(All monetary figures are expressed in U.S. dollars unless otherwise stated)

Dundee Precious Metals Inc. ("DPM" or the "Company") (TSX:DPM)(TSX:DPM.WT.A)

today reported fourth quarter 2012 adjusted net earnings (1) of $21.5 million

($0.17 per share) compared to $31.9 million ($0.25 per share) for the same

period in 2011. Reported fourth quarter 2012 net earnings attributable to common

shareholders were $14.7 million ($0.12 per share) compared to $22.7 million

($0.18 per share) for the same period in 2011. Adjusted net earnings in the year

2012 were $80.9 million ($0.65 per share) compared to $80.1 million ($0.64 per

share) for the same period in 2011. Net earnings attributable to common

shareholders in the year 2012 were $54.4 million ($0.43 per share) compared to

$86.1 million ($0.69 per share) for the same period in 2011.

The quarter over quarter decrease in adjusted net earnings was driven primarily

by higher taxes, a higher cost per tonne of concentrate produced at Deno Gold

and higher depreciation, operating and administrative expenses. These

unfavourable variances were partially offset by higher volumes of payable gold

and silver sold and a stronger U.S. dollar. Net earnings attributable to common

shareholders were also impacted by after-tax unrealized mark-to-market losses

related to the Company's metal price hedges and investment in Sabina Gold &

Silver Corp. ("Sabina") special warrants of $6.9 million (2011 - unrealized

losses of $9.2 million). For 2012, the increase in adjusted net earnings was due

primarily to higher volumes of payable gold and copper sold, a stronger U.S.

dollar and higher gold prices, partially offset by lower copper prices, lower

volumes smelted at NCS, a higher cost per tonne of concentrate produced at Deno

Gold, higher depreciation, administrative and exploration expenses and higher

taxes. Net earnings attributable to common shareholders were also impacted by

after-tax unrealized mark-to-market losses related to metal price hedges and the

Sabina special warrants of $26.5 million (2011 - unrealized gains of $0.8

million).

"Our performance in 2012 was underpinned by strong operating and financial

results from Chelopech where we completed our mine expansion in December, on

time and under budget, and delivered record production. The capital projects to

address Deno Gold's lead content and NCS' fugitive emissions are nearing

completion with each operation expected to be in position to return to normal

operating levels in the first half of 2013," said Jonathan Goodman, President

and CEO. "We are in very good shape financially, ending the year with $122

million in cash and anticipating continued strong cash flow generation in 2013.

Further, we have access to a new undrawn $150 million revolving credit facility,

positioning the Company with maximum flexibility to fund further growth in

2013."

Adjusted EBITDA (1) in the fourth quarter and twelve months of 2012 was $37.7

million and $124.6 million, respectively, compared to $37.0 million and $117.5

million in the corresponding periods in 2011, driven by the same factors

affecting adjusted net earnings, with the exception of depreciation and income

tax.

Concentrate production in the fourth quarter of 2012 of 32,428 tonnes was 25%

lower than the corresponding period in 2011 due primarily to lower copper grades

at Chelopech and lower volumes of ore processed at Deno Gold. Concentrate

production in 2012 of 135,809 tonnes was 8% higher than 2011 due primarily to

higher volumes of ore mined and processed at Chelopech, partially offset by

lower volumes of ore processed at Deno Gold and lower copper grades at

Chelopech. In the fourth quarter and twelve months of 2011, 19,967 tonnes and

60,083 tonnes of oxidized ore, stockpiled on surface from past mining

operations, were processed at Deno Gold to supplement mine production and to

fully utilize the mill. There was no oxidized ore processed in 2012.

Concentrate smelted at NCS in the fourth quarter of 2012 of 45,823 tonnes was

comparable to the corresponding prior year period. Concentrate smelted in 2012

of 159,356 tonnes was 12% lower than the corresponding period in 2011 due

primarily to the impact of the Namibian Minister of Environment and Tourism's

directives to limit production to 50% and 75% of the smelter's operating

capacity during the second quarter of 2012 and the balance of 2012,

respectively. The new gas cleaning systems were completed in January 2013 and

tie-ins and commissioning will be conducted during the first quarter of 2013.

Thereafter, testing will be performed to ensure that the modifications are

producing a decrease in emissions before approval is granted to lift the

existing curtailment.

