Gran Tierra Energy Inc.

(“Gran Tierra” or

the “Company”) (NYSE American:GTE)(TSX:GTE)(LSE:GTE) today

announced the Company’s financial and operating results for the

quarter ended June 30, 2023 (“

the

Quarter”). All dollar amounts are in United States

dollars, and production amounts are on an average working interest

(“

WI”) before royalties basis unless otherwise

indicated. Per barrel (“

bbl”) and bbl per day

(“

BOPD”) amounts are based on WI sales before

royalties. For per bbl amounts based on net after royalty

(“

NAR”) production, see Gran Tierra’s Quarterly

Report on Form 10-Q filed August 1, 2023.

Message to Shareholders

Gary Guidry, President and Chief Executive

Officer of Gran Tierra, commented: “During the first half of 2023,

Gran Tierra completed its development campaign with the drilling of

21 development wells in three of our major fields which have been

producing oil at rates in line with and at times exceeding our

expectations. Currently, our third quarter-to-date 2023 total

average production levels stands at an impressive ~35,300 BOPD. Now

that our development campaign has been completed, capital

expenditures are expected to decrease significantly in the second

half of 2023, which should allow the Company to focus on the

generation of free cash flow.

Gran Tierra is pleased to provide a mid-year

reserves update that we announced today in a separate press

release. The positive results announced in the reserves update are

a testament to the Company’s operational success and our in-country

relationships that have allowed the Company to secure the

Suroriente Block continuation agreement. We invite you to read the

reserves update press release in its entirety.

Looking ahead, we are entering an exciting phase

of growth. With the 2023 development campaign now completed, we are

gearing up to drill exploration wells in Ecuador. This represents a

promising opportunity for Gran Tierra to follow-up on existing

exploration success achieved in Ecuador during 2022. Our Company's

financial position remains robust, which gives us the flexibility

to make strategic investments and seize opportunities that drive

long-term value creation for our shareholders as they arise. We

continue to focus on maximizing operational efficiency and managing

costs effectively to ensure sustainable growth and

profitability.

We are also pleased to announce that we plan to

continue our investment in the protection and conservation of the

Andean-Amazon rainforest in the Putumayo Basin of Colombia by

extending our support to the NaturAmazonas project. The project,

founded by Gran Tierra and world renowned non-governmental

organization Conservation International, has grown into an alliance

of public and private institutions working together to address the

root causes of deforestation. We began our reforestation work

nearly a decade ago because one of our longstanding goals is to

leave the environment in a better condition than when we arrived.

During the first 6 years of the project, Gran Tierra’s initial

investment of $13 million has already produced impactful results

that have benefited the environment and local communities,

including the reforestation and restoration of over 1,400 hectares

of land and the planting of over 1.2 million trees.”

Key Highlights of the

Quarter:

-

Production:

- Gran Tierra’s

total average production was 33,719 BOPD, an increase of 7%

compared to first quarter 2023 (“the Prior

Quarter”) and up 10% from second quarter 2022

(“one year ago”). Gran Tierra’s production in the

Quarter was the Company’s highest quarterly average total

production since the second quarter of 2019.

- The Company’s

third quarter-to-date 2023 total average production (1) has been

approximately 35,300 BOPD.

- Quality

and Transportation Discounts: The Company’s quality and

transportation discount narrowed to $14.10 per bbl, down from

$18.45 per bbl in the Prior Quarter and up from $13.00 per bbl one

year ago. The Castilla oil differential narrowed to $9.41 per bbl,

down from $15.17 per bbl in the Prior Quarter and up from $7.82 per

bbl one year ago (Castilla is the benchmark for the Company’s

Middle Magdalena Valley Basin oil production). The Vasconia

differential narrowed to $5.53 per bbl, down from $7.87 per bbl in

the Prior Quarter and up from $5.09 per bbl one year ago (Vasconia

is the benchmark for the Company’s Putumayo Basin oil production).

Differentials to Brent pricing have continued to narrow as 2023 has

progressed. The current(1) Castilla differential is approximately

$6.64 per bbl and the Vasconia differential is approximately $3.96

per bbl.

- Net

Income: Gran Tierra incurred a net loss of $11 million,

compared to a net loss of $10 million in the Prior Quarter and net

income of $53 million one year ago, which was primarily due to the

$13 million of realized foreign exchange loss mainly associated

with the strengthening of the Colombian peso by 9% in the Quarter

and the payment of the Company’s 2022 income taxes in the Quarter,

which are paid in Colombian pesos. The Company’s net income over

the last 12 months was $51 million.

- Oil

Price: The Brent oil price averaged $77.73 per bbl, down

5% from the Prior Quarter and down 31% from one year ago.

- Realized

Foreign Exchange Loss: During the Quarter, a $13 million

realized foreign exchange loss was recognized primarily as a result

of the strengthening of the Colombian peso by 9% in the Quarter and

the payment of the 2022 income taxes in the Quarter, which are paid

in Colombian pesos.

- Basic

Earnings Per Share: Gran Tierra incurred a net loss of

$0.33 per share, compared to a net loss of $0.28 per share in the

Prior Quarter and net earnings of $1.44 per share one year

ago.

- Diluted

Earnings Per Share: Gran Tierra incurred a net loss of

$0.33 per share, compared to a net loss of $0.28 per share in the

Prior Quarter and net earnings of $1.42 per share one year

ago.

