International Tower Hill Mines Ltd. (TSX: ITH)(NYSE Amex:

THM)(FRANKFURT: IW9) ("ITH" or the "Company") is pleased to

announce the results from the latest 20 holes completed in its

50,000-metre Summer 2010 Livengood Exploration Program (to see Fig.

1 please click on: http://media3.marketwire.com/docs/ith107.jpg).

The infill portion of the Summer program is focused on conversion

of resources to the measured and indicated categories as well as

testing the down dip extension potential of the deposit. The

Company is currently operating seven drills at Livengood (three RC

and four core rigs).

Highlights of the ongoing 2010 work program at Livengood include:

-- Infill drilling continues to improve the definition of large higher

grade areas within the overall deposit as indicated by holes MK-RC-0410

(97.5 metres of 1.11 g/t gold) and MK-RC-0414 (134.1 metres of 1.32 g/t

gold) in the Core Zone. A higher grade area (+1 g/t gold) is being

established in the Core Zone that is approximately 200 metres wide and a

kilometre long. This expansion of the near surface higher grades

reported last month (NR10-31) is anticipated to be the focus of initial

production.

-- The Money Knob deposit at Livengood continues to expand laterally and

several of the recent drill holes indicate a significant expansion of

the Core Zone at depth.

-- The Company's pre-feasibility study is underway with ongoing

hydrological studies, surface mine facility location analysis, phase 2

metallurgical studies (optimizing milling and heap leaching recoveries),

deposit-scale geotechnical studies, and continuing environmental

baseline data collection.

Core Zone Expansion at Depth

The Company's recent Preliminary Economic Analysis (NR10-32)

shows that the potential pit would economically mine the June, 2010

estimated indicated and inferred resource to the bottom of the

existing drilling. Extending the mineralization below the current

drill depth will increase the global resource and could likely

expand the in-pit resource and increase mine life. Several drill

holes from the Core Zone reported in this news release have

returned intercepts below the previous base of drilling indicating

that the Livengood ore zone continues at depth. Significant new

intersections (Table 1) at depth include 45.7 metres at 0.9g/t gold

(333.8 to 379.5 metres down hole) in MK-RC-0410 and 44.2 metres at

0.9 g/t gold (266.7-310.9 metres), 15.2 metres at 1.0 g/t gold

(313.9-329.2 metres) and 10.7 metres at 1.0 g/t gold (333.8-344.4

metres), all in MK-RC-0411. These extensions could expand future

pit designs and increase the contained ounces proposed to be

mined.

Table 1: Significant Livengood New Intercepts(i)

(i) Intercepts are calculated using a 0.25g/t gold cutoff and a maximum of

3 metres of internal waste.

From To Thickness Gold

Drill Hole (metres) (metres) (metres) (g/t) Area

---------------------------------------------------------------------------

---------------------------------------------------------------------------

MK-RC-0409 44.20 60.96 16.76 0.47 Sunshine (infill)

67.06 80.77 13.71 1.01

includes 77.72 80.77 3.05 1.77

172.21 184.40 12.19 0.55

MK-RC-0410 201.17 298.70 97.53 1.11 Core (infill)

includes 205.74 224.03 18.29 1.73

includes 252.98 260.60 7.62 2.11

includes 266.70 274.32 7.62 1.39

includes 284.99 292.61 7.62 1.24

307.85 323.09 15.24 0.65

includes 313.94 316.99 3.05 1.75

333.76 379.48 45.72 0.93

includes 342.90 345.95 3.05 3.78

includes 362.71 374.90 12.19 1.56

MK-RC-0411 111.25 121.92 10.67 0.61 Core (infill)

141.73 169.16 27.43 0.65

188.98 195.07 6.09 3.21

219.46 262.13 42.67 0.81

includes 220.98 228.60 7.62 1.74

266.70 310.90 44.20 0.86

includes 278.89 291.08 12.19 1.89

313.94 329.18 15.24 1.04

333.76 344.42 10.66 1.00

MK-RC-0412 82.30 88.39 6.09 0.55 Olive

MK-RC-0413 257.56 259.08 1.52 3.19 Money Knob

MK-RC-0414 13.72 50.29 36.57 0.86 Core (infill)