Deliveries of concentrate in the fourth quarter of 2012 of 35,261 tonnes were 4%

lower than the corresponding period in 2011 due primarily to lower concentrate

production at Chelopech. This was partially offset by an inventory drawdown of

copper concentrate produced at Deno Gold as deliveries that had been delayed in

the first nine months of 2012 as a result of the high lead content in copper

concentrate were sold in the fourth quarter of 2012. In the fourth quarter of

2012, payable gold in concentrate sold was up 14% and payable copper in

concentrate sold decreased by 3%. Deliveries of concentrate in 2012 of 136,948

tonnes were 11% higher than 2011 due primarily to increased concentrate

production at Chelopech, partially offset by lower copper and zinc concentrate

production at Deno Gold. Payable copper and gold in concentrate sold in 2012

were up 14% and 23%, respectively, relative to 2011 due primarily to increased

production at Chelopech.

Consolidated cash cost of sales per ounce of gold sold, net of by-product

credits, in the fourth quarter of 2012 was $193 compared to negative $151 for

the fourth quarter of 2011. The quarter over quarter increase was due primarily

to lower realized copper prices, higher treatment charges and a higher cash cost

per tonne of ore processed at Deno Gold. Cash cost of sales per ounce of gold

sold, net of by-product credits, in 2012 was $117 compared to negative $63

during the same period in 2011. This increase was due primarily to higher

treatment charges, a higher cash cost per tonne of ore processed at Deno Gold

and lower by-product prices, partially offset by higher volumes of payable

metals sold.

Cash provided from operating activities, before changes in non-cash working

capital, during the fourth quarter and twelve months of 2012 was $30.7 million

and $121.1 million, respectively, down $11.1 million and $2.5 million from the

corresponding prior year periods due primarily to the same factors affecting

adjusted net earnings and higher income tax payments.

Capital expenditures in the fourth quarter and twelve months of 2012 were $51.0

million and $149.0 million, respectively, compared to $30.2 million and $117.6

million in the corresponding periods in 2011. These increases were due primarily

to increased construction activities in connection with NCS' capital program,

partially offset by reduced construction activities at Chelopech with the

completion of its expansion.

As at December 31, 2012, DPM maintained a solid financial position with minimal

debt, representing 10% of total capitalization, a consolidated cash position of

$121.5 million and an investment portfolio valued at $75.6 million. In February

2013, DPM refinanced $81.25 million in term loans, essentially shifting the

Chelopech loans to DPM, and closed a $150 million committed long-term revolving

credit facility with a small consortium of banks, including its existing

lenders.

For 2013, mine output at Chelopech is expected to range between 1.90 million and

2.05 million tonnes of ore, reflecting the expanded capacity of the mine and

mill. Mine output at Deno Gold is expected to range between 550,000 and 600,000

tonnes. Concentrate smelted at NCS is expected to range between 195,000 and

215,000 tonnes, provided the existing temporary curtailment is lifted by no

later than mid-year 2013.

The Company's estimated metals production for 2013 is set out in the

following table:

----------------------------------------------------------------------------

Metals contained in

concentrate produced: Chelopech Deno Gold Total

----------------------------------------------------------------------------

Gold (ounces) 125,000 - 143,000 25,000 - 30,000 150,000 - 173,000

Copper (million

pounds) 43.0 - 46.0 2.5 - 3.0 45.5 - 49.0

Zinc (million pounds) - 12.0 - 14.5 12.0 - 14.5

Silver (ounces) 182,000 - 195,000 438,000 - 528,000 620,000 - 723,000

----------------------------------------------------------------------------

Assuming current exchange rates, 2013 unit cash cost per tonne of ore processed

is expected to range between $42 and $46 at Chelopech and between $71 and $80 at

Deno Gold. The cash cost per tonne of concentrate smelted at NCS is expected to

range between $320 and $355.

For 2013, the Company's approved growth capital expenditures(1) are expected to

range between $240 million and $300 million. These expenditures relate primarily

to the construction of an acid plant and electric furnace at NCS, stage 1 of the

Pyrite Project at Chelopech, the development and construction activities related

to the Krumovgrad Gold Project, and exploration and/or development work being

undertaken to enhance underground operations and advance the open pit project at

Deno Gold. Sustaining capital expenditures(1) are expected to range between $35

million and $45 million. Further details can be found in the Company's MD&A

under the section "2013 Outlook".

