InterRent REIT Reports on Operations for Second Quarter 2010

August 12 2010 - 7:42PM

Marketwired Canada

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN

THE UNITED STATES

InterRent Real Estate Investment Trust (TSX:IIP.UN)(TSX:IIP.DB) ("InterRent")

today reported continued progress in the implementation of its strategic plan

along with the financial results for the second quarter ended June 30, 2010.

Highlights for the Three Months Ended June 30, 2010

-- Gross rental revenues for the quarter were $9.5 million, up 3.7%

compared to Q2 2009 and 3.5% for the first half of the year compared to

the first half of 2009.

-- Net revenues for the quarter were $8.4 million, a 4.5% decrease compared

to Q2 2009 and a 3.4% decrease for the first half of the year compared

to the first half of 2009. This decrease is as a result of the

management's decision to move to market rates and more selective

criteria for new tenants.

-- In keeping with management's repositioning strategy, the average monthly

rent for the quarter increased to $789 per unit from $760 (Q2 2009) and

from $780 (Q1 2010) an increase of 3.7% and 1.1% respectively.

-- The capital investments in rental units and common areas over the last

quarter are expected to positively impact the ability to achieve market

rents, attract stable tenants and reduce vacancies.

-- Net Operating Income (NOI) decreased by 15% to $3.9 million compared to

Q2 2009 and a 16% decrease for the first half of the year compared to

2009. Compared to Q1 2010, NOI is up by 29.8% over the first quarter of

2010.

-- Operating costs increased, primarily due to the strategic decision in Q4

2009 to outsource property management to a third party. This move was

done in order to implement a complete restructuring of the operating

model as well as property specific operating expenses and was required

to achieve market rents. These costs have begun to return to stabilized

levels and management expects them to decrease in Q3 and Q4.

-- Funds from Operations (FFO) were $0.60 million, up from $0.56 million

over the three months ended March 31, 2009 and up $0.72 million from the

first quarter of 2010. FFO per REIT unit was $0.02 for the three months

ended June 30, 2010 compared to $0.03 in 2009.

-- Distributable Income (DI) was ($0.36) million, or ($0.01) per unit

compared to ($0.06) million, or ($0.00) per REIT unit over the three

months ended June 30, 2009.

Financial Highlights

----------------------------------------------------------------------------

3 Months 3 Months 6 Months 6 Months

Ended Ended Ended Ended

In $ OOO's (Except for June 30, June 30, June 30, June 30,

per Unit) 2010 2009 2010 2009

----------------------------------------------------------------------------

Gross Rental revenue $ 9,451 $ 9,118 $ 18,823 $ 18,181

Less: Vacancy & rebates $ 1,277 $ 597 $ 2,326 $ 1,155

Other revenue $ 218 $ 271 $ 450 $ 509

Net revenue $ 8,392 $ 8,792 $ 16,946 $ 17,535

Expenses

Operating expenses $ 1,928 $ 1,622 $ 3,947 $ 3,205

Property taxes $ 1,472 $ 1,415 $ 2,947 $ 2,830

Utilities $ 1,130 $ 1,210 $ 3,214 $ 3,362

----------------------------------------------------

Total expenses $ 4,530 $ 4,247 $ 10,108 $ 9,397

----------------------------------------------------

Net operating income $ 3,862 $ 4,545 $ 6,838 $ 8,138

----------------------------------------------------

Operating margins 46.0% 51.7% 40.4% 46.4%

----------------------------------------------------------------------------

Funds from Operations

(FFO) $ 605 $ 560 $ 496 $ 1,015

FFO per weighted

average Unit $ 0.02 $ 0.03 $ 0.02 $ 0.06

----------------------------------------------------------------------------

Distributable income

(DI) ($356) ($56) ($991) ($90)

DI per weighted average

Unit ($0.01) ($0.00) ($0.04) ($0.00)

----------------------------------------------------------------------------

Weighted average Units

outstanding 28,486,967 18,286,719 28,269,933 18,282,874

----------------------------------------------------------------------------

Results for the Three Months Ended June 30, 2010

"The implementation of management's strategic plan is well underway. The

upgrades to property common areas and first impression upgrades will

significantly impact our ability to achieve market rents, attract stable tenants

and reduce vacancies" said Mike McGahan, Chief Executive Officer.