56.39 190.50 134.11 1.32

includes 76.20 89.92 13.72 2.29

includes 97.54 111.25 13.71 2.45

includes 115.82 121.92 6.10 2.34

includes 135.64 140.21 4.57 1.84

includes 153.92 175.26 21.34 2.26

195.07 204.22 9.15 0.56

214.88 233.17 18.29 0.99

includes 214.88 217.93 3.05 3.17

237.74 260.60 22.86 0.61

262.13 283.46 21.33 0.38

MK-RC-0415 106.68 112.78 6.10 1.54 Tower

includes 106.68 109.73 3.05 2.43

123.44 134.11 10.67 0.78

262.13 274.32 12.19 0.30

277.37 306.32 28.95 0.38

316.99 333.76 16.77 0.55

338.33 347.47 9.14 0.67

382.52 396.24 13.72 0.48

MK-RC-0416 156.97 166.12 9.15 0.93

MK-RC-0417 18.29 32.00 13.71 1.10 Core (infill)

includes 19.81 24.38 4.57 2.57

48.77 196.60 147.83 0.82

includes 100.58 103.63 3.05 1.85

includes 128.02 138.68 10.66 2.09

214.88 228.60 13.72 0.56

280.42 291.08 10.66 0.53

312.42 320.04 7.62 0.97

324.61 352.04 27.43 0.43

MK-RC-0418 150.88 166.12 15.24 0.54 Olive

172.21 199.64 27.43 0.94

includes 182.88 185.93 3.05 2.51

MK-RC-0419 47.24 54.86 7.62 0.92 Tower

248.41 256.03 7.62 0.92

MK-RC-0420 138.68 149.35 10.67 0.68 Lillian (lost hole)

MK-RC-0421 134.11 143.26 9.15 0.55 Olive

256.03 262.13 6.10 1.15

includes 259.08 262.13 3.05 2.06

326.14 335.28 9.14 0.58

MK-RC-0422 117.35 124.97 7.62 1.44 Lillian

includes 137.16 140.21 3.05 2.60

131.06 140.21 9.15 1.10

152.40 172.21 19.81 0.52

MK-RC-0423 12.19 24.38 12.19 0.75 Tower

includes 21.34 24.38 3.04 1.88

333.76 344.42 10.66 2.70

includes 335.28 338.33 3.05 8.53

MK-RC-0424 51.82 76.20 24.38 0.57 Core (infill)

120.40 179.83 59.43 0.60

324.61 333.76 9.15 0.72

MK-RC-0426 13.72 21.34 7.62 0.67 Tower

MK-RC-0427 92.96 102.11 9.15 0.55 Core (infill)

117.35 128.02 10.67 0.66

143.26 213.36 70.10 1.01

includes 158.50 161.54 3.04 3.43

includes 172.21 181.36 9.15 3.23

217.93 233.17 15.24 0.54

237.74 252.98 15.24 0.45

MK-10-57 0.00 37.49 37.49 0.44 Sunshine (infill)

48.92 92.05 43.13 0.89

includes 67.67 75.29 7.62 2.05

97.11 116.13 19.02 0.56

117.96 193.85 75.89 0.96

includes 140.82 146.91 6.09 3.02

includes 173.05 177.39 4.34 3.48

198.73 211.07 12.34 0.53

212.29 234.60 22.31 0.43

238.80 254.05 15.25 1.22

257.37 267.16 9.79 0.99

includes 258.47 264.86 6.39 1.32

312.51 324.42 11.91 0.45

MK-10-59 211.77 219.56 7.79 1.52 Tower (infill)

223.11 240.41 17.30 0.72

243.48 250.24 6.76 0.76

261.40 276.45 15.05 0.69

Livengood Project Highlights

-- Drilling at the project continues to expand the deposit, with the

current estimated resource only representing a snapshot in time. The

latest resource estimate (as at June 22, 2010) of 409 Mt at an average

grade of 0.83 g/t gold (10.9Moz Indicated) and 94 Mt at an average grade

of 0.79 g/t gold (2.4Moz Inferred), both at a 0.5 g/t gold cut-off

grade, makes Livengood one of the largest new gold discoveries in North

America.

