Linamar Comments on Receivable Exposure Levels With GM and Chrysler

April 02 2009 - 4:12PM

Marketwired Canada

In light of the uncertainties existing in today's automotive marketplace Linamar

Corporation (TSX:LNR) is disclosing its current receivable exposure levels to GM

and Chrysler.

Linamar understands that under US bankruptcy laws, in the event of a company

entering chapter 11 bankruptcy, all goods delivered within 20 days of the date

of the chapter 11 filing obtain a special priority and are paid as part of the

chapter 11 reorganization, once the reorganization plan is approved. Any goods

shipped prior to 20 days before the date of the chapter 11 filing are at risk. A

GM or Chrysler bankruptcy would be a unique and unusual event whose consequences

can't be foreseen and there can be no assurance of recovery.

The combined total of Linamar's receivables balance greater than 20 days with GM

and Chrysler is in aggregate estimated to be less than 30 million or

approximately 9% of Linamar's total receivables balance as of March 31st, 2009.

"Our typical experience with customers in the past that have filed for chapter

11 protection is that we have been able to recover up to half or more of at risk

receivables", said Linamar CEO Linda Hasenfratz. "We are pleased that our

diversification efforts have allowed us to minimize our risk with any one

customer in this way, particularly in light of uncertainties in the industry at

this time".

Linamar Corporation (TSX:LNR) is a diversified global manufacturing company of

highly engineered products. The company's Powertrain and Driveline focused

divisions are world leaders in the collaborative design, development and

manufacture of precision metallic components, modules and systems for global

vehicle and power generation markets. The company's Industrial division is a

world leader in the design and production of innovative mobile industrial

equipment, notably its class-leading aerial work platforms and telehandlers.

With more than 11,000 employees in 37 manufacturing locations, 5 R&D centers and

11 sales offices in Canada, the US, Mexico, Germany, Hungary, the UK, China,

Korea and Japan Linamar generated sales of over $2.2 Billion in 2008. For more

information about Linamar Corporation and its industry leading products and

services, visit www.linamar.com

Certain information regarding Linamar set forth in this document, including

management's assessment of the Company's future plans and operations may

constitute forward-looking statements. This information is based on current

expectations that are subject to significant risks and uncertainties that are

difficult to predict. Actual results may differ materially from these

anticipated in the forward-looking statements due to factors such as customer

demand and timing of buying decisions, product mix, competitive products and

pricing pressure. In addition, uncertainties and difficulties in domestic and

foreign financial markets and economies could adversely affect demand from

customers. These factors, as well as general economic and political conditions,

may in turn have a material adverse effect on the Company's financial results.

The Company assumes no obligation to update the forward-looking statements, or

to update the reasons why actual results could differ from those reflected in

the forward-looking statements.

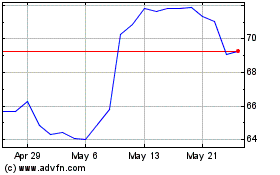

Linamar (TSX:LNR)

Historical Stock Chart

From Jun 2024 to Jul 2024

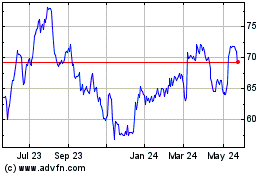

Linamar (TSX:LNR)

Historical Stock Chart

From Jul 2023 to Jul 2024