Gildan Activewear Inc. (GIL; TSX and NYSE) today announced that its

President and CEO, Vince Tyra has unveiled his key focus strategic

priorities. Concurrently, the Company also reconfirmed its 2024

full year guidance and announced preliminary Q1 revenue.

Furthermore, the Company intends to hold an Investor Day in the

Fall of 2024 to provide a comprehensive strategic plan.

Reflecting on his first 90 days, Vince Tyra

said, “I’m excited to be leading Gildan at this pivotal time.

Having completed 90 days at the helm of Gildan, I wanted to share

with you my key focus strategic priorities and articulate how we

can leverage our strengths and accelerate value creation for all

stakeholders. Importantly, these priorities reflect feedback

received from shareholders and their desire for us to continue

sustainably growing Gildan. As we continue to execute on the key

components of the Gildan Sustainable Growth strategy, my first few

months as CEO have confirmed my belief that Gildan’s core

fundamentals are strong and that we are in a great position to

unlock further potential and launch the next phase of our growth.

My management team and I will continue to review the business and

we look forward to presenting a fuller view at an Investor Day this

Fall.”

With its three key pillars, Growth, Innovation,

and ESG, the Gildan Sustainable Growth (GSG) strategy has set the

foundation for the Company’s future. Capitalizing on this strong

foundation and the continued execution of the GSG plan which

remains core to Gildan’s business, today Vince Tyra outlined his

key focus strategic priorities to unlock further growth potential

while amplifying the Company’s commercial capabilities. These five

key priorities are:

- Successfully execute supply chain

initiatives to maintain availability, cost leadership and industry

leading margins;

- Leverage Gildan’s unique brands and

develop distinct commercial capabilities to accelerate growth and

strengthen the Company’s market position;

- Deepen Gildan’s relationships with

existing and prospective retail partners, strengthening the

Company’s position as the supplier of choice;

- Complement Gildan’s strong North

American market position with renewed focus on select international

markets to drive growth; and

- Empower and build world-class

talent and leadership to ensure long term resilience of Gildan’s

business.

Medium-term Targets Assuming no

deterioration in the current macroeconomic environment, Gildan is

confident that the targeted priorities will position the Company to

continue to drive market share gains in key product categories,

unlock further opportunities in targeted markets and deliver on key

financial metrics over the 2025-2028 period, reflecting the

following:

- Net sales growth at a compound

annual growth rate in the mid-single digits range

- Annual adjusted operating margin(1)

in the range of 18% to 21%

- Capital expenditures (capex) as a

percentage of sales of about 5% per year, on average, to support

long-term growth and vertical integration

- Adjusted diluted EPS(2) growth per

annum in the high-single to low double-digit range

Gildan expects to maintain its capital

allocation priorities which, beyond planned capex deployment, focus

on annual dividend growth, continued share repurchases now in line

with a leverage framework of 1.5x to 2x, and value accretive

M&A. The combination of the above is expected to drive strong

shareholder returns.

2024 Outlook and preliminary Q1 2024

revenue

Gildan today reconfirmed its 2024 full year

guidance as announced on February 21, 2024 in its Q4 2023 press

release as well as the assumptions underpinning this guidance:

- Revenue growth for the full year to be

flat to up low-single digits;

- Adjusted operating margin(1) slightly

above the high end of the 18% to 20% annual target range. This

compares to fiscal 2023 adjusted operating margin of 17.3%; fiscal

2023 operating margin was 20.1%.

- Capex to come in at approximately 5% of

sales;

- Adjusted diluted EPS(2) in the range of

$2.92 to $3.07, up significantly between 13.5% and 19.5% year over

year. This compares to 2023 adjusted diluted EPS of $2.57; fiscal

2023 GAAP diluted EPS was $3.03;

- Free cash flow above 2023 levels driven

by increased profitability, lower working capital investments and

lower capital expenditures than in 2023.

In addition, Gildan today announced that its

preliminary Q1 2024 net sales are expected to come in at

approximately $695 million, or down about 1% year over year, as

previewed in our Q4 2023 press release.

The above outlook as well as the medium-term

targets assume no meaningful deterioration from current market

conditions including the pricing and inflationary environment, and

no further deterioration in geopolitical environments. They reflect

reasonable industry growth and expected market share gains. Though

the timing of the potential enactment of legislation remains

uncertain, we have also incorporated the estimated impact of the

implementation of draft Global Minimum Tax legislation in Canada

and Barbados on our effective tax rate, retroactive to January 1,

2024, as well as certain refundable tax credits expected. In

addition, they reflect Gildan’s expectations as of April 15, 2024

and are subject to significant risks and business uncertainties,

including those factors described under “Forward-Looking

Statements” in this press release and the annual MD&A for the

year ended December 31, 2023.