- Adjusted

EBITDA(2): Adjusted EBITDA(2) was $85

million compared to $89 million in the Prior Quarter and $140

million one year ago. Adjusted EBITDA(2) was negatively impacted by

the $13 million realized foreign exchange loss. Twelve month

trailing Adjusted EBITDA(2) to Net Debt(2) was 1.2 times.

- Funds

Flow from Operations(2):

Funds flow from operations(2) was $53 million, down 12% from the

Prior Quarter and down 49% from one year ago. Funds flow from

operations(2) was negatively impacted by the $13 million realized

foreign exchange loss. Over the last 12 months, Gran Tierra’s funds

flow from operations(2) was $288 million.

- Free

Cash Flow(2): During the

Quarter, the Company’s capital expenditures exceeded funds flow

from operations by approximately $12 million as a result of the

Company’s front-end loaded 2023 development program which saw the

drilling of 7 development wells in the Quarter, which completed the

development program for 2023, which consisted of a total of 21

wells. The majority of the Company’s capital expenditures were

incurred in the first half of 2023 and with the current Brent oil

price, narrowing of differentials and current production levels, we

expect to meet our free cash flow(2) targets for 2023.

- Share

Buybacks:

- During the

Quarter, pursuant to Gran Tierra’s current normal course issuer bid

(“NCIB”), Gran Tierra purchased 20,439 shares, for

a total purchase price of $107,810, at a weighted average price of

approximately $5.27 per share. Since the commencement of the NCIB

on September 1, 2022, Gran Tierra has purchased 3.6 million shares,

representing approximately 9.8% of Gran Tierra’s outstanding shares

as of June 30, 2022. The NCIB was completed and expired when the

10% share maximum of Gran Tierra’s public float as of August 22,

2022, was reached in May 2023.

-

Cash: As of June 30, 2023, the Company had a cash

balance of $69 million and net debt(2) of $503 million. With the

forecasted free cash flow in the second half of 2023, we expect to

exit 2023 with over $150 million of cash.

- Undrawn

Credit Facility: Gran Tierra’s credit facility, with a

capacity of up to $150 million, remains undrawn.

- Oil

Price Hedges: Gran Tierra does not currently have any oil

price hedges in place and expects to fully benefit from any

increases in oil prices.

-

Additional Key Financial Metrics:

- Capital

Expenditures: Capital expenditures of $66 million were

lower than the Prior Quarter’s level of $71 million and slightly up

from $65 million compared to one year ago. During the Quarter, Gran

Tierra drilled 7 development wells in Colombia.

- Oil

Sales: Gran Tierra generated oil sales of $158 million, up

10% from the Prior Quarter and down 23% from one year ago. Oil

sales increased compared to the Prior Quarter primarily as a result

of an 8% increase in sales volumes, partially offset by a 5%

decrease in Brent price. Lower oil sales relative to one year ago

were driven primarily by the decrease in Brent oil price and the

widening of quality and transportation discounts compared to the

same period, which were partially offset by the increase in the

Company’s oil production over the same timeframe.

-

Operating

Netback(2)(3): The

Company’s operating netback(2)(3) was $34.58 per bbl, down 2% from

the Prior Quarter and down 42% from one year ago. As with oil

sales, changes in operating netback relative to the Prior Quarter

were driven by a decrease in Brent oil price. Compared to one year

ago the change in operating netback were largely driven by the

decrease in Brent oil price and higher quality and transportation

discounts over the same time period.

-

Operating Expenses: Gran Tierra’s operating

expenses increased 9% to $15.86 per bbl, up from $14.59 per bbl in

the Prior Quarter, primarily due to higher road maintenance and

environmental activities, partially offset by a lower number of

workovers. Compared to one year ago, operating expenses increased

by 10% on a per bbl basis, due primarily to increased Ecuador

operations, higher environmental costs and partially offset by a

lower number of workovers.

- General

and Administrative (“G&A”) Expenses: G&A expenses

before stock-based compensation were $3.12 per bbl, down from $3.95

per bbl in the Prior Quarter due to lower legal and information

technology costs, partially offset by higher consulting fees

attributed to optimization projects and up from $2.86 when compared

to one year ago.

- Cash

Netback: Cash netback per bbl was $17.37, compared to

$21.16 in the Prior Quarter as a result of a decrease in Brent

price of $4.37 per bbl and a $4.18 per bbl realized foreign

exchange loss in the Quarter due to the strengthening Colombian

peso and payment of the 2022 income taxes paid in the Quarter. In

the Prior Quarter, the realized foreign exchange loss was of $0.42

per bbl. Compared to one year ago, cash netback per bbl decreased

by $20.34 from $37.71, despite a $34.25 per bbl decrease in the

Brent oil price over the same period.

Exploration Campaign:

- Gran Tierra has

secured a drilling rig to begin the Ecuador exploration campaign

that is expected to now start in the fourth quarter of 2023. Gran

Tierra expects to drill two to three exploration wells in

2023.