-- The Core and Sunshine Zones together account for most of the higher

grade mineralization (Indicated Resources of 202 Mt at an average grade

of 1.07 g/t gold and Inferred Resources of 40 Mt at an average grade of

1.06 g/t gold, based on a cut-off grade of 0.70 g/t gold) and will form

the basis for starter pit design work.

-- Ongoing metallurgical studies are focusing on the potential use of

milling, with a flotation-gravity circuit, which has returned initial

recoveries to a concentrate of 89%, thus offering significant potential

for operational and capital cost savings. Test data for conventional

whole ore milling with a gravity-CIL system produced initial recoveries

of 76% (See NR10-19). Optimization work is ongoing for these processing

alternatives, as they have the potential to make significant positive

impact on project economics.

-- The geometry of the currently defined shallowly dipping, outcropping

deposit has a low strip ratio amenable to low cost open pit mining which

could support a high production rate and economies of scale.

-- No major permitting hurdles have been identified to date.

-- The Livengood project has a very favourable logistical location, being

situated 110 road kilometres north of Fairbanks, Alaska along the paved,

all-weather Elliott Highway, the Trans-Alaska Pipeline Corridor, and the

proposed Alaska natural gas pipeline route. The terminus of the Alaska

State power grid lies approximately 80 kilometres to the south.

-- ITH controls 100% of its approximately 145 square kilometre Livengood

land package, which is made up of fee land leased from the Alaska Mental

Health Trust, a number of smaller private mineral leases and 115 Alaska

state mining claims.

Geological Overview

The Livengood Deposit is hosted in a thrust-interleaved sequence

of Proterozoic to Palaeozoic sedimentary and volcanic rocks.

Mineralization is related to a 90 million year old (Fort Knox age)

dike swarm that cuts through the thrust stack. Primary ore controls

are a combination of favourable lithologies and crosscutting

structural zones. In areas distal to the main structural zones, the

selective development of disseminated mineralization in favourable

host rocks is the main ore control. Within the primary structural

corridors, all lithologies can be pervasively altered and

mineralized. Devonian volcanic rocks and Cretaceous dikes represent

the most favourable host lithologies and are pervasively altered

and mineralized throughout the deposit. Two dominant structural

controls are present: 1) the major shallow south-dipping faults

which host dikes and mineralization which are related to dilatant

movement on structures of the original fold-thrust architecture

during post-thrusting relaxation, and 2) steep NW trending linear

zones which focus the higher-grade mineralization which cuts across

all lithologic boundaries. The net result is broad flat-lying zones

of stratabound mineralization around more vertically continuous,

higher grade core zones with a resulting lower strip ratio for the

overall deposit and higher grade areas that could be amenable for

starter pit production.

The surface gold geochemical anomaly at Livengood covers an area

6 kilometres long by 2 kilometres wide, of which approximately half

has been explored by drilling to date. Surface exploration is

ongoing as new targets are being developed to the northeast and

west of the known deposit.

Qualified Person and Quality Control/Quality Assurance

Jeffrey A. Pontius (CPG 11044), a qualified person as defined by

National Instrument 43-101, has supervised the preparation of the

scientific and technical information that forms the basis for this

news release and has approved the disclosure herein. Mr. Pontius is

not independent of ITH, as he is the President and CEO and holds

common shares and incentive stock options.

Development work at the Livengood Project is directed by Carl E.

Brechtel (Colorado PE 23212, Nevada PE 8744), who is a qualified

person as defined by National Instrument 43-101. He is a member of

SME, AusIMM and SAIMM. Mr. Brechtel is not independent of ITH, as

he is the COO and holds incentive stock options.

