Granite Real Estate Investment Trust and Granite REIT Inc.

(TSX: GRT.UN; NYSE: GRP.U) (“Granite” or the “Trust”) announced

today its combined results for the three and six month periods

ended June 30, 2024.

SECOND QUARTER 2024 HIGHLIGHTS

Highlights for the three month period ended June 30, 2024 are

set out below:

Financial:

- Granite's net operating income ("NOI") was $116.8 million in

the second quarter of 2024 compared to $108.6 million in the prior

year period, an increase of $8.2 million primarily as a result of

the completion of a development property in Brantford, Canada in

the first quarter of 2024, contractual rent adjustments and

consumer price index based increases and renewal leasing

activity;

- Same property NOI - cash basis(4) increased by 6.0% for the

second quarter of 2024, excluding the impact of foreign

exchange;

- Funds from operations ("FFO")(1) was $83.5 million ($1.32 per

unit) in the second quarter of 2024 compared to $77.6 million

($1.21 per unit) in the second quarter of 2023;

- Adjusted funds from operations ("AFFO")(2) was $73.8 million

($1.17 per unit) in the second quarter of 2024 compared to $69.5

million ($1.09 per unit) in the second quarter of 2023;

- During the three month period ended June 30, 2024, the Canadian

dollar weakened against the Euro and the US dollar, respectively,

relative to the prior year period. The impact of foreign exchange

on FFO for the three month period ended June 30, 2024, relative to

the same period in 2023, was $0.02 per unit, and for AFFO, the

impact of foreign exchange was $0.02 per unit;

- AFFO payout ratio(3) was 70% for the second quarter of 2024

compared to 73% in the second quarter of 2023;

- Occupancy as at June 30, 2024 and committed occupancy as at

August 7, 2024 are each 94.5%;

- Granite recognized $0.8 million in net fair value losses on

investment properties in the second quarter of 2024, which were

primarily attributable to the expansion in discount and terminal

capitalization rates across selective Granite assets in Europe

largely due to market conditions, partially offset by the lease

renewal of a property in the GTA and fair market rent increases in

selective European markets. The value of investment properties was

further increased by unrealized foreign exchange gains of $59.6

million in the second quarter of 2024 resulting from the relative

weakening of the Canadian dollar against the US dollar and Euro, as

at June 30, 2024; and

- Granite's net income attributable to stapled unitholders in the

second quarter of 2024 was $76.2 million in comparison to $62.5

million in the prior year period primarily due to a positive change

in the fair value on investment properties of $12.7 million and a

$8.2 million increase in net operating income as noted above,

partially offset by a $3.6 million increase in fair value losses on

financial instruments and a $3.0 million increase in interest

expense and other financing costs.

Operations:

- During the second quarter of 2024, Granite achieved average

rental rate spreads of 25% over expiring rents representing

approximately 890,000 square feet of new leases and renewals

completed in the quarter.

Financing:

- During the second quarter of 2024, Granite repurchased 644,300

stapled units under its normal course issuer bid at an average

stapled unit cost of $68.62 for total consideration of $44.2

million, excluding commissions and taxes on net repurchases of

stapled units.

GRANITE’S FINANCIAL, OPERATING AND PROPERTY

HIGHLIGHTS

Three Months

Ended

June 30,

Six Months Ended

June 30,

(in millions, except as noted)

2024

2023

2024

2023

Revenue

$

140.3

$

130.3

$

279.2

$

259.9

Net operating income ("NOI")

$

116.8

$

108.6

$

231.3

$

216.0

Net income attributable to stapled

unitholders

$

76.2

$

62.5

$

165.3

$

72.2

Funds from operations ("FFO")(1)

$

83.5

$

77.6

$

166.0

$

157.2

Adjusted funds from operations

("AFFO")(2)

$

73.8

$

69.5

$

151.8

$

144.6

Diluted FFO per stapled unit(1)

$

1.32

$

1.21

$

2.62

$

2.46

Diluted AFFO per stapled unit(2)

$

1.17

$

1.09

$

2.39

$

2.26

Monthly distributions paid per stapled

unit

$

0.83

$

0.80

$

1.65

$

1.60

AFFO payout ratio(3)

70

%

73

%

69

%

71

%

As at June 30, 2024 and December 31,

2023

2024

2023

Fair value of investment properties

$

9,035.6

$

8,808.1

Cash and cash equivalents

$

101.3

$

116.1

Total debt(5)

$

3,036.1

$

2,998.4

Net leverage ratio(6)