Financial and Operational Highlights

(all amounts in $000s, except per share and bbl

amounts)

| |

Three Months Ended June 30, |

|

Three Months Ended March 31, |

|

Six Months Ended June 30, |

|

|

|

2023 |

|

|

2022 |

|

|

|

2023 |

|

|

|

2023 |

|

|

2022 |

|

| |

|

|

|

|

|

|

|

| Net (Loss)

Income |

$ |

(10,825 |

) |

$ |

52,972 |

|

|

$ |

(9,700 |

) |

|

$ |

(20,525 |

) |

$ |

67,091 |

|

|

Per Share - Basic(4) |

$ |

(0.33 |

) |

$ |

1.44 |

|

|

$ |

(0.28 |

) |

|

$ |

(0.61 |

) |

$ |

1.82 |

|

|

Per Share - Diluted(4) |

$ |

(0.33 |

) |

$ |

1.42 |

|

|

$ |

(0.28 |

) |

|

$ |

(0.61 |

) |

$ |

1.80 |

|

| |

|

|

|

|

|

|

|

| Oil

Sales |

$ |

157,902 |

|

$ |

205,785 |

|

|

$ |

144,190 |

|

|

$ |

302,092 |

|

$ |

380,354 |

|

| Operating

Expenses |

|

(48,491 |

) |

|

(39,494 |

) |

|

|

(41,369 |

) |

|

|

(89,860 |

) |

|

(74,429 |

) |

| Transportation

Expenses |

|

(3,691 |

) |

|

(2,513 |

) |

|

|

(3,066 |

) |

|

|

(6,757 |

) |

|

(5,347 |

) |

| Operating

Netback(2)(3) |

$ |

105,720 |

|

$ |

163,778 |

|

|

$ |

99,755 |

|

|

$ |

205,475 |

|

$ |

300,578 |

|

| |

|

|

|

|

|

|

|

| G&A Expenses

Before Stock-Based Compensation |

$ |

9,549 |

|

$ |

7,847 |

|

|

$ |

11,196 |

|

|

$ |

20,745 |

|

$ |

15,626 |

|

| G&A Stock-Based

Compensation Expense |

|

317 |

|

|

1,989 |

|

|

|

1,500 |

|

|

|

1,817 |

|

|

6,546 |

|

| G&A Expenses,

Including Stock Based Compensation |

$ |

9,866 |

|

$ |

9,836 |

|

|

$ |

12,696 |

|

|

$ |

22,562 |

|

$ |

22,172 |

|

| |

|

|

|

|

|

|

|

| Adjusted

EBITDA(2) |

$ |

84,522 |

|

$ |

140,113 |

|

|

$ |

88,677 |

|

|

$ |

173,199 |

|

$ |

259,491 |

|

| |

|

|

|

|

|

|

|

|

EBITDA(2) |

$ |

91,794 |

|

$ |

146,048 |

|

|

$ |

86,740 |

|

|

$ |

178,534 |

|

$ |

252,798 |

|

| |

|

|

|

|

|

|

|

| Net Cash Provided by

Operating Activities |

$ |

37,877 |

|

$ |

143,197 |

|

|

$ |

49,253 |

|

|

$ |

87,130 |

|

$ |

247,022 |

|

| |

|

|

|

|

|

|

|

| Funds Flow from

Operations(2) |

$ |

53,106 |

|

$ |

103,625 |

|

|

$ |

60,016 |

|

|

$ |

113,122 |

|

$ |

190,935 |

|

| |

|

|

|

|

|

|

|

| Capital

Expenditures |

$ |

65,565 |

|

$ |

65,199 |

|

|

$ |

71,062 |

|

|

$ |

136,627 |

|

$ |

106,682 |

|

| |

|

|

|

|

|

|

|

| Free Cash

Flow(2) |

$ |

(12,459 |

) |

$ |

38,426 |

|

|

$ |

(11,046 |

) |

|

$ |

(23,505 |

) |

$ |

84,253 |

|

| |

|

|

|

|

|

|

|

|

Average Daily Volumes (BOPD) |

|

|

|

|

|

|

|

|

WI Production Before Royalties |

|

33,719 |

|

|

30,607 |

|

|

|

31,611 |

|

|

|

32,671 |

|

|

29,988 |

|

|

Royalties |

|

(6,515 |

) |

|

(7,392 |

) |

|

|

(6,085 |

) |

|

|

(6,301 |

) |

|

(6,962 |

) |

| Production

NAR |

|

27,204 |

|

|

23,215 |

|

|

|

25,526 |

|

|

|

26,370 |

|

|

23,026 |

|

| Decrease (Increase) in

Inventory |

|

67 |

|

|

(368 |

) |

|

|

(355 |

) |

|

|

(143 |

) |

|

(236 |

) |

| Sales |

|

27,271 |

|

|

22,847 |

|

|

|

25,171 |

|

|

|

26,227 |

|

|

22,790 |

|

| Royalties, % of WI

Production Before Royalties |

|

19 |

% |

|

24 |

% |

|

|

19 |

% |

|

|

19 |

% |

|

23 |

% |

| |

|

|

|

|

|

|

|

|

Per bbl |

|

|

|

|

|

|

|

|

Brent |

$ |

77.73 |

|

$ |

111.98 |

|

|

$ |

82.10 |

|

|

$ |

79.91 |

|

$ |

104.94 |

|

| Quality and

Transportation Discount |

|

(14.10 |

) |

|

(13.00 |

) |

|

|

(18.45 |

) |

|

|

(16.27 |

) |

|

(12.73 |

) |

|

Royalties |

|

(11.98 |

) |

|

(24.07 |

) |

|

|

(12.80 |

) |

|

|

(12.38 |

) |

|

(21.32 |

) |

| Average Realized

Price |

|

51.65 |

|

|

74.91 |

|

|

|

50.85 |

|

|

|

51.26 |

|

|

70.89 |

|

| Transportation

Expenses |

|

(1.21 |

) |

|

(0.91 |

) |

|

|

(1.08 |

) |

|

|

(1.15 |

) |

|