InterRent continues to focus on investing in energy efficient devices including

boilers as well as water and hydro saving devices. These investments help to

drive down operational costs while benefiting the environment. InterRent is also

upgrading common areas throughout the portfolio in order to maximize the

potential to increase rents on turnover throughout the portfolio.

"All the hard work our staff in the field have been doing is beginning to bear

fruit as we deliver on our plan. As of August 11, 2010, we have seen our per

unit vacancy rate come down to 7.4%. Although we still have much work to do,

this represents a significant increase in occupancy and indicates that we are on

the right path." said Mike McGahan, Chief Executive Officer.

In keeping with the management strategy of maximizing returns for unitholders

and focusing on clusters of buildings within geographical proximity to each

other in order to build operational efficiencies and attract focused,

professional staff, properties are reviewed on a regular basis to determine if

they should be kept or disposed of. As of August 11, 2010, two locations have

been listed and are conditionally sold. These locations represent a total of 26

units.

(i)Non-GAAP Measures

InterRent REIT assesses and measures segmented operating results based on

performance measures referred to as "Funds From Operations" ("FFO") and

Distributable Income ("Dl"). Both FFO and DI are widely accepted supplemental

measures on the performance of a Canadian real estate investment trust; however,

they are not measures defined by Canadian generally accepted accounting

principles ("GAAP"). The GAAP measurements most comparable to FFO and DI are

total cash flow from operating activities and net earnings. FFO and DI, however,

should not be construed as an alternative to net earnings or cash flow from

operating activities determined in accordance with GAAP as indicators of

InterRent REIT's performance. In addition, InterRent REIT's calculation

methodology for FFO and Dl may differ from that of other real estate companies

and trusts and therefore readers should not place reliance on these measures.

About InterRent

InterRent is a real estate investment trust engaged in building unitholder value

through the accretive acquisition, ownership and operation of strategically

located income producing multi-residential real estate, with 4,033 apartment

suites under ownership.

Forward Looking Statements

This news release contains "forward-looking statements" within the meaning of

the United States Private Securities Litigation Reform Act of 1995 and

applicable Canadian securities legislation. Generally, these forward-looking

statements can be identified by the use of forward-looking terminology such as

"plans", "anticipated", "expects" or "does not expect", "is expected", "budget",

"scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not

anticipate", or "believes", or variations of such words and phrases or state

that certain actions, events or results "may", "could", "would", "might" or

"will be taken", "occur" or "be achieved". InterRent is subject to significant

risks and uncertainties which may cause the actual results, performance or

achievements to be materially different from any future results, performance or

achievements expressed or implied by the forward looking statements contained in

this release. A full description of these risk factors can be found in

InterRent's publicly filed information which may be located at www.sedar.com.

InterRent cannot assure investors that actual results will be consistent with

these forward looking statements and InterRent assumes no obligation to update

or revise the forward looking statements contained in this release to reflect

actual events or new circumstances.

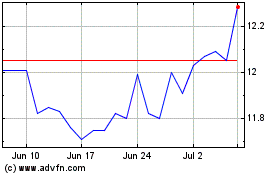

InterRent Real Estate In... (TSX:IIP.UN)

Historical Stock Chart

From Jun 2024 to Jul 2024

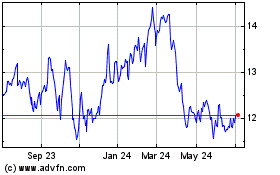

InterRent Real Estate In... (TSX:IIP.UN)

Historical Stock Chart

From Jul 2023 to Jul 2024