Conference Call and Webcast

Information

The event will take place on April 15, 2024, at

4:45 PM ET. The conference call can be accessed by dialing (800)

715-9871 (Canada & U.S.) or (646) 307-1963 (international) and

entering passcode 3097304#. A live audio webcast of the

conference call and presentation,

as well as a replay, will be available at the following

link: Gildan Investor Update. A replay of the call will be

available for 7 days starting at 10:00 PM ET by dialing (800)

770-2030 (Canada & U.S.) or (609) 800-9909 (international) and

entering the same passcode.

Non-GAAP Financial Measures and

RatiosThe Company reports its financial results in

accordance with International Financial Reporting Standards

(“IFRS”). However, we use non-GAAP financial measures and ratios to

assess our operating performance and liquidity. Securities

regulations require that companies caution readers that earnings

and other measures adjusted to a basis other than IFRS do not have

standardized meanings and are unlikely to be comparable to similar

measures used by other companies. Accordingly, they should not be

considered in isolation. In this press release, we use non-GAAP

financial ratios, including adjusted operating margin and adjusted

diluted EPS, to measure our performance and financial condition

from one period to the next, which excludes the variation caused by

certain adjustments that could potentially distort the analysis of

trends in our operating performance, and because we believe such

measures provide meaningful information to investors on the

Company’s financial performance and financial condition. We refer

the reader to section 16.0 of the Company’s Management’s Discussion

and Analysis for the year ended December 31, 2023 (“FY2023

MD&A”) entitled “Definition and reconciliation of non-GAAP

financial measures”, which section is incorporated by reference

into this press release, filed with the securities regulatory

authorities in Canada, available on SEDAR+ at

www.sedarplus.ca and on the Company’s website at

www.gildancorp.com under the “Investors” section, for the

definition and complete reconciliation of all non-GAAP financial

measures and ratios used and presented by the Company to the most

directly comparable IFRS measures.

| (1) |

|

Adjusted operating margin: Adjusted operating

income is calculated as operating income before restructuring and

acquisition-related costs. Adjusted operating income also excludes

impairment (impairment reversal) of intangible assets, the impact

of the Company's strategic product line initiatives, net insurance

gains, gain on sale and leaseback (new in 2023) and CEO separation

costs and related advisory fees on shareholder matters (new in

2023). Adjusted operating margin is calculated as adjusted

operating income divided by net sales, excluding the sales return

allowance for anticipated product returns related to discontinued

SKUs. Further details, including an explanation of the composition

and usefulness of this ratio, as well as a calculation of this

ratio, are provided at section 16.0 of the FY2023 MD&A,

available on SEDAR+ at www.sedarplus.ca, which section is

incorporated by reference into this press release. |

| |

|

|

| (2) |

|

Adjusted diluted EPS: Adjusted net earnings are

calculated as net earnings before restructuring and

acquisition-related costs, Impairment (impairment reversal) of

intangible assets, net of write-downs, the impact of the Company's

strategic product line initiatives, net insurance gains, gain on

sale and leaseback (new in 2023), CEO separation costs and related

advisory fees on shareholder matters (new in 2023), and income tax

expense or recovery relating to these items. Adjusted net earnings

also excludes income taxes related to the re-assessment of the

probability of realization of previously recognized or

de-recognized deferred income tax assets, and income taxes relating

to the revaluation of deferred income tax assets and liabilities as

a result of statutory income tax rate changes in the countries in

which we operate. Adjusted diluted EPS is calculated as adjusted

net earnings divided by the diluted weighted average number of

common shares outstanding. Further details, including an

explanation of the composition and usefulness of this ratio, as

well as a calculation of this ratio, are provided at section 16.0

of the FY2023 MD&A, available on SEDAR+ at www.sedarplus.ca,

which section is incorporated by reference into this press

release. |

Caution Concerning Forward-Looking

StatementsReferences in this press release to “Gildan”,

the “Company”, or the words “we”, “us”, and “our” refer, depending

on the context, either to Gildan Activewear Inc. or to Gildan

Activewear Inc. together with its subsidiaries.