32

%

33

%

Number of income-producing properties

138

137

Gross leasable area (“GLA”), square

feet

63.3

62.9

Occupancy, by GLA

94.5

%

95.0

%

Committed occupancy, by GLA(9)

94.5

%

NA

Magna as a percentage of annualized

revenue(8)

27

%

26

%

Magna as a percentage of GLA

19

%

19

%

Weighted average lease term in years, by

GLA

5.9

6.2

Overall capitalization rate(7)

5.3

%

5.2

%

A more detailed discussion of Granite’s combined financial

results for the three and six month periods ended June 30, 2024 and

2023 is contained in Granite’s Management’s Discussion and Analysis

of Results of Operations and Financial Position ("MD&A") and

the unaudited condensed combined financial statements for those

periods and the notes thereto, which are available through the

internet on the Canadian Securities Administrators’ System for

Electronic Data Analysis and Retrieval Plus (“SEDAR+”) and can be

accessed at www.sedarplus.ca and on the United States Securities

and Exchange Commission’s (the “SEC”) Electronic Data Gathering,

Analysis and Retrieval System (“EDGAR”), which can be accessed at

www.sec.gov.

2023 GLOBAL ENVIRONMENTAL, SOCIAL, GOVERNANCE + RESILIENCE

(ESG+R) REPORT

Today, Granite released its 2023 ESG+R report which highlights

Granite's ESG+R program initiatives and updates from the 2023

calendar year. A copy of the report can be found on Granite's

website at https://granitereit.com/2023-global-esgr-report.

2024 OUTLOOK

For 2024 outlook, Granite’s FFO forecast has been adjusted to

reflect a slight reduction in NOI as a result of new vacancy and

some revised leasing assumptions on certain vacant properties,

offset by reductions in general and administrative expenses, most

of which have been realized to date. The FFO per unit forecast

range has been narrowed to $5.30 to $5.40 from the previous

forecast range of $5.30 to $5.45. Similarly, for AFFO per unit, the

forecast range has also narrowed to $4.60 to $4.70 from previous

forecast of $4.60 to $4.75. Granite has not made any changes to

foreign currency exchange rate assumptions pertaining to the

forecast period from July to December 2024. The high and low ranges

continue to reflect foreign currency exchange rate assumptions

where the high end of the range estimates the Canadian dollar to

Euro exchange rate of 1.48 and the Canadian dollar to US dollar

exchange rate of 1.38. On the low end of the range, we are assuming

exchange rates of the Canadian dollar to Euro of 1.43 and the

Canadian dollar to US dollar of 1.32. With respect to constant

currency same property NOI – cash basis guidance, Granite is

reducing its forecast range to 6.0% to 6.5% from the previous

forecast range of 7.0% to 8.0%, based on a four-quarter average

over 2024. The reduction in constant currency same property NOI -

cash basis is a result of the updated vacancy and leasing

assumptions noted above. Granite’s 2024 outlook assumes no

acquisitions and dispositions, excludes all corporate restructuring

costs and assumes no favourable reversals of tax provisions

relating to prior years which cannot be determined at this

time.

Non-IFRS measures are included in Granite’s 2024 forecasts above

(see “NON-IFRS PERFORMANCE MEASURES”). See also “FORWARD-LOOKING

STATEMENTS”.

CONFERENCE CALL

Granite will hold a conference call and live audio webcast to

discuss its financial results. The conference call will be chaired

by Kevan Gorrie, President and Chief Executive Officer.

Date:

Thursday, August 8, 2024 at 11:00 a.m.

(ET)

Telephone:

North America (Toll-Free):

1-800-579-2543

International (Toll): 1-785-424-1789

Conference ID/Passcode:

REIT

Webcast:

To access the live audio webcast in

listen-only mode, please visit

https://events.q4inc.com/attendee/995179082 or

https://granitereit.com/events.

To hear a replay of the webcast, please visit

https://granitereit.com/events. The replay will be available for 90

days.

OTHER INFORMATION

Additional property statistics as at June 30, 2024 have been

posted to our website at

https://granitereit.com/property-statistics-q2-2024. Copies of

financial data and other publicly filed documents are available

through the internet on SEDAR+, which can be accessed at

www.sedarplus.ca and on EDGAR, which can be accessed at

www.sec.gov.

Granite is a Canadian-based REIT engaged in the acquisition,

development, ownership and management of logistics, warehouse and

industrial properties in North America and Europe. Granite owns 143

investment properties representing approximately 63.3 million

square feet of gross leasable area.

