H&R Announces Closing of $200 Million Offering of Stapled Units and June Distribution

May 31 2011 - 8:23AM

PR Newswire (Canada)

TORONTO, May 31, 2011 /CNW/ -- /NOT FOR DISTRIBUTION TO U.S.

NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES.

ANY FAILURE TO COMPLY WITH THIS RESTRICTION MAY CONSTITUTE A

VIOLATION OF U.S. SECURITIES LAW./ TORONTO, May 31, 2011 /CNW/ -

H&R Real Estate Investment Trust and H&R Finance Trust

(collectively, "H&R") (TSX: HR.UN) announced today that they

have closed the previously announced offering of $200 million of

H&R stapled units (the "Stapled Units"). H&R had previously

agreed to sell the Stapled Units to a syndicate of underwriters

co-led by CIBC and RBC Capital Markets, on a bought deal basis. The

net proceeds of the offering will be used by H&R to fund future

development projects, property acquisitions and for general trust

purposes. Purchasers of the Stapled Units will be entitled to

participate in the following distribution declared for June, 2011:

_____________________________________________________________________

|Distribution/ Stapled Unit|Annualized| Record Date |Distribution

Date|

|__________________________|__________|_____________|_________________|

| $0.07917 | $0.95 |June 16, 2011| June 30, 2011 |

|__________________________|__________|_____________|_________________|

About H&R REIT and H&R Finance Trust H&R REIT is an

open-ended real estate investment trust, which owns a North

American portfolio of 36 offices, 120 industrial and 131 retail

properties comprising over 39 million square feet. The foundation

of H&R REIT's success since inception in 1996 has been a

disciplined strategy that leads to consistent and profitable

growth. H&R REIT leases its properties long term to

creditworthy tenants and strives to match those leases with

primarily long-term, fixed-rate financing. H&R Finance Trust is

an unincorporated investment trust, which primarily invests in

notes issued by an H&R REIT subsidiary. In 2008, H&R REIT

completed an internal reorganization which resulted in each issued

and outstanding H&R REIT unit trading together with a unit of

H&R Finance Trust as a "stapled unit" on the Toronto Stock

Exchange. Forward-looking Statements Certain information in this

news release contains forward-looking information within the

meaning of applicable securities laws (also known as

forward-looking statements) including, among others, statements

relating to the objectives of H&R REIT and H&R Finance

Trust (together, "H&R"), strategies to achieve those

objectives, H&R's beliefs, plans, estimates, and intentions,

and similar statements concerning anticipated future events,

results, circumstances, performance or expectations that are not

historical facts including, in particular, H&R REIT's

expectation regarding future acquisition of properties.

Forward-looking statements generally can be identified by words

such as "outlook", "objective", "may", "will", "expect", "intend",

"estimate", "anticipate", "believe", "should", "plans", "project",

"budget" or "continue" or similar expressions suggesting future

outcomes or events. Such forward-looking statements reflect

H&R's current beliefs and are based on information currently

available to management. These statements are not guarantees of

future performance and are based on H&R's estimates and

assumptions that are subject to risk and uncertainties, including

those discussed in H&R's materials filed with the Canadian

securities regulatory authorities from time to time, which could

cause the actual results and performance of H&R to differ

materially from the forward-looking statements contained in this

news release. Those risks and uncertainties include, among other

things, risks related to: prices and market value of securities of

H&R; availability of cash for distributions; development and

financing relating to The Bow development; restrictions pursuant to

the terms of indebtedness; liquidity; credit risk and tenant

concentration; interest rate and other debt related risk; tax risk;

ability to access capital markets; dilution; lease rollover risk;

construction risks; currency risk; unitholder liability;

co-ownership interest in properties; competition for real property

investments; environmental matters; reliance on one corporation for

management of substantially all of H&R REIT's properties;

changes in legislation and indebtedness of H&R. Material

factors or assumptions that were applied in drawing a conclusion or

making an estimate set out in the forward-looking statements

include that the general economy is stable; local real estate

conditions are stable; interest rates are relatively stable; and

equity and debt markets continue to provide access to capital.

H&R cautions that this list of factors is not exhaustive.

Although the forward-looking statements contained in this news

release are based upon what H&R believes are reasonable

assumptions, there can be no assurance that actual results will be

consistent with these forward-looking statements. All

forward-looking statements in this news release are qualified by

these cautionary statements. These forward-looking statements are

made as of today and H&R, except as required by applicable law,

assumes no obligation to update or revise them to reflect new

information or the occurrence of future events or circumstances. To

view this news release in HTML formatting, please use the following

URL:

http://www.newswire.ca/en/releases/archive/May2011/31/c8770.html p

Larry Froom, Chief Financial Officerbr/ Phone: (416) 635-7520br/

Email: a href="mailto:info@hr-reit.com"info@hr-reit.com/a /p

Copyright

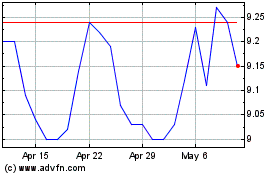

H and R Real Estate Inve... (TSX:HR.UN)

Historical Stock Chart

From Oct 2024 to Nov 2024

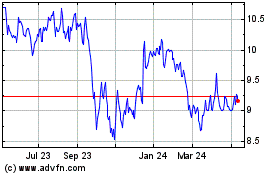

H and R Real Estate Inve... (TSX:HR.UN)

Historical Stock Chart

From Nov 2023 to Nov 2024