E-L Financial Corporation Limited Announces December 31, 2013 Year End Financial Results

March 04 2014 - 2:34PM

Marketwired

E-L Financial Corporation Limited Announces December 31, 2013 Year

End Financial Results

TORONTO, ONTARIO--(Marketwired - Mar 4, 2014) - E-L Financial

Corporation Limited ("E-L Financial")

(TSX:ELF)(TSX:ELF.PR.F)(TSX:ELF.PR.G)(TSX:ELF.PR.H) today reported

for the year ended December 31, 2013, consolidated net operating

income from continuing operations1 of $140.6 million or $31.84 per

share2 in 2013 compared with $71.4 million or $14.53 per share in

2012. The $69.2 million increase in net operating income in 2013

versus 2012 is mainly attributable to the $44.5 million increase in

life insurance operation's ("Empire Life's") net operating income

resulting primarily from the Individual Insurance product line. The

increase is due mainly to the favourable impact of long-term

interest rate movements and stock market movements in 2013. E-L

Corporate's net operating income increased $24.6 million

principally due to the recovery of refundable dividend taxes

resulting from the $301.5 million payment of the special dividend

to Common shareholders.

Net income

E-L Financial earned

consolidated net income from continuing operations of $596.6

million compared with $432.3 million in 2012. The $164.3 million

increase in net income is due primarily to a $396.0 million

increase in E-L Corporate's fair value through profit or loss

("FVTPL") investments during the year compared to $125.8 million in

2012, an increase of $131.6 million from United Corporations

Limited's ("United") investments and the favourable impact of stock

market movements during 2013. In 2012, the Company recognized a

$142.2 million gain on the consolidation of United.

On November 1, 2013,

the Company completed the sale of its formerly wholly-owned

subsidiary, The Dominion, to The Travelers Companies, Inc. for

gross proceeds of $1.08 billion, resulting in an after-tax gain of

$266.4 million. This gain combined with The Dominion's ten month

earnings for 2013 of $44.7 million resulted in $311.1 million

earned from discontinued operations.

Net income from

continuing and discontinued operations resulted in E-L Financial

earning total consolidated net income of $907.7 million or $227.18

per share compared with $479.6 million or $118.41 per share in

2012.

Comprehensive income

E-L Financial earned

consolidated comprehensive income of $871.6 million or $217.99 per

share in 2013 compared with $469.4 million or $115.82 per share in

2012. Consolidated other comprehensive loss ("OCL") was $36.1

million or $9.19 per share compared with $10.2 million or $2.59 per

share in 2012.

The $25.9 million

increase in OCL for 2013 is mainly due to the reclassification of

significant gains relating to The Dominion's liquidation of its

common share portfolio.

E-L Financial's net

equity value per Common Share1 at December 31, 2013 was

$872.45.

"We are pleased with

2013's exceptional results," said Duncan Jackman, Chairman,

President and CEO of E-L Financial. "This year saw a continuation

of strong performance by equity markets globally and an increase in

long-term bond yields. As a result, our investment portfolio

benefited from positive equity market performance and the life

insurance business reported record net income on the heels of an

improving yield environment. In addition, the year culminated with

the sale of our general insurance business, generating a

significant gain. Many things went right for us this year, leaving

the company in a strong financial position to continue building

shareholder value over the long-term."

CONSOLIDATED SUMMARY

OF COMPREHENSIVE INCOME

|

|

2013 |

|

|

Continuing Operations |

Discontinued |

|

|

|

(thousands of dollars) |

E-L Corporate |

Empire Life |

Total |

The Dominion |

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net operating income |

$ |

47,913 |

$ |

92,678 |

$ |

140,591 |

|

|

|

|

|

Realized gain (loss) on available for sale investments including

impairment write downs |

|

11,061 |

|

(2,459) |

|

8,602 |

|

|

|

|

|

Share of income of associates |

|

51,337 |

|

- |

|

51,337 |

|

|

|

|

|

E-L Corporate's fair value change in fair value through profit or

loss investments |

|

396,023 |

|

|

|

396,023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

506,334 |

|

90,219 |

|

596,553 |

|

311,126 |

|

907,679 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive income (loss) |

|

32,834 |

|

(5,235) |

|

27,599 |

|

(63,701) |

|

(36,102) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive income |

$ |

539,168 |

$ |

84,984 |

$ |

624,152 |

$ |

247,425 |

$ |

871,577 |

|

|

|

|

2012 |

|

Restated 3 |

Continuing Operations |

Discontinued |

|

|

|

(thousands of dollars) |

E-L Corporate |

Empire Life |

Total |

The Dominion |

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net operating income |

$ |

23,301 |

$ |

48,154 |

$ |

71,455 |

|

|

|

|

|

Realized gain on available for sale investments

including impairment write downs |

|

4,310 |

|

15,690 |

|

20,000 |

|

|

|

|

|

Share of income of associates |

|

72,823 |

|

- |

|

72,823 |

|

|

|

|

|

E-L Corporate's fair value change in fair value

through profit or loss investments |

|

125,810 |

|

|

|

125,810 |

|

|

|

|

|

Gain on the consolidation of United |

|

142,241 |

|

- |

|

142,241 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

368,485 |

|

63,844 |

|

432,329 |

|

47,275 |

|

479,604 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive income (loss) |

|

5,863 |

|

(16,800) |

|

(10,937) |

|

753 |

|

(10,184) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive income |

$ |

374,348 |

$ |

47,044 |

$ |

421,392 |

$ |

48,028 |

$ |

469,420 |

1Use of non-GAAP

measures:

"net operating

income" is net income excluding realized gain on available for sale

investments including impairment write downs, the Company's share

of income from associates and the fair value change in fair value

through profit or loss investments in the E-L Corporate portfolio,

all net of tax. The term net operating income does not have any

standardized meaning according to GAAP and therefore may not be

comparable to similar measures presented by other companies.

"net equity value

per Common share" provides an indication of the accumulated

shareholder value, adjusting shareholders' equity to reflect

investments in associates at fair value, net of tax, as opposed to

their carrying value.

2 All earnings per

share figures are net of dividends paid on First Preference

shares.

3 Net operating

income and other comprehensive income (loss) for December 31, 2012

have been restated to reflect the impact of the prior period

adjustment related to the remeasurement of defined benefit plans

resulting in a $6,863 increase in net operating income and a

$12,354 decrease in other comprehensive income for the year ended

December 31, 2012.

E-L Financial Corporation LimitedMark M. TaylorExecutive

Vice-President and Chief Financial Officer(416) 947-2578(416)

362-2592

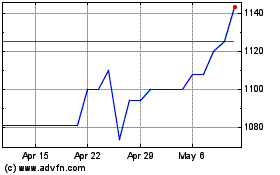

E L Financial (TSX:ELF)

Historical Stock Chart

From Jun 2024 to Jul 2024

E L Financial (TSX:ELF)

Historical Stock Chart

From Jul 2023 to Jul 2024