For further information, please see our website at

www.granitereit.com or contact Teresa Neto, Chief Financial

Officer, at (647) 925-7560.

NON-IFRS MEASURES, RATIOS AND RECONCILIATIONS

Readers are cautioned that certain terms used in this press

release such as FFO, AFFO, FFO payout ratio, AFFO payout ratio,

same property NOI - cash basis, constant currency same property NOI

- cash basis, total debt and net debt, net leverage ratio, and any

related per unit amounts used by management to measure, compare and

explain the operating results and financial performance of the

Trust do not have standardized meanings prescribed under

International Financial Reporting Standards (“IFRS”) and,

therefore, should not be construed as alternatives to net income,

cash provided by operating activities or any other measure

calculated in accordance with IFRS. Additionally, because these

terms do not have a standardized meaning prescribed by IFRS, they

may not be comparable to similarly titled measures presented by

other publicly traded entities.

(1) FFO is a non-IFRS performance measure that is widely used by

the real estate industry in evaluating the operating performance of

real estate entities. Granite calculates FFO as net income

attributable to stapled unitholders excluding fair value gains

(losses) on investment properties and financial instruments, gains

(losses) on sale of investment properties including the associated

current income tax, deferred income taxes, corporate restructuring

costs and certain other items, net of non-controlling interests in

such items. The Trust’s determination of FFO follows the definition

prescribed by the Real Estate Property Association of Canada

(“REALPAC”) guidelines on Funds From Operations & Adjusted

Funds From Operations for IFRS dated January 2022 (“REALPAC

Guidelines”) except for the exclusion of corporate restructuring

costs. Granite considers FFO to be a meaningful supplemental

measure that can be used to determine the Trust’s ability to

service debt, fund capital expenditures and provide distributions

to stapled unitholders. FFO is reconciled to net income, which is

the most directly comparable IFRS measure (see table below). FFO

should not be construed as an alternative to net income or cash

flow provided by operating activities determined in accordance with

IFRS.

(2) AFFO is a non-IFRS performance measure that is widely used

by the real estate industry in evaluating the recurring economic

earnings performance of real estate entities after considering

certain costs associated with sustaining such earnings. Granite

calculates AFFO as net income attributable to stapled unitholders

including all adjustments used to calculate FFO and further adjusts

for actual maintenance capital expenditures that are required to

sustain Granite’s productive capacity, leasing costs such as

leasing commissions and tenant allowances incurred and non-cash

straight-line rent and tenant incentive amortization, net of

non-controlling interests in such items. The Trust's determination

of AFFO follows the definition prescribed by the REALPAC Guidelines

except for the exclusion of corporate restructuring costs as noted

above. Granite considers AFFO to be a meaningful supplemental

measure that can be used to determine the Trust’s ability to

service debt, fund expansion capital expenditures, fund property

development and provide distributions to stapled unitholders after

considering costs associated with sustaining operating earnings.

AFFO is also reconciled to net income, which is the most directly

comparable IFRS measure (see table below). AFFO should not be

construed as an alternative to net income or cash flow provided by

operating activities determined in accordance with IFRS.

Three Months Ended

June 30,

Six Months Ended

June 30,

(in millions, except per unit amounts)

2024

2023

2024

2023

Net income attributable to stapled

unitholders

$

76.2

$

62.5

$

165.3

$

72.2

Add (deduct):

Fair value losses (gains) on investment

properties, net

0.8

13.5

(11.8

)

86.5

Fair value losses (gains) on financial

instruments, net

2.5

(1.1

)

4.5

(0.6

)

Loss on sale of investment properties

—

—

—

0.6

Deferred tax expense (recovery)

5.4

5.4

9.2

(6.9

)

Fair value remeasurement of the Executive

Deferred Stapled Unit Plan

(1.2

)

(0.4

)

(1.0

)

4.2

Fair value remeasurement of the Directors

Deferred Stapled Unit Plan

(1.2

)

(0.5

)

(1.2

)

0.9

Corporate restructuring costs(1)

0.9

—

1.1

—

Non-controlling interests relating to the

above

0.1

(1.8

)

(0.1

)

0.3

FFO

[A]

$

83.5

$

77.6

$

166.0

$

157.2

Add (deduct):

Maintenance or improvement capital

expenditures incurred

(5.8

)

(2.2

)

(6.4

)

(2.3

)

Leasing costs

(0.3

)

(1.9

)

(0.5

)

(2.3

)