The work program at Livengood was designed and is supervised by

Chris Puchner, Chief Geologist (CPG 07048), of the Company, who is

responsible for all aspects of the work, including the quality

control/quality assurance program. On-site personnel at the project

photograph the core from each individual borehole prior to

preparing the split core. Duplicate reverse circulation drill

samples are collected with one split sent for analysis.

Representative chips are retained for geological logging. On-site

personnel at the project log and track all samples prior to sealing

and shipping. All sample shipments are sealed and shipped to ALS

Chemex in Fairbanks, Alaska for preparation and then on to ALS

Chemex in Reno, Nevada or Vancouver, B.C. for assay. ALS Chemex's

quality system complies with the requirements for the International

Standards ISO 9001:2000 and ISO 17025:1999. Analytical accuracy and

precision are monitored by the analysis of reagent blanks,

reference material and replicate samples. Quality control is

further assured by the use of international and in-house standards.

Finally, representative blind duplicate samples are forwarded to

ALS Chemex and an ISO compliant third party laboratory for

additional quality control.

About International Tower Hill Mines Ltd.

International Tower Hill Mines Ltd. is a resource exploration

company focused on the ongoing development of the advanced,

multimillion-ounce gold discovery at Livengood in Alaska. ITH is

committed to the aggressive development of the Livengood Project,

thereby giving its shareholders the maximum value for their

investment.

On behalf of INTERNATIONAL TOWER HILL MINES LTD.

Jeffrey A. Pontius, President and Chief Executive Officer

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements and

forward-looking information (collectively, "forward-looking

statements") within the meaning of applicable Canadian and US

securities legislation. All statements, other than statements of

historical fact, included herein including, without limitation,

statements regarding the anticipated content, commencement and cost

of exploration programs, anticipated exploration program results,

the discovery and delineation of mineral

deposits/resources/reserves, the potential for the expansion of the

estimated resources at Livengood, the potential for any production

at the Livengood project, the potential for higher grade

mineralization to form the basis for a starter pit component in any

production scenario, the potential low strip ratio of the Livengood

deposit being amenable for low cost open pit mining that could

support a high production rate and economies of scale, the

potential for cost savings due to the high gravity concentration

component of some of the Livengood mineralization, the completion

of a pre-feasibility study at Livengood, the potential for a

production decision to be made regarding Livengood, the potential

commencement of any development of a mine at Livengood following a

production decision, business and financing plans and business

trends, are forward-looking statements. Information concerning

mineral resource estimates and the preliminary economic analysis

thereof also may be deemed to be forward-looking statements in that

it reflects a prediction of the mineralization that would be

encountered, and the results of mining it, if a mineral deposit

were developed and mined.

Although the Company believes that such statements are

reasonable, it can give no assurance that such expectations will

prove to be correct. Forward-looking statements are typically

identified by words such as: believe, expect, anticipate, intend,

estimate, postulate and similar expressions, or are those, which,

by their nature, refer to future events. The Company cautions

investors that any forward-looking statements by the Company are

not guarantees of future results or performance, and that actual

results may differ materially from those in forward looking

statements as a result of various factors, including, but not

limited to, variations in the nature, quality and quantity of any

mineral deposits that may be located, variations in the market

price of any mineral products the Company may produce or plan to

produce, the Company's inability to obtain any necessary permits,

consents or authorizations required for its activities, the

Company's inability to produce minerals from its properties

successfully or profitably, to continue its projected growth, to

raise the necessary capital or to be fully able to implement its

business strategies, and other risks and uncertainties disclosed in

the Company's Annual Information Form filed with certain securities

commissions in Canada and the Company's annual report on Form 40-F

filed with the United States Securities and Exchange Commission

(the "SEC"), and other information released by the Company and

filed with the appropriate regulatory agencies. All of the

Company's Canadian public disclosure filings may be accessed via

www.sedar.com and its United States public disclosure filings may

be accessed via www.sec.gov, and readers are urged to review these

materials, including the technical reports filed with respect to

the Company's mineral properties.