(1.00 |

) |

| Average Realized Price

Net of Transportation Expenses |

|

50.44 |

|

|

74.00 |

|

|

|

49.77 |

|

|

|

50.11 |

|

|

69.89 |

|

| Operating

Expenses |

|

(15.86 |

) |

|

(14.38 |

) |

|

|

(14.59 |

) |

|

|

(15.25 |

) |

|

(13.87 |

) |

| Operating

Netback(2)(3) |

|

34.58 |

|

|

59.62 |

|

|

|

35.18 |

|

|

|

34.86 |

|

|

56.02 |

|

| G&A Expenses

Before Stock-Based Compensation |

|

(3.12 |

) |

|

(2.86 |

) |

|

|

(3.95 |

) |

|

|

(3.52 |

) |

|

(2.91 |

) |

| Realized Foreign

Exchange (Loss) / Gain |

|

(4.18 |

) |

|

0.59 |

|

|

|

(0.42 |

) |

|

|

(2.37 |

) |

|

0.09 |

|

| Cash Settlements on

Derivative Instruments |

|

— |

|

|

(6.48 |

) |

|

|

— |

|

|

|

— |

|

|

(4.92 |

) |

| Interest Expense,

Excluding Amortization of Debt Issuance Costs |

|

(3.81 |

) |

|

(4.03 |

) |

|

|

(3.90 |

) |

|

|

(3.85 |

) |

|

(4.16 |

) |

| Interest

Income |

|

0.21 |

|

|

— |

|

|

|

0.27 |

|

|

|

0.24 |

|

|

— |

|

| Net Lease

Payments |

|

0.15 |

|

|

0.13 |

|

|

|

0.19 |

|

|

|

0.17 |

|

|

0.08 |

|

| Current Income Tax

Expense |

|

(6.46 |

) |

|

(9.26 |

) |

|

|

(6.21 |

) |

|

|

(6.34 |

) |

|

(8.62 |

) |

| Cash

Netback(2) |

$ |

17.37 |

|

$ |

37.71 |

|

|

$ |

21.16 |

|

|

$ |

19.19 |

|

$ |

35.58 |

|

| |

|

|

|

|

|

|

|

|

Share Information (000s) |

|

|

|

|

|

|

|

|

Common Stock Outstanding, End of

Period(4) |

|

33,287 |

|

|

36,887 |

|

|

|

33,307 |

|

|

|

33,287 |

|

|

36,887 |

|

| Weighted Average Number

of Common and Outstanding Stock -

Basic(4) |

|

33,300 |

|

|

36,857 |

|

|

|

34,451 |

|

|

|

33,872 |

|

|

36,798 |

|

| Weighted Average Number

of Common and Outstanding Stock -

Diluted(4) |

|

33,300 |

|

|

37,423 |

|

|

|

34,451 |

|

|

|

33,872 |

|

|

37,298 |

|

(1) Gran Tierra’s third quarter-to-date 2023

total average production is for the time period from July 1 to July

31, 2023.(2) Funds flow from operations, operating netback, net

debt, cash netback, earnings before interest, taxes and depletion,

depreciation and accretion (“DD&A”)

(“EBITDA”) and

EBITDA adjusted for non-cash lease expense, lease payments,

unrealized foreign exchange gains or losses, stock-based

compensation expense, unrealized derivative instruments gains or

losses, inventory impairment, gain on re-purchase of Senior Notes

and other financial instruments gains or losses (“Adjusted

EBITDA”), cash flow, free cash flow and net debt are

non-GAAP measures and do not have standardized meanings under

generally accepted accounting principles in the United States of

America (“GAAP”). Cash flow refers to funds flow

from operations. Free cash flow refers to funds flow from

operations less capital expenditures. Refer to “Non-GAAP Measures”

in this press release for descriptions of these non-GAAP measures

and, where applicable, reconciliations to the most directly

comparable measures calculated and presented in accordance with

GAAP.(3) Operating netback as presented is defined as oil sales

less operating and transportation expenses. See the table titled

Financial and Operational Highlights above for the components of

consolidated operating netback and corresponding reconciliation.(4)

Reflects our 1-for-10 reverse stock split that became effective

May 5, 2023.

Conference Call

Information:

Gran Tierra will host its second quarter 2023

results conference call on Wednesday, August 2, 2023, at 9:00 a.m.

Mountain Time, 11:00 a.m. Eastern Time. Interested parties may

access the conference call by registering at the following link:

https://register.vevent.com/register/BIc965d6f578624020a8fd58c5cac2b6e1.

The call will also be available via webcast at

www.grantierra.com.

Corporate Presentation:

Gran Tierra’s Corporate Presentation has been

updated and is available on the Company website at

www.grantierra.com.

