Eastern Platinum Limited ("Eastplats" or the "Company")

(TSX:ELR)(AIM:ELR)(JSE:EPS) reports a review of funding for all its

South African mining operations based on the current economic

environment has been completed. Management at the Crocodile River

Mine ("CRM") has thoroughly analysed its mining operations and

proposes to implement a comprehensive mine development plan to

reduce costs and improve efficiencies. The proposed plan would

involve extensive underground development resulting in reduced

stoping production and increased "on-reef" development in the near

term, leading to significant increases in mineable reserves,

production, and operating flexibility in the medium and

long-term.

As reported in the Company's news release dated May 30, 2012

("Eastplats Suspends Funding for the Mareesburg/KV Project"), the

review of all the Company's mining and development projects was

conducted in response to continuing cost pressures combined with

depressed metal prices and negative industry outlook for a

near-term recovery.

There have been encouraging improvements in production at CRM,

particularly from the Zandfontein section. However, as a result of

continued issues facing the industry, the Company proposes to

temporarily suspend stoping at Zandfontein and embark on a 12 to 18

month development program. This program will focus on "on-reef"

development by "wide raising/winzing" in preparation for increased

future stoping production, as well as "off-reef" development of the

new service decline and the 5, 6 and 7-level footwall drives. Over

18 months, this plan would result in the completion of up to 28

raise lines available for mining as well as providing production of

UG2 reef for plant feed. Additionally, cleaning, sweeping and

vamping of previously mined areas will be maximized, along with the

reclamation of material and equipment from "back-areas". Combined

with the continued construction and equipping of underground

infrastructure and the new chairlift-conveyor, this development

plan would provide the necessary stope availability to sustain

significantly greater production levels over the long term with

lower unit costs. Additionally, the deeper levels of the mine will

be developed for production securing the long-term future of the

operation. Should there be a marked improvement in industry

conditions in the interim, CRM can react quickly and ramp up

production at Zandfontein at any time.

At the Maroelabult section, it is proposed to continue "on-reef"

mining operations, along with the development of major conveyor

development ends, with the objective of achieving a sustainable

production target of 30,000 tpm.

The concentrator at CRM has two streams and its operation would

be optimized to suit the revised production tonnages, utilizing one

stream for "Run-of-Mine" material only, and the secondary circuit

handling "re-mined" tonnes from the tailings dam.

Overhead and administrative costs across the Company's

operations would also be targeted for reduction, and non-critical

capital expenditures would be deferred to beyond 2013.

In keeping with the South African Labour Relations Act, CRM

management will commence the required consultation process with

potentially affected employees and their representatives to review

the need for possible restructuring and the potential implications

to staffing levels as a result of the proposed plan.

The capital expenditure required to implement the proposed

development plan would be funded by cash generated from "on-reef"

mining operations at both Zandfontein and Maroelabult, cash on

hand, and the sale of mining equipment and real estate assets owned

by CRM that are surplus to requirements. Following the consultation

period and final costing exercise to be conducted over the next 30

days, the Company will be in a position to provide guidance for

production for both 2012 and 2013.

As a result of the Company's decision to suspend funding for the

ongoing development of the Mareesburg open pit mine and

construction of the Kennedy's Vale Concentrator Plant (the

"Project"), the Company has terminated the Facilities Agreement

dated December 30, 2011 with UniCredit Bank AG, London Branch and

Standard Finance (Isle of Man) Limited (a subsidiary of Standard

Bank Group Limited) for the US$100 million financing package that

was to be used to part fund the development costs of the Project.

The Company and the banks have agreed to investigate the

restructuring of the financing package when the Project is

restarted.

"We are committed to the ongoing operation and accelerated

development of CRM in the near-term in order to maintain its

potential as a safe, sustainable and profitable mine in the medium

and long-term, and at the same time, safeguard our cash resources

and overall business interests; this development plan would achieve

these objectives and would provide us with enormous operational

flexibility going forward," stated Ian Rozier, CEO of

Eastplats.

The qualified person having reviewed the operating disclosures

presented in this press release is Mr. Brian Montpellier,

P.Eng.

Total shares issued and outstanding: 928,187,807

Cautionary Statement on Forward-Looking Information

This press release, which contains certain forward-looking

statements, is intended to provide readers with a reasonable basis

for assessing the financial performance of the Company. All

statements, other than statements of historical fact, are

forward-looking statements. The words "believe", "expect",

"anticipate", "contemplate", "target", "plan", "intends",

"continue", "budget", "estimate", "may", "will", "schedule" and

similar expressions identify forward looking statements.

Forward-looking statements are necessarily based upon a number of

estimates and assumptions that, while considered reasonable by the

Company, are inherently subject to significant business, economic

and competitive uncertainties and contingencies. Known and unknown

factors could cause actual results to differ materially from those

projected in the forward-looking statements. Such factors include,

but are not limited to, fluctuations in the currency markets such

as Canadian dollar, South African Rand and U.S. dollar,

fluctuations in the prices of PGM and other commodities, changes in

government legislation, taxation, controls, regulations and

political or economic developments in Canada, the United States,

South Africa, or Barbados or other countries in which the Company

carries or may carry on business in the future, risks associated

with mining or development activities, the speculative nature of

exploration and development, including the risk of obtaining

necessary licenses and permits, and quantities or grades of

reserves. Many of these uncertainties and contingencies can affect

the Company's actual results and could cause actual results to

differ materially from those expressed or implied in any

forward-looking statements made by, or on behalf of, the Company.

Readers are cautioned that forward-looking statements are not

guarantees of future performance. There can be no assurance that

such statements will prove to be accurate and actual results and

future events could differ materially from those acknowledged in

such statements. Specific reference is made to the Company's most

recent Annual Information Form on file with Canadian provincial

securities regulatory authorities for a discussion of some of the

factors underlying forward-looking statements.

The Company disclaims any intention or obligation to update or

revise any forward-looking statements whether as a result of new

information, future events or otherwise, except to the extent

required by applicable laws.

No stock exchange, securities commission or other regulatory

authority has approved or disapproved the information contained

herein.

Contacts: Eastern Platinum Limited Investor Relations

1-(604)-685-6851 1-(604)-685-6493 (FAX)info@eastplats.com

www.eastplats.com Canaccord Genuity Limited, London Rob Collins

NOMAD +44 (0) 207 7523 8000 PSG Capital (Pty) Limited Johan Fourie

JSE SPONSOR +27 21 887 9602johanf@psgcapital.com

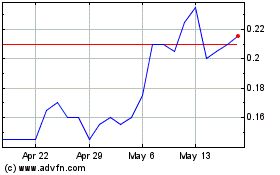

Eastern Platinum (TSX:ELR)

Historical Stock Chart

From Oct 2024 to Nov 2024

Eastern Platinum (TSX:ELR)

Historical Stock Chart

From Nov 2023 to Nov 2024