The 2013 outlook provided above may not occur evenly through the year. The

estimated metals contained in concentrate produced and volumes of concentrate

smelted may vary from quarter to quarter depending on the areas being mined, the

timing of concentrate deliveries and planned outages, and in the case of NCS,

the lifting of the existing temporary curtailment. Also, the rate of capital

expenditures may vary from quarter to quarter based on the schedule for and

execution of each capital project, and, where applicable, receipt of the

necessary permits and approvals.

(1) Adjusted net earnings, adjusted basic earnings per share, adjusted earnings

before interest, taxes, depreciation and amortization ("EBITDA"), and growth and

sustaining capital expenditures are not defined measures under International

Financial Reporting Standards ("IFRS"). Presenting these measures from period to

period helps management and investors evaluate earnings and cash flow trends

more readily in comparison with results from prior periods. Refer to the

"Non-GAAP Financial Measures" section of the management's discussion and

analysis for the year ended December 31, 2012 (the "MD&A") for further

discussion of these items, including reconciliations to net earnings

attributable to common shareholders and earnings before income taxes.

Key Financial and Operational Highlights

----------------------------------------------------------------------------

$ millions, except where noted Three Months Twelve Months

---------------- -----------------

Ended December 31, 2012 2011 2012 2011

----------------------------------------------------------------------------

Revenue 103.1 88.5 384.7 338.5

Gross profit 39.2 39.1 157.0 131.8

Earnings before income taxes 16.2 16.6 49.7 88.6

Net earnings attributable to common

shareholders 14.7 22.7 54.4 86.1

Basic earnings per share 0.12 0.18 0.43 0.69

Adjusted EBITDA (1) 37.7 37.0 124.6 117.5

Adjusted net earnings (1) 21.5 31.9 80.9 80.1

Adjusted basic earnings per share (1) 0.17 0.25 0.65 0.64

Cash flow provided from operating

activities, before changes in non-cash

working capital 30.7 41.8 121.1 123.6

Concentrate produced (mt) 32,428 43,151 135,809 125,253

Metals in concentrate produced:

Gold (ounces) 32,667 41,044 142,474 120,757

Copper ('000s pounds) 10,884 13,928 45,171 39,794

Zinc ('000s pounds) 2,880 5,130 15,425 19,585

Silver (ounces) 143,501 177,870 665,857 670,819

NCS - concentrate smelted (mt) 45,823 47,588 159,356 180,403

Deliveries of concentrates (mt) 35,261 36,864 136,948 123,789

Payable metals in concentrate sold:

Gold (ounces) 35,815 31,434 134,848 110,026

Copper ('000s pounds) 10,981 11,324 42,104 36,838

Zinc ('000s pounds) 3,082 2,826 14,204 16,898

Silver (ounces) 180,155 117,254 547,193 595,914

Cash cost of sales per ounce of gold sold,

net of by-product credits ($) (1) 193 (151) 117 (63)

----------------------------------------------------------------------------

(1) Adjusted EBITDA; adjusted net earnings; adjusted basic earnings per

share; and cash cost of sales per ounce of gold sold, net of by-product

credits are not defined measures under IFRS. Refer to the MD&A for

reconciliations to IFRS measures.

DPM's annual audited consolidated financial statements, and MD&A for the fourth

quarter and year ended December 31, 2012, are posted on the Company's website at

www.dundeeprecious.com and have been filed on Sedar at www.sedar.com.

The Company will be holding a call to discuss its 2012 fourth quarter and annual

results on Friday, February 15, 2013, at 9:00 a.m. (E.S.T.). Participants are

invited to join the live webcast (audio only) at:

http://www.gowebcasting.com/4130. Alternatively participants can access a listen

only telephone option at 416-695-6616 or North America Toll Free at

1-800-766-6630. A replay of the call will be available at 905-694-9451 or North

America Toll Free at 1-800-408-3053, passcode 4317707. The audio webcast for

this conference call will also be archived and available on the Company's

website at www.dundeeprecious.com.