Certain statements included in this press

release constitute “forward looking statements” within the meaning

of the U.S. Private Securities Litigation Reform Act of 1995 and

Canadian securities legislation and regulations, and are subject to

important risks, uncertainties, and assumptions. This forward

looking information includes, amongst others, information with

respect to our objectives and the strategies to achieve these

objectives, including statements related to the GSG strategy and

our key focus strategic priorities , as well as information with

respect to our beliefs, plans, expectations, anticipations,

estimates, and intentions, including, without limitation, our

expectation with regards to net sales and revenue growth, adjusted

operating margin, working capital, adjusted diluted earnings per

share, free cash flow, business dispositions, acquisitions or other

business transactions, capital return and capital investments or

expenditures, including our financial outlook set forth in this

press release under the sections “Medium-term Targets” and “2024

Outlook and preliminary Q1 2024 revenue”. The net sales figure

reported above with respect to the first quarter of 2024 is

preliminary, has not been reviewed by Gildan’s auditors and is

subject to change as our Q1 2024 financial results are

finalized.

Forward-looking statements generally can be

identified by the use of conditional or forward-looking terminology

such as “may”, “will”, “expect”, “intend”, “estimate”, “project”,

“assume”, “anticipate”, “plan”, “foresee”, “believe”, or

“continue”, or the negatives of these terms or variations of them

or similar terminology. We refer you to the Company’s filings with

the Canadian securities' regulatory authorities and the U. S.

Securities and Exchange Commission, as well as the risks described

under the “Financial risk management”, “Critical accounting

estimates and judgments”, and “Risks and uncertainties” sections of

the FY2023 MD&A for a discussion of the various factors that

may affect the Company’s future results. Material factors and

assumptions that were applied in drawing a conclusion or making a

forecast or projection are also set out throughout such document

and this press release, including certain assumptions relating to

the financial outlook described in this press release under the

sections “Medium-term Targets” and “2024 Outlook and preliminary Q1

2024 revenue”.

Forward-looking statements are inherently

uncertain and the results or events predicted in such statements,

information and outlook may differ materially from actual results

or events. Material factors, which could cause actual results or

events to differ materially from a conclusion, forecast, or

projection in such forward-looking statements include, but are not

limited to changes in general economic, financial or geopolitical

conditions globally or in one or more of the markets we serve,

including the pricing and inflationary environment, and our ability

to implement our growth strategies and plans, as well as those

factors listed in the FY2023 MD&A under the “Risks and

uncertainties” section and “Caution regarding forward-looking

statements” sections. These factors may cause the Company’s actual

performance and financial results in future periods to differ

materially from any estimates or projections of future performance

or results expressed or implied by such forward-looking

statements.

There can be no assurance that the expectations

represented by our forward-looking statements will prove to be

correct. The purpose of the forward-looking statements is to

provide a description of management’s expectations regarding the

Company’s future financial performance and may not be appropriate

for other purposes. Furthermore, unless otherwise stated, the

forward-looking statements contained in this press release are made

as of the date of this press release, and we do not undertake any

obligation to update publicly or to revise any of the included

statements, information and outlook, whether as a result of new

information, future events, or otherwise unless required by

applicable legislation or regulation. The forward-looking

statements contained in this press release are expressly qualified

by this cautionary statement.

About GildanGildan is a leading

manufacturer of everyday basic apparel. The Company’s product

offering includes activewear, underwear and socks, sold to a broad

range of customers, including wholesale distributors,

screenprinters or embellishers, as well as to retailers that sell

to consumers through their physical stores and/or e-commerce

platforms and to global lifestyle brand companies. The Company

markets its products in North America, Europe, Asia Pacific, and

Latin America, under a diversified portfolio of Company-owned

brands including Gildan®, American Apparel®, Comfort Colors®,

GOLDTOE® and Peds®.

Gildan owns and operates vertically integrated,

large-scale manufacturing facilities which are primarily located in

Central America, the Caribbean, North America, and Bangladesh.

Gildan operates with a strong commitment to industry-leading

labour, environmental and governance practices throughout its

supply chain in accordance with its comprehensive ESG program

embedded in the Company's long-term business strategy. More

information about the Company and its ESG practices and initiatives

can be found at www.gildancorp.com.

Investor inquiries:

Jessy Hayem, CFA

Vice-President, Head of Investor Relations

(514) 744-8511

jhayem@gildan.com

Media inquiries:

Genevieve Gosselin

Director, Global Communications and Corporate Marketing (514) 343-8814

ggosselin@gildan.com

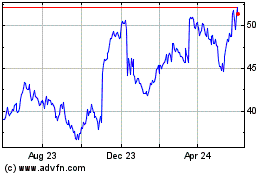

Gildan Activewear (TSX:GIL)

Historical Stock Chart

From Nov 2024 to Dec 2024

Gildan Activewear (TSX:GIL)

Historical Stock Chart

From Dec 2023 to Dec 2024