income from continuing operations

of $3,339,000 for the six months ended June 30, 2009 compared to

$1,902,000 for the same period in 2008. Cash flow from continuing

operations before changes in non-cash working capital for the six

months ended June 30, 2009 is $2,721,000 compared to $2,725,000 for

the same period in 2008. Earnings per share from continuing

operations were $0.06 per share for the six months ended June 30,

2009 compared to $0.03 per share for the same period in 2008.

The Company sold one property in the first six months and has

entered into agreements to sell other properties in the 2nd half of

the year. Accordingly the Company has reflected the income from the

properties sold and to be sold as income from discontinued

operations. The income from discontinued operations, including the

gain on the sale completed, net of taxes and non-controlling

interest, was $2,386,000.

The net income for the six months was $5,725,000 compared to

$2,007,000 for the six months ended June 30, 2008. Earnings per

share were $.10 per share compared to $.04 for the six months ended

June 30, 2008.

The Company had previously announced its intentions to apply for

rezoning of 5.7 acres of land it owns at Lougheed Highway and

Willingdon Ave. in Burnaby, British Columbia. The Company has

decided not to pursue the development of this property but rather

has entered into an agreement to sell the property. The closing

date for the sale is in the Company's 4th quarter of 2009.

The Company is anticipating recording the sale of property,

including the Lougheed and Willingdon property, for approximately

$62 million in the second half of the year. The gain on the sale of

the property, before tax, will be approximately $29 million. As a

condition of the sale of property the Company will provide vendor

financing for $27.75 million repayable over the next three years at

$9.25 million per year plus interest.

The Company is pleased to announce a 5.25 cents per share

dividend will be payable September 4, 2008 to shareholders of

record August 21, 2008.

This press release contains forward-looking statements regarding

the future success of Madison's business that are subject to risk

and uncertainties. Examples of such forward-looking statements

include, but are not limited to, statements concerning the

anticipated closings of property sales. Forward looking information

typically contain statements with words such as "expect",

"believe", "plan", "forecast", "intend" or similar words

suggesting

future outcomes. These forward-looking statements involve known

and unknown risk and uncertainties that may cause Madison's actual

results, performance or achievements to be materially different

from any future results, performance or achievements expressed or

implied in these forward-looking statements. These risks include

risks related to the closing and financing risk and the risks and

uncertainties described in the Company's 2008 annual report and

second quarter MD&A. Although the forward-looking statements

contained herein are based upon what management believes to be

current and reasonable assumptions, Madison cannot assure readers

that the actual results will be consistent with these

forward-looking statements. The forward-looking statements

contained herein are made as of the date of this press release and

are expressly qualified in their entirety by this cautionary

statement. Except as required by law, the Company undertakes no

obligation to publicly update or revise any such forward-looking

statements to reflect in its expectations or in events, conditions

or circumstances on which any such forward-looking statements may

be based, or that may affect the likelihood that actual results

from those set forth in the forward-looking statements.

Contacts: Madison Pacific Properties Inc. Mr. Alan Firth

President (604) 732-6540 Madison Pacific Properties Inc. Mr. Bill

Ramsey Chief Financial Officer (604) 732-6540 (604) 732-6550

(FAX)

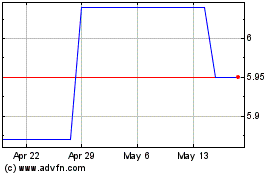

Madison Pacific Properties (TSX:MPC)

Historical Stock Chart

From Jun 2024 to Jul 2024

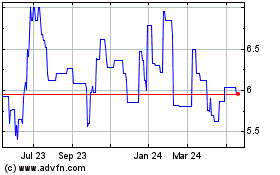

Madison Pacific Properties (TSX:MPC)

Historical Stock Chart

From Jul 2023 to Jul 2024