Contact Information

For investor and media inquiries please contact:

Gary Guidry President & Chief Executive Officer

Ryan Ellson Executive Vice President & Chief Financial

Officer

Rodger Trimble Vice President, Investor Relations

+1-403-265-3221

info@grantierra.com

About Gran Tierra Energy

Inc.Gran Tierra Energy Inc. together with its subsidiaries

is an independent international energy company currently focused on

oil and natural gas exploration and production in Colombia and

Ecuador. The Company is currently developing its existing portfolio

of assets in Colombia and Ecuador and will continue to pursue

additional new growth opportunities that would further strengthen

the Company’s portfolio. The Company’s common stock trades on the

NYSE American, the Toronto Stock Exchange and the London Stock

Exchange under the ticker symbol GTE. Additional information

concerning Gran Tierra is available at www.grantierra.com. Except

to the extent expressly stated otherwise, information on the

Company's website or accessible from our website or any other

website is not incorporated by reference into and should not be

considered part of this press release. Investor inquiries may be

directed to info@grantierra.com or (403) 265-3221.

Gran Tierra's Securities and Exchange Commission

(the “SEC”) filings are available on the SEC

website at http://www.sec.gov. The Company’s Canadian securities

regulatory filings are available on SEDAR at http://www.sedar.com

and UK regulatory filings are available on the National Storage

Mechanism website at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism.

Forward Looking Statements and Legal

Advisories:This press release contains opinions,

forecasts, projections, and other statements about future events or

results that constitute forward-looking statements within the

meaning of the United States Private Securities Litigation Reform

Act of 1995, Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended,

and financial outlook and forward looking information within the

meaning of applicable Canadian securities laws (collectively,

“forward-looking statements”). The use of the words “expect”,

“plan”, “can,” “will,” “should,” “guidance,” “forecast,” “signal,”

“progress” and “believes”, derivations thereof and similar terms

identify forward-looking statements. In particular, but without

limiting the foregoing, this press release contains forward-looking

statements regarding: the Company’s expected future production,

capital expenditures and free cash flow, the Company’s targeted

cash balance and uses of excess free cash flow, the Company’s plans

regarding strategic investments and growth, the Company’s drilling

program and the Company’s expectations of commodity prices and its

positioning for the remainder of 2023. The forward- looking

statements contained in this press release reflect several material

factors and expectations and assumptions of Gran Tierra including,

without limitation, that Gran Tierra will continue to conduct its

operations in a manner consistent with its current expectations,

pricing and cost estimates (including with respect to commodity

pricing and exchange rates), and the general continuance of assumed

operational, regulatory and industry conditions in Colombia and

Ecuador, and the ability of Gran Tierra to execute its business and

operational plans in the manner currently planned.

Among the important factors that could cause

actual results to differ materially from those indicated by the

forward-looking statements in this press release are: our

operations are located in South America and unexpected problems can

arise due to guerilla activity, strikes, local blockades or

protests; technical difficulties and operational difficulties may

arise which impact the production, transport or sale of our

products; other disruptions to local operations; global health

events; global and regional changes in the demand, supply, prices,

differentials or other market conditions affecting oil and gas,

including inflation and changes resulting from a global health

crisis, the Russian invasion of Ukraine, or from the imposition or

lifting of crude oil production quotas or other actions that might

be imposed by OPEC, such as its recent decision to cut production

and other producing countries and resulting company or third-party

actions in response to such changes; changes in commodity prices,

including volatility or a prolonged decline in these prices

relative to historical or future expected levels; the risk that

current global economic and credit conditions may impact oil prices

and oil consumption more than we currently predict. which could

cause further modification of our strategy and capital spending

program; prices and markets for oil and natural gas are

unpredictable and volatile; the effect of hedges; the accuracy of

productive capacity of any particular field; geographic, political

and weather conditions can impact the production, transport or sale

of our products; our ability to execute its business plan and

realize expected benefits from current initiatives; the risk that

unexpected delays and difficulties in developing currently owned

properties may occur; the ability to replace reserves and

production and develop and manage reserves on an economically

viable basis; the accuracy of testing and production results and

seismic data, pricing and cost estimates (including with respect to

commodity pricing and exchange rates); the risk profile of planned

exploration activities; the effects of drilling down-dip; the

effects of waterflood and multi-stage fracture stimulation

operations; the extent and effect of delivery disruptions,

equipment performance and costs; actions by third parties; the

timely receipt of regulatory or other required approvals for our

operating activities; the failure of exploratory drilling to result

in commercial wells; unexpected delays due to the limited

availability of drilling equipment and personnel; volatility or

declines in the trading price of our common stock or bonds; the

risk that we do not receive the anticipated benefits of government

programs, including government tax refunds; our ability to comply

with financial covenants in its credit agreement and indentures and

make borrowings under any credit agreement; and the risk factors

detailed from time to time in Gran Tierra’s periodic reports filed

with the Securities and Exchange Commission, including, without

limitation, under the caption “Risk Factors” in Gran Tierra’s

Annual Report on Form 10-K for the year ended December 31, 2022

filed February 21, 2023 and its other filings with the SEC. These

filings are available on the SEC website at http://www.sec.gov and

on SEDAR at www.sedar.com.

