Goodfellow Reports Its Results for the Fourth Quarter and Fiscal Year Ended November 30, 2023 and Declares a Dividend

February 19 2024 - 8:23PM

Goodfellow Inc. (TSX: GDL) (the “Company” or “Goodfellow”)

announced its financial results today.

For the fourth quarter ended November 30, 2023,

the Company reported net earnings of $2.1 million or $0.25 per

share compared to net earnings of $4.4 million or $0.52 per share a

year ago. Consolidated sales for the three months ended November

30, 2023 were $125.4 million compared to $149.3 million last

year.

For the fiscal year ended November 30, 2023, the

Company reported net earnings of $14.7 million or $1.72 per share

compared to net earnings of $32.7 million or $3.82 per share a year

ago. Consolidated sales for the fiscal year ended November 30, 2023

were $512.8 million compared to $631.2 million last year.

Goodfellow concluded its 125th anniversary year

on a positive note, demonstrating resilience despite numerous

external challenges. The retail sector experienced a significant

downturn in demand, leading to an oversupply in the market, with

the flooring category suffering the most significant setback in the

second quarter of 2023. In addition, demand and prices for

hardwoods declined considerably, with signs of recovery becoming

evident only in the early months of fiscal 2024. Goodfellow’s

ability to meet expectations in difficult business conditions, can

be attributed to the diversity of its product offering and the

dedication of its talented team.

The Board of directors of Goodfellow Inc.

declared an eligible dividend of $0.50 per share payable on March

19, 2024, to shareholders of record at the close of business on

March 5, 2024. This dividend is designated as an eligible dividend

under the Income Tax Act (Canada). The declaration, timing, amount

and payment of future dividends remain at the direction of the

Board of Directors.

About Goodfellow

Goodfellow is a diversified manufacturer of

value-added lumber products, as well as a wholesale distributor of

building materials and floor coverings. Goodfellow has a

distribution footprint from coast-to-coast in Canada servicing

commercial and residential sectors through lumber yard retailer

networks, manufacturers, industrial and infrastructure project

partners, and floor covering specialists. Goodfellow also leverages

its value-added product capabilities to serve lumber markets

internationally. Goodfellow Inc. is a publicly traded company, and

its shares are listed on the Toronto Stock Exchange under the

symbol “GDL”.