Tenant allowances

(1.0

)

(0.4

)

(1.6

)

(1.0

)

Tenant incentive amortization

—

1.1

0.1

2.2

Straight-line rent amortization

(2.6

)

(4.9

)

(5.8

)

(9.5

)

Non-controlling interests relating to the

above

—

0.2

—

0.3

AFFO

[B]

$

73.8

$

69.5

$

151.8

$

144.6

Basic FFO per stapled unit

[A]/[C]

$

1.33

$

1.22

$

2.63

$

2.47

Diluted FFO per stapled unit

[A]/[D]

$

1.32

$

1.21

$

2.62

$

2.46

Basic AFFO per stapled unit

[B]/[C]

$

1.17

$

1.09

$

2.40

$

2.27

Diluted AFFO per stapled unit

[B]/[D]

$

1.17

$

1.09

$

2.39

$

2.26

Basic weighted average number of

stapled units

[C]

63.0

63.7

63.2

63.7

Diluted weighted average number of

stapled units

[D]

63.2

63.9

63.4

63.9

(1) Effective January 1, 2024, Granite

amended its definition of Funds From Operations (FFO) to exclude

corporate restructuring costs associated with the uncoupling of the

Trust’s stapled unit structure (refer to “NON-IFRS PERFORMANCE

MEASURES” in the MD&A). See also “SIGNIFICANT MATTERS - STAPLED

UNIT STRUCTURE” in the MD&A. Granite views these restructuring

costs as non-recurring, as they are solely related to this specific

transaction and do not reflect normal operating activities.

(3) The FFO and AFFO payout ratios are calculated as monthly

distributions, which exclude special distributions, declared to

unitholders divided by FFO and AFFO (non-IFRS performance

measures), respectively, in a period. FFO payout ratio and AFFO

payout ratio may exclude revenue or expenses incurred during a

period that can be a source of variance between periods. The FFO

payout ratio and AFFO payout ratio are supplemental measures widely

used by investors in evaluating the sustainability of the Trust’s

monthly distributions to stapled unitholders.

Three Months Ended

June 30,

Six Months Ended

June 30,

(in millions, except as noted)

2024

2023

2024

2023

Monthly distributions declared to

unitholders

[A]

$

51.9

$

51.0

$

104.2

$

102.0

FFO

[B]

83.5

77.6

166.0

157.2

AFFO

[C]

73.8

69.5

151.8

144.6

FFO payout ratio

[A]/[B]

62

%

66

%

63

%

65

%

AFFO payout ratio

[A]/[C]

70

%

73

%

69

%

71

%

(4) Same property NOI — cash basis refers to the NOI — cash

basis (NOI excluding lease termination and close-out fees, and the

non-cash impact from straight-line rent and tenant incentive

amortization) for those properties owned by Granite throughout the

entire current and prior year periods under comparison. Same

property NOI — cash basis excludes properties that were acquired,

disposed of, classified as development properties or assets held

for sale during the periods under comparison. Granite believes that

same property NOI — cash basis is a useful measure in understanding

period-over-period organic changes in NOI — cash basis from the

same stock of properties owned.

Sq ft(1)

Three Months Ended

June 30,

Sq ft(1)

Six Months Ended

June 30,

(in millions)

2024

2023

$ change

% change

(in millions)

2024

2023

$ change

% change

Revenue

$

140.3

$

130.3

10.0

$

279.2

$

259.9

19.3

Less: Property operating costs

23.5

21.7

1.8

47.9

43.9

4.0

NOI

$

116.8

$

108.6

8.2

7.6

%

$

231.3

$

216.0

15.3

7.1

%

Add (deduct):

Lease termination and close-out fees

(0.5

)

—

(0.5

)

(0.5

)

—

(0.5

)

Straight-line rent amortization

(2.6

)

(4.9

)

2.3

(5.8

)

(9.5

)

3.7

Tenant incentive amortization

—

1.1

(1.1

)

0.1

2.2

(2.1

)

NOI - cash basis

63.3

$

113.7

$

104.8

8.9

8.5

%

63.3

$

225.1

$

208.7

16.4

7.9

%

Less NOI - cash basis for:

Acquisitions

—

—

—

—

1.0

0.4

0.3

0.1

Developments

0.5

(1.3

)

—

(1.3

)

2.8

(6.4

)

—

(6.4

)

Dispositions and assets held for sale

—

—

—

—

—

—

(0.2

)

0.2

Same property NOI - cash basis

62.9

$

112.4

$

104.8

7.6

7.3

%

59.8

$

219.1

$

208.8

10.3

4.9

%

Constant currency same property NOI -

cash basis(2)

62.9

$

112.4

$

106.0

6.4

6.0

%

59.8

$

219.1

$

210.2

8.9

4.2

%

(1) The square footage relating to the NOI

— cash basis represents GLA of 63.3 million square feet as at June

30, 2024. The square footage relating to the same property NOI —

cash basis represents the aforementioned GLA excluding the impact

from the acquisitions, dispositions, assets held for sale and

developments during the relevant period.