The forward-looking statements contained in this

press release are based on certain assumptions made by Gran Tierra

based on management’s experience and other factors believed to be

appropriate. Gran Tierra believes these assumptions to be

reasonable at this time, but the forward-looking statements are

subject to risk and uncertainties, many of which are beyond Gran

Tierra’s control, which may cause actual results to differ

materially from those implied or expressed by the forward looking

statements. The risk that the assumptions on which the 2023 outlook

are based prove incorrect may increase the later the period to

which the outlook relates. In particular, the unprecedented nature

of industry volatility may make it particularly difficult to

identify risks or predict the degree to which identified risks will

impact Gran Tierra’s business and financial condition. All

forward-looking statements are made as of the date of this press

release and the fact that this press release remains available does

not constitute a representation by Gran Tierra that Gran Tierra

believes these forward-looking statements continue to be true as of

any subsequent date. Actual results may vary materially from the

expected results expressed in forward-looking statements. Gran

Tierra disclaims any intention or obligation to update or revise

any forward-looking statements, whether as a result of new

information, future events or otherwise, except as expressly

required by applicable law. In addition, historical, current and

forward-looking sustainability-related statements may be based on

standards for measuring progress that are still developing,

internal controls and processes that continue to evolve, and

assumptions that are subject to change in the future.

The estimates of future cash and free cash flow

may be considered to be future-oriented financial information or a

financial outlook for the purposes of applicable Canadian

securities laws. Financial outlook and future oriented financial

information contained in this press release about prospective

financial performance, financial position or cash flows are

provided to give the reader a better understanding of the potential

future performance of the Company in certain areas and are based on

assumptions about future events, including economic conditions and

proposed courses of action, based on management's assessment of the

relevant information currently available, and to become available

in the future. In particular, this press release contains projected

operational and financial information for 2023 to allow readers to

assess the Company's ability to fund its programs. These

projections contain forward-looking statements and are based on a

number of material assumptions and factors set out above.

Actual results may differ significantly from the

projections presented herein. The actual results of Gran Tierra's

operations for any period could vary from the amounts set forth in

these projections, and such variations may be material. See above

for a discussion of the risks that could cause actual results to

vary. The future-oriented financial information and financial

outlooks contained in this press release have been approved by

management as of the date of this press release. Readers are

cautioned that any such financial outlook and future-oriented

financial information contained herein should not be used for

purposes other than those for which it is disclosed herein. The

Company and its management believe that the prospective financial

information has been prepared on a reasonable basis, reflecting

management's best estimates and judgments, and represent, to the

best of management's knowledge and opinion, the Company's expected

course of action. However, because this information is highly

subjective, it should not be relied on as necessarily indicative of

future results.

Non-GAAP Measures

This press release includes non-GAAP financial

measures as further described herein. These non-GAAP measures do

not have a standardized meaning under GAAP. Investors are cautioned

that these measures should not be construed as alternatives to net

income or loss, cash flow from operating activities or other

measures of financial performance as determined in accordance with

GAAP. Gran Tierra’s method of calculating these measures may differ

from other companies and, accordingly, they may not be comparable

to similar measures used by other companies. Each non-GAAP

financial measure is presented along with the corresponding GAAP

measure so as to not imply that more emphasis should be placed on

the non-GAAP measure.

Operating netback as presented is defined as oil

sales less operating and transportation expenses. See the table

entitled Financial and Operational Highlights above for the

components of consolidated operating netback and corresponding

reconciliation.

Cash netback as presented is defined as net

income or loss adjusted for depletion, depreciation and accretion

(“DD&A”) expenses, deferred tax expense or recovery,

stock-based compensation expense or recovery, amortization of debt

issuance costs, non-cash lease expense, lease payments, unrealized

foreign exchange gain or loss, derivative instruments gain or loss,

cash settlement on derivative instruments and other gain.

Management believes that operating netback and cash netback are

useful supplemental measures for investors to analyze financial

performance and provide an indication of the results generated by

Gran Tierra’s principal business activities prior to the

consideration of other income and expenses. A reconciliation from

net income or loss to cash netback is as follows:

| |

Three Months Ended June 30, |

|

Three Months Ended March 31, |

|

Six Months Ended June 30, |

|

Cash Netback - (Non-GAAP) Measure ($000s) |

|

2023 |

|

|

2022 |

|

|

|

2023 |

|

|

|

2023 |

|

|

2022 |

|

| Net (loss)