Dundee Precious Metals Inc. is a Canadian based, international gold mining

company engaged in the acquisition, exploration, development, mining and

processing of precious metals. The Company's principal operating assets include

the Chelopech operation, which produces a gold, copper and silver concentrate,

located east of Sofia, Bulgaria; the Deno Gold operation, which produces a gold,

copper, zinc and silver concentrate, located in southern Armenia; and the Tsumeb

smelter, a concentrate processing facility located in Namibia. DPM also holds

interests in a number of developing gold properties located in Bulgaria, Serbia,

and northern Canada, including interests held through its 53.1% owned

subsidiary, Avala Resources Ltd., its 47.3% interest in Dunav Resources Ltd.

("Dunav") and its 10.7% interest in Sabina Gold & Silver Corp.

Cautionary Note Regarding Forward-Looking Statements

This press release contains "forward-looking statements" that involve a number

of risks and uncertainties. Forward-looking statements include, but are not

limited to, statements with respect to the future price of gold, copper, zinc

and silver, the estimation of mineral reserves and resources, the realization of

mineral estimates, the timing and amount of estimated future production and

output, costs of production, capital expenditures, costs and timing of the

development of new deposits, success of exploration activities, permitting time

lines, currency fluctuations, requirements for additional capital, government

regulation of mining operations, environmental risks, unanticipated reclamation

expenses, title disputes or claims, limitations on insurance coverage and timing

and possible outcome of pending litigation. Often, but not always,

forward-looking statements can be identified by the use of words such as

"plans", "expects", or "does not expect", "is expected", "budget", "scheduled",

"estimates", "forecasts", "intends", "anticipates", or "does not anticipate", or

"believes", or variations of such words and phrases or state that certain

actions, events or results "may", "could", "would", "might" or "will" be taken,

occur or be achieved. Forward-looking statements are based on the opinions and

estimates of management as of the date such statements are made, and they

involve known and unknown risks, uncertainties and other factors which may cause

the actual results, performance or achievements of the Company to be materially

different from any other future results, performance or achievements expressed

or implied by the forward-looking statements. Such factors include, among

others: the actual results of current exploration activities; actual results of

current reclamation activities; conclusions of economic evaluations; changes in

project parameters as plans continue to be refined; future prices of gold,

copper, zinc and silver; possible variations in ore grade or recovery rates;

failure of plant, equipment or processes to operate as anticipated; accidents,

labour disputes and other risks of the mining industry; delays in obtaining

governmental approvals or financing or in the completion of development or

construction activities, fluctuations in metal prices, as well as those risk

factors discussed or referred to in Management's Discussion and Analysis under

the heading "Risks and Uncertainties" and other documents filed from time to

time with the securities regulatory authorities in all provinces and territories

of Canada and available at www.sedar.com.

Although the Company has attempted to identify important factors that could

cause actual actions, events or results to differ materially from those

described in forward-looking statements, there may be other factors that cause

actions, events or results not to be anticipated, estimated or intended. There

can be no assurance that forward-looking statements will prove to be accurate,

as actual results and future events could differ materially from those

anticipated in such statements. Unless required by securities laws, the Company

undertakes no obligation to update forward-looking statements if circumstances

or management's estimates or opinions should change. Accordingly, readers are

cautioned not to place undue reliance on forward-looking statements.

FOR FURTHER INFORMATION PLEASE CONTACT:

Dundee Precious Metals Inc.

Jonathan Goodman

President and Chief Executive Officer

(416) 365-2408

jgoodman@dundeeprecious.com

Dundee Precious Metals Inc.

Hume Kyle

Executive Vice President and Chief Financial Officer

(416) 365-5091

hkyle@dundeeprecious.com

Dundee Precious Metals Inc.

Lori Beak

Senior Vice President, Investor & Regulatory Affairs and

Corporate Secretary

(416) 365-5165

lbeak@dundeeprecious.com

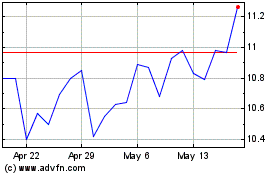

Dundee Precious Metals (TSX:DPM)

Historical Stock Chart

From Jun 2024 to Jul 2024

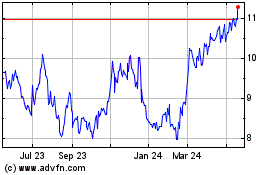

Dundee Precious Metals (TSX:DPM)

Historical Stock Chart

From Jul 2023 to Jul 2024