Cautionary Note Regarding References to Resources and

Reserves

National Instrument 43 101 - Standards of Disclosure for Mineral

Projects ("NI 43-101") is a rule developed by the Canadian

Securities Administrators which establishes standards for all

public disclosure an issuer makes of scientific and technical

information concerning mineral projects. Unless otherwise

indicated, all resource estimates contained in or incorporated by

reference in this press release have been prepared in accordance

with NI 43-101 and the guidelines set out in the Canadian Institute

of Mining, Metallurgy and Petroleum (the "CIM") Standards on

Mineral Resource and Mineral Reserves, adopted by the CIM Council

on November 14, 2004 (the "CIM Standards") as they may be amended

from time to time by the CIM.

United States shareholders are cautioned that the requirements

and terminology of NI 43-101 and the CIM Standards differ

significantly from the requirements and terminology of the SEC set

forth in the SEC's Industry Guide 7 ("SEC Industry Guide 7").

Accordingly, the Company's disclosures regarding mineralization may

not be comparable to similar information disclosed by companies

subject to SEC Industry Guide 7. Without limiting the foregoing,

while the terms "mineral resources", "inferred mineral resources",

"indicated mineral resources" and "measured mineral resources" are

recognized and required by NI 43-101 and the CIM Standards, they

are not recognized by the SEC and are not permitted to be used in

documents filed with the SEC by companies subject to SEC Industry

Guide 7. Mineral resources which are not mineral reserves do not

have demonstrated economic viability, and US investors are

cautioned not to assume that all or any part of a mineral resource

will ever be converted into reserves. Further, inferred resources

have a great amount of uncertainty as to their existence and as to

whether they can be mined legally or economically. It cannot be

assumed that all or any part of the inferred resources will ever be

upgraded to a higher resource category. Under Canadian rules,

estimates of inferred mineral resources may not form the basis of a

feasibility study or prefeasibility study, except in rare cases.

The SEC normally only permits issuers to report mineralization that

does not constitute SEC Industry Guide 7 compliant "reserves" as

in-place tonnage and grade without reference to unit amounts. The

term "contained ounces" is not permitted under the rules of SEC

Industry Guide 7. In addition, the NI 43-101 and CIM Standards

definition of a "reserve" differs from the definition in SEC

Industry Guide 7. In SEC Industry Guide 7, a mineral reserve is

defined as a part of a mineral deposit which could be economically

and legally extracted or produced at the time the mineral reserve

determination is made, and a "final" or "bankable" feasibility

study is required to report reserves, the three-year historical

price is used in any reserve or cash flow analysis of designated

reserves and the primary environmental analysis or report must be

filed with the appropriate governmental authority.

This press release is not, and is not to be construed in any way

as, an offer to buy or sell securities in the United States.

NR10-34

Contacts: International Tower Hill Mines Ltd. Quentin Mai

Vice-President - Corporate Communications (604) 683-6332 or Toll

Free: 1-888-770-7488 (604) 408-7499 (FAX)

qmai@internationaltowerhill.com International Tower Hill Mines Ltd.

Shirley Zhou Manager - Corporate Communications (604) 638-3246 or

Toll Free: 1-888-770-7488 (604) 408-7499 (FAX)

szhou@internationaltowerhill.com www.ithmines.com

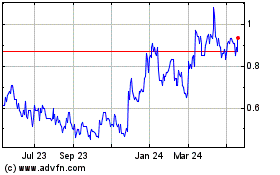

International Tower Hill... (TSX:ITH)

Historical Stock Chart

From Jun 2024 to Jul 2024

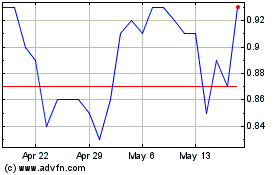

International Tower Hill... (TSX:ITH)

Historical Stock Chart

From Jul 2023 to Jul 2024