income |

$ |

(10,825 |

) |

$ |

52,972 |

|

|

$ |

(9,700 |

) |

|

$ |

(20,525 |

) |

$ |

67,091 |

|

| Adjustments to

reconcile net income (loss) to cash netback |

|

|

|

|

|

|

|

|

DD&A expenses |

|

56,209 |

|

|

42,216 |

|

|

|

51,721 |

|

|

|

107,930 |

|

|

83,179 |

|

|

Deferred tax expense |

|

13,975 |

|

|

13,241 |

|

|

|

15,277 |

|

|

|

29,252 |

|

|

31,954 |

|

|

Stock-based compensation expense |

|

317 |

|

|

1,989 |

|

|

|

1,500 |

|

|

|

1,817 |

|

|

6,546 |

|

|

Amortization of debt issuance costs |

|

1,019 |

|

|

1,131 |

|

|

|

781 |

|

|

|

1,800 |

|

|

2,018 |

|

|

Non-cash lease expense |

|

1,109 |

|

|

747 |

|

|

|

1,144 |

|

|

|

2,253 |

|

|

1,158 |

|

|

Lease payments |

|

(636 |

) |

|

(388 |

) |

|

|

(606 |

) |

|

|

(1,242 |

) |

|

(732 |

) |

|

Unrealized foreign exchange (gain) loss |

|

(8,062 |

) |

|

4,341 |

|

|

|

514 |

|

|

|

(7,548 |

) |

|

(498 |

) |

|

Derivative instruments loss |

|

— |

|

|

5,172 |

|

|

|

— |

|

|

|

— |

|

|

26,611 |

|

|

Cash settlements on derivative instruments |

|

— |

|

|

(17,796 |

) |

|

|

— |

|

|

|

— |

|

|

(26,392 |

) |

|

Other gain |

|

— |

|

|

— |

|

|

|

(615 |

) |

|

|

(615 |

) |

|

— |

|

| Cash

netback |

$ |

53,106 |

|

$ |

103,625 |

|

|

$ |

60,016 |

|

|

$ |

113,122 |

|

$ |

190,935 |

|

EBITDA, as presented, is defined as net income

or loss adjusted for DD&A expenses, interest expense and income

tax expense or recovery. Adjusted EBITDA, as presented, is defined

as EBITDA adjusted for non-cash lease expense, lease payments,

unrealized foreign exchange gain or loss, stock-based compensation

expense or recovery, unrealized derivative instruments gain or

loss, other gain or loss, and other financial instruments gain or

loss. Management uses this supplemental measure to analyze

performance and income generated by our principal business

activities prior to the consideration of how non-cash items affect

that income, and believes that this financial measure is useful

supplemental information for investors to analyze our performance

and our financial results. A reconciliation from net income or loss

to EBITDA and adjusted EBITDA is as follows:

| |

Three Months Ended June 30, |

|

Three Months Ended March 31, |

|

Six Months Ended June 30, |

|

Twelve Month Trailing June

30, |

|

EBITDA - (Non-GAAP) Measure ($000s) |

|

2023 |

|

|

2022 |

|

|

|

2023 |

|

|

|

2023 |

|

|

2022 |

|

|

|

2023 |

|

| Net (loss)

income |

$ |

(10,825 |

) |

$ |

52,972 |

|

|

$ |

(9,700 |

) |

|

$ |

(20,525 |

) |

$ |

67,091 |

|

|

$ |

51,413 |

|

| Adjustments to

reconcile net income (loss) to EBITDA and Adjusted

EBITDA |

|

|

|

|

|

|

|

|

|

|

DD&A expenses |

|

56,209 |

|

|

42,216 |

|

|

|

51,721 |

|

|

|

107,930 |

|

|

83,179 |

|

|

|

205,031 |

|

|

Interest expense |

|

12,678 |

|

|

12,194 |

|

|

|

11,836 |

|

|

|

24,514 |

|

|

24,322 |

|

|

|

46,685 |

|

|

Income tax expense |

|

33,732 |

|

|

38,666 |

|

|

|

32,883 |

|

|

|

66,615 |

|

|

78,206 |

|

|

|

94,315 |

|

| EBITDA |

$ |

91,794 |

|

$ |

146,048 |

|

|

$ |

86,740 |

|

|

$ |

178,534 |

|

$ |

252,798 |

|

|

$ |

397,444 |

|

|

Non-cash lease expense |

|

1,109 |

|

|

747 |

|

|

|

1,144 |

|

|

|

2,253 |

|

|

1,158 |

|

|

|

3,913 |

|

|

Lease payments |

|

(636 |

) |

|

(388 |

) |

|

|

(606 |

) |

|

|

(1,242 |

) |

|

(732 |

) |

|

|

(2,176 |

) |

|

Unrealized foreign exchange (gain) loss |

|

(8,062 |

) |

|

4,341 |

|

|

|

514 |

|

|

|

(7,548 |

) |

|

(498 |

) |

|

|

3,201 |

|

|

Stock-based compensation expense |

|

317 |

|

|

1,989 |

|

|

|

1,500 |

|

|

|

1,817 |

|

|

6,546 |

|

|

|

4,320 |

|

|

Unrealized derivative instruments loss |

|

— |

|

|

(12,624 |

) |

|

|

— |

|

|

|

— |

|

|

219 |

|

|

|

(219 |

) |

|

Other gain |

|

— |

|

|

— |

|

|

|

(615 |

) |

|

|

(615 |

) |

|

— |

|

|

|

(3,213 |

) |

|

Other financial instruments gain |

|

— |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

— |

|

|

|

(7 |

) |

| Adjusted

EBITDA |

$ |

84,522 |

|

$ |

140,113 |

|

|

$ |

88,677 |

|

|

$ |

173,199 |

|

$ |

259,491 |

|

|

$ |

403,263 |

|

Funds flow from operations, as presented, is

defined as net income or loss adjusted for DD&A expenses,

deferred tax expense or recovery, stock-based compensation expense

or recovery, amortization of debt issuance costs, non-cash lease

expense, lease payments, unrealized foreign exchange gain or loss,

derivative instruments gain or loss, cash settlement on derivative

instruments, other gain, and other financial instruments gain or

loss. Management uses this financial measure to analyze performance

and income or loss generated by our principal business activities

prior to the consideration of how non-cash items affect that income

or loss, and believes that this financial measure is also useful

supplemental information for investors to analyze performance and

our financial results. Free cash flow, as presented, is defined as

funds flow from operations adjusted for capital expenditures.