|

|

|

|

|

GOODFELLOW INC. |

|

|

|

Consolidated Statements of Comprehensive

Income |

|

| For the

years ended November 30, 2023 and 2022 |

|

| (in thousands of

dollars, except per share amounts) Unaudited |

|

|

|

|

|

|

|

Years ended |

|

|

November 30 2023 |

November 30 2022 |

|

|

$ |

$ |

|

|

|

|

|

Sales |

512,821 |

631,185 |

|

Expenses |

|

|

|

Cost of goods sold |

400,461 |

495,125 |

|

Selling, administrative and general expenses |

89,841 |

88,143 |

|

Net financial costs |

2,429 |

3,201 |

|

|

492,731 |

586,469 |

|

|

|

|

| Earnings

before income taxes |

20,090 |

44,716 |

|

|

|

|

| Income

taxes |

5,402 |

12,037 |

|

|

|

|

|

Net earnings |

14,688 |

32,679 |

|

|

|

|

| Items

that will not subsequently be reclassified to net earnings |

|

|

|

|

|

|

|

Remeasurement of defined benefit plan obligation net of taxes of

$984 ($355 in 2022) |

2,531 |

914 |

|

|

|

|

|

Total comprehensive income |

17,219 |

33,593 |

|

|

|

|

|

Net earnings per share – Basic and Diluted |

1.72 |

3.82 |

|

GOODFELLOW INC. |

|

|

|

Consolidated Statements of Financial Position |

|

|

| (in

thousands of dollars) Unaudited |

|

|

|

|

|

|

|

|

As at |

As at |

|

|

November 30 2023 |

November 30 2022 |

|

|

$ |

$ |

|

Assets |

|

|

|

Current Assets |

|

|

|

Cash |

28,379 |

3,420 |

|

Trade and other receivables |

53,674 |

64,423 |

|

Income taxes receivable |

6,286 |

2,439 |

|

Inventories |

98,473 |

112,294 |

|

Prepaid expenses |

4,215 |

2,555 |

|

Total Current Assets |

191,027 |

185,131 |

| |

|

|

|

Non-Current Assets |

|

|

|

Property, plant and equipment |

32,761 |

32,269 |

|

Intangible assets |

1,487 |

2,096 |

|

Right-of-use assets |

11,354 |

14,999 |

|

Defined benefit plan asset |

15,347 |

11,620 |

|

Other assets |

777 |

802 |

|

Total Non-Current Assets |

61,726 |

61,786 |

|

Total Assets |

252,753 |

246,917 |

|

|

|

|

|

Liabilities |

|

|

|

Current Liabilities |

|

|

|

Trade and other payables |

37,620 |

36,286 |

|

Provision |

2,789 |

2,281 |

|

Current portion of lease liabilities |

4,732 |

4,969 |

|

Total Current Liabilities |

45,141 |

43,536 |

| |

|

|

|

Non-Current Liabilities |

|

|

|

Provision |

- |

634 |

|

Lease liabilities |

8,497 |

12,537 |

|

Deferred income taxes |

4,112 |

3,431 |

|

Total Non-Current Liabilities |

12,609 |

16,602 |

|

Total Liabilities |

57,750 |

60,138 |

|

|

|

|

|

Shareholders’ Equity |

|

|

|

Share capital |

9,379 |

9,419 |

|

Retained earnings |

185,624 |

177,360 |

|

|

195,003 |

186,779 |

|

Total Liabilities and Shareholders’ Equity |

252,753 |

246,917 |

|

GOODFELLOW INC. |

|

|

|

Consolidated Statements of Cash Flows |

|

|

|

For the years ended November 30, 2023 and

2022 |

|

|

(in thousands of dollars) Unaudited |

|

|

|

Years ended |

|

|

November 30 2023 |

November 30 2022 |

|

|

$ |

$ |

|

Operating Activities |

|

|

|

Net earnings |

14,688 |

32,679 |

|

Adjustments for: |

|

|

|

Depreciation and amortization of: |

|

|

|

Property, plant and equipment |

3,311 |

2,551 |

|

Intangible assets |

602 |

608 |

|

Right-of-use assets |

4,697 |

4,551 |

|

Gain on disposal of property, plant and

equipment |

(139) |

(45) |

|

Accretion expense on provision |

271 |

102 |

|

Provision |

(397) |

666 |

|

Income taxes |

5,402 |

12,037 |

|

Interest expense |

996 |

1,230 |

|

Interest on lease liabilities |

431 |

603 |

|

Funding in (deficit) excess of pension plan

expense |

(212) |

46 |

|

Other |

24 |

23 |

|

|

29,674 |

55,051 |

|

|

|

|

|

Changes in non-cash working capital items |

24,213 |

(3,734) |

|

Interest paid |

(1,367) |

(1,731) |

|

Income taxes paid |

(9,552) |

(23,573) |

|

|

13,294 |

(29,038) |

|

Net Cash Flows from Operating Activities |

42,968 |

26,013 |

|

|

|

|

|

Financing Activities |

|

|

|

Net decrease in bank indebtedness |

- |

(2,000) |

|

Payment of lease liabilities |

(5,350) |

(4,985) |

|

Redemption of shares |

(456) |

(56) |

|

Dividends paid |

(8,539) |

(7,706) |

|

Net Cash Flows from Financing Activities |

(14,345) |

(14,747) |

|

|

|

|

|

Investing Activities |

|

|

|

Acquisition of property, plant and equipment |

(3,836) |

(4,827) |

|

Decrease (increase) in intangible assets |

7 |

(54) |

|

Proceeds on disposal of property, plant and equipment |

147 |

45 |

|

Other assets |

18 |

(17) |

|

Net Cash Flows from Investing Activities |

(3,664) |

(4,853) |

|

|

|

|

| Net cash

inflow |

24,959 |

6,413 |

|

Cash (bank indebtedness), beginning of year |

3,420 |

(2,993) |

|

Cash, end of year |

28,379 |

3,420 |

|

GOODFELLOW INC. |

|

Consolidated Statements of Changes in Shareholders’

Equity |

|

For years ended November 30, 2023 and

2022 |

|

(in thousands of dollars) |

|

Unaudited |

|

|

|

|

Share Capital |

Retained Earnings |

Total |

|

|

$ |

$ |

$ |

| |

|

|

|

|

Balance as at November 30, 2021 |

9,424 |

151,524 |

160,948 |

|

|

|

|

|

|

Net earnings |

- |

32,679 |

32,679 |

|

Other comprehensive income |

- |

914 |

914 |

|

|

|

|

|

|

Total comprehensive income |

- |

33,593 |

33,593 |

|

|

|

|

|

| |

|

|

|

|

Dividend |

- |

(7,706) |

(7,706) |

|

Redemption of Shares |

(5) |

(51) |

(56) |

|

|

|

|

|

|

Balance as at November 30, 2022 |

9,419 |

177,360 |

186,779 |

|

|

|

|

|

|

Net earnings |

- |

14,688 |

14,688 |

|

Other comprehensive income |

- |

2,531 |

2,531 |

|

|

|

|

|

|

Total comprehensive income |

- |

17,219 |

17,219 |

|

|

|

|

|

|

Dividend |

- |

(8,539) |

(8,539) |

|

Redemption of Shares |

(40) |

(416) |

(456) |

|

|

|

|

|

|

Balance as at November 30, 2023 |

9,379 |

185,624 |

195,003 |

Goodfellow Inc.Patrick GoodfellowPresident and CEOT: 450

635-6511 F: 450

635-3730info@goodfellowinc.com

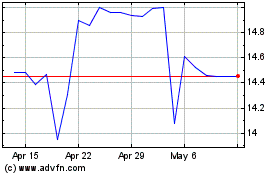

Goodfellow (TSX:GDL)

Historical Stock Chart

From Nov 2024 to Dec 2024

Goodfellow (TSX:GDL)

Historical Stock Chart

From Dec 2023 to Dec 2024