(2) Constant currency same property NOI -

cash basis is calculated by converting the comparative same

property NOI - cash basis at current period average foreign

exchange rates.

(5) Total debt is calculated as the sum of all current and

non-current debt, the net mark to market fair value of derivatives

and lease obligations as per the consolidated financial statements.

Net debt subtracts cash and cash equivalents from total debt.

Granite believes that it is useful to include the derivatives and

lease obligations for the purposes of monitoring the Trust’s debt

levels.

(6) The net leverage ratio is calculated as net debt (a non-IFRS

performance measure defined above) divided by the fair value of

investment properties. The net leverage ratio is a non-IFRS ratio

used in evaluating the Trust’s degree of financial leverage,

borrowing capacity and the relative strength of its balance

sheet.

As at June 30, 2024 and December 31,

2023

2024

2023

Unsecured debt, net

$

3,095.6

$

3,066.0

Derivatives, net

(94.1

)

(100.8

)

Lease obligations

34.6

33.2

Total debt

$

3,036.1

$

2,998.4

Less: cash and cash equivalents

101.3

116.1

Net debt

[A]

$

2,934.8

$

2,882.3

Investment properties

[B]

$

9,035.6

$

8,808.1

Net leverage ratio

[A]/[B]

32

%

33

%

(7) Overall capitalization rate is calculated as stabilized net

operating income (property revenue less property expenses) divided

by the fair value of the property.

(8) Annualized revenue for each period presented is calculated

as the contractual base rent for the month subsequent to the

quarterly reporting period multiplied by 12 months. Annualized

revenue excludes revenue from properties classified as assets held

for sale.

(9) Committed occupancy as at August 7, 2024.

FORWARD-LOOKING STATEMENTS

This press release may contain statements that, to the extent

they are not recitations of historical fact, constitute

“forward-looking statements” or “forward-looking information”

within the meaning of applicable securities legislation, including

the United States Securities Act of 1933, as amended, the United

States Securities Exchange Act of 1934, as amended, and applicable

Canadian securities legislation. Forward-looking statements and

forward-looking information may include, among others, statements

regarding Granite’s future plans, goals, strategies, intentions,

beliefs, estimates, costs, objectives, capital structure, cost of

capital, tenant base, tax consequences, economic performance or

expectations, or the assumptions underlying any of the foregoing.

Words such as “outlook”, “may”, “would”, “could”, “should”, “will”,

“likely”, “expect”, “anticipate”, “believe”, “intend”, “plan”,

“forecast”, “project”, “estimate”, “seek” and similar expressions

are used to identify forward-looking statements and forward-looking

information. Forward-looking statements and forward-looking

information should not be read as guarantees of future events,

performance or results and will not necessarily be accurate

indications of whether or the times at or by which such future

performance will be achieved. Undue reliance should not be placed

on such statements. There can also be no assurance that Granite’s

expectations regarding various matters, including the following,

will be realized in a timely manner, with the expected impact or at

all: the effectiveness of measures intended to mitigate such

impact, and Granite’s ability to deliver cash flow stability and

growth and create long-term value for unitholders; Granite’s

ability to advance its ESG+R program and related targets and goals;

the expansion and diversification of Granite’s real estate

portfolio and the reduction in Granite’s exposure to Magna and the

special purpose properties; Granite’s ability to accelerate growth

and to grow its net asset value, FFO and AFFO per unit, and

constant currency same property NOI - cash basis; Granite's ability

to execute on its strategic plan and its priorities for the

remainder of 2024; Granite's 2024 outlook for FFO per unit, AFFO

per unit and constant currency same property NOI, including the

anticipated impact of future foreign currency exchange rates on FFO

and AFFO per unit and expectations regarding Granite's business

strategy; fluctuations in foreign currency exchange rates and the

effect on Granite's revenues, expenses, cash flows, assets and

liabilities; Granite's ability to offset interest or realize

interest savings relating to its term loans, debentures and cross

currency interest rate swaps; Granite’s ability to find and

integrate satisfactory acquisition, joint venture and development

opportunities and to strategically deploy the proceeds from

recently sold properties and financing initiatives; Granite's

intended use of available liquidity, its ability to obtain secured

funding against its unencumbered assets and its expectations

regarding the funding of its ongoing operations and future growth;