Management uses this financial measure to analyze cash flow

generated by our principal business activities after capital

requirements and believes that this financial measure is also

useful supplemental information for investors to analyze

performance and our financial results. A reconciliation from net

income or loss to both funds flow from operations and free cash

flow is as follows:

| |

Three Months Ended June 30, |

|

Three Months Ended March 31, |

|

Six Months Ended June 30, |

|

Twelve Month Trailing June 30, |

|

Funds Flow From Operations - (Non-GAAP)

Measure ($000s) |

|

2023 |

|

|

2022 |

|

|

|

2023 |

|

|

|

2023 |

|

|

2022 |

|

|

|

2023 |

|

| Net (loss)

income |

$ |

(10,825 |

) |

$ |

52,972 |

|

|

$ |

(9,700 |

) |

|

$ |

(20,525 |

) |

$ |

67,091 |

|

|

$ |

51,413 |

|

| Adjustments to

reconcile net income (loss) to funds flow from

operations |

|

|

|

|

|

|

|

|

|

|

DD&A expenses |

|

56,209 |

|

|

42,216 |

|

|

|

51,721 |

|

|

|

107,930 |

|

|

83,179 |

|

|

|

205,031 |

|

|

Deferred tax expense |

|

13,975 |

|

|

13,241 |

|

|

|

15,277 |

|

|

|

29,252 |

|

|

31,954 |

|

|

|

22,638 |

|

|

Stock-based compensation expense |

|

317 |

|

|

1,989 |

|

|

|

1,500 |

|

|

|

1,817 |

|

|

6,546 |

|

|

|

4,320 |

|

|

Amortization of debt issuance costs |

|

1,019 |

|

|

1,131 |

|

|

|

781 |

|

|

|

1,800 |

|

|

2,018 |

|

|

|

3,310 |

|

|

Non-cash lease expense |

|

1,109 |

|

|

747 |

|

|

|

1,144 |

|

|

|

2,253 |

|

|

1,158 |

|

|

|

3,913 |

|

|

Lease payments |

|

(636 |

) |

|

(388 |

) |

|

|

(606 |

) |

|

|

(1,242 |

) |

|

(732 |

) |

|

|

(2,176 |

) |

|

Unrealized foreign exchange (gain) loss |

|

(8,062 |

) |

|

4,341 |

|

|

|

514 |

|

|

|

(7,548 |

) |

|

(498 |

) |

|

|

3,201 |

|

|

Derivative instruments loss |

|

— |

|

|

5,172 |

|

|

|

— |

|

|

|

— |

|

|

26,611 |

|

|

|

— |

|

|

Cash settlements on derivative instruments |

|

— |

|

|

(17,796 |

) |

|

|

— |

|

|

|

— |

|

|

(26,392 |

) |

|

|

(219 |

) |

|

Other gain |

|

— |

|

|

— |

|

|

|

(615 |

) |

|

|

(615 |

) |

|

— |

|

|

|

(3,213 |

) |

|

Other financial instruments gain |

|

— |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

— |

|

|

|

(7 |

) |

| Funds flow from

operations |

$ |

53,106 |

|

$ |

103,625 |

|

|

$ |

60,016 |

|

|

$ |

113,122 |

|

$ |

190,935 |

|

|

$ |

288,211 |

|

|

Capital expenditures |

$ |

65,565 |

|

$ |

65,199 |

|

|

$ |

71,062 |

|

|

$ |

136,627 |

|

$ |

106,682 |

|

|

$ |

266,549 |

|

| Free cash

flow |

$ |

(12,459 |

) |

$ |

38,426 |

|

|

$ |

(11,046 |

) |

|

$ |

(23,505 |

) |

$ |

84,253 |

|

|

$ |

21,662 |

|

Net debt as of June 30, 2023, was $503

million, calculated using the sum of 6.25% Senior Notes and 7.75%

Senior Notes, excluding deferred financing fees of $572 million,

less cash and cash equivalents of $69 million.

Presentation of Oil and Gas

Information

References to a formation where evidence of

hydrocarbons has been encountered is not necessarily an indicator

that hydrocarbons will be recoverable in commercial quantities or

in any estimated volume. Gran Tierra’s reported production is a mix

of light crude oil and medium and heavy crude oil for which there

is not a precise breakdown since the Company’s oil sales volumes

typically represent blends of more than one type of crude oil. Well

test results should be considered as preliminary and not

necessarily indicative of long-term performance or of ultimate

recovery. Well log interpretations indicating oil and gas

accumulations are not necessarily indicative of future production

or ultimate recovery. If it is indicated that a pressure transient

analysis or well-test interpretation has not been carried out, any

data disclosed in that respect should be considered preliminary

until such analysis has been completed. References to thickness of

“oil pay” or of a formation where evidence of hydrocarbons has been

encountered is not necessarily an indicator that hydrocarbons will

be recoverable in commercial quantities or in any estimated

volume.

This press release contains certain oil and gas

metrics, including operating netback and cash netback, which do not

have standardized meanings or standard methods of calculation and

therefore such measures may not be comparable to similar measures

used by other companies and should not be used to make comparisons.

These metrics are calculated as described in this press release and

management believes that they are useful supplemental measures for

the reasons described in this press release.

Such metrics have been included herein to

provide readers with additional measures to evaluate the Company’s

performance; however, such measures are not reliable indicators of

the future performance of the Company and future performance may

not compare to the performance in previous periods.

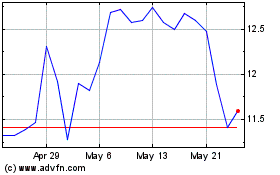

Gran Tierra Energy (TSX:GTE)

Historical Stock Chart

From Nov 2024 to Dec 2024

Gran Tierra Energy (TSX:GTE)

Historical Stock Chart

From Dec 2023 to Dec 2024