any future offerings under the Shelf Prospectuses; the potential

for expansion and rental growth at the property in Ajax, Ontario

and the enhancement to the yield of the property from such

potential expansion and rental growth; the completion of the

property in Ajax, Ontario and subsequent commencement of the lease

in the third quarter of 2024; the potential for expansion and

rental growth at the property in Weert, Netherlands and the

enhancement to the yield of the property from such potential

expansion and rental growth; obtaining site planning approval of a

0.7 million square foot distribution facility on the 34.0 acre site

in Brantford, Ontario; obtaining site planning approval for a third

phase of development for up to 1.3 million square feet on the 101.5

acre site in Houston, Texas and the potential yield from the

project; the development of 12.9 acres of land in West Jefferson,

Ohio and the potential yield from that project; the development of

a 0.6 million square foot multi-phased business park on the

remaining 36.0 acre parcel of land in Brantford, Ontario and the

potential yield from that project; the development of a 0.2 million

square foot modern distribution/logistics facility on the 10.1

acres of land in Brant County, Ontario and the potential yield of

the project; estimates regarding Granite's development properties

and expansion projects, including square footage of construction,

total construction costs and total costs; Granite’s ability to meet

its target occupancy goals; Granite’s ability to secure

sustainability or other certifications for any of its properties;

Granite’s ability to generate peak solar capacity on its

properties; the impact of the refinancing of the term loans on

Granite’s returns and cash flow; the amount of any distributions;

the effect of any legal proceedings on Granite; and the timing and

successful completion of the Arrangement that would simplify

Granite’s capital structure by replacing its current stapled unit

structure with a conventional REIT trust unit structure.

Forward-looking statements and forward-looking information are

based on information available at the time and/or management’s good

faith assumptions and analyses made in light of Granite’s

perception of historical trends, current conditions and expected

future developments, as well as other factors Granite believes are

appropriate in the circumstances. Forward-looking statements and

forward-looking information are subject to known and unknown risks,

uncertainties and other unpredictable factors, many of which are

beyond Granite’s control, that could cause actual events or results

to differ materially from such forward-looking statements and

forward-looking information. Important factors that could cause

such differences include, but are not limited to, the risk of

changes to tax or other laws and treaties that may adversely affect

Granite REIT’s mutual fund trust status under the Income Tax Act

(Canada) or the effective tax rate in other jurisdictions in which

Granite operates; the risks related to Russia’s 2022 invasion of

Ukraine that may adversely impact Granite’s operations and

financial performance; economic, market and competitive conditions

and other risks that may adversely affect Granite’s ability to

expand and diversify its real estate portfolio; and the risks set

forth in the “Risk Factors” section in Granite’s AIF for 2023 dated

February 28, 2024, filed on SEDAR+ at www.sedarplus.ca and attached

as Exhibit 1 to the Trust’s Annual Report on Form 40-F for the year

ended December 31, 2023 filed with the SEC and available online on

EDGAR at www.sec.gov, all of which investors are strongly advised

to review. The “Risk Factors” section also contains information

about the material factors or assumptions underlying such

forward-looking statements and forward-looking information.

Forward-looking statements and forward-looking information speak

only as of the date the statements and information were made and

unless otherwise required by applicable securities laws, Granite

expressly disclaims any intention and undertakes no obligation to

update or revise any forward-looking statements or forward-looking

information contained in this press release to reflect subsequent

information, events or circumstances or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240807128928/en/

Teresa Neto Chief Financial Officer (647) 925-7560

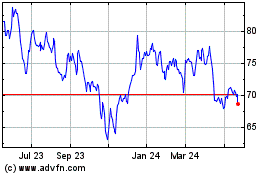

Granite Real Estate Inve... (TSX:GRT.UN)

Historical Stock Chart

From Oct 2024 to Nov 2024

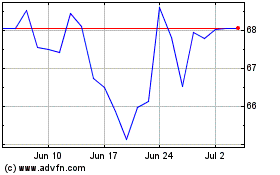

Granite Real Estate Inve... (TSX:GRT.UN)

Historical Stock Chart

From Nov 2023